Seven Ways to Fund Retirement Without Using Your Superannuation: Retirement is often seen as the golden years, a time for relaxation and personal fulfillment. But achieving that dream requires a well-thought-out financial plan. While superannuation is the primary method many people rely on for retirement funding, it’s not the only option available. Whether you want to build multiple income streams, reduce your reliance on super, or simply explore other avenues, this article will guide you through seven effective ways to fund your retirement without touching your superannuation. Trust me, the second option will surprise you!

Seven Ways to Fund Retirement Without Using Your Superannuation

There’s no one-size-fits-all answer to funding your retirement. Whether it’s downsizing your home, investing, working part-time, or turning a hobby into a business, there are many ways to supplement your superannuation and ensure you can live comfortably in retirement. The key is to plan ahead, diversify your income sources, and make choices that align with your personal goals. Remember, retirement isn’t just about stopping work—it’s about enjoying the fruits of your labor and securing your financial future. So, start today, and explore these options to create a retirement plan that works for you.

| Method | Key Benefits | Best for | Considerations | Official Resources |

|---|---|---|---|---|

| Downsize Your Home | Free up capital from a larger home, avoid high maintenance costs | Homeowners in big properties | Emotional attachment, moving costs | Australian Tax Office |

| Part-Time Work | Supplemental income, social interaction, sense of purpose | Active retirees looking to stay engaged | Requires finding flexible employment | Australian Government |

| Self-Employment | Flexibility, self-paced work, income generation | Entrepreneurs, freelancers | Requires a business plan and initiative | Business.gov.au |

| Investments | Capital growth, passive income, diversified risk | Those with investment knowledge | Market risks, capital loss potential | ASX |

| Family Trust | Estate planning, asset protection, tax advantages | Those with family assets | Legal setup and management costs | LegalZoom |

| Selling Collectibles | Quick lump sum from rare items like art or antiques | Collectors or enthusiasts | Risk of undervaluing items, market fluctuations | Antiques Roadshow |

| Part-Time Job | Income without full-time commitment | Those seeking low-stress work | Time commitment, finding suitable work | AARP |

Seven Ways to Fund Retirement Without Using Your Superannuation

1. Downsize Your Home: Cash in on the Property Market

One of the easiest ways to fund your retirement without using super is downsizing your home. Real estate has long been a reliable way to build wealth. If you’re living in a large home, especially in a high-value area, selling it can release a significant chunk of money. This can be especially helpful for retirees who no longer need a large property.

Not only will downsizing free up capital, but it will also reduce your ongoing expenses, such as property taxes, maintenance costs, and mortgage repayments. Imagine turning that large backyard into a cash reserve for your retirement!

Practical Example:

Let’s say you’re living in a house worth $1.5 million, but you don’t need all that space. If you sell it and purchase a smaller home for $700,000, you could pocket $800,000 in profit! That’s a considerable sum to invest in your retirement, and you’ll be left with a smaller, more manageable home.

Considerations:

While the financial benefits are clear, downsizing can come with emotional hurdles, especially if you have a deep attachment to your home. Also, there are the costs involved in moving, including agent fees and moving expenses. But if you’re ready for a change, this can be a highly effective strategy.

Additional Tips:

- Evaluate Your Neighborhood: In some cases, you might not even need to sell your home outright. Renting it out can bring in consistent income while allowing you to move into a smaller property. Research rental markets in your area to see if this is a viable option.

- Timing the Market: The timing of when you sell matters. If the real estate market is booming, you may get a higher price for your home, significantly boosting your retirement fund.

2. Part-Time Work: Stay Active and Earn Some Cash

It might seem surprising, but working part-time during retirement can be a game-changer. Part-time work doesn’t just bring in extra cash—it also keeps you mentally and physically active. The good news is that finding a part-time job these days is easier than ever, especially with the gig economy booming.

How It Works:

Part-time work can come in various forms, from freelance jobs to consulting gigs in your industry. The gig economy has exploded in recent years, providing a wealth of options for retirees. You can work on your terms, either from home or at flexible hours.

Example:

Consider a retiree who was once a graphic designer. Instead of diving into full-time retirement, they choose to take on two or three freelance projects a month. This provides a steady income stream while allowing them to enjoy their retirement.

Considerations:

You may need to search for positions that offer flexible hours, or you might need to network and advertise your skills if you choose the freelance route. But the added benefit of social engagement and mental stimulation can make this a great option for many.

Additional Tips:

- Remote Work: Many companies now offer remote part-time jobs, which means you can work from the comfort of your home. Platforms like Upwork and Freelancer connect retirees with companies that need project-based work done.

- Stay Active: Working part-time isn’t just about earning money. It also helps keep you social, engaged, and active, which is key to maintaining mental health and well-being in retirement.

3. Self-Employment: Turn Your Passion into Profit

For those with a specific skill or hobby, turning it into a self-employed business can be a rewarding and financially viable option. Whether it’s starting an online business, offering consulting services, or teaching skills you’ve mastered over the years, self-employment offers the ultimate flexibility.

Practical Example:

Let’s say you’re a retired teacher. You could offer tutoring sessions for local students or create an online course to teach others your skills. You don’t have to commit to a traditional work schedule, and you get to decide how much you work.

Considerations:

Starting your own business requires planning, and you may need some initial investment to get things rolling. There are also legal and tax obligations to consider when running a business, so make sure you consult with a professional before jumping in.

Additional Tips:

- Online Platforms: The internet offers a wealth of platforms where retirees can monetize their knowledge and skills. Websites like Etsy, eBay, and even YouTube allow individuals to set up shop and sell products or services.

- Start Small: Don’t be afraid to start with a small-scale business and gradually grow it as you get more comfortable. This allows you to test the waters without putting too much pressure on yourself.

4. Investments: Grow Your Wealth Without a Day Job

Investing is a powerful tool that can help fund your retirement without requiring you to actively work. Through investments in stocks, bonds, real estate, or other assets, you can generate passive income that helps support your lifestyle.

How It Works:

When you invest, your money works for you. For example, stocks can generate dividends, and bonds can yield interest payments. If you have a solid understanding of the market, you can build a diversified investment portfolio that produces a steady income stream.

Example:

Say you invest $100,000 in a balanced portfolio of stocks and bonds that generate a 5% return annually. That’s an extra $5,000 per year to add to your retirement savings!

Considerations:

Investing always carries risks, and there’s always the possibility that the market could take a downturn. However, by diversifying and working with a financial advisor, you can minimize risk and ensure long-term growth.

Additional Tips:

- Dividend Stocks: One of the most common and effective ways to generate passive income is by investing in dividend stocks. These stocks pay regular dividends to their shareholders, offering a consistent income stream.

- Real Estate: You can also invest in real estate to generate rental income. It’s a more hands-on investment but can provide a steady cash flow during retirement.

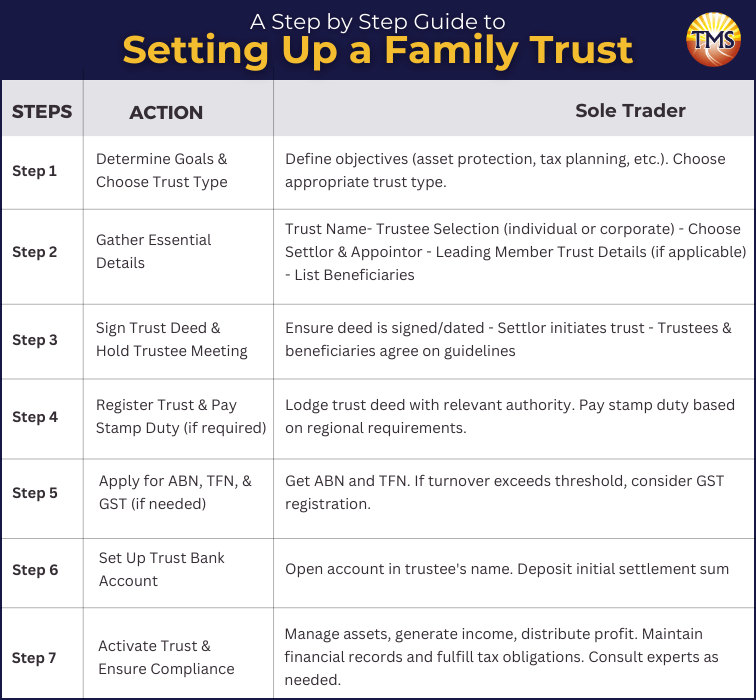

5. Family Trust: Protect Your Assets and Reduce Taxes

Setting up a family trust can be a powerful tool for retirement planning. It allows you to manage assets, protect wealth, and even reduce taxes while passing down your estate to your heirs. By setting up a family trust, you can create a structure that supports your retirement goals while ensuring your wealth is protected for future generations.

How It Works:

A family trust allows you to transfer ownership of your assets to the trust, where they are managed by a trustee for the benefit of your beneficiaries. This can help reduce the taxes you pay and ensure that your estate is distributed according to your wishes.

Example:

If you own a rental property that generates income, placing it in a family trust can help you protect that income from taxes, while ensuring that your children inherit the property without the hassle of going through probate.

Considerations:

Family trusts can be complex and require professional legal assistance to set up. Be sure to consult with an estate planner or attorney to ensure that you set everything up correctly.

Additional Tips:

- Tax Benefits: Family trusts are especially beneficial when it comes to minimizing the tax burden on your estate. By distributing income to beneficiaries in lower tax brackets, you can reduce the overall tax rate.

- Asset Protection: A family trust can also help protect your assets from creditors, which can be particularly valuable if you are worried about long-term healthcare costs or business liabilities.

6. Selling Collectibles: Unlock the Value of Rare Items

Many people don’t realize the value of items they’ve accumulated over the years—whether it’s a rare collection of coins, antiques, or even vintage cars. These valuable items can be sold to fund your retirement and provide an additional source of income.

How It Works:

You can sell these collectibles through online auction sites, at specialty auctions, or to private buyers. With the right market conditions, your items may fetch a much higher price than you expect.

Example:

A retiree with a collection of rare stamps could sell their collection for a substantial sum. This one-time sale could provide a significant boost to their retirement fund.

Considerations:

The value of collectibles can fluctuate, and it’s important to get professional appraisals before selling. Additionally, there may be tax implications for the sale, so it’s essential to consult with a tax advisor.

Additional Tips:

- Appraisal: Always get your collectibles appraised by a professional before putting them up for sale. This ensures you get the best possible price.

- Timing: The market for collectibles can be unpredictable. It’s important to keep an eye on trends and try to sell when the demand is high.

7. Part-Time Job: Earn Money Without Full-Time Commitment

While this point is similar to the previous one, it’s worth noting again. A part-time job can be the perfect solution for those who want to supplement their income without committing to a full-time job. Whether it’s working in retail, hospitality, or helping out in a local charity shop, the key is finding something that you enjoy.

Example:

A retiree who loves animals might take up part-time work at a local pet store or volunteer at an animal shelter. This not only provides an income but also allows them to stay engaged in a cause they care about.

Considerations:

The beauty of a part-time job is its flexibility. However, finding something that aligns with your skills and interests may take some time and effort.

Additional Tips:

- Local Businesses: Many small businesses are eager to hire retirees for part-time roles, especially those who bring valuable life experience and reliability to the table. Consider applying to local shops or cafes.

- Online Jobs: Many online platforms offer flexible part-time roles that allow you to work from home, providing additional convenience and income.

Centrelink Rules for Caravan and Boat Dwellers in Australia—What You Must Know in 2025

Centrelink Payment Hike Now in Effect for 2.4 Million Australians—Here’s What You’ll Get

Centrelink and ATO Send Urgent July 1 Warning to Tax Return Filers—How to Avoid Costly Mistakes