Social Security Payment Missing on July 23: Social Security is a lifeline for millions of Americans, especially retirees who depend on these monthly payments for their livelihoods. But what happens when your Social Security payment goes missing or is delayed? On July 23, 2025, some retirees found themselves in this situation, leaving many wondering why their payments hadn’t come through as expected. If you are one of those affected, don’t worry! There’s a simple process to figure out what happened, and more importantly, how to fix it. In this article, we’ll walk you through the key reasons why your Social Security check might be missing, what steps you can take to resolve the issue, and what changes might be affecting payment schedules in the near future. Whether you’re a retiree or just curious about how Social Security payments work, this guide will give you all the details you need to understand what’s going on with your payment.

Social Security Payment Missing on July 23

Social Security payments are an essential source of income for retirees, and missing a payment can cause stress. If you find that your payment was delayed or didn’t arrive on time, don’t panic. Start by verifying your banking information, checking with your bank, and reviewing any notices you may have received. If the problem persists, contact the Social Security Administration for assistance. By understanding the reasons behind payment delays and taking the proper steps to resolve them, you can ensure that your benefits arrive without issue in the future. Be proactive about updating your payment preferences, especially with the transition to electronic payments coming up soon.

| Topic | Details |

|---|---|

| Affected Group | Retirees and Social Security beneficiaries |

| Issue Date | July 23, 2025 |

| Average Payment | $2,002 for retirees (2025) |

| Maximum Payment | $5,108 for those delaying retirement until age 70 |

| Reasons for Missing Payments | Banking issues, address changes, overpayment recovery, electronic payment transition |

| Steps to Take | Verify bank details, contact SSA, review overpayment notices |

| Official Website | Social Security Administration |

Understanding the July 23, 2025, Social Security Payment Delay

Social Security payments are issued on a regular schedule based on your birthday. Those born between the 21st and 31st of any month typically receive their payments on the fourth Wednesday of the month—this includes July 23, 2025. If you haven’t received your check or direct deposit by then, it can be a frustrating experience. However, there are several reasons why this might happen.

The most common reason for delays is issues with banking details. Social Security payments are almost always direct deposit these days. If your bank account details are outdated or incorrect, the payment won’t go through. Additionally, if you recently moved or changed your address, paper checks may be delayed. Another significant factor is the recent changes in how Social Security handles overpayment recovery. Some individuals may notice deductions from their benefits if they’ve been overpaid in the past.

Why Are Social Security Payment Missing on July 23?

1. Banking Information Issues

A common reason Social Security payments don’t arrive on time is outdated or incorrect banking information. If you’ve recently changed your bank account or moved to a new bank, but haven’t updated your Social Security details, your payment may be delayed.

What You Can Do: Always make sure your bank account details are current with the Social Security Administration (SSA). You can do this online or by contacting the SSA directly.

2. Change of Address

If you receive paper checks instead of direct deposit, a change in your address can result in delays. Even minor errors in your address can lead to your check being sent to the wrong place.

What You Can Do: Notify the SSA of any changes in your address promptly. You can update your address online or through their customer service.

3. Overpayment Recovery

If you’ve previously been overpaid by Social Security, you might notice a reduction in your payment. Starting July 24, 2025, the SSA will begin withholding 50% of monthly benefits from individuals who have overpaid in the past. This policy aims to recover overpayments more efficiently.

What You Can Do: If you suspect that an overpayment has occurred, check any official notices from the SSA regarding this issue. Respond to them promptly to prevent further issues.

4. Electronic Payment Transition

The SSA is working to transition all beneficiaries to electronic payments by September 30, 2025. If you still receive your benefits via check, this transition could cause delays in some cases, particularly if you haven’t signed up for direct deposit.

What You Can Do: If you haven’t already, consider switching to electronic payments. This will not only ensure timely payments but is also a more secure way to receive your benefits.

The Impact of Social Security Delays on Retirees

Delays in Social Security payments can be more than just an inconvenience—they can disrupt retirees’ financial stability. Many retirees rely on Social Security as their primary or sole source of income, and when payments are late, they can face difficulties paying for everyday expenses, medical bills, and housing costs.

If you’re experiencing a delay, it’s important to have a plan. Some retirees may need to tap into emergency savings or credit cards if their payments are delayed. It’s also worth contacting your bank and SSA early on to resolve the issue as quickly as possible.

Step-by-Step Guide for Resolving Missing Payments

If your payment hasn’t arrived, here’s a clear guide on what steps you should take:

Step 1: Verify Your Banking Information

The first thing you should do is check that the SSA has your correct bank account details. This can be done online through your “My Social Security” account, or by contacting the SSA directly.

Step 2: Check with Your Bank

If your banking details are up-to-date, contact your bank to confirm if the payment has been posted. Sometimes, the issue may be on the bank’s end rather than Social Security’s.

Step 3: Look for Overpayment Notices

If you’ve been notified about overpayments, make sure you review any paperwork sent by the SSA. The agency may be recovering overpayments from previous years.

Step 4: Contact the Social Security Administration

If you’ve taken the above steps and still haven’t received your payment after three business days, it’s time to contact the SSA. They can provide more information on why your payment is delayed and help you resolve the issue. You can reach them at 1-800-772-1213.

Step 5: Prepare for Future Payments

To prevent future issues, ensure that your payment method is updated (direct deposit is the fastest and safest), and that the SSA has your current address on file.

How to Set Up Direct Deposit for Social Security?

If you haven’t already set up direct deposit, it’s a good idea to do so now to avoid any future payment delays. Here’s a step-by-step guide on how to set up direct deposit for your Social Security benefits:

- Log In to Your “My Social Security” Account: You can set up direct deposit online by logging into your “My Social Security” account.

- Provide Your Bank Information: You’ll need to enter your bank’s routing number and your account number. Make sure you double-check your account details to avoid errors.

- Confirm the Setup: After entering your information, confirm the details and submit the form. You’ll receive a confirmation from the SSA when your setup is complete.

Setting up direct deposit is a simple and secure way to ensure that your payments arrive on time, every time.

Understanding Social Security Payment Schedules and Calendar

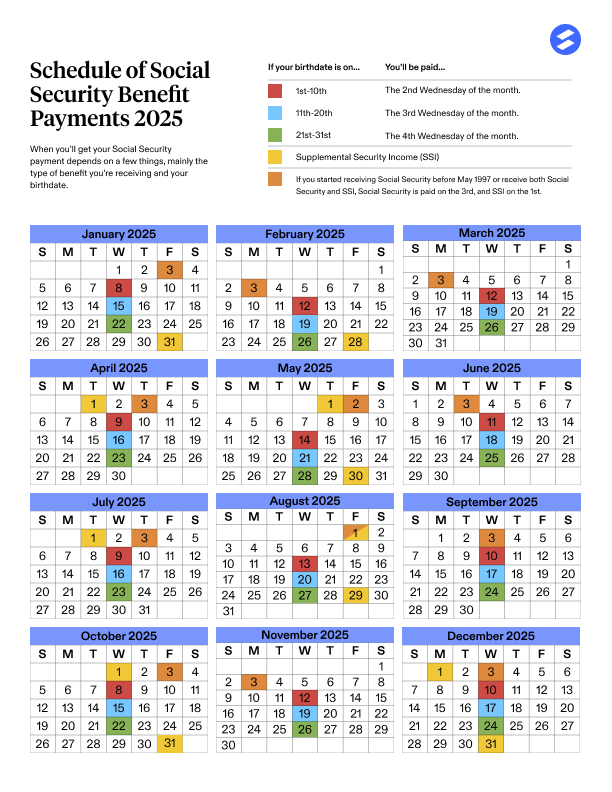

Social Security payments are issued on a schedule that depends on your birthdate. Here’s a general overview of when you can expect your payment based on your birth month:

- 1st to 10th of the Month: Payment arrives on the second Wednesday.

- 11th to 20th of the Month: Payment arrives on the third Wednesday.

- 21st to 31st of the Month: Payment arrives on the fourth Wednesday.

This system allows the SSA to stagger payments and reduce administrative load. Knowing your specific payment date will help you plan ahead and avoid the stress of missed payments.

Dealing with Payment Errors and Reporting Fraud

While delays and missing payments are often due to common issues, sometimes the situation can be more serious, such as fraud or errors in payment processing.

If you suspect any errors with your payment, including fraud, it’s crucial to act quickly. The SSA provides several ways to report fraud, including their Fraud Hotline at 1-800-269-0271.

Social Security Introduces New Rules in July That Will Impact Monthly Payments Across the US

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Average July Social Security Payments by Age Group From 62 to 67 Across the US