Senior Couples Set to Get $3,089 Social Security Payment: If you’re a senior couple living in the United States, there’s an important update that could brighten your financial outlook this summer. Starting in July 2025, eligible senior couples are expected to receive an average Social Security payment of $3,089. This isn’t a bonus or a one-time stimulus check—it’s your regular monthly benefit, adjusted to keep up with inflation and living costs. With food prices, rent, and utilities continuing to rise, every dollar counts. This guide breaks down who qualifies for this payment, how it’s calculated, when it’s distributed, and how you can maximize your benefits. Whether you’re already collecting or planning to retire soon, this article is your go-to resource.

Senior Couples Set to Get $3,089 Social Security Payment

The average Social Security payment of $3,089 for senior couples in July 2025 is a significant source of monthly income. But to get the most out of it, you need to understand how it’s calculated, file at the right time, and plan smartly. The choices you make today—when to retire, how long to work, whether to delay filing—can impact your Social Security income for life. Don’t leave money on the table. Remember: this isn’t charity. You earned it.

| Topic | Details |

|---|---|

| Average Payment | $3,089 per month for eligible senior couples |

| Payment Date | July 3, 9, 16, or 23, depending on birthday and benefit type |

| Eligibility | Both spouses must qualify for Social Security retirement benefits |

| Adjustment | Includes 2.5% Cost-of-Living Adjustment (COLA) for 2025 |

| Taxability | Benefits may be taxable depending on combined income |

| Source | Social Security Administration |

What Does the $3,089 Social Security Payment Represent?

First things first—this isn’t a bonus or extra check being handed out. The $3,089 is the average monthly benefit received by senior couples where both spouses qualify for Social Security retirement benefits. It includes the recent 2.5% Cost-of-Living Adjustment (COLA) for 2025.

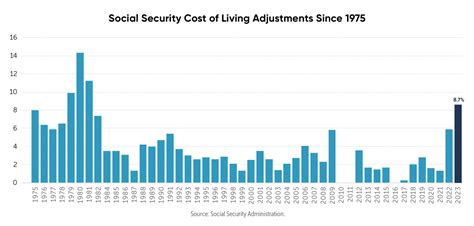

The COLA is a routine annual adjustment made by the Social Security Administration (SSA) to ensure that payments keep pace with inflation. For 2025, a modest 2.5% increase was announced after reviewing the Consumer Price Index. But here’s the kicker: not every couple will receive exactly $3,089. This is an average. Your actual payment could be higher or lower based on your work history, income, and when you filed for benefits.

Who Is Eligible for the $3,089 Social Security Payment?

To qualify for a Social Security retirement benefit in the U.S., each spouse must meet the following conditions:

1. Earned Work Credits

You must have earned at least 40 work credits, which is roughly 10 years of work paying into the Social Security system. These credits are accumulated based on your earnings, and the threshold changes slightly every year.

2. Filed for Retirement Benefits

Each spouse must file for their own retirement benefit or as a spouse (if they didn’t work or earned less). The benefit amount is affected by when you choose to claim:

- Filing at Full Retirement Age (FRA) (between 66–67 depending on birth year) ensures you get 100% of your benefit.

- Filing early (as young as 62) reduces your monthly payment permanently.

- Delaying benefits until age 70 can increase your check by up to 32%.

3. Married Status

To be considered a senior couple for Social Security purposes, you must be legally married and each receiving benefits based on your own or spousal work records.

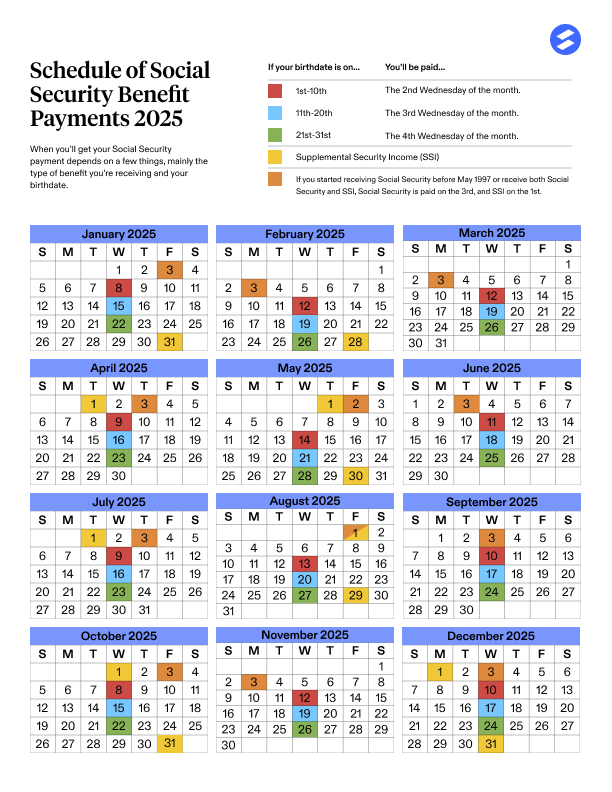

July 2025 Social Security Payment Schedule

The Social Security Administration pays benefits based on the birth date of the primary beneficiary:

| Beneficiary Birthday | Payment Date (July 2025) |

|---|---|

| 1st–10th | Wednesday, July 9 |

| 11th–20th | Wednesday, July 16 |

| 21st–31st | Wednesday, July 23 |

| Beneficiaries before May 1997 or SSI recipients | Wednesday, July 3 |

Your payment will arrive on one of these dates depending on your situation.

Social Security History: How We Got Here

The Social Security Act was signed into law in 1935 by President Franklin D. Roosevelt during the Great Depression. It was designed to provide financial protection for retirees, survivors, and the disabled.

Today, more than 71 million Americans receive monthly payments, and for nearly 40% of seniors, Social Security provides over 50% of their income. It’s not welfare—it’s a system you paid into for decades, now returning the favor in your golden years.

How the Social Security Benefit Is Calculated?

The amount each person receives is based on their highest 35 years of indexed earnings. The SSA uses a complex formula that factors in:

- Average Indexed Monthly Earnings (AIME)

- Primary Insurance Amount (PIA)

- Adjustments for early or delayed retirement

Couples who both worked full-time and filed at or after their FRA are more likely to be in the average $3,089 range. If one spouse didn’t work or had lower earnings, they might qualify for spousal benefits, which can be up to 50% of the other spouse’s full benefit.

How to Check Your Payment Amount?

The best way to find out your exact benefit amount is to create or log in to your My Social Security account:

Steps:

- Visit ssa.gov/myaccount

- Log in or create an account

- Click “Estimate Benefits” to see your personalized projections

- Use the Retirement Estimator to test filing scenarios

The SSA also sends out annual “Social Security Statements” by mail or email showing your projected benefits.

Can Social Security Benefits Be Taxed?

Unfortunately, yes—Social Security benefits may be taxable if your combined income is above certain limits.

Combined Income = AGI + Nontaxable Interest + ½ of Your Social Security

For couples:

- If your combined income is $32,000–$44,000, up to 50% of your benefits may be taxable

- Over $44,000? Up to 85% of your benefits may be taxable

Tip: Talk to a tax advisor or use the IRS’s interactive tax tool to find out if you’ll owe taxes.

How to Maximize Benefits As Senior Couples Set to Get $3,089 Social Security Payment?

Even if you’re already collecting, there are still ways to boost your benefits:

1. Delay Claiming

Each year you delay past your FRA increases your check by about 8%—up to age 70.

2. Keep Working Longer

Social Security averages your 35 best earning years. Working a few more years at a higher wage can replace lower-earning years and raise your benefit.

3. Spousal & Survivor Benefits

- Spousal benefit: Up to 50% of your spouse’s benefit if you have little or no work history

- Survivor benefit: The higher earner’s benefit continues for the surviving spouse after death

State Tax Rules for Social Security Benefits

While the federal government may tax Social Security, most states do not.

However, 12 states do tax benefits in some form:

- Colorado

- Connecticut

- Kansas

- Minnesota

- Missouri

- Montana

- Nebraska

- New Mexico

- Rhode Island

- Utah

- Vermont

- West Virginia

Social Security and Inflation: What to Expect in the Future

COLAs are based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The next COLA for 2026 will be announced in October 2025.

In high-inflation years like 2022, COLAs were as high as 8.7%, the biggest jump in over 40 years. For 2025, the 2.5% increase is smaller, reflecting lower inflation rates—but it’s still a valuable adjustment.

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

July 2025 Social Security Payments: Important Dates Every Washington State Resident Should Know

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent