Social Security Is Running Out of Cash: Let’s get real about something that affects every single working American — Social Security. For nearly 90 years, it’s been the financial backbone of retirement in the U.S., offering peace of mind to workers, elders, and those with disabilities. But now, the warning bells are sounding louder than ever. According to the latest government projections, Social Security is running out of cash, and the timeline is more alarming than you might think. Whether you’re 22 and clocking in at your first job, 42 and managing kids and bills, or 62 and prepping for retirement, this issue touches your future. So let’s break it down in a way anyone can understand — no Wall Street lingo, just clear truth and a roadmap for action.

Social Security Is Running Out of Cash

The truth is, Social Security isn’t vanishing, but it’s changing — and not for the better, unless we act. Don’t wait for politicians to sort this out. Make a plan. Stay informed. And most importantly, teach your family to prepare, just like our ancestors taught us to hunt, gather, and store for the future. Because whether you’re on a reservation in the Dakotas or a suburb in New York, the principle remains the same: those who plan ahead thrive, even when the system falters.

| Topic | Details |

|---|---|

| Program At Risk | Social Security (OASI & DI Trust Funds) |

| Depletion Date | As early as 2033 (OASI) |

| Projected Cuts | Up to 23% in monthly benefits |

| Shortfall Began | 2021 |

| Trust Fund Reserves | Will be depleted without Congressional action |

| Main Causes | Aging population, longer life spans, payroll tax shortfall |

| Official Source | SSA.gov |

What’s Really Going On With Social Security?

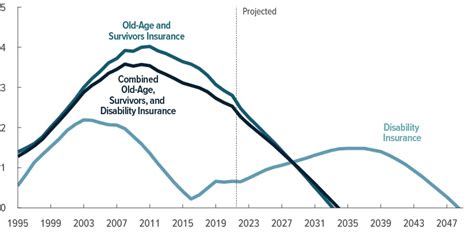

Social Security has two trust funds — one for retirees and survivors (OASI), and one for disability benefits (DI). The problem? The OASI fund will be depleted by 2033, according to the 2024 Social Security Trustees Report. That means by then, the system won’t have enough in reserves to cover full benefit payments.

Does that mean your Social Security check disappears? No. But it does mean you might only get 77 cents on the dollar unless Congress steps in. That’s like turning a $2,000 check into just $1,540 a month — permanently.

How Did We Get Here?

Let’s look at the root causes:

1. More Retirees, Fewer Workers

The Baby Boom generation is retiring at a rapid pace — roughly 10,000 Americans hit retirement age every single day. Meanwhile, younger generations aren’t having as many kids, which means fewer workers are paying into the system to support retirees.

2. People Are Living Longer

This is a good thing overall — but it puts a strain on Social Security. The program was never designed to support 20–30 years of retirement, yet that’s what many retirees now require.

3. Payroll Taxes Aren’t Enough

Social Security is primarily funded through payroll taxes. Workers and employers each pay 6.2% of wages, up to a limit ($168,600 in 2024). That means any income above that is not taxed for Social Security, reducing revenue.

4. Economic Changes and Legislative Gridlock

Wages have stagnated. Fewer people work full-time traditional jobs. Plus, Congress has yet to reach an agreement on how to fix the system — though both parties admit something must be done.

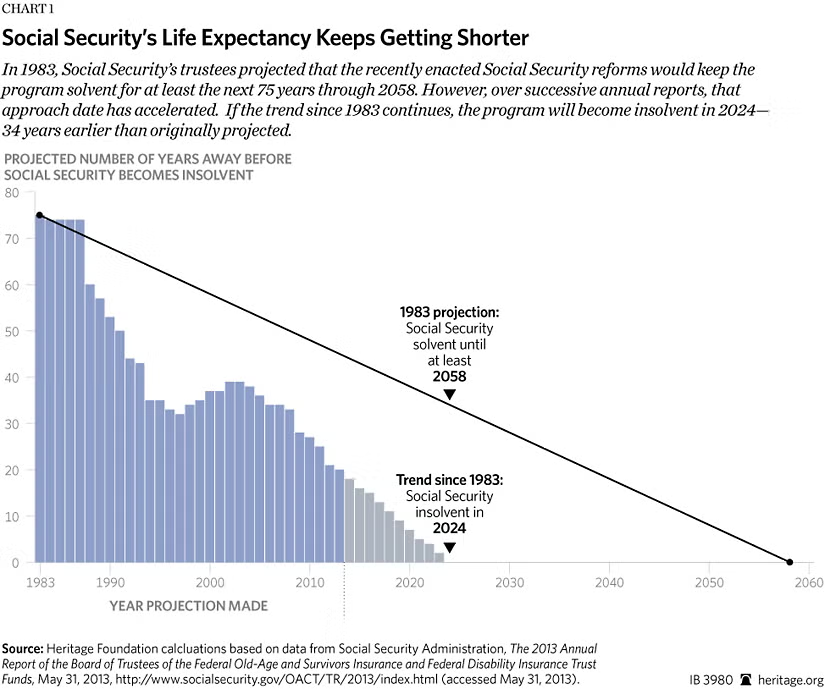

A Timeline of the Crisis

Let’s break it down year-by-year:

- 2021: For the first time, Social Security paid out more than it collected. Trust fund interest helped cover the gap.

- 2024: Trustees project that without changes, the OASI trust fund will be depleted in 2033.

- 2033: At this point, the Social Security Administration would only be able to pay out about 77%–80% of scheduled benefits.

- 2034: The combined OASI and DI funds are expected to run dry.

- 2035 and Beyond: The system enters a pay-as-you-go model unless reforms are passed — meaning benefits will permanently remain reduced.

What’s Being Proposed to Fix Social Security Is Running Out of Cash?

Lawmakers and policy experts have floated several ideas:

1. Raise or Remove the Payroll Tax Cap

Currently, income above $168,600 (2024) is not taxed for Social Security. Raising or eliminating this cap could bring in billions more annually.

2. Increase the Retirement Age

Some proposals suggest slowly raising the full retirement age from 67 to 69 or 70 to reflect longer lifespans.

3. Raise Payroll Tax Rates

Even a small increase in the Social Security tax (e.g., from 6.2% to 7.4%) could restore long-term solvency.

4. Reduce Benefits for High Earners

Means-testing would reduce or eliminate Social Security for the wealthiest recipients.

5. Lower Cost-of-Living Adjustments (COLAs)

Some plans propose reducing annual COLAs, which are designed to help benefits keep up with inflation.

A Real-World Example: Meet David

David is 55, lives in Oklahoma, and earns $60,000 a year. He plans to retire at 67, with Social Security providing around $1,850 per month. If Congress fails to act and the trust fund runs dry, David’s benefit could drop to $1,425/month — a loss of over $5,000 per year.

That would force him to work longer, cut expenses, or draw down his savings faster than planned. Multiply that by millions of Americans, and you can see the scale of the problem.

How You Can Protect Yourself — At Every Age

If You’re in Your 20s or 30s

- Don’t count on Social Security alone. Start investing now — compound interest is your superpower.

- Consider a Roth IRA or employer-sponsored 401(k).

- Educate yourself on retirement planning — knowledge is wealth.

If You’re in Your 40s or 50s

- Review your Social Security statement on SSA.gov/myaccount.

- Pay off high-interest debt and increase retirement contributions.

- Plan for lower benefits — better to be safe than sorry.

If You’re Nearing Retirement

- If possible, delay claiming benefits to increase your monthly payout.

- Work part-time to stretch savings and delay withdrawals.

- Consider annuities, home equity, or other income streams.

Financial Resilience from the Native Perspective

In many Native communities, wealth isn’t just about dollars. It’s about intergenerational strength. Protecting the future of our families means teaching the youth about money, supporting our elders today, and building systems that endure for generations.

Host financial literacy sessions in your community. Encourage elders to check their benefits and help younger generations learn to invest. Social Security is a tool — but self-reliance and community support are what sustain us.

How Social Security May Evolve Under President Trump’s Proposed Changes

Social Security’s Future Faces Uncertainty — Here Are 6 Smart Ways to Save More Now

Paper Checks to Be Phased Out — Social Security Pushes for Electronic Payment Transition

What Should You Do Right Now?

- Create a mySocialSecurity account at SSA.gov to review your earnings history and estimated benefits.

- Increase your savings rate, even by 1% per year. Small increases add up over time.

- Diversify your retirement plan with stocks, mutual funds, and maybe even real estate.

- Call your representatives and urge them to prioritize Social Security reform.