Republican Senator Lays Out Social Security Changes: Social Security, a cornerstone of retirement and disability benefits in the United States, is facing challenges as it edges toward insolvency. To address this looming issue, Republican Senator Bill Cassidy has put forward a new plan that could drastically reshape how the system functions. The proposal includes significant changes to how Social Security is funded, which could impact future benefits for millions of Americans. This article breaks down the proposed changes, explains the potential effects, and offers insight into how these changes could shape the future of Social Security.

Republican Senator Lays Out Social Security Changes

The proposed changes to Social Security by Senator Bill Cassidy are an important step in addressing the program’s financial challenges. While the plan offers hope for future beneficiaries, there are significant risks involved, particularly with the investment strategy. The debate over Social Security reform is far from over, but it’s clear that action is needed to ensure the program remains viable for generations to come. Whether through Cassidy’s proposal or other measures, finding a sustainable solution for Social Security is crucial to the financial well-being of millions of Americans.

| Key Points | Details | Sources |

|---|---|---|

| Proposed Changes | Creating a separate investment fund for higher returns, including stocks and bonds | Investopedia |

| Funding Mechanism | Initial $1.5 trillion infusion into the new fund, projected to grow over 75 years | Newsweek |

| Protecting Current Beneficiaries | Focus on safeguarding benefits for current and near-future recipients | Washington Post |

| Risks and Concerns | Market volatility, long time frame for returns, and absence of structural reforms | CBS News |

| Additional Bills and Tax Relief | “One Big Beautiful Bill Act” signed by President Trump for seniors 65+ | MarketWatch |

Introduction: A New Plan for Social Security

In an era where Social Security faces potential cuts and increased scrutiny, Senator Bill Cassidy’s proposal offers a fresh solution. The plan is designed to protect the financial future of Social Security while also ensuring that current and future retirees continue to receive their benefits. Cassidy’s proposal stands out because it introduces the idea of investing in higher-return assets like stocks and bonds, which is a departure from the traditional approach that relies heavily on payroll taxes and the trust fund. This could be a game-changer in how Social Security is funded and managed.

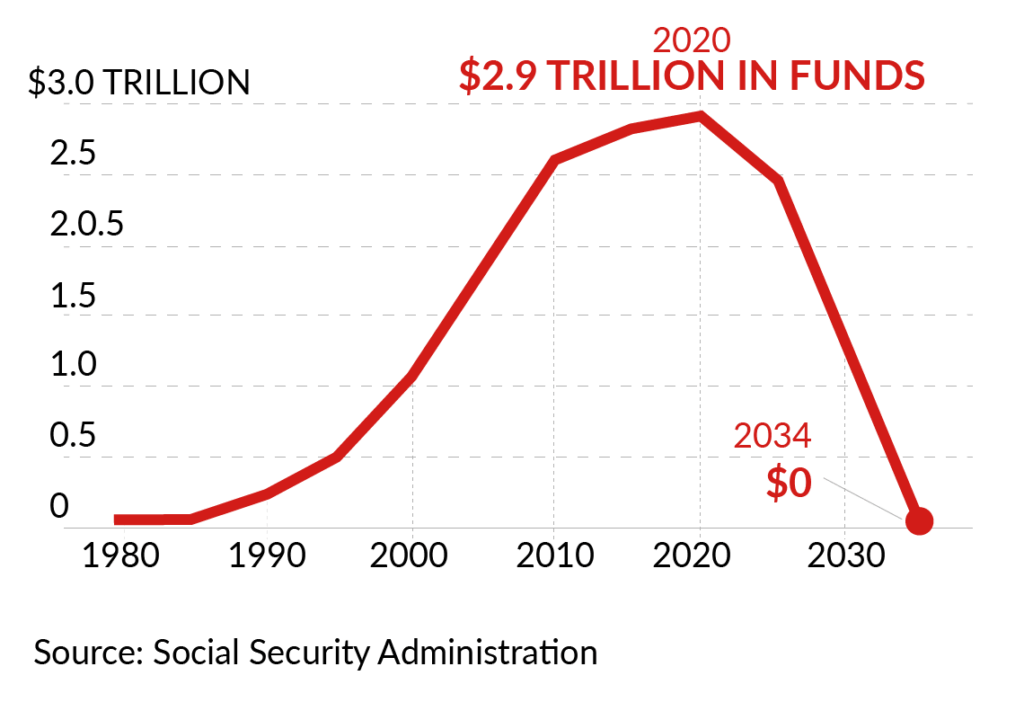

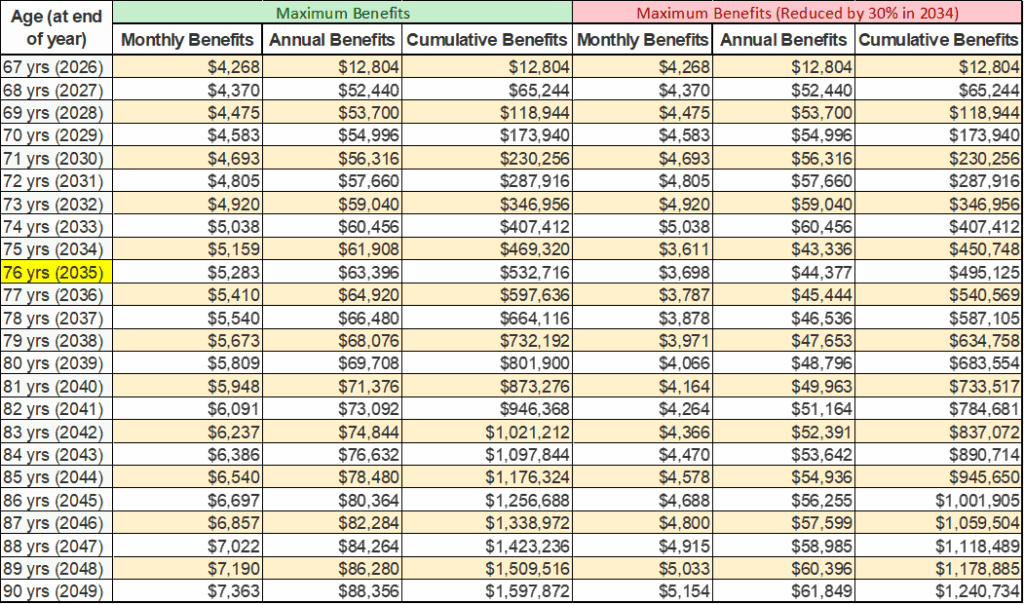

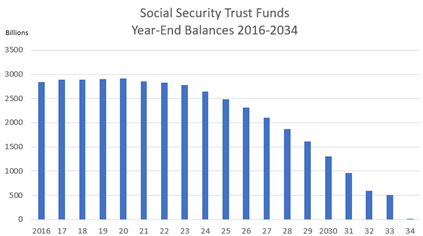

Social Security, which millions of Americans rely on for retirement, disability, and survivors’ benefits, is in serious financial trouble. According to the latest estimates, the Social Security trust fund is projected to be depleted by 2033, meaning that without significant changes, benefits could be slashed by up to 20-25%. Cassidy’s proposal seeks to address this gap and extend the life of the program, but there are questions about the feasibility and risks of his plan. Let’s dive into the details.

What’s in Cassidy’s Plan?

The Investment Fund: A New Approach

At the heart of Senator Cassidy’s proposal is the creation of a separate investment fund for Social Security. This fund would be distinct from the existing Social Security trust fund and would be managed differently. Instead of relying solely on payroll taxes, which are subject to economic fluctuations, the new fund would be allowed to invest in higher-return assets such as stocks and bonds.

Cassidy’s plan calls for an initial infusion of $1.5 trillion into the fund, with the hope that it will grow significantly over the next 75 years. The idea is that, by investing in these assets, the fund can generate higher returns than the traditional government bonds used in the current Social Security trust fund. The long-term goal is for the fund to eventually provide additional revenue to supplement payroll taxes, repaying money to the U.S. Treasury as needed.

Protecting Current Beneficiaries

One of the primary concerns when discussing Social Security reform is the impact on current beneficiaries—those who rely on Social Security for their daily expenses. Cassidy’s plan addresses this concern by ensuring that current and near-future beneficiaries will not see a reduction in their benefits. This is important because Social Security is a lifeline for millions of Americans, particularly those who rely on it as their primary source of income in retirement.

The proposal also takes into account future beneficiaries, aiming to preserve their benefits by securing the financial health of the program. While the investment fund may take decades to reach full maturity, the hope is that it will ultimately create a more sustainable system for future generations.

Risks and Concerns

While Cassidy’s plan has received some praise, it has also faced significant criticism. One of the main concerns is the market volatility associated with investing in stocks and bonds. The stock market, while capable of delivering high returns, is also subject to fluctuations that could negatively impact the fund. If the market performs poorly during key periods, it could affect the fund’s ability to generate enough revenue to meet future obligations.

Another concern is the time frame required for the fund to grow. 75 years is a long time, and critics argue that the proposal doesn’t address the immediate financial shortfall facing Social Security. The lack of immediate structural reforms—such as changes to eligibility, benefit amounts, or payroll taxes—means that the program could still face financial difficulties in the short term.

The One Big Beautiful Bill Act

In addition to Cassidy’s proposal, the Republican Party has also introduced other measures related to Social Security. For example, the One Big Beautiful Bill Act, which was signed into law by President Trump, includes provisions that could impact Social Security. One key provision is a temporary tax deduction for seniors aged 65 and older. This could result in lower federal income taxes for many Social Security recipients.

However, while this tax relief may benefit seniors in the short term, some experts have raised concerns that it could accelerate the insolvency of Social Security. By reducing tax revenue, the program’s ability to fund benefits could be compromised, leading to even larger deficits in the future.

Alternative Proposals to Social Security Reform

While Cassidy’s proposal has garnered attention, it’s far from the only idea on the table. In fact, there are a variety of proposals from both Republican and Democratic lawmakers aimed at addressing Social Security’s financial challenges.

- Raising the Payroll Tax: One common proposal is to increase the payroll tax rate. Currently, 6.2% of an individual’s earnings up to a certain cap are taxed to fund Social Security. Increasing this rate could provide more funding for the program.

- Raising the Retirement Age: Another option is raising the retirement age. As people live longer, the age at which someone can begin receiving benefits has become a point of discussion.

- Means Testing: Some argue that higher-income individuals should receive fewer benefits, or none at all. This proposal, called means testing, would reduce benefits for wealthier Americans to preserve funds for those who need them most.

Each of these proposals has its supporters and detractors, and it’s likely that any eventual reform will include a mix of solutions.

Historical Context of Social Security

Before diving further into proposed reforms, it’s helpful to understand where Social Security came from and why it’s so vital today.

Social Security was signed into law in 1935 by President Franklin D. Roosevelt as part of his New Deal program to provide financial support to elderly Americans. Initially, it was a modest program designed to keep seniors out of poverty. Over the decades, the program has expanded to cover a variety of benefits, including disability and survivor benefits. Today, Social Security serves as a critical safety net for millions, providing income to approximately 70 million Americans.

Why Republican Senator Lays Out Social Security Changes Matters?

The Importance of Social Security

For many Americans, Social Security is more than just a safety net; it’s a critical source of income. According to the Social Security Administration, nearly 70 million Americans receive benefits, including retirees, disabled individuals, and survivors of deceased workers. Social Security accounts for about 40% of the income for elderly Americans. Without it, many would face significant hardship in their later years.

The Impact of Insolvency

If Social Security were to become insolvent, benefits could be reduced by as much as 20-25%. This would result in lower monthly payments for millions of Americans, significantly affecting their quality of life. Reforming the system is essential to ensuring that Social Security continues to provide the financial support that Americans need in retirement and in times of hardship.

Potential Solutions

There are many ideas on the table for reforming Social Security. Some, like Cassidy’s proposal, focus on investment strategies to generate higher returns. Others advocate for changes to the program’s structure, such as raising the retirement age or increasing payroll taxes. While no solution is perfect, it’s clear that action is needed to ensure the long-term stability of Social Security.

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers