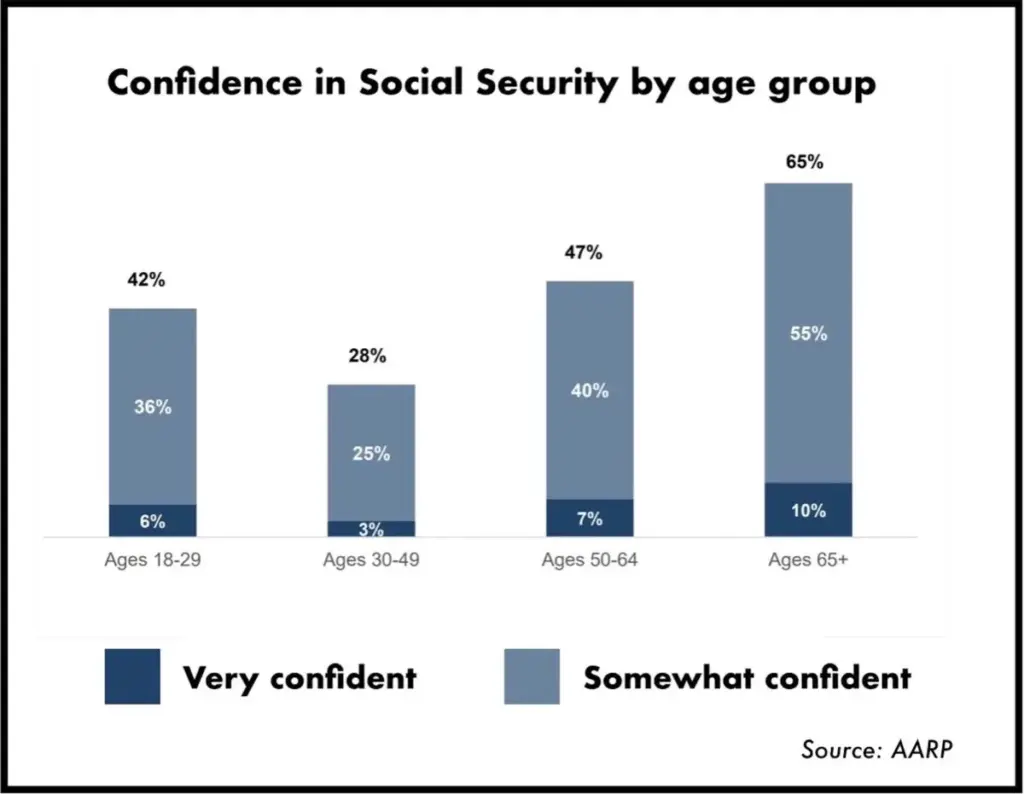

Social Security Confidence Hits 15-Year Low: It’s no secret that young Americans are losing faith in Social Security—and the numbers back it up. According to a brand-new AARP survey, confidence among adults aged 18–49 has hit a 15-year low, with just 25% believing the program will be there for them when they retire. That’s a big drop from past years and a serious red flag for future financial planning. If you’re in your 20s, 30s, or even 40s, you’ve probably had a moment where you thought, “Will Social Security even be around when I’m old?” Turns out, you’re not alone. The concern is widespread and growing louder each year.

Social Security Confidence Hits 15-Year Low

The good news? Social Security is not bankrupt. The bad news? It’s on track to be underfunded in less than a decade. That means lower payouts unless major policy reforms take place. For young adults, the smartest move is to plan as if Social Security will supplement your savings—not support you entirely. Start saving now, diversify your income, stay informed, and advocate for reform. Social Security may have been built for a different time—but with smart planning, it can still be part of your retirement future.

| Topic | Details |

|---|---|

| Confidence in Social Security (18–49 age group) | Only 25% believe they’ll receive full benefits |

| Confidence across all adults | Down to 36% from 43% in 2020 |

| Expected Trust Fund Depletion | As early as 2033–2034, according to SSA |

| Portion of benefits payable after depletion | About 81–83%, unless Congress takes action |

| Top concerns among young adults | Government instability, inflation, personal debt |

| Official Source | Social Security Administration |

What Is Social Security and Why Should You Care?

Social Security is America’s largest federal retirement and disability benefit system. It provides monthly payments to over 67 million beneficiaries, including retirees, disabled workers, and survivors. It’s funded through payroll taxes under the Federal Insurance Contributions Act (FICA).

If you work and pay FICA taxes, you’re earning “credits” toward future benefits. After working for about 10 years, most people qualify. But here’s the catch—those future benefits depend on the program staying solvent.

Why Social Security Confidence Hits 15-Year Low?

1. Scary Headlines About Depletion

The Social Security Trustees report that the combined trust fund will run dry by 2033 or 2034. After that, the program could only pay about 81% of scheduled benefits. While this doesn’t mean the program goes bankrupt, the idea of a cut is enough to shake confidence.

Young workers fear they’ll pay in their whole lives and receive reduced—or no—benefits. This misconception is widespread and fuels a lot of the panic. In reality, Social Security will continue to receive payroll taxes, so the system doesn’t disappear overnight. Still, the projected shortfall is very real.

2. Generational Disillusionment

Millennials and Gen Z have experienced the Great Recession, COVID-19, inflation surges, student loan crises, and rising housing costs—all by the time they’re expected to start building wealth. Their distrust isn’t just about Social Security. It’s about the whole economic system.

Most younger Americans grew up watching boomers retire with pensions, home equity, and full benefits. Now, they face contract work, gig jobs, and no pensions, plus fears that government programs won’t be there when needed. It’s no wonder trust is eroding.

3. Rising Financial Anxiety and Student Debt

More than 43 million Americans hold student loans, with an average debt balance of over $37,000. When you add rising rent, childcare costs, and wage stagnation, retirement planning feels like a luxury, not a necessity. Many prioritize paying off debt over saving.

Add the fear that Social Security might underdeliver, and it’s easy to see why a growing number of young workers are checking out of traditional retirement planning altogether.

4. Lack of Financial Education

Financial literacy in the U.S. is shockingly low. Many adults don’t understand how Social Security is funded, what their estimated benefits are, or how retirement planning fits into a larger wealth strategy. Schools rarely cover personal finance, and families often don’t know enough to teach it.

This lack of knowledge leaves people vulnerable to misinformation, fear-driven decisions, and reactive politics.

What the Data Says — It’s Not All Doom

While the fears are valid, the situation is fixable. But it depends on how fast—and how wisely—Congress acts.

According to the 2025 AARP survey:

- 78% of adults worry Social Security won’t be enough in retirement.

- 96% agree the program is essential for retirement security.

- 67% say it’s more important now than five years ago.

- 85% of both Republicans and Democrats support protecting the program.

So, Americans—regardless of age or political affiliation—don’t want to lose Social Security. They just don’t know if it’ll still be strong when it’s their turn.

How Does Social Security Actually Work?

Social Security works on a pay-as-you-go basis. Here’s a basic outline:

- Workers pay 6.2% of their earnings into the Social Security trust fund.

- Employers match that with another 6.2%.

- That money is used to pay benefits to today’s retirees and beneficiaries.

- The surplus (if any) goes into the trust fund.

When the system takes in less than it pays out, it taps into that trust fund—which is what’s happening now due to an aging population and longer life expectancy.

Can It Be Fixed? Yes, But It Requires Action

There are several practical options to reform the system. Lawmakers could:

- Raise or eliminate the income cap (currently $168,600 in 2024).

- Increase payroll taxes slightly, from 6.2% to 6.5% or higher.

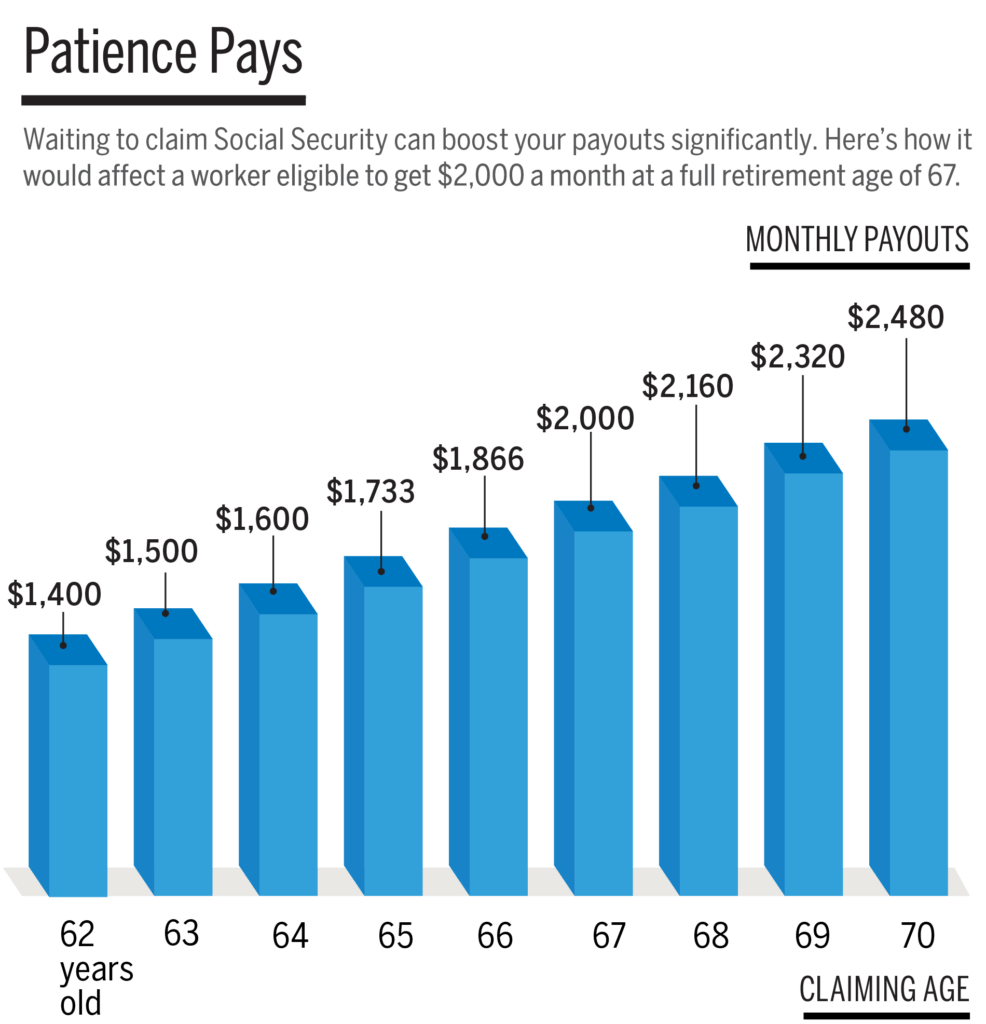

- Raise the full retirement age from 67 to 68 or 70.

- Reduce benefits for high earners.

- Broaden the tax base to include investment income or self-employed contractors.

None of these are easy choices, and every one has trade-offs. But experts agree that acting sooner rather than later makes reforms less painful.

What Should Young Adults Do Now?

Even if you’re not retiring for 30+ years, you can take smart steps to protect your financial future.

Start Saving Early

The power of compound interest can’t be overstated. Starting to save just $50–$100 a month in your 20s or 30s can add up to six figures by the time you’re 60. Use retirement accounts like a Roth IRA, 401(k), or HSAs for tax-advantaged growth.

Diversify Your Income

Look beyond your job. Invest in mutual funds, ETFs, rental properties, or side businesses. Passive income streams provide a cushion against Social Security uncertainty.

Use Digital Planning Tools

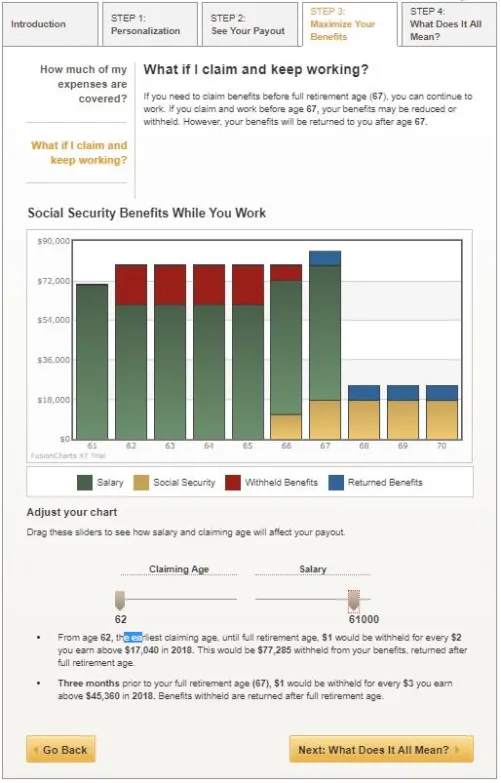

Try calculators like:

- SSA Benefit Estimator

- Fidelity Retirement Score

- Vanguard Retirement Planner

These tools help you understand what to expect—and how to fill any gaps.

Get Educated

Podcasts, blogs, YouTube, and online courses can teach you the basics of budgeting, investing, and planning. Knowledge is power when navigating complex systems like Social Security.

Talk to a Financial Advisor

If you’re serious about preparing, work with a certified financial planner (CFP) who understands retirement timelines and Social Security optimization.

How Employers and Policymakers Can Help?

While individuals can take steps, broader reforms must happen at the government and employer level.

- Employers can offer 401(k) matches, automatic enrollment, and financial wellness programs.

- Schools should teach personal finance starting in middle and high school.

- Congress must address the trust fund shortfall with bipartisan urgency, not delay.

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Social Security Is Running Out of Cash — Here’s the Shocking Timeline

Your Fall Benefits May Arrive Differently — Major Social Security, VA Payout Change Ahead