Say Goodbye to Social Security as We Know It: The year 2026 is set to be a game-changer for Social Security, bringing with it several critical changes that could significantly impact retirees and future beneficiaries. These changes are the result of evolving financial realities, legislative shifts, and changing public expectations. While most people are familiar with the basics of Social Security—like the age at which they can start receiving benefits and how much they can expect—few understand the full scope of the transformations coming in 2026. If you’re planning to retire soon or have family members who rely on Social Security, you’ll want to pay close attention to these shifts. This article will guide you through the key changes in Social Security set for 2026, explaining what they mean for your benefits, when to claim them, and how they fit into broader retirement planning. Whether you’re a future retiree, a financial professional, or just someone interested in staying informed, this guide is for you.

Say Goodbye to Social Security as We Know It

The changes coming to Social Security in 2026 are significant, and how you plan for them will determine the quality of your retirement. Understanding these updates, such as the shift in full retirement age, the COLA increase, and the changes to tax deductions, can help you make informed decisions. While challenges like the potential depletion of the Social Security Trust Fund remain, proactive planning now can help ensure your retirement is as secure as possible.

| Key Changes | Impact on Beneficiaries | References |

|---|---|---|

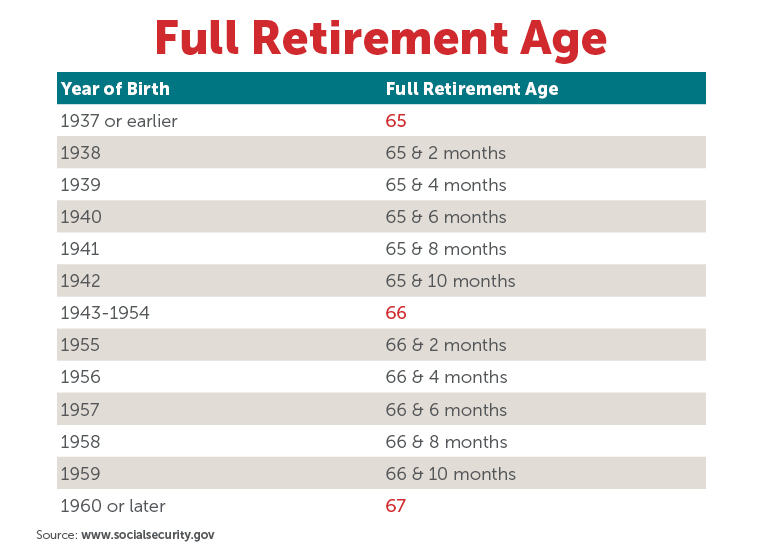

| Full Retirement Age (FRA) reaches 67 | Those born in 1960 or later will need to wait until age 67 to claim full benefits. | Social Security Administration |

| Projected 2.7% Cost-of-Living Adjustment (COLA) | A slight increase in monthly benefits for retirees, but rising healthcare costs may offset the gain. | AInvest |

| New $6,000 Senior Tax Deduction | Seniors can claim this temporary deduction, but it does not apply to Social Security benefits. | Kiplinger |

| Windfall Elimination Provision (WEP) Repealed | Public-sector retirees with non-Social Security-covered pensions may see an increase in benefits. | Social Security Fairness Act |

| Phase-Out of Paper Checks | Beneficiaries must switch to direct deposit or prepaid cards to receive payments. | The Sun |

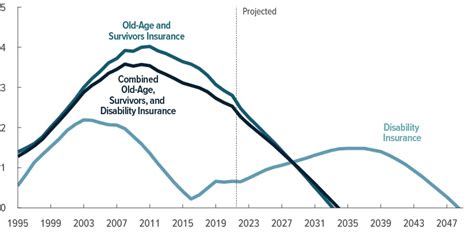

| Financial Concerns: Trust Fund Depletion | Social Security trust fund projected to be depleted by 2033, with a possible 20% benefit cut unless action is taken. | Barrons |

Full Retirement Age (FRA) Reaches 67

For decades, Social Security’s Full Retirement Age (FRA) has gradually been increasing. By 2026, anyone born in 1960 or later will see their FRA set at 67 years old. This means that those who are aiming to retire at 65 or even 62 will face a significant reduction in their monthly benefits, as claiming early results in a permanent cut. If you choose to claim your benefits at 62, for example, you could lose 30% of your benefits compared to waiting until you reach FRA. On the flip side, waiting until age 70 to claim your benefits could result in up to a 24% increase in your monthly payment.

What does this mean for you? Simply put, if you’re planning to retire around age 62 or 65, you may want to consider waiting a few more years. If you can afford to wait, the added monthly benefit could make a significant difference in your retirement income over time. On the other hand, if you need to retire early, be prepared for the reduced benefits and plan your finances accordingly.

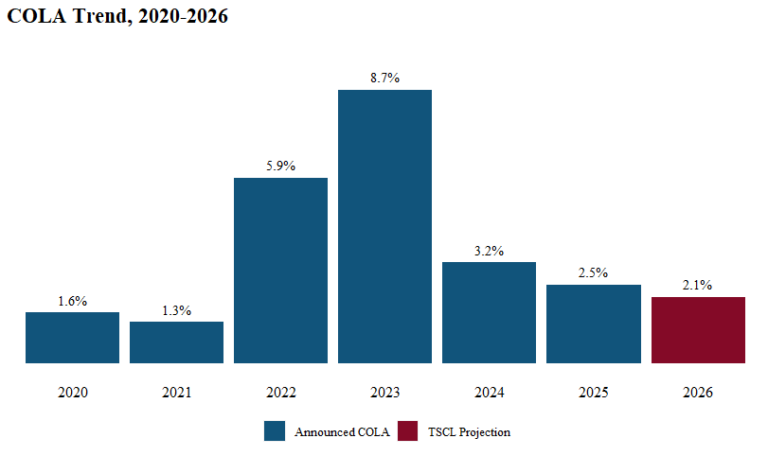

Projected 2.7% Cost-of-Living Adjustment (COLA)

In 2026, the Social Security Administration (SSA) estimates a 2.7% Cost-of-Living Adjustment (COLA). This COLA is designed to help keep pace with inflation and adjust Social Security benefits to account for rising prices of goods and services. For many retirees, this could mean an extra $53 per month on average.

However, it’s important to note that this bump might not feel as impactful as it sounds. Why? Because rising healthcare costs—especially the 11.6% increase in Medicare Part B premiums—may eat up most, if not all, of the COLA adjustment. If you’re relying on Social Security to cover a large portion of your expenses, you’ll need to factor in these healthcare costs when making your retirement budget.

Practical advice: Keep an eye on your Medicare premiums and adjust your budget accordingly. If you’re planning to retire soon, it’s a good idea to explore Medicare Advantage plans or look into long-term care insurance options to help mitigate these rising healthcare costs.

The $6,000 Senior Tax Deduction

One of the more unexpected changes for 2026 is the introduction of a $6,000 senior tax deduction for individuals aged 65 and older, as part of the “One Big Beautiful Bill” passed in July 2025. This temporary measure provides a way for seniors earning less than $75,000 (or $150,000 for couples) to reduce their taxable income, potentially lowering their overall tax burden.

While this deduction can be a helpful way to save money, it’s important to clarify that it does not apply to Social Security benefits themselves. So if you were hoping to use this deduction to avoid taxes on your Social Security income, you’re out of luck. This provision is focused solely on federal income taxes.

What should you do? Be sure to update your tax planning strategy to take full advantage of this deduction. You may also want to consult a tax professional to ensure you’re making the most of this new benefit.

The End of the Windfall Elimination Provision (WEP)

If you’re a public-sector retiree who worked in a job not covered by Social Security (think teachers, police officers, and government employees), you may have been subjected to the Windfall Elimination Provision (WEP). This provision reduced the Social Security benefits of individuals who had both worked in non-Social Security-covered jobs and had a pension from those jobs.

But good news for many: The WEP is being repealed under the Social Security Fairness Act. This means that millions of public-sector retirees will see an increase in their monthly Social Security payments starting in 2026. Some retirees will even receive retroactive payments to compensate for the benefits they lost under the WEP.

This is a huge win for people who have worked in public service careers. If you’ve been affected by the WEP in the past, make sure to check your benefits statement and review how this repeal will impact your retirement plan.

Phasing Out of Paper Checks

In a move to modernize its operations and prevent fraud, the Social Security Administration (SSA) will phase out paper checks by September 30, 2025. This means that, moving forward, all beneficiaries must switch to either direct deposit or prepaid debit cards to receive their payments.

If you’re one of the millions of people still receiving paper checks, you’ll need to take action now to avoid delays or missed payments. Setting up direct deposit is a straightforward process, and many banks will help you do this for free.

Financial Concerns: Say Goodbye to Social Security as We Know It

Despite these reforms, there is still a looming financial challenge for Social Security. The Social Security Trust Fund is projected to be depleted by 2033, meaning that, unless Congress acts, Social Security beneficiaries could face a 20% reduction in their benefits.

So what can you do now? It’s time to stay informed and be ready for potential changes in Social Security’s funding structure. Some potential solutions include increasing payroll taxes or adjusting the formulas used to calculate benefits. However, finding a political consensus on these solutions has proven difficult.

Retirement planning should take this uncertainty into account. It’s important to diversify your retirement savings and not rely solely on Social Security. Consider other retirement accounts like 401(k)s, IRAs, and Roth IRAs to help build a more secure future.

Other Factors to Consider for 2026

In addition to the more obvious changes, there are a few other trends and adjustments that could affect you in 2026. These include:

More Focus on Long-Term Care Planning

As healthcare costs continue to rise, long-term care is becoming an increasingly important component of retirement planning. Starting in 2026, many more retirees will be encouraged to explore long-term care insurance or other forms of savings dedicated to healthcare costs. Without this planning, many retirees may find themselves in financial distress as healthcare expenses take a larger bite out of their retirement savings.

An Increase in Social Security Fraud Prevention

With the phase-out of paper checks, Social Security fraud is expected to decline. The SSA is also introducing more stringent security protocols for online access to benefits and account information. Beneficiaries are encouraged to use two-factor authentication and regularly monitor their accounts for any suspicious activity.

The Role of Employer-Sponsored Retirement Plans

Many workers, especially younger individuals, are increasingly relying on employer-sponsored 401(k)s to prepare for retirement. The automatic enrollment and increasing contributions to these plans mean that workers will enter retirement with more savings than previous generations. Keep an eye on how Social Security fits into this broader context of retirement savings to understand how much you’ll need to live comfortably.

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Upcoming Social Security Changes Require Immediate Action — Missing Deadline Could Delay Your Money

Social Security Shake-Up Incoming — What Every Recipient Needs to Know Now