Social Security 2026 Adjustment Falls Flat: As we look ahead to 2026, Social Security beneficiaries are facing a year of potential financial hardship due to a modest 2.6% Cost-of-Living Adjustment (COLA). While any COLA increase is a welcome change, this year’s adjustment is unlikely to sufficiently offset the rising costs of living. With healthcare and housing prices soaring, many retirees will find themselves struggling to keep pace with inflation. This article delves into why the 2026 COLA is falling short, what this means for retirees, and offers insights into how seniors can better plan their finances in these challenging times.

Social Security 2026 Adjustment Falls Flat

The 2026 COLA adjustment offers a 2.6% increase, but it won’t be enough to fully meet the needs of retirees grappling with rising healthcare and housing costs. With the Social Security Trust Fund facing potential insolvency by 2032, it’s vital for retirees to stay proactive. Adjust your budget, consider delaying benefits, and explore additional income sources to help weather the financial strain. By taking these steps, you can better navigate the challenges ahead and ensure a more secure future.

| Topic | Details |

|---|---|

| Projected COLA Increase for 2026 | 2.6%, based on the Consumer Price Index for Urban Wage Earners (CPI-W) |

| Rising Costs | Healthcare costs up by 2.8%, Housing up by 3.9%, outpacing the projected COLA |

| Social Security Trust Fund | Expected insolvency by 2032, leading to potential 24% benefit cuts without intervention |

| Proposed Adjustments | Shift from CPI-W to CPI-E (Consumer Price Index for the Elderly) to better reflect senior needs |

| Political Impact | “Boosting Benefits and COLAs for Seniors Act” faces political hurdles |

What is COLA and How Does It Affect Retirees?

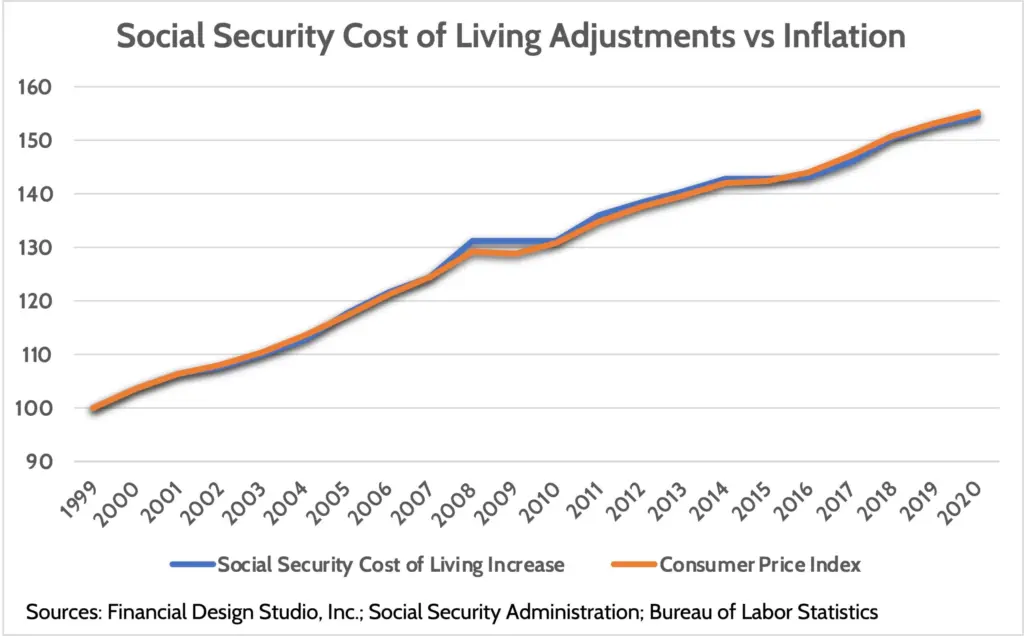

Cost-of-Living Adjustments (COLA) are annual increases to Social Security benefits designed to keep up with inflation. These adjustments are based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation that tracks the price of everyday goods and services.

For 2026, a 2.6% COLA increase was proposed. On the surface, this might seem like a decent raise, but it’s essential to remember that COLA doesn’t always capture the reality of expenses that retirees face, especially when the cost of healthcare and housing continues to rise significantly.

Why COLA is Falling Short?

The issue with the CPI-W is that it doesn’t focus on the specific spending patterns of retirees. For instance, retirees tend to spend much more on healthcare and housing than the general population. These costs have increased much more quickly than the 2.6% COLA, leaving seniors at a financial disadvantage.

- Healthcare Costs

Over the past year, healthcare costs have increased by 2.8%, while the COLA stands at only 2.6%. Healthcare is one of the largest expenses for retirees, especially as they age and need more frequent medical attention. - Housing Costs

Whether you’re renting or own a home, housing costs have risen substantially. Over the past year, housing prices have gone up by 3.9%, meaning many retirees will be paying more for shelter. Property taxes, utility bills, and rent all contribute to these costs. - Food and Transportation

The cost of groceries and gas has also been on the rise. With food up by 4% and energy prices climbing by 5%, seniors are finding their fixed incomes stretched even further.

The Real Inflation Seniors Face

While the CPI-W tracks general inflation, it doesn’t account for the unique financial pressures faced by seniors. The rise in healthcare and housing costs is a perfect example of this gap. In fact, seniors tend to see a much higher effective inflation rate than the rest of the population because their expenses differ significantly.

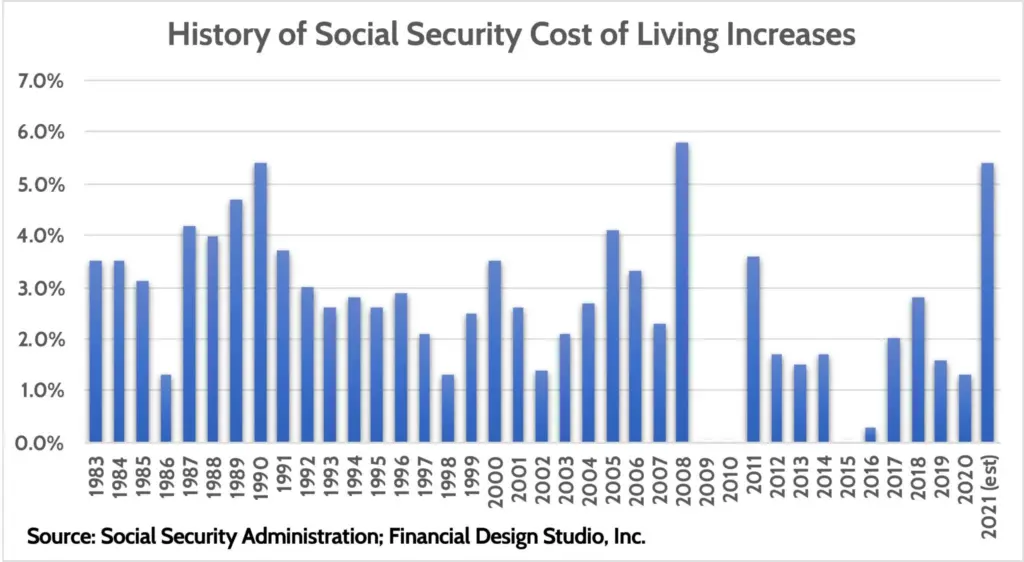

Historical Context of COLA Adjustments

To understand the significance of the 2026 adjustment, it helps to look at historical trends. Over the last few decades, COLA adjustments have fluctuated, with some years offering substantial increases and others, like 2026, providing minimal relief.

Recent COLA Adjustments

- 2025: The COLA was 3.2%, which was a significant boost after several years of low or no increases.

- 2024: There was a modest 2.8% adjustment.

- 2023: Retirees saw a 5.9% increase, which was a rare, high adjustment due to the surging inflation in 2022.

While the increases over the years have helped seniors keep up with inflation, 2.6% in 2026 doesn’t provide much of a cushion in the face of rising expenses.

Political Landscape Around Social Security

The future of Social Security is a topic that’s constantly in the news, especially as the Social Security Trust Fund faces looming insolvency. According to the Social Security Administration, the Trust Fund is projected to run out of money by 2032, which could lead to a 24% reduction in benefits across the board. This would be a catastrophic hit for many retirees who are already struggling with inflation.

There’s also ongoing debate in Congress about how to fix Social Security for future generations. The “Boosting Benefits and COLAs for Seniors Act” is a legislative proposal that aims to improve the COLA by switching from the CPI-W to the CPI-E (the Consumer Price Index for the Elderly). This change would more accurately reflect the needs of seniors, particularly in areas like healthcare.

However, political gridlock remains a significant barrier to progress. Advocates for change warn that without immediate action, retirees could face even more severe cuts to their benefits in the coming years.

What Can Retirees Do to Prepare for Social Security 2026 Adjustment Falls Flat

With rising costs and a modest COLA adjustment, retirees need to take proactive steps to safeguard their financial future. Here are some practical tips for managing your finances in retirement:

1. Stay Informed and Adjust Your Budget

Stay updated on changes to Social Security and COLA by checking official resources like the Social Security Administration’s website. In addition, reevaluate your budget regularly to adjust for price increases. Prioritize essential expenses like housing, healthcare, and groceries while cutting back on discretionary spending.

2. Delay Social Security Benefits

If you can afford to, consider delaying your Social Security benefits until later in life. By waiting to claim benefits, you can earn delayed retirement credits, which will increase your monthly benefit.

3. Look into Healthcare and Long-Term Care Insurance

Since healthcare costs are a major concern, make sure to explore options for additional coverage. Medicare Advantage plans can help cover some of the costs that Original Medicare doesn’t, and long-term care insurance can provide additional support if you need help with daily activities.

4. Consider Other Income Sources

If Social Security alone won’t cut it, think about additional income sources. This might include part-time work, rental income, or even turning a hobby into a side business.

State-Specific Considerations

Cost of living varies significantly depending on where you live. For instance:

- California and New York have high housing and healthcare costs, making a 2.6% COLA much less effective for seniors in those states.

- Florida and Texas, while often more affordable, still see rising costs in areas like healthcare and utilities, which can impact retirees.

It’s crucial to tailor your financial planning to the state you live in, considering both the cost of living and local taxes.

2026 Social Security COLA Forecast Updated — Here’s the Estimated Benefit Increase

Social Security COLA 2026 Update: How Much Bigger Will Your Check Be, According to July’s Estimate?

What Seniors Really Want From Social Security’s 2026 COLA — And What They Might Get