SASSA Crackdown Begins: In South Africa, the South African Social Security Agency (SASSA) has begun a major crackdown aimed at rooting out social grant recipients who are hiding their income. This is part of a broader effort to ensure that government resources reach only those who truly need them. If you’re a grant recipient, or you know someone who is, this article is for you. We’ll break down the situation in simple terms and help you understand how it affects you. Plus, we’ll give you practical advice on how to avoid getting into trouble.

SASSA Crackdown Begins

SASSA’s crackdown on hidden income is designed to keep the social grant system fair and functional. The key takeaway here is: be honest about your income. Whether you’re self-employed, working a side hustle, or getting family support, make sure you report it. Not only will you avoid serious consequences, but you’ll also help make sure that social grants go to those who need them most. By following the guidelines and submitting the necessary documents, you’ll be able to continue receiving the support you deserve without any issues. Remember, transparency is key in these situations.

| Key Data & Stats | Description |

|---|---|

| SASSA Crackdown | Focused on grant recipients hiding income. |

| 210,000 Flagged | Number of beneficiaries flagged for review based on financial inconsistencies. |

| Legal Risks | Failure to comply may lead to fraud investigations, suspension, or permanent removal from the system. |

| Required Documents | Certified ID, bank statements, proof of income, etc. |

| Official Website | SASSA Official Website |

What is the SASSA Crackdown?

The SASSA crackdown refers to the ongoing review process where the agency is carefully scrutinizing grant recipients to make sure they are not hiding income from other sources. You might wonder why this is happening now, and the answer lies in the increasing number of people who have been found to be undisclosing certain incomes, whether from jobs, side hustles, or even family contributions.

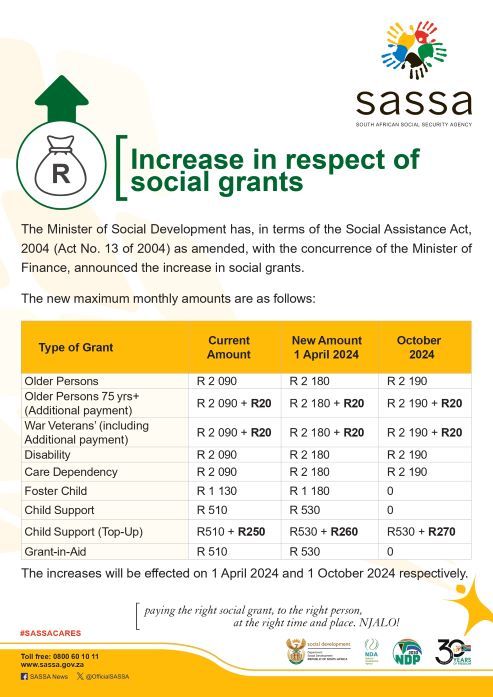

SASSA’s mission is simple: to ensure that social grants, such as child support or disability benefits, go to the people who need them most. That means, if someone is receiving a grant but also making money from other sources they didn’t report, that could be a violation of the rules. With the new scrutiny, SASSA is using technology, such as data cross-checks, to track down people who may be hiding this extra income.

Why This Matters: SASSA’s Goal

At its core, the SASSA crackdown is about fairness. Social grants are meant to assist individuals who are financially vulnerable. When someone hides their income, they take away resources from those who truly need it. The South African government wants to ensure that the funds are used effectively, and that people who need financial support get what they deserve.

This review process has already flagged 210,000 beneficiaries, and more could be on the horizon. If you’re a recipient, it’s time to take note. This article will explain how to stay compliant and avoid potential pitfalls in the process.

What Are SASSA’s Main Concerns?

SASSA is particularly concerned with certain types of hidden income. These include:

- Undisclosed Employment: If you are employed and don’t report your income, this is a serious issue.

- Unreported Business Activities: Running a small business or side hustle that you haven’t declared can trigger an investigation.

- Family Income: Sometimes, people hide the income of a spouse or other family members.

- Multiple Government Benefits: If you are receiving other forms of financial aid, failing to report them can be a red flag.

- Suspicious Bank Transactions: Large or unusual bank deposits that don’t match your declared income are under scrutiny.

SASSA works closely with banks and other government institutions to cross-check information. So, if you’re hiding something, it’s likely to come out.

The Social Impact of the Crackdown

The SASSA crackdown not only protects the integrity of the system but also ensures that the grants are being distributed where they are needed most. Social grants play a critical role in improving the lives of many South Africans, especially those in marginalized communities. The increased scrutiny is essential for reducing fraud and misuse.

By making sure that only eligible recipients get grants, SASSA helps keep the program sustainable. In the long run, this protects vulnerable people from losing access to these crucial benefits. For those who are honest and transparent, there should be no issues, and they can continue receiving the support they deserve.

What Happens If You’re Flagged?

If SASSA flags you for review, they’ll ask you to submit certain documents. These may include:

- Certified Copy of Your ID or Smart ID Card: You need to prove your identity.

- Bank Statements from the Past Three Months: This will help SASSA see if your income matches what you’ve declared.

- Proof of Your Employment or a Sworn Affidavit: If you’re employed, you may need to show proof of discharge from your last employer. If you can’t, you might need to provide a sworn affidavit.

- Documentation of Your Children’s Birth Certificates: If you’re applying for child support grants, this is necessary.

- Proof of Ownership of Property: If you own property, you’ll need to prove it, along with any relevant rates or taxes on unoccupied property.

- Proof of Extra Income: Any other paperwork that shows sources of income not previously declared.

Failure to provide these documents could lead to suspension of payments, permanent removal from the system, and even legal action. It’s important to comply as soon as possible to avoid these penalties.

How to Avoid Trouble with SASSA Crackdown Begins?

To avoid getting into trouble, here’s what you should do:

- Report All Your Income: Whether you have a side job, business, or receive help from family, be upfront about it.

- Keep Your Documents Updated: Always have the necessary documents, like ID, bank statements, and proof of income, ready to submit if requested.

- Don’t Hide Anything: If you’re unsure about something, it’s better to declare it than risk being caught later.

- Respond Quickly to Requests: If SASSA contacts you, make sure to respond promptly to avoid delays or penalties.

- Keep Records: Make sure you have a clear record of your income and any government benefits you receive, in case you ever need to prove them.

Real-Life Case Study: Understanding the Impact

Imagine you’re a young woman living in a rural area, receiving child support from SASSA. You also run a small catering business on the side, earning about R3,000 a month. If you don’t declare this income to SASSA, your business may be flagged when SASSA checks your financial records. As a result, your grant could be suspended, and you might even be asked to repay funds. To avoid this, all you have to do is report your extra income and submit your business-related documents when asked. This will help ensure that you remain eligible for the support you need.

Support Services Available to SASSA Beneficiaries

If you find yourself confused about the requirements or need help complying, several resources are available:

- Legal Aid: There are various legal aid organizations in South Africa that can help beneficiaries navigate disputes with SASSA.

- Financial Counseling: Many nonprofit organizations offer free or low-cost financial counseling for low-income individuals to help them manage their finances and ensure they are reporting their income correctly.

- SASSA Helplines: If you need to contact SASSA directly, you can call their toll-free number at 0800 60 10 11 or email [email protected] for assistance.

SASSA Confirms July 2025 Social Grant Payment Schedule- Check Details!

Over 2 Million South Africans Could Lose SASSA Grants Amid Payment Chaos

SASSA Adds a New Fourth Payment Date — Who Qualifies for the Extra Payout?