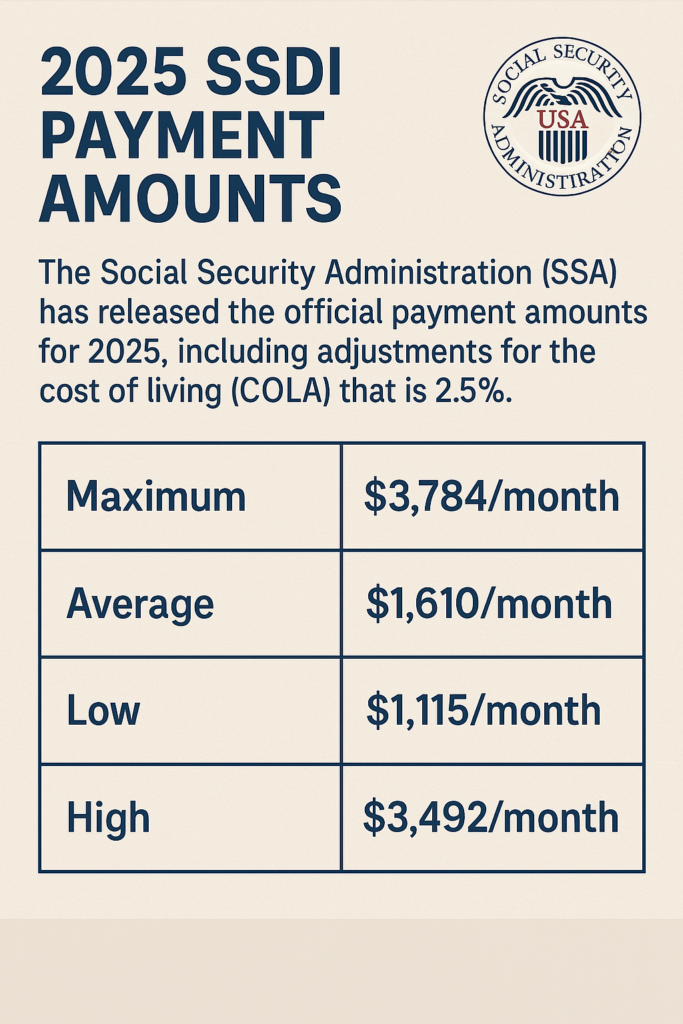

Social Security Disability Payments Rise: If you’re among the millions of Americans who rely on Social Security Disability Insurance (SSDI), you’re probably aware that the system is going through a lot of changes. As of 2025, one of the most significant changes is the increase in SSDI payments, with the maximum monthly benefit reaching $4,018 for those at full retirement age. This rise in benefits is a result of a 2.5% Cost-of-Living Adjustment (COLA) that’s been applied across the board. While this sounds like great news, understanding the fine details can help you make the most of this update. Whether you’re an individual currently receiving SSDI benefits or a professional helping clients navigate the complexities of Social Security, it’s important to know what these changes mean and how they affect you. Let’s dive into the details, break it all down, and discuss how you can take advantage of these updates to benefit you or your clients.

Social Security Disability Payments Rise

| Key Information | Details |

|---|---|

| New SSDI Maximum Monthly Benefit | $4,018 |

| Average Monthly SSDI Benefit | $1,580 |

| COLA Increase | 2.5% |

| Substantial Gainful Activity (SGA) Limit | $1,620 for non-blind, $2,700 for blind |

| Trial Work Period (TWP) | $1,160 per month |

| Eligibility | Based on your lifetime average earnings |

| Official SSA Website | www.ssa.gov |

What Does This Change Mean?

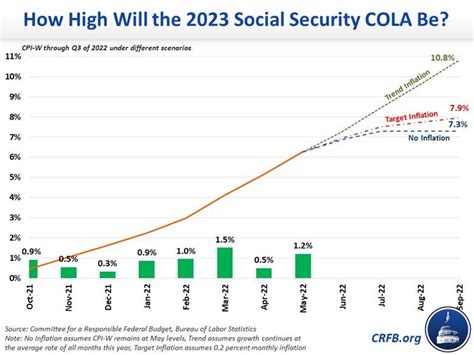

For those already receiving benefits, the increase in SSDI payments is likely a welcome sight. A 2.5% COLA means that the cost of living adjustment is meant to help offset inflationary pressures, ensuring that the purchasing power of your benefits remains as high as possible. The COLA increase in 2025 follows a general upward trend, but the percentage can fluctuate each year depending on inflation rates and other economic factors.

To understand this increase better, let’s put it into perspective:

- Before the increase: The highest benefit was $3,800/month for someone who has reached full retirement age.

- After the increase: The new maximum benefit will be $4,018/month.

- That’s a $218 increase, which might seem modest on paper but can make a significant difference over time.

This is important for those who have worked hard and paid into the Social Security system over their lifetimes. The more you earned during your working years, the higher your SSDI benefit is likely to be.

A Real-Life Example

Let’s imagine John, a middle-aged man who worked in a skilled trade for 25 years. He was injured on the job and is now receiving SSDI benefits. Before the COLA adjustment, John received around $2,500 per month. With the COLA increase, his monthly payment will go up by about $62.50, bringing his total monthly benefit to $2,562.50. Over a year, that’s an additional $750, which may not seem like a lot, but it can make a difference in managing everyday expenses.

Practical Advice for SSDI Recipients

If you’re currently receiving SSDI or planning to apply, here are some practical steps to make the most out of these changes:

- Review Your Benefits Annually: Every year, it’s wise to check your benefits statement. The SSA sends a statement detailing your benefits, and with this new increase, you’ll want to make sure you’re receiving the correct amount.

- Understand Your SGA Limits: As a recipient of SSDI, you have certain limits on how much you can earn while still being eligible for benefits. For 2025, the Substantial Gainful Activity (SGA) Limit is $1,620/month for non-blind individuals, and $2,700/month for those who are blind. This means you can still work part-time or earn extra income without losing your benefits, as long as you stay under these limits.

- Maximize Your Benefits: If you’re nearing retirement age and are planning to transition from SSDI to regular Social Security benefits, it’s important to understand that SSDI benefits can convert to Social Security retirement benefits when you reach full retirement age. Knowing this transition timeline will help you manage your income more effectively.

- Consider Financial Planning: While SSDI benefits are designed to provide financial support, they may not cover all your living expenses. Many people use additional savings, investments, or even seek financial assistance programs to supplement their income. It’s important to have a financial plan in place that accounts for your specific needs.

- Plan for Unexpected Expenses: With inflation on the rise, even small increases in SSDI benefits can make a big difference. However, it’s important to budget carefully for unexpected medical or living costs that may come your way. Consider establishing an emergency fund or looking into additional insurance coverage for specific needs like healthcare or dental.

Breaking Down the SSDI System: Who Qualifies?

Understanding who qualifies for SSDI is crucial to know whether these changes impact you or someone you work with.

Eligibility Requirements

SSDI is available for people who are unable to work due to a disability that is expected to last at least one year or result in death. To qualify, you must meet certain work and medical requirements:

- Work Credits: You must have worked a certain number of years in jobs that paid Social Security taxes. The number of credits needed depends on your age at the time you become disabled.

- For instance, younger workers may need fewer credits (6 credits for someone under 24), while someone older may need up to 40 credits to qualify.

- Disability Status: The Social Security Administration (SSA) will evaluate your medical condition to determine whether it meets their definition of a disability. This means your disability must severely limit your ability to perform basic work-related tasks.

- Average Earnings: Your SSDI benefits are based on the average earnings from jobs where you paid Social Security taxes. The more you earned during your working years, the higher your benefit will be.

A Closer Look at the Trial Work Period (TWP)

The Trial Work Period (TWP) allows SSDI recipients to test their ability to return to work without losing benefits. For 2025, the TWP threshold is $1,160/month. During this period, you can continue to receive SSDI benefits while working, as long as you don’t earn more than this threshold amount.

The TWP is designed to help you gradually return to the workforce without fear of losing your SSDI benefits right away. Once you’ve completed the TWP, your earnings will be evaluated, and the SSA will determine if you can continue receiving benefits based on your income level.

How to Apply for Social Security Disability Payments Rise?

If you’re wondering how to apply for SSDI or help someone apply, here’s a step-by-step guide:

- Gather Your Documentation: The SSA will require documentation to prove that you are unable to work due to your disability. This could include medical records, work history, and more. Be thorough with your paperwork to avoid delays.

- Apply Online or In Person: The easiest way to apply for SSDI is to use the SSA’s online application tool. You can apply from the comfort of your home. Alternatively, you can apply in person or by phone at your local Social Security office.

- Wait for a Decision: Once you’ve submitted your application, the SSA will review your case. This process can take months, so it’s important to be patient. If you’re denied, you have the right to appeal the decision.

- Consider Working with a Professional: If your case is complicated, or if you’re worried about navigating the paperwork and medical requirements, it might be a good idea to consult with a Social Security disability lawyer. They can help ensure your application is submitted properly.

Social Security Shake-Up Incoming — What Every Recipient Needs to Know Now

$967 Social Security Payment Arrives in 12 Days — Are You on the List?

Your Fall Benefits May Arrive Differently — Major Social Security, VA Payout Change Ahead