RSDI Payments of $1,857: Retirement, Survivors, and Disability Insurance (RSDI) payments are crucial for many Americans, offering financial stability to those who have contributed to Social Security throughout their working lives. In July 2025, millions of beneficiaries can expect their RSDI payments on specific dates, and understanding when and how these payments work is essential. This article will provide you with all the details on RSDI payments, including the specific paydays, eligibility criteria, and other key information to help you manage your finances. Whether you’re new to Social Security benefits, receiving payments for the first time, or helping a loved one navigate the system, this guide will provide all the insights you need in a clear and straightforward way.

RSDI Payments of $1,857

Understanding your RSDI payment schedule and managing your benefits wisely is crucial for financial stability. In July 2025, millions of Americans will receive $1,857 in Social Security benefits on specific dates. By knowing when to expect your payment and budgeting effectively, you can ensure that your RSDI benefits last throughout the month.

| Key Point | Details |

|---|---|

| RSDI Payment Amount | $1,857 |

| Payday Dates in July 2025 | July 9, July 16, July 23 |

| Eligibility | Based on birth date, with a specific schedule depending on your birth month. |

| Official SSA Resource | SSA Payment Schedule |

| How to Plan for Payments | Check your birth date, then match it to the corresponding payday. |

| Taxation on RSDI Payments | Payments may be taxed depending on your income level. |

| Managing RSDI Payments | Tips for budgeting, saving, and maximizing your benefits. |

What is RSDI?

Retirement, Survivors, and Disability Insurance (RSDI) is a Social Security program designed to provide financial assistance to individuals who have contributed to the Social Security system during their working years. This can include individuals receiving benefits due to retirement, disability, or due to the death of a family member.

RSDI plays a pivotal role in providing financial security for Americans who may no longer be able to work due to age, disability, or other circumstances. For many, these benefits represent a significant portion of their income, and understanding when and how to access them is critical for long-term financial planning.

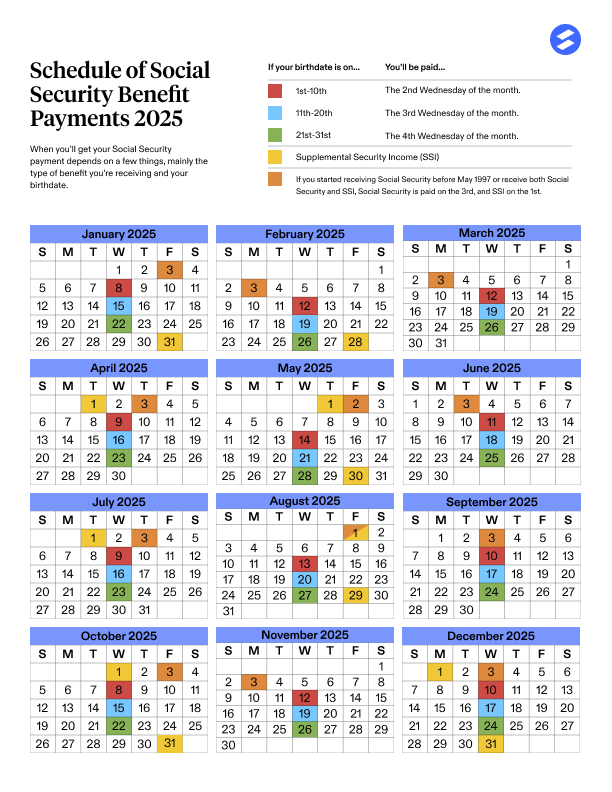

The July 2025 RSDI Payment Schedule

The Social Security Administration (SSA) releases RSDI payments on specific days each month. However, the payment dates are not uniform across all recipients; they are based on the date of birth. In July 2025, payments will be staggered across three different days:

- July 9, 2025: For individuals whose birthday falls between the 1st and 10th of the month.

- July 16, 2025: For individuals born between the 11th and 20th.

- July 23, 2025: For individuals born between the 21st and 31st.

How Do I Know When I’ll Get My Payment?

It’s simple: check your birthdate! The SSA has set a payment schedule that’s based on the day of the month you were born. Here’s how it works:

- If your birthday falls between the 1st and 10th, your payment will arrive on July 9, 2025.

- If your birthday falls between the 11th and 20th, expect your payment on July 16, 2025.

- If your birthday falls between the 21st and 31st, your payment will be on July 23, 2025.

Why the Staggered Schedule?

The staggered payment schedule helps the SSA manage payments more efficiently. It prevents a backlog or delay if everyone were to receive their payments on the same day. With millions of beneficiaries receiving Social Security benefits, spreading out payment dates ensures a smoother process for both the SSA and recipients.

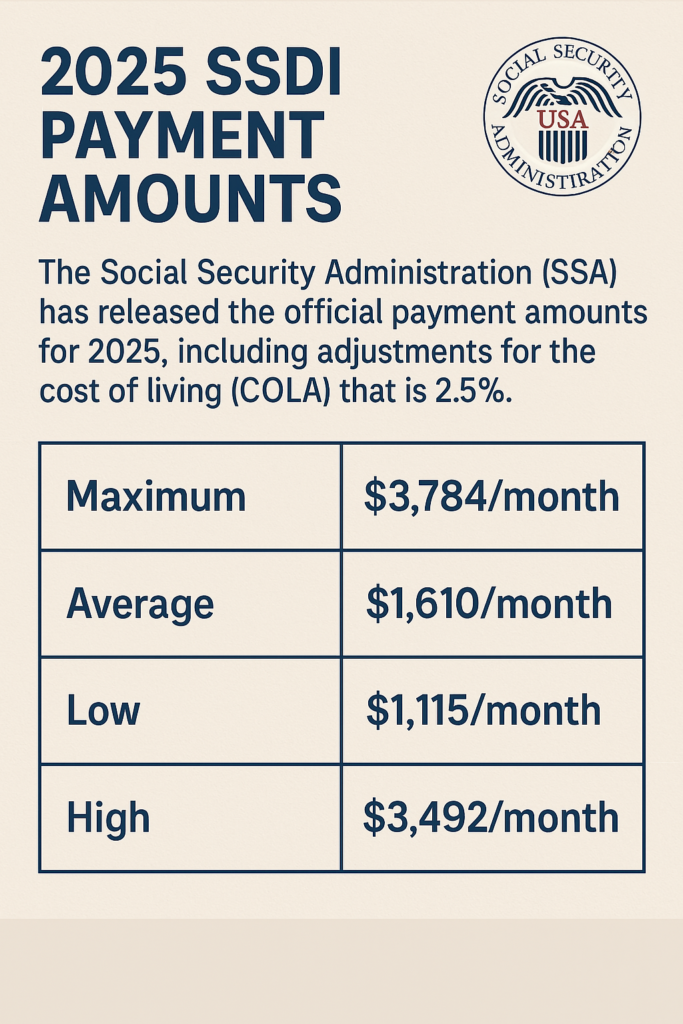

How Much Will I Receive in July 2025?

In July 2025, the typical RSDI payment is $1,857. This is the average amount for those who qualify, though your payment may differ depending on several factors, such as:

- Work History: Your past earnings and number of years worked contribute to the amount of your monthly RSDI payment.

- Spouse or Family Member Benefits: If you are receiving benefits due to a deceased spouse or family member, your payment may be different.

- Disability Status: For those receiving disability benefits, the amount may also vary based on their unique circumstances.

The amount you receive depends on how much you’ve earned during your working years.

Taxation on RSDI Payments

One of the important considerations when it comes to RSDI payments is taxes. Are Social Security benefits taxable? Yes, in some cases, they are.

- If you file as an individual and your total income exceeds $25,000 in a year, you may have to pay taxes on your RSDI benefits.

- For couples filing jointly, the threshold is $32,000.

Your taxable amount depends on your total income, which includes income from wages, pensions, and interest. To avoid surprises at tax time, it’s a good idea to track your income and consult with a tax advisor to determine if your benefits will be taxed.

How to Manage RSDI Payments of $1,857 Effectively?

For many, RSDI payments are a primary source of income. Managing this money wisely is essential to ensuring long-term financial stability. Here are some tips to make the most of your RSDI payments:

1. Budgeting Your Monthly Payments

Since RSDI payments typically come once a month, it’s important to budget carefully to make sure your money lasts throughout the month. Here’s how:

- List all of your monthly expenses, including rent, utilities, groceries, insurance, and transportation.

- Set aside money for savings each month, even if it’s a small amount.

- Prioritize bills and other essential expenses over discretionary spending.

If you’re struggling to make ends meet, the SSA offers resources and programs to help low-income beneficiaries, such as Supplemental Security Income (SSI). Contact your local SSA office to inquire about assistance options.

2. Consider Setting Up Direct Deposit

If you haven’t already, consider setting up direct deposit with the SSA. This option allows your payments to be automatically deposited into your bank account, which is faster and more secure than waiting for a check in the mail.

3. Look for Additional Assistance Programs

There are several programs available for low-income or disabled individuals that can supplement your RSDI payments. Programs like Medicaid, SNAP, and LIHEAP (Low Income Home Energy Assistance Program) can help reduce the financial strain. Be sure to explore these opportunities if you’re eligible.

4. Build an Emergency Fund

Although RSDI payments provide a steady income, it’s still wise to have an emergency fund. Having a financial cushion can help you avoid financial distress in case of unexpected expenses, like medical bills or car repairs. Start small, but make it a priority.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Deadline Alert—July 2025 Social Security Cutoff Is Closer Than You Think