Retiring Soon? If you’re retiring soon, you’re probably dreaming about what comes next—long walks, grandkid visits, maybe some gardening, golf, or globe-trotting. But here’s the kicker: where you choose to retire can make or break your retirement.

That’s not an exaggeration. In 2025, the cost of living, healthcare access, taxes, and even climate risks vary drastically from state to state. With more retirees living longer and relying on fixed incomes, the decision of where to retire is one of the most important financial and lifestyle choices you’ll make. So whether you’re looking for sunshine, savings, or peace and quiet, we’ve done the legwork for you. Let’s dig into the 10 best and 10 worst U.S. states to retire in—based on facts, real numbers, and real retiree experiences.

Retiring Soon? These 10 States Are the Best

Retiring well means more than leaving the workforce—it’s about designing the life you want and choosing the right place to live it. The best states offer low taxes, affordable healthcare, safety, and lifestyle perks that make your money stretch and your days more enjoyable. Don’t rush the decision. Do your research, take scouting trips, talk to locals, and use this guide as your starting point. A smarter retirement starts with the right location.

| Category | Top Picks |

|---|---|

| Best States | Florida, Delaware, New Hampshire, South Dakota, Alaska |

| Worst States | Kentucky, Louisiana, Mississippi, Hawaii, New Jersey |

| Most Tax-Friendly | Wyoming, Florida, Alaska, Nevada |

| Highest Cost of Living | Hawaii, California, New York |

| Best Healthcare Access | Massachusetts, Wisconsin, Pennsylvania |

| Source Links | SSA.gov, WalletHub |

Why Where You Retire Matters More Than Ever?

You might think you can retire just about anywhere, but here’s the thing—retirement isn’t just about money. It’s about security, health, lifestyle, and peace of mind. Where you live impacts everything from how far your Social Security check goes to how quickly you can see a doctor.

Factors to consider include:

- State income tax on pensions and Social Security

- Cost of living (housing, groceries, transportation)

- Access to healthcare, especially specialists

- Climate and risk of natural disasters

- Safety, community, and recreational options

This isn’t just about escaping snow. It’s about setting yourself up to live well for 20–30+ more years.

The 10 Best States If You’re Retiring Soon in 2025

1. Florida

Florida has no state income tax, no tax on Social Security or retirement income, and offers a wide range of senior communities. Combine that with sunshine, beaches, and affordable housing (in many areas), and you’ve got a retiree paradise. Popular cities include Sarasota, The Villages, and Fort Myers.

2. Delaware

Delaware offers no sales tax, low property taxes, and generous exclusions on retirement income. For East Coast retirees, it’s close to Philly, Baltimore, and D.C. without the big-city cost. Plus, it boasts a mild climate and improving healthcare access.

3. New Hampshire

Known for its scenic landscapes, low crime, and no income or sales tax, New Hampshire is popular with nature lovers and fiscally conscious retirees alike. Healthcare quality is high, and the cost of living is moderate compared to neighboring states like Massachusetts.

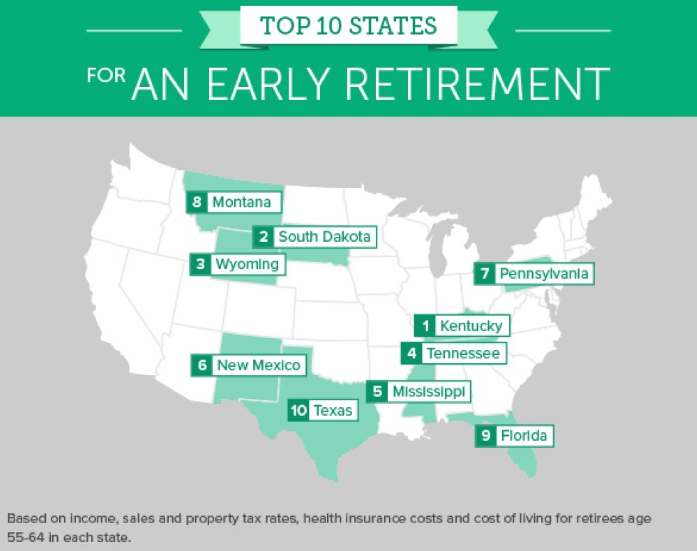

4. South Dakota

South Dakota flies under the radar but offers low taxes, a low cost of living, and a surprisingly robust healthcare system in cities like Sioux Falls. It also ranks high for retiree satisfaction and safety.

5. Alaska

Believe it or not, Alaska is financially appealing: no income tax, no sales tax, and an annual dividend from oil revenue (around $1,300 per resident in recent years). It’s not for everyone, but if you love solitude and nature, it’s worth a look.

6. Wyoming

Like South Dakota, Wyoming offers no state income tax, low property tax, and a relaxed pace of life. Towns like Cheyenne and Casper are small but have growing senior support systems and healthcare access.

7. Pennsylvania

Retirement income—including pensions, 401(k)s, IRAs, and Social Security—is not taxed in Pennsylvania, and healthcare access is excellent, especially near major hospitals in Pittsburgh, Philadelphia, and Harrisburg.

8. Wisconsin

Wisconsin is often overlooked but boasts a strong healthcare system, relatively low housing costs, and a strong sense of community. Summers are beautiful, and towns like Madison and Green Bay are very retiree-friendly.

9. Maine

Retirees looking for peace and natural beauty find a lot to love in Maine. Healthcare access is improving, especially in Portland and Bangor, and the crime rate is one of the lowest in the country.

10. Montana

Montana doesn’t have a sales tax and is known for its open spaces and outdoor recreation. While winters are cold, retirees love its slow pace and low crime rate. Housing remains affordable outside Bozeman and Missoula.

The 10 Worst States to Retire in 2025

1. Kentucky

High poverty and smoking rates, below-average healthcare, and limited public services for seniors make Kentucky a tough retirement spot. Retirees report difficulty accessing specialized medical care.

2. Louisiana

Despite its culture and food, Louisiana ranks low in healthcare, safety, and quality of life for seniors. It also has one of the highest obesity and chronic disease rates in the U.S.

3. Mississippi

Mississippi consistently ranks last in health outcomes and senior services. While housing is cheap, other services—especially healthcare—can be hard to come by.

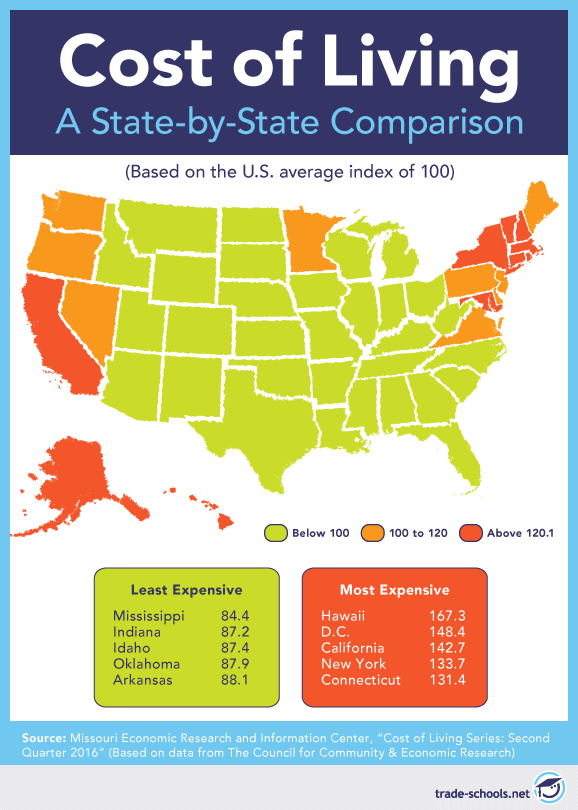

4. Hawaii

Hawaii’s natural beauty comes at a steep price. The cost of living is 88% above the national average, and basic goods like groceries and gas are imported—making them extremely expensive. Healthcare access is also limited on smaller islands.

5. New Jersey

High property taxes (average $9,500 per year), traffic congestion, and high healthcare costs make New Jersey one of the least affordable retirement states.

6. Rhode Island

Small but expensive, Rhode Island taxes some retirement income, has high property taxes, and ranks poorly for cost-of-living and elder healthcare accessibility.

7. Arkansas

Though housing is cheap, Arkansas has high crime rates and underperforming healthcare systems, especially in rural areas where services are scarce.

8. West Virginia

Limited senior services, economic instability, and healthcare access challenges have placed West Virginia low on most retirement indexes.

9. California

California has a high income tax rate (up to 13.3%) and sky-high housing prices. Retirees often find themselves squeezed financially—even in affordable inland areas.

10. Washington (State)

Washington has no income tax, but rising property costs, especially near Seattle, and overall cost of living make it tough for retirees on fixed incomes.

Cost of Living Comparison Table (2025)

| State | Housing Index | Healthcare Index | Overall Cost Index |

|---|---|---|---|

| Florida | 101 | 95 | 100 |

| Hawaii | 191 | 122 | 188 |

| Delaware | 103 | 89 | 98 |

| California | 183 | 111 | 152 |

| Wyoming | 93 | 84 | 92 |

| National Avg | 100 | 100 | 100 |

Best Healthcare States for Retirees

| State | Healthcare Rank | Notes |

|---|---|---|

| Massachusetts | #1 | Best hospitals, senior care access |

| Wisconsin | #3 | Top rural and urban facilities |

| Pennsylvania | #5 | Quality hospitals statewide |

| Louisiana | #47 | Low access, poor outcomes |

| Mississippi | #49 | Chronic shortages, low funding |

What About Climate and Natural Disasters?

Some retirees move for weather—but don’t forget natural disaster risk.

- High Risk: Florida (hurricanes), California (wildfires and earthquakes), Louisiana (flooding), Arizona (extreme heat)

- Low Risk: Wisconsin, Pennsylvania, New Hampshire

Real Retiree Voices

“I left New Jersey and moved to Delaware. My taxes dropped by over $8,000 a year, and I’m closer to my grandkids in Maryland.” — Carol W., 66

“We sold our house in New York, moved to Florida, and paid cash for a home with room to spare. We play pickleball and walk the beach daily.” — Luis M., 70

Actionable Retirement Relocation Checklist

- Research tax implications of your top 3 states

- Visit during different seasons to test comfort

- Compare healthcare providers in your area

- Check public transportation and walkability

- Review crime rates and natural disaster risk

- Join a local Facebook group or forum for retirees

Age 65? You Could Get a $1,611 Social Security Payment This July – Check Eligibility Criteria!

Social Security Sends Out Urgent Email Over Trump Tax Bill Confusion – Check Details!

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!