Social Security Forecasts Keep Getting Worse: The future of Social Security has been a topic of growing concern in recent years. With the trust fund depletion projected to arrive sooner than expected, many Americans are wondering if they should claim their benefits early, fearing that the system may run dry before they get their fair share. The idea of a reduced benefit might be a source of anxiety, but before you make any major decisions about claiming Social Security, it’s important to understand the facts, explore your options, and make an informed choice. In this article, we’ll break down the current state of Social Security forecasts, how they affect you, and whether you should consider claiming your benefits earlier than planned. We’ll also offer practical tips and resources to help you navigate this tricky terrain.

Social Security Forecasts Keep Getting Worse

The future of Social Security is uncertain, but that doesn’t mean you should panic. The decision of when to claim your benefits depends on your individual situation, including your health, financial needs, and retirement goals. Whether you decide to claim early or wait until later, it’s essential to plan ahead and consult with a financial professional who can guide you through the process. Remember, Social Security benefits are an important part of your retirement plan, but they shouldn’t be your only source of income. Start preparing now to secure your financial future.

| Topic | Details | Source |

|---|---|---|

| Social Security Fund Depletion | Projected to run out by 2033, 9 months sooner than last forecast. | Barron’s |

| Benefit Cuts | Without action from Congress, benefits may be cut by 23%. | SSA |

| Full Retirement Age (FRA) | Full benefits at 67, but claiming early reduces monthly payments by 30%. | SSA |

| Delayed Benefits | Delaying benefits until age 70 increases monthly benefits by 8% per year. | Schwab |

| When Early Claiming Makes Sense | Immediate financial need, health concerns, dependents, or other retirement income. | Americancentury |

The Big Question: Is Social Security Running Out of Money?

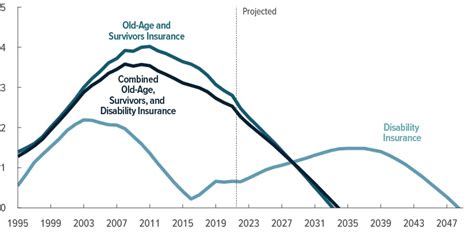

One of the most pressing concerns about Social Security is the fund depletion. As of now, the Social Security trust fund—which helps pay out benefits to retirees—is projected to run out of money by 2033. This is nine months sooner than previously expected.

Why is this happening? Well, there are a couple of factors at play. First, there’s a decrease in revenue from taxes and wages, which is partly due to recent changes in tax laws. Second, the aging population means more people are claiming Social Security benefits while fewer younger workers are contributing to the fund. Essentially, the number of people receiving benefits is increasing, while the number of workers paying into the system is shrinking.

This depletion doesn’t mean that Social Security benefits will disappear, but it does mean that they could be reduced by about 23% starting in 2033 unless Congress takes action. This has led many people to wonder whether they should claim their Social Security benefits earlier, fearing that waiting could lead to receiving less money in the future.

How Does Social Security Forecasts Keep Getting Worse Affect Your Social Security Claiming Strategy?

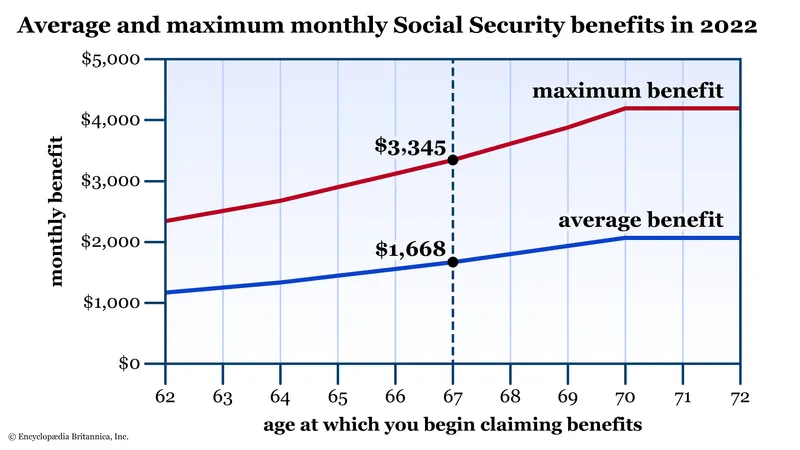

The decision of when to claim your Social Security benefits is one of the most important financial decisions you will make. The amount of money you receive each month depends on several factors, including when you claim your benefits, your age, and your lifetime earnings.

Here’s a quick breakdown of the key age milestones:

- 62: The earliest age you can claim Social Security. However, if you claim at 62, you will receive reduced benefits, sometimes by up to 30% less than if you wait until your Full Retirement Age (FRA).

- Full Retirement Age (FRA): For most people, FRA is 67. If you claim at your FRA, you’ll receive your full monthly benefit.

- 70: If you wait until age 70 to claim, your benefits increase by 8% per year for each year you delay beyond your FRA. This can significantly increase your monthly payments.

Let’s break this down with an example: If your monthly benefit at FRA is $2,000, claiming at 62 could reduce that to about $1,400 per month. However, if you wait until 70, that amount could rise to about $2,480 per month. As you can see, waiting could lead to a significant boost in your monthly benefits.

Should You Claim Early?

While delaying your claim is often recommended, it’s not the right choice for everyone. There are situations where claiming early makes sense. Here are a few reasons why you might want to consider filing for Social Security benefits before reaching your FRA:

1. Immediate Financial Need

If you find yourself in a situation where you need the money immediately to cover basic living expenses, claiming early might be your best option. Remember, while the reduction in benefits can be significant, it may still be more advantageous than not having the funds to cover your needs.

2. Health Concerns

If you have health issues or a family history of early death, you might not live long enough to benefit from waiting until age 70. In such cases, claiming early could make sense, as it would allow you to start receiving benefits sooner.

3. Dependents

If you have young children or other dependents who rely on your income, claiming early may provide the financial support they need. In some cases, your dependents can also receive benefits based on your earnings record, even if you file early.

4. Other Sources of Income

If you have other retirement savings or pensions to rely on, claiming early may allow you to leave your investments untouched for a few more years. This could help you maximize your wealth in the long run.

When to Wait? The Case for Delaying Your Claim

While claiming early can make sense in some situations, waiting to claim Social Security until your Full Retirement Age (FRA) or even age 70 will likely lead to a larger monthly benefit in the long run.

If you’re able to delay your claim, consider these advantages:

- Bigger monthly payments: Delaying your claim until 70 gives you an 8% increase per year in benefits.

- More lifetime income: If you live longer than expected, waiting to claim could result in a higher lifetime benefit.

- More time to save: If you have other sources of retirement income or savings, delaying your Social Security claim may give you more time to grow your nest egg.

Example:

Let’s revisit the earlier example: If you can wait until age 70 to claim, your $2,000 benefit at FRA would increase to $2,480 per month, representing a $480 difference per month. If you live to 80, that’s an extra $5,760 per year.\

Potential Solutions for Social Security’s Future

While the future of Social Security may look bleak at the moment, there are potential solutions to ensure the program remains solvent. Some experts suggest raising the payroll tax rate, which is currently at 6.2% for both employees and employers. Others suggest increasing the maximum amount of income subject to Social Security taxes, which could generate more revenue for the system.

Legislative solutions such as gradually increasing the retirement age or adjusting the benefit formula could also be considered. However, these changes would need bipartisan support to be enacted.

As a Social Security recipient, it’s important to stay informed about changes that may come down the line, and advocate for solutions that preserve the system.

Real-Life Examples

John’s Story:

John, 62, is facing mounting medical bills and has no other retirement savings. He decides to claim his Social Security benefits early because the immediate cash flow helps him cover expenses. While he loses out on the full benefit, the extra $1,400 per month provides him with the relief he needs.

Susan’s Story:

Susan, 66, has multiple retirement accounts and feels financially secure for the long haul. She decides to delay claiming her benefits until age 70. By doing this, she’ll receive $2,480 per month instead of $2,000. Her decision to wait will provide her with a larger benefit, and she’s able to leave her retirement savings alone.

Tips for Maximizing Social Security Benefits

- Work for 35 years: Social Security benefits are based on your highest 35 years of earnings. If you have fewer than 35 years of work, zeros are averaged in, lowering your benefit.

- Factor in spousal benefits: If you’re married, spousal benefits can increase your total Social Security payout. Be sure to explore both your and your spouse’s eligibility.

- Don’t forget about taxes: Remember, Social Security benefits can be taxed. Understand how your income will affect your tax situation, especially if you plan to continue working in retirement.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Understanding the Eight-Year Rule That Could Maximize Your Social Security Benefits

Social Security Benefits for Widows/Widowers and Survivors

Widows and widowers are eligible for Social Security survivor benefits. If you’ve lost a spouse, you might be able to claim their Social Security benefits instead of your own, especially if it results in a higher payout. This can be a critical financial lifeline during a difficult time.