Social Security Cuts Could Slash $18,000 a Year: America, we’ve got a serious conversation to have — one that could hit your wallet hard if you’re not paying attention. Social Security cuts could slash $18,000 a year from some Americans by 2033, and that ain’t just pocket change. Whether you’re pushing papers at a 9–5 or planning to retire with grandkids on your lap, these potential changes could shake up your financial future. So, what’s the deal with Social Security? Is your retirement check at risk? How can you prepare? We’re breaking it all down in plain talk — no financial degree required — with facts, stats, and real advice that works whether you’re 10 years from retiring or just starting your first job.

Social Security Cuts Could Slash $18,000 a Year

Social Security cuts could slash $18,000 a year from some Americans by 2033, and the effects would ripple across every age and income level. Whether you’re a retiree, Gen Xer, Millennial, or Gen Z worker, these changes are real — and closer than they seem. Don’t panic — plan. By understanding your benefits, saving smart, delaying your claim if possible, and pressuring Congress for action, you can build a retirement future that’s solid no matter what happens to the trust fund.

| Key Point | Details |

|---|---|

| Topic | Social Security cuts could reach $18,000/year for some by 2033 |

| Why It Matters | The Social Security Trust Fund is projected to be insolvent by 2033, causing automatic cuts of up to 24% |

| Who’s at Risk | Especially those retiring in or after early 2033, with dual-earner households hardest hit |

| Cut Amount | Up to $1,500/month loss; equal to $18,000/year |

| Average Benefit Now | ~$1,907/month for retired workers |

| How to Prepare | Boost savings, delay retirement, diversify income, stay informed |

| Official Source | Social Security Administration |

What’s Going On With Social Security?

Let’s break it down real simple: Social Security is the monthly check Uncle Sam sends out to millions of retired Americans. That check is funded by payroll taxes paid by today’s workers. It’s a “pay-as-you-go” system, meaning the money you pay now is funding today’s retirees — not your future check.

But here’s the catch: there’s more money going out than coming in.

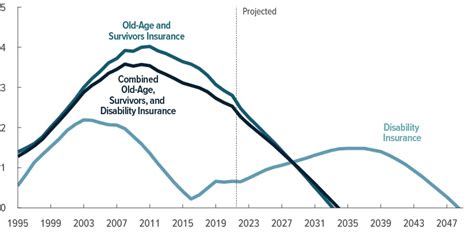

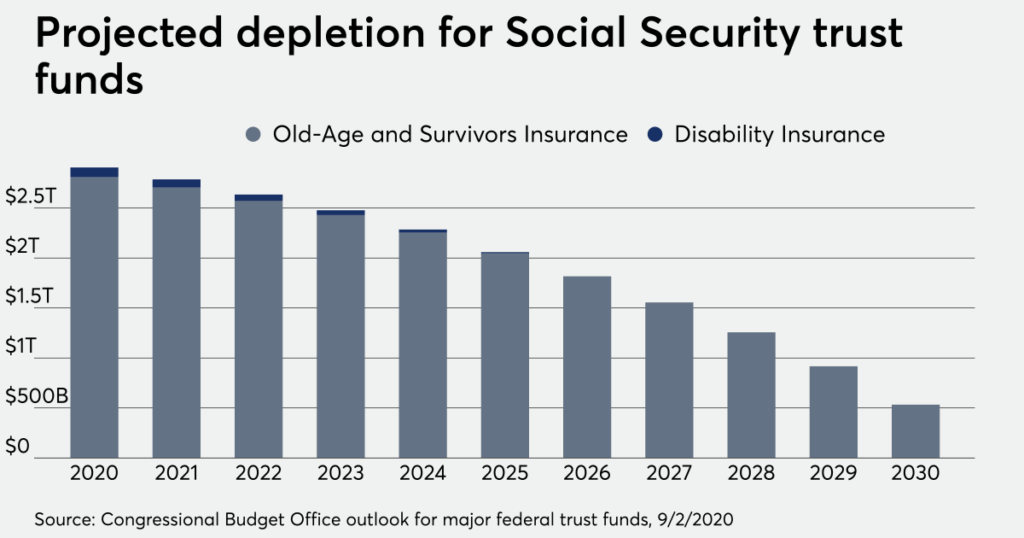

According to the Social Security Trustees’ 2024 Report, the Old-Age and Survivors Insurance (OASI) Trust Fund — the part that pays out retirement benefits — is expected to run dry by 2033. That doesn’t mean Social Security disappears. It means the trust fund won’t have enough to pay full benefits. If Congress doesn’t act, the Social Security Administration (SSA) will only be able to pay about 76% to 80% of promised benefits, triggering a benefit cut of about 24%.

The Committee for a Responsible Federal Budget (CRFB) estimates that some dual-income couples could lose more than $18,000 per year if this happens.

Why Social Security Cuts Could Slash $18,000 a Year?

This crisis didn’t pop up overnight. Here’s why the system is strained:

- Longer Lifespans – People are living well into their 80s and 90s, meaning more years of benefits.

- Fewer Workers Per Retiree – Back in 1960, there were about 5 workers for every retiree. In 2024, it’s closer to 2.7.

- Lower Birth Rates – Fewer babies mean fewer future workers to pay into the system.

- No Major Reforms Since the 1980s – The last major overhaul was in 1983. We’ve been coasting since then.

The bottom line? Social Security’s math is no longer working — and without new revenue or reduced costs, the program faces automatic cuts.

Who’s Most at Risk?

Let’s look at who could feel the sting the most.

Dual-Earner Households (Middle Class): These households may face up to $18,000/year in lost benefits. With two earners, the combined benefits are higher — and so are the cuts.

Single-Earner Couples: Households where one spouse worked and the other didn’t may see around $13,600/year in reductions.

Low-Income Retirees: Though they receive less in absolute terms, a $11,000/year loss can be devastating when Social Security makes up most or all of their income.

High-Earning Professionals: Individuals with the max taxable income history could lose as much as $24,000/year, but may have other income streams to buffer the hit.

Women & Minority Groups: These groups often have lower average lifetime earnings and longer lifespans — meaning they’ll rely on benefits longer and feel cuts more deeply.

How Much Do People Get From Social Security Now?

As of 2024, average monthly benefits are:

- $1,907/month for retired workers

- $3,303/month for retired couples

That’s about $39,636/year for a couple. A 24% cut could mean losing $9,500/year for an average worker or over $18,000/year for dual-income couples.

While it might not sound like a lot for the wealthy, this is often the primary or only income source for nearly half of retirees in the U.S.

Timeline of What Could Happen

| Year | Event |

|---|---|

| 2024 | Trustees confirm 2033 insolvency forecast |

| 2025-2032 | Congress debates reform; public concern grows |

| Late 2032 | If no fix is passed, SSA begins adjusting payments |

| 2033 | Full benefits no longer payable; cuts up to 24% begin |

This timeline isn’t set in stone — but it’s based on projections by top actuaries and economists. A delay in action could cause sharp, automatic reductions.

What Can You Do to Prepare?

While we can’t fix Social Security ourselves, we can protect our own future.

1. Know Your Numbers

Sign up at SSA.gov to track your earnings and estimate your benefits. This helps you understand your projected income and retirement age eligibility.

2. Start Saving More — Now

To cover a cut of 24%, the average person would need about $138,000 extra in savings. This is assuming a 4% annual withdrawal.

That’s doable over 10–15 years with steady contributions to:

- 401(k) or 403(b) plans (especially with employer match)

- Traditional or Roth IRAs

- HSAs (if eligible)

Use automated transfers or increase your contribution rate 1% annually.

3. Delay Claiming If You Can

Claiming at 62 reduces your monthly check by up to 30%. Waiting until 67 (full retirement age) or 70 increases benefits. Each year you delay past age 67 boosts your check by 8%.

Even with cuts looming, delaying still offers higher lifetime value if you live past your late 70s.

4. Diversify Your Income Streams

Don’t rely solely on Social Security. Build your own “retirement stool” with:

- Pension income (if available)

- Dividends from investments

- Real estate rental income

- Consulting, freelancing, or part-time work

- Annuities for guaranteed income

5. Consider Lifestyle Adjustments

Downsize your home, relocate to a low-tax or lower-cost-of-living state, or eliminate debts before retirement. These strategies boost flexibility and reduce pressure on your monthly income.

Government Proposals to Fix Social Security

Washington is finally feeling the pressure. Here are the major ideas on the table:

- Raising the Full Retirement Age to 68 or 70

- Increasing Payroll Taxes from 6.2% to as much as 7.4%

- Lifting the Tax Cap (currently $168,600 in income) so the wealthy pay more

- Means-Testing Benefits to reduce checks for high-income retirees

- Reducing Cost of Living Adjustments (COLAs)

Each plan has trade-offs, and none are politically easy. But delay means deeper cuts for everyone.

What About the Younger Generation?

Millennials and Gen Z shouldn’t assume they’re safe. In fact, they may be most impacted:

- Retirement age could increase to 70 or beyond

- Benefits may be reduced or phased out for high earners

- More burden to self-fund retirement

Young workers should start saving early, maximize tax-advantaged accounts, and stay involved in policy conversations.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Think Social Security Cuts Are Bad? The Fix Might Be Even Worse