‘Revenge Saving’ Is the Bold Money Move Everyone’s Trying: In a world where rising prices, inflation, and the unpredictability of the job market are constantly threatening to derail financial security, a new financial trend is making waves: Revenge Saving. The idea behind this bold money move is simple – it’s about fighting back against rising costs and the uncertainty of the economy by aggressively saving money. It’s a concept that many are turning to as a way to regain control of their finances after years of indulgent spending. But what exactly is revenge saving, and why is it becoming so popular among younger generations like Millennials and Gen Z? Let’s dive in, explore its origins, benefits, and how you can start using this strategy to build a secure future for yourself.

‘Revenge Saving’ Is the Bold Money Move Everyone’s Trying

| Key Topic | Details |

|---|---|

| What is Revenge Saving? | Aggressive saving as a response to economic pressures like inflation, job insecurity, and rising prices. |

| Who is Practicing It? | Millennials and Gen Z are leading the charge in revenge saving. |

| Why It Works? | Focuses on financial independence and building security during uncertain times. |

| Key Strategy | Cutting discretionary spending, building emergency funds, and automating savings. |

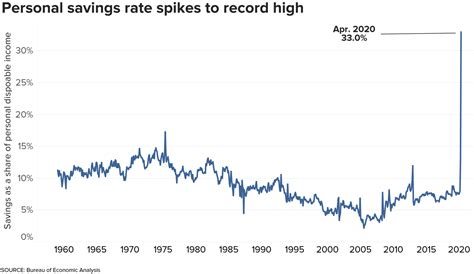

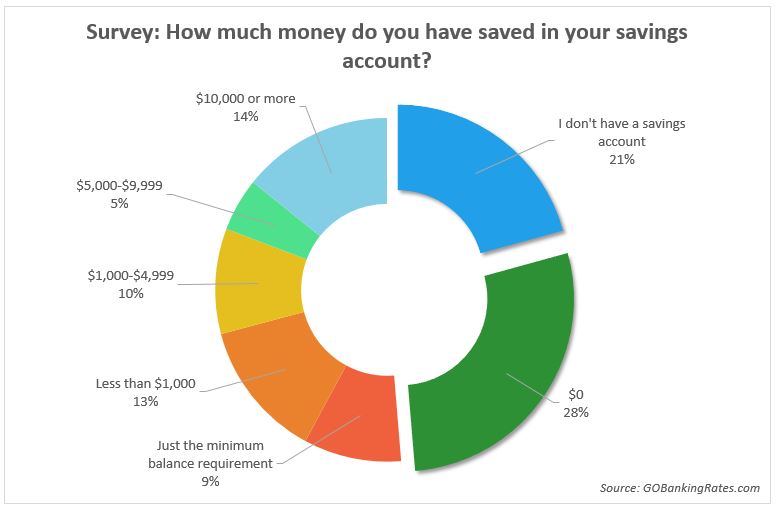

| Statistics | Personal savings rate in the U.S. rose from 4.1% to 4.9% in early 2025. 45% of Americans are increasing emergency fund savings. |

| How to Start | Automate savings, audit subscriptions, set specific financial goals, and reduce non-essential spending. |

| Global Impact | Similar trends are emerging in other countries, especially China and parts of Europe. |

| Additional Resources | For more tips on smart saving, check out MarketWatch’s guide on revenge saving. |

What is Revenge Saving?

In a nutshell, revenge saving is a reaction to the economic pressures that many people are feeling today. After years of splurging on luxury goods and experiences in the post-pandemic boom, people are now turning the tables. They’re focusing on building financial security by aggressively saving money. Unlike revenge spending, where consumers throw caution to the wind and buy impulsively, revenge saving involves the opposite. It’s about cutting back on unnecessary spending, building emergency funds, and taking control of your financial future.

This strategy has particularly gained traction among younger generations – those who are still feeling the effects of high student loans, inflation, and the challenging job market. For many, it’s an emotional reaction to the uncertainty they face, but it’s also an empowering choice. By focusing on savings, people are gaining a sense of control over their financial lives.

Why is Revenge Saving So Popular?

The rise of revenge saving comes as no surprise when we look at the broader economic context. Inflation has been hitting American wallets hard, making everyday essentials more expensive. At the same time, interest rates are climbing, making it harder to borrow money for big purchases like homes and cars. On top of that, the job market is still unpredictable, with layoffs, hiring freezes, and concerns over economic recessions looming.

But revenge saving is more than just a reaction to negative forces – it’s also about financial empowerment. After years of feeling financially insecure, many individuals are looking for ways to regain control. Revenge saving allows them to be proactive, and it provides a tangible way to deal with financial uncertainty. It’s no longer about buying more to feel good. It’s about building wealth for a rainy day and feeling secure in an unpredictable world.

How Does ‘Revenge Saving’ Is the Bold Money Move Everyone’s Trying Work?

The mechanics of revenge saving are pretty straightforward. Here’s a breakdown of the key strategies that people are using to save aggressively:

1. Automate Your Savings

One of the easiest ways to get started with revenge saving is to automate your savings. This means setting up automatic transfers to a dedicated savings account every time you get paid. It ensures that saving becomes a regular habit and reduces the temptation to spend your money elsewhere. You can set up a high-yield savings account to grow your savings faster, and some banks even offer automatic savings plans to make this process seamless.

2. Audit Your Subscriptions

We all have subscriptions that we’re not really using – whether it’s a streaming service, a gym membership, or a magazine subscription. Audit your subscriptions regularly and cancel any that you don’t need or aren’t using. This can free up a surprising amount of money that can be redirected into savings.

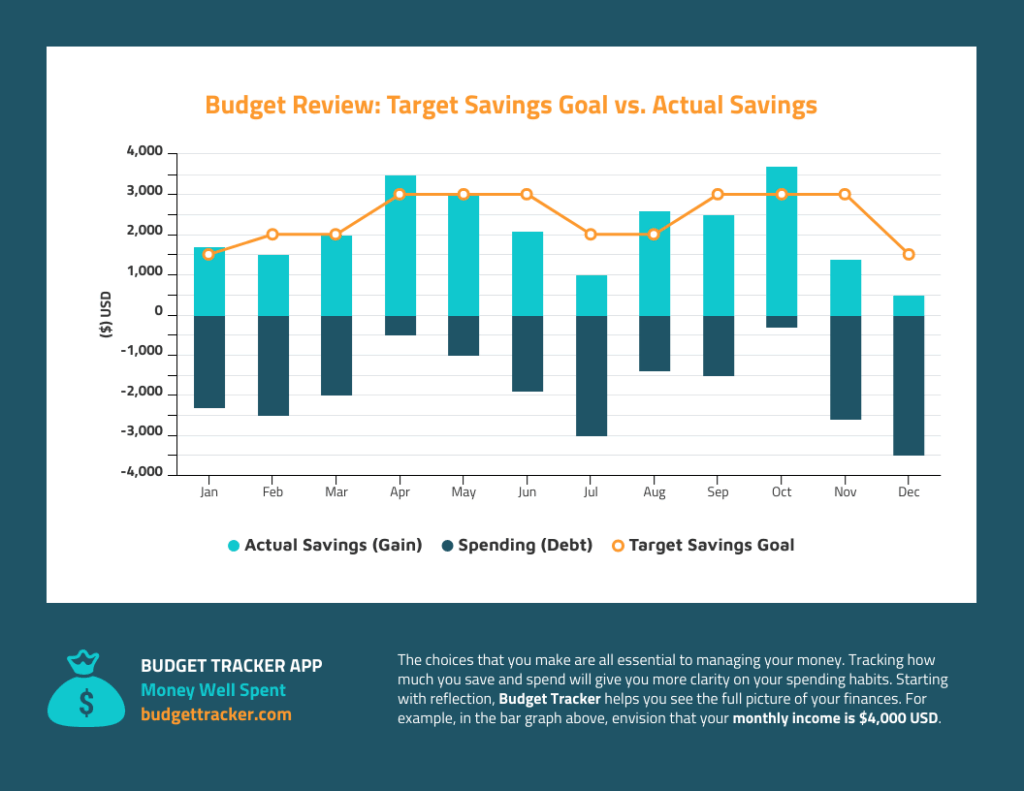

3. Create a Budget and Stick to It

A crucial part of revenge saving is cutting back on unnecessary spending. That means creating a budget that helps you track your income and expenses. Once you’ve got a solid understanding of where your money is going, you can identify areas where you can cut back. This may mean reducing discretionary spending, like dining out or buying luxury goods. The goal is to spend less so you can save more.

4. Set Specific Savings Goals

Instead of just saving money with no real purpose, set specific savings goals. Whether it’s saving for an emergency fund, a vacation, or a new home, having clear goals will help keep you motivated and focused. Make sure to break your goals into smaller milestones and celebrate each achievement along the way.

5. Focus on Building Emergency Funds

Perhaps the most critical part of revenge saving is building up an emergency fund. With the uncertain state of the world today, it’s more important than ever to have a financial cushion. Ideally, you should aim to save enough to cover three to six months’ worth of living expenses. This gives you a buffer if you lose your job or face an unexpected expense.

The Global Impact of Revenge Saving

While revenge saving is largely associated with U.S. consumers, it’s a trend that’s making waves in other parts of the world as well. In China, Gen Z is embracing a more frugal lifestyle, largely due to high unemployment rates and economic uncertainty. Similarly, in Europe, many younger people are putting off big purchases and focusing on saving due to similar financial pressures.

What’s interesting about this trend is how it transcends geographical boundaries. In a world that’s becoming more interconnected, revenge saving is one of the few financial movements that unites people in their quest for financial freedom, regardless of where they live.

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

How to Finally Stop Overspending—Practical Tips That Actually Work