SASSA Targets 210,000 Recipients Earning Over R65K: If you’re one of the millions of South Africans relying on social grants to put food on the table or keep the lights on, there’s something big you need to know. The South African Social Security Agency (SASSA) has officially identified more than 210,000 individuals receiving grants while also earning more than R65,000 annually—which is far above the limit allowed for certain grant programs.

SASSA isn’t staying quiet about it either. They’ve launched a formal compliance review and issued a firm message: “Come clean within 30 days or risk having your grant cancelled.” This development has stirred concern, confusion, and a lot of questions. In this guide, we’ll break it all down in simple, straight-shooting language.

SASSA Targets 210,000 Recipients Earning Over R65K

The news that SASSA is targeting 210,000 grant recipients earning above R65,000/year is a reminder to everyone: the social grant system relies on honesty and transparency. If your income has changed or if you’re unsure about your eligibility, don’t risk being caught out—go to SASSA, disclose the truth, and correct your record. This isn’t just about avoiding trouble. It’s about making sure the system works for everyone—especially those who need it the most.

| Item | Details |

|---|---|

| Focus | SASSA investigates 210,000 recipients earning over R65,000/year |

| Income Breach Threshold | R65,000/year (~R5,416/month) |

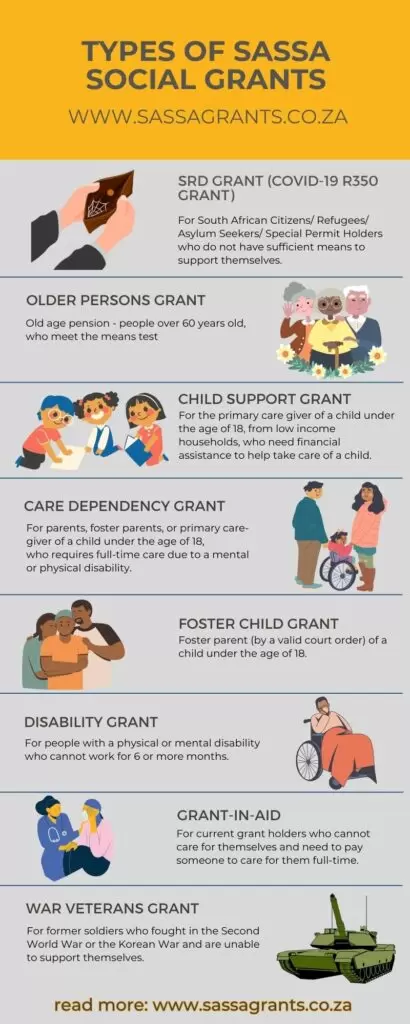

| Grant Types Affected | Old Age, Child Support, Disability, SRD (R370) |

| Detection Method | Credit bureaus, SARS, bank account monitoring |

| Required Action | Report to SASSA within 30 days with income proof |

| Potential Risks | Grant cancellation, legal prosecution, debt recovery |

| Official Website | https://www.sassa.gov.za |

Why This Crackdown Is Happening Now?

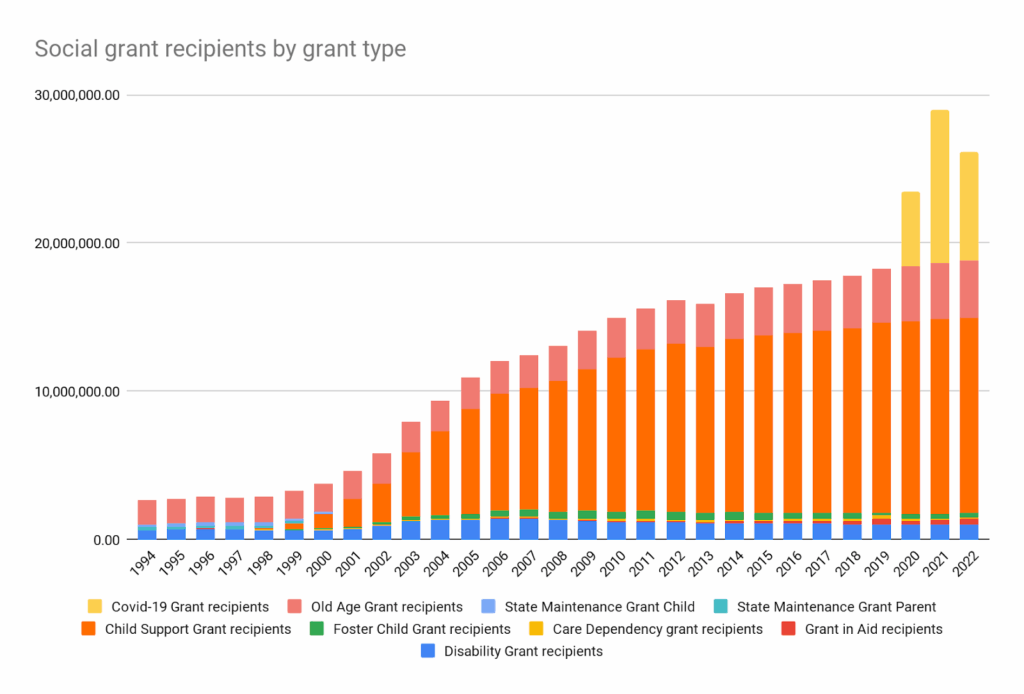

SASSA provides critical support to over 18 million people across South Africa every month. These funds are meant to help the country’s most vulnerable citizens—including elderly pensioners, disabled individuals, single parents, and unemployed youth.

But as the cost of living rises and government budgets tighten, public institutions are under pressure to make sure that every rand is spent responsibly.

To do this, SASSA teamed up with SARS, major South African banks, and credit bureaus to identify discrepancies between declared income and actual earnings. Those found earning more than R65,000/year without reporting it now face a serious decision: voluntarily disclose and verify their income or face possible fraud charges and grant revocation.

Who Is Affected by the Income Threshold?

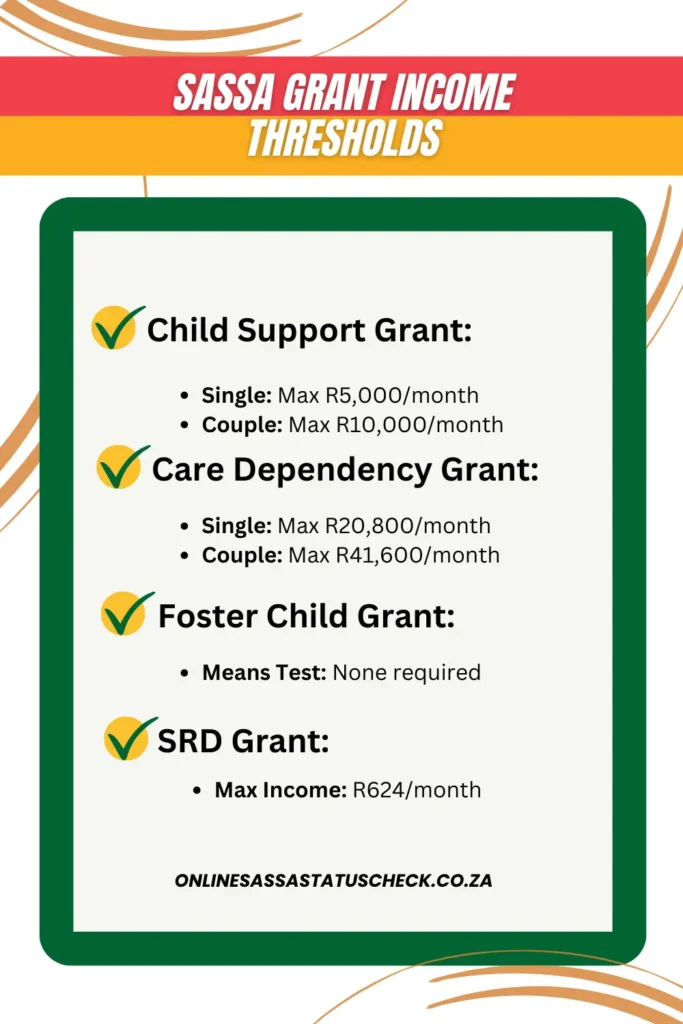

Let’s make something clear: Not all grants have the same income rules.

Here’s a breakdown of popular grant types and how much income disqualifies you:

| Grant Type | Max Annual Income | Notes |

|---|---|---|

| Child Support Grant | R60,000 (single); R120,000 (married couple) | For low-income caregivers |

| Old Age Grant | R96,840 (single); R193,680 (couple) | For seniors 60+ |

| Disability Grant | R96,840 (single); R193,680 (couple) | Based on certified disability |

| SRD Grant (R370) | R624/month max | For unemployed, no income |

If you’re receiving any of these grants and earning more than the listed amount—even temporarily or through a side hustle—you must disclose that income to SASSA.

What You Should Do If You’re The One Whom SASSA Targets 210,000 Recipients Earning Over R65K

If your grant has been suspended, or if you received a notification from SASSA saying your income is under review, here’s what to do right now.

Step 1: Check Your Grant Status Online

Head to https://srd.sassa.gov.za and use your ID number to check your payment status. Look for phrases like:

- “Under Review”

- “Deferred”

- “Income Threshold Exceeded”

Step 2: Collect Proof of Income

You’ll need to show exactly how much you earn and from where. Bring:

- Three months of recent bank statements

- Payslips, if you’re employed

- A letter from an employer if you do part-time or casual work

- A sworn affidavit if income is informal (e.g., cash from hair braiding or carpentry)

- Proof of any rental income or side hustles

Step 3: Visit Your Local SASSA Office Within 30 Days

You’ll need to present your documentation in person. If your situation is legitimate and you’re still under the income threshold for your specific grant, your payment could be reinstated.

If your income exceeds the allowed limit, you’ll likely be disqualified from further payments, and may even be asked to repay previous grants received while ineligible.

Real-Life Examples: How This Impacts People

To understand how real people are affected, let’s look at two fictional—but realistic—scenarios:

Thabo’s Mistake

Thabo, a 32-year-old unemployed father, applied for the SRD R370 grant. A few months later, he started helping his uncle run a tuck shop and was paid R1,000 per week in cash. He didn’t report this income.

SASSA flagged him via bank deposit patterns and mobile payment history. Now, Thabo must repay R3,700 in benefits and is blacklisted from reapplying.

Mam’Dlamini’s Dilemma

Mam’Dlamini, a 65-year-old widow, receives the Old Age Grant. Her daughter sends her R1,500/month from Johannesburg. Mam’Dlamini also rents out a back room in her house for R2,000/month.

Together, that’s over R3,500 monthly—pushing her over the income threshold. She’s now under review.

Legal Consequences of Non-Disclosure

If you’re receiving a grant you’re not entitled to, that’s considered fraud. And under South African law, fraud carries serious penalties.

According to the Social Assistance Act of 2004:

- Offenders can face up to 5 years in prison

- Fines of up to R100,000

- An order to repay the entire amount received

- Potential blacklisting on national databases

SASSA has already opened multiple fraud cases in recent years, recovering millions in improper payments.

How SASSA Detects Fraud?

This isn’t a random witch hunt. SASSA has access to:

- Credit bureau records showing home loans, vehicle financing, and income history

- SARS declarations, including IRP5s and tax returns

- Banking information that shows regular or large deposits

- Mobile payment systems (like eWallet or Instant Money) flagged for suspicious patterns

SASSA says their systems use automated red flags to detect inconsistent income declarations.

Global Comparisons: This Isn’t Just a South African Issue

In the United States, people caught misusing welfare programs face felony charges, massive fines, and jail time. The Supplemental Nutrition Assistance Program (SNAP) audits all income sources including tips, bonuses, and under-the-table pay.

In the UK, the Department for Work and Pensions (DWP) monitors income in real time and has jailed individuals for lying about their circumstances.

South Africa is now moving in the same direction—modernizing fraud detection and emphasizing compliance.

What You Should Do Moving Forward?

The best way to protect yourself is to stay informed and compliant. Here’s a checklist:

- Always report any changes in income, even temporary boosts

- Keep your bank records clean—avoid large unexplained deposits

- Don’t apply for grants if you’re unsure about your eligibility

- Use the SASSA hotline (0800 60 10 11) or their website for clarity

- If your grant stops, don’t panic—you may still have options to appeal or reapply legally

Social Consequences: Why Honesty Matters

It’s easy to think, “It’s just R370 a month, no big deal.” But in reality, when thousands of ineligible people claim grants, it creates delays, budget shortfalls, and mistrust. Legitimate beneficiaries are often left waiting, and the system becomes stretched to the limit.

Fraudulent use of social grants erodes public trust and puts pressure on those who really need assistance. By staying honest, you help build a fairer, stronger system.

SASSA Confirms July 2025 Grant Payment Dates— When You’ll Receive Your Payouts?

What Really Happens If You Breach the SASSA Income Threshold— Check Details to Secure Your Payments

SASSA July 2025 Payments Updated—Will the Child Support Grant Date Change Too?