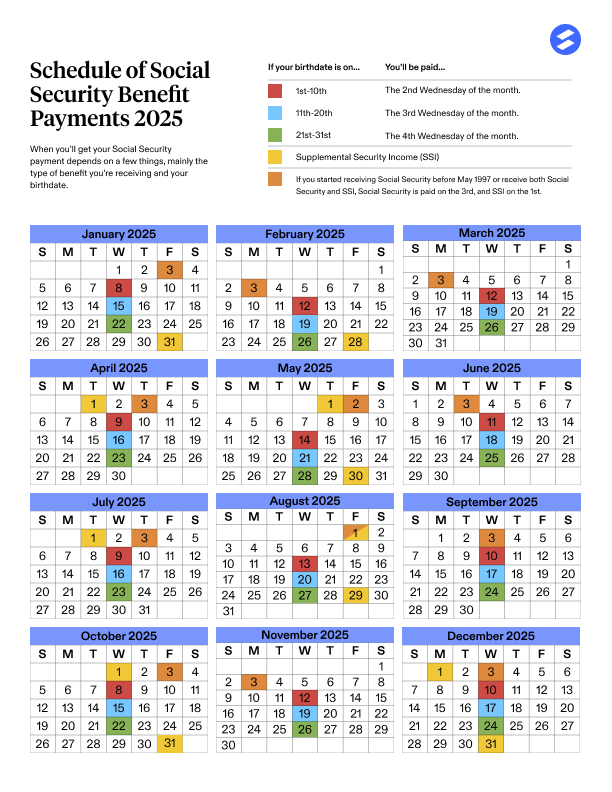

Social Security Payment Confirmed: that’s the news making the rounds among millions of American seniors, disability recipients, and survivors. If you were born between the 1st and 10th of any month, your Social Security benefit will be deposited on Wednesday, July 9, 2025. But this article goes far beyond the date—it’s your complete guide to everything happening in Social Security this year, from policy shifts to payment boosts. With the 2025 2.5% Cost-of-Living Adjustment (COLA), new benefit fairness laws, and evolving tax and fraud concerns, there’s plenty to unpack. Whether you’re new to benefits or a long-time recipient, you’ll find actionable, easy-to-understand insights here—written in a tone that’s warm, respectful, and backed by real experience.

Social Security Payment Confirmed

If you’re expecting your Social Security payment on July 9, 2025, know that you’re receiving more than just a check—you’re tapping into decades of earned benefits and a safety net designed to support you through retirement or disability. With new policies like WEP repeal, a COLA boost, and ongoing legislative developments, this is a pivotal year in Social Security history.

Use this moment to:

- Track your payment date

- Explore your benefit increases

- Plan for taxes and state add-ons

- Stay alert to fraud

- Think long-term about how and when you claim

This isn’t just paperwork—it’s your financial lifeline. Protect it. Understand it. Plan smart.

| Feature | Details |

|---|---|

| Payment Date | July 9, 2025 (for those born between the 1st–10th of any month) |

| COLA Increase | 2.5% boost began in January 2025—average benefit raised by ~$50 |

| Average Monthly Benefit | Retired workers: $2,002; SSDI: $1,582; SSI Individual: $967; Couple: $1,450 |

| WEP Repeal | Windfall Elimination Provision eliminated Jan 2025 under Social Security Fairness Act |

| Max Monthly Benefit (2025) | Up to $5,108 if claimed at age 70 with max lifetime earnings |

| Combined Trust Fund Outlook | Projected to remain solvent through 2035 |

| Official Payment Schedule Source | www.ssa.gov |

What’s Special About the July 9 Payment?

If your birthday lands between the 1st and 10th, you’re in the second Wednesday payment group. In July 2025, that date is Wednesday, July 9. These payments apply to:

- Retirees receiving Social Security

- Survivors of deceased workers

- SSDI (Social Security Disability Insurance) recipients

- Those who qualify for both SSI and SSDI, depending on filing date

The 2.5% COLA added in January is included in this payment, so you should notice a modest increase compared to last year.

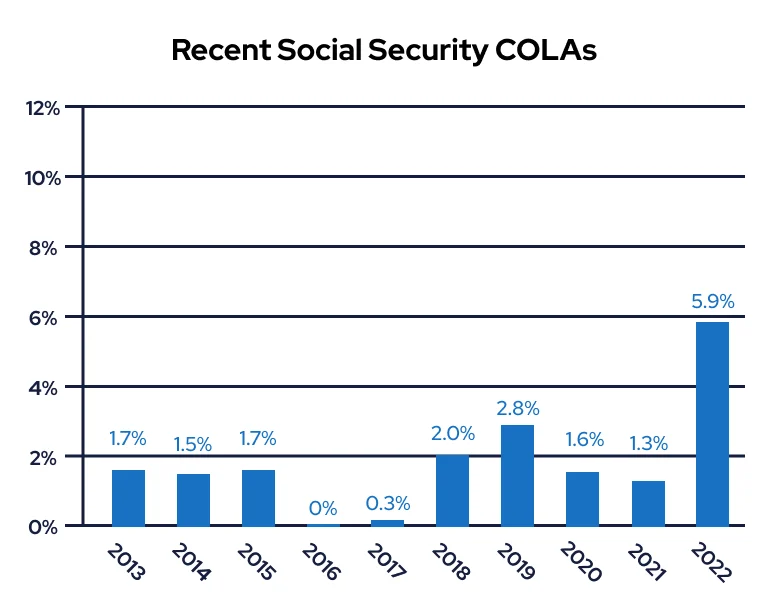

Understanding the 2.5% COLA Increase

The Cost-of-Living Adjustment (COLA) is how Social Security keeps up with inflation. The 2.5% increase in 2025 was based on price data from the third quarter of 2024. While lower than the 3.2% increase in 2024, it still adds real value:

- A $2,000 monthly benefit in 2024 becomes $2,050 in 2025

- Over 12 months, that adds up to an extra $600

This is especially helpful for fixed-income individuals coping with rising prices in essentials like groceries, medication, and housing.

A Closer Look at WEP Repeal and Why It Matters

The Windfall Elimination Provision (WEP) was a controversial law that reduced Social Security benefits for people who worked in both the private and public sectors. As of January 5, 2025, WEP is no more. The Social Security Fairness Act of 2024 repealed it, restoring full benefits to:

- Public school teachers

- Firefighters, police officers, and other public servants

- Dual-career retirees with pension and Social Security earnings

Many affected individuals are now receiving retroactive payments going back to January 2024, along with permanently restored monthly benefits.

Payment Delays and What to Do About Them

Sometimes things don’t go as planned. If your July 9 payment doesn’t show up:

- Wait 3 business days before contacting SSA

- Call your bank first to verify deposit issues

- If no resolution, call SSA at 1-800-772-1213 (TTY 1-800-325-0778)

Pro Tip: Set up text alerts or use the “my Social Security” online account to track payment status.

Guarding Against Social Security Fraud

Fraudsters have grown more sophisticated, targeting seniors via calls, texts, and phishing emails. Red flags include:

- Calls claiming your SSN is “suspended”

- Requests for banking or personal info

- Threats of arrest or legal action

SSA will never call you demanding payment or ask for personal info over the phone. Report scams to oig.ssa.gov.

What About New Applicants? How to Get Started On Social Security Payment Confirmed

If you’re nearing retirement or just became disabled, it’s crucial to start the process early. Here’s how:

- Set up a “my Social Security” account at www.ssa.gov/myaccount

- Review your earnings history for errors

- Use the Retirement Estimator to forecast benefits

- Apply online (for most) or make an in-person appointment

Eligibility starts as early as age 62, but delaying benefits up to age 70 increases your monthly amount significantly.

State Supplemental Payments: Not All SSI Checks Are Equal

Many states provide additional SSI payments on top of the federal amount:

- California: Up to $238 extra per month

- New York: Up to $87 more monthly

- Texas and Florida: No additional state supplement

To learn if your state offers extra, check with your local Social Security office or visit your state’s department of human services website.

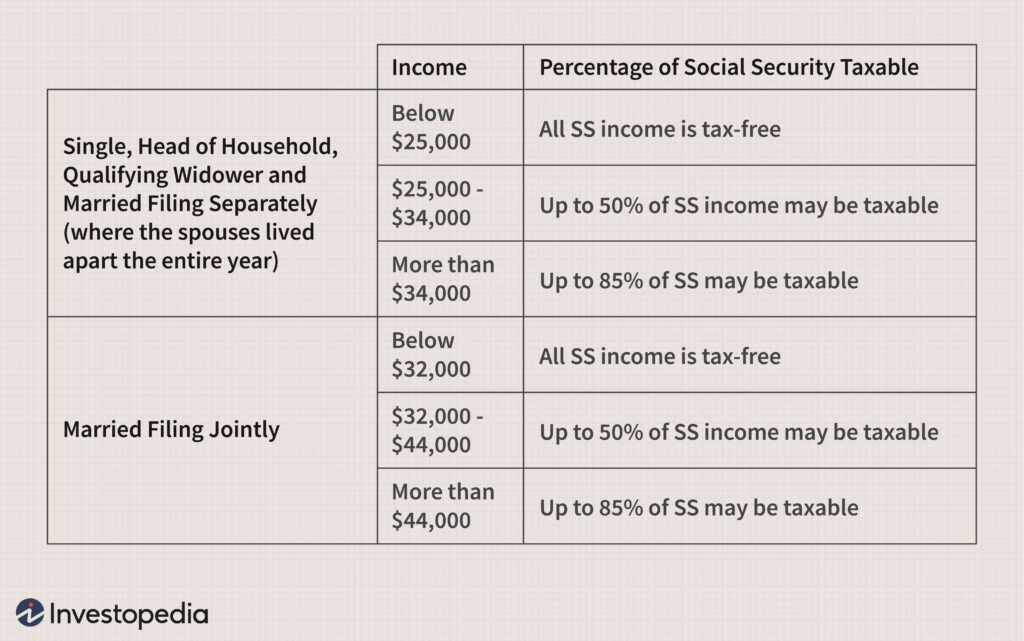

Taxation of Social Security Benefits

Depending on your combined income, up to 85% of your Social Security benefits may be taxed.

Thresholds in 2025:

- Single: > $25,000

- Married filing jointly: > $32,000

Strategies to reduce taxes:

- Use Roth IRA withdrawals

- Keep other income below threshold

- Consider Qualified Charitable Distributions from IRAs if over age 70½

2025 Earnings Limits for Early Retirees

If you claim benefits before full retirement age (FRA) and continue working, the SSA may withhold part of your benefits.

In 2025:

- Annual limit: $23,400

- If you exceed it, SSA withholds $1 for every $2 over the limit

- In the year you reach FRA, limit increases to $62,160 (then $1 for every $3 withheld)

After FRA, there’s no penalty for working and collecting benefits simultaneously.

Real-Life Examples

Carlos, born July 2, receives $2,050 a month after COLA. He uses SSA’s mobile site to track payments and budget for his medications.

Janine, a retired nurse from Ohio, finally had her WEP penalty lifted and received a $7,300 retroactive lump sum in March.

Sam and Rita, a couple in California, both receive SSI and benefit from California’s additional state supplement—totaling about $1,800 monthly between them.

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed

Trump’s Claim That His Bill Ends Social Security Taxes Debunked by Experts

Future of Social Security: What Experts Say

The long-term health of the program is a major policy issue. Here’s what experts are projecting:

- Trust fund depletion expected by 2035, after which benefits may be reduced by ~17% unless Congress intervenes

- Proposals to extend solvency include:

- Lifting the taxable earnings cap (currently $168,600)

- Slightly raising payroll taxes

- Increasing FRA beyond 67

“Social Security is not going bankrupt,” says Kathleen Romig of the Center on Budget and Policy Priorities. “It will pay benefits, but changes are needed to ensure full benefits continue long-term.”