Privatizing Social Security Could Completely Reshape Your IRA Strategy: The idea of privatizing Social Security has been a hot topic in the U.S. for years. It’s a bold move that could significantly reshape how Americans save for retirement, especially when it comes to IRAs (Individual Retirement Accounts). If you’re someone who has always relied on Social Security as a safety net for your future, you might be wondering how this change will affect your long-term financial plan. Would it mean more responsibility for you? And how can you adjust your IRA strategy in response to these changes? In this article, we’ll break down what privatizing Social Security really means, how it could impact your IRA, and most importantly, how you can adapt your retirement strategy to make sure you’re prepared, whether you’re a beginner or a pro in the world of finance.

Privatizing Social Security Could Completely Reshape Your IRA Strategy

Privatizing Social Security could change the way Americans think about retirement. With the potential for more personal responsibility, your IRA will likely become a central part of your retirement strategy. By taking proactive steps today—like maximizing contributions, diversifying your investments, and seeking professional advice—you can ensure that you’re prepared for whatever the future brings. The key is to stay informed, plan carefully, and make your IRA work harder for you.

| Key Point | Details |

|---|---|

| What Privatizing Social Security Means | A potential shift from government-managed benefits to individual accounts, creating more personal responsibility in retirement planning. |

| Impact on IRAs | Increased focus on IRAs as a primary retirement vehicle, with new opportunities and challenges in terms of contributions, investments, and management. |

| Potential Benefits | Enhanced investment opportunities, higher contribution limits, and more control over your retirement funds. |

| Challenges to Consider | Market volatility, higher fees, and the complexity of managing privatized accounts. |

| Practical Steps to Take | Maximize IRA contributions, diversify investments, and seek professional financial advice. |

A Brief History of Social Security

Before we dive into the potential implications of privatization, let’s take a quick trip down memory lane. Social Security, as we know it, was established in 1935 under President Franklin D. Roosevelt to provide financial support for retired workers, widows, orphans, and the disabled. The idea was simple: workers contribute a percentage of their wages into the system, and in return, they receive a monthly benefit after they retire.

Over the years, Social Security has expanded to cover more individuals and has become the backbone of retirement planning for millions of Americans. However, due to demographic shifts, including longer life expectancies and fewer workers contributing to the system, the sustainability of Social Security has come into question. This is where the idea of privatization emerges—allowing individuals more control over their retirement funds but also placing more responsibility on them to ensure a secure future.

Why Should You Care About This Change?

Now that we know what privatizing Social Security could mean, why should you care? For many Americans, Social Security is a critical part of their retirement plan. But if the government no longer guarantees those benefits, you’ll need to lean more heavily on your personal savings—specifically, your IRA.

Your IRA could become your primary source of income in retirement. This means you’ll need to rethink how you’re managing your IRA and whether you’re taking full advantage of the tax benefits and growth opportunities it offers.

IRAs come in two main types: Traditional and Roth. A Traditional IRA allows you to deduct your contributions from your taxable income, but you’ll have to pay taxes when you withdraw the money in retirement. On the other hand, a Roth IRA lets you contribute after-tax dollars, but your withdrawals in retirement are tax-free. Both types of accounts have their pros and cons, and the best one for you depends on your specific financial situation.

How Privatizing Social Security Could Completely Reshape Your IRA Strategy?

If Social Security is privatized, your IRA will become even more important as the cornerstone of your retirement savings. Let’s take a look at how this could impact your retirement strategy:

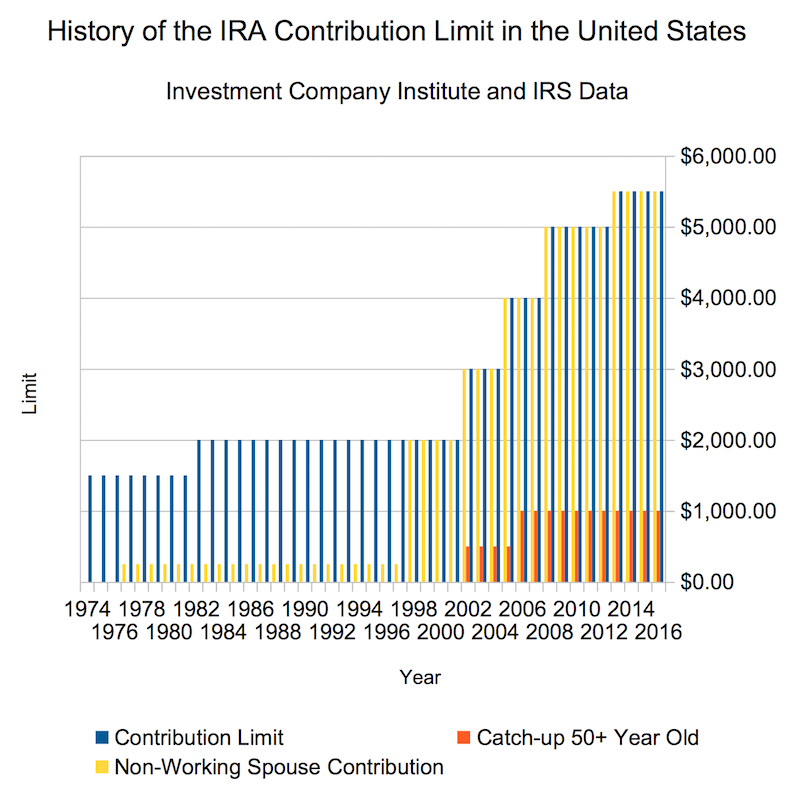

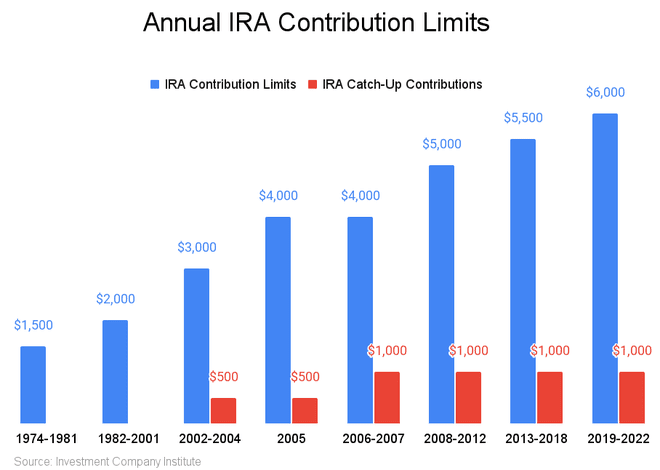

1. Increased Contributions Limits

If the government moves toward privatization, lawmakers may raise the contribution limits for IRAs, giving you more room to save. This could help you compensate for the loss of guaranteed Social Security income by allowing you to sock away more money into tax-advantaged accounts.

Currently, the annual contribution limit for IRAs is $6,500 for those under 50, and $7,500 for those 50 and older (as of 2023). If these limits were increased, it could make it easier for you to save more for retirement.

2. Expanded Investment Opportunities

One of the biggest advantages of a privatized Social Security system is the opportunity to have more control over your retirement savings. With IRAs, you already have a wide range of investment options, from stocks and bonds to real estate and precious metals.

In a privatized system, you might be able to access even more investment opportunities, which could potentially boost your retirement savings. With the right investment strategy, you could grow your money faster than the current Social Security system allows.

3. The Role of Annuities

In a privatized system, you might need to find other ways to create a steady income stream in retirement. Social Security has traditionally been a form of guaranteed income, but with privatization, you might need to consider alternatives like annuities to ensure that you don’t run out of money.

An annuity is a financial product that provides regular payments to you over a certain period, often for the rest of your life. Some retirement planners suggest allocating a portion of your IRA to an annuity to mimic the guaranteed income Social Security provides.

4. More Responsibility for Your Future

One thing that’s certain about a privatized system is that you’ll be more responsible for your own future. Unlike Social Security, which provides a guaranteed income stream, a privatized account means you’ll have to monitor your investments, make smart decisions, and adjust your strategy as needed.

This will require more financial literacy and planning on your part. It might be time to take a closer look at your investment strategy and consider working with a financial advisor to make sure you’re on track to meet your retirement goals.

Pros and Cons of Privatizing Social Security

Pros:

- Greater Control: Privatization allows individuals to have more control over their retirement savings.

- Potential for Higher Returns: If managed well, investments could provide greater returns than traditional Social Security.

- Incentive to Save More: Higher contribution limits could lead to more personal savings for retirement.

Cons:

- Market Risk: No guaranteed returns, meaning retirement income could fluctuate based on market performance.

- Increased Responsibility: Without government oversight, it’s up to individuals to make sound investment decisions.

- Possibly Higher Fees: Managing personal accounts might come with increased administrative costs.

Real-Life Example: Chile’s Privatization of Social Security

Chile became the first country to fully privatize its social security system in 1981. Under this model, Chileans contribute to personal retirement accounts managed by private pension funds. While the system has been praised for increasing the savings rate, it has also faced criticism for creating inequalities. Some people who invested poorly or saw poor market returns struggled with inadequate retirement funds. The Chilean experience shows that privatizing Social Security is a double-edged sword—providing opportunities for greater returns but introducing risks that need careful management.

Practical Steps You Can Take Now

Even if privatizing Social Security is still in the works, it’s a good idea to start preparing for the potential changes now. Here’s what you can do to adapt:

- Maximize Your IRA Contributions: Take full advantage of the current contribution limits. If they increase in the future, try to max out your contributions to take advantage of tax breaks and growth opportunities.

- Diversify Your Investments: Don’t put all your eggs in one basket. If Social Security is privatized, you’ll need a diversified portfolio to help weather the ups and downs of the market.

- Consider Annuities: While not for everyone, annuities can help ensure you have a steady income stream in retirement. Speak to a financial advisor about whether this makes sense for you.

- Stay Educated: Keep learning about personal finance and investment strategies. The more you know, the better you’ll be at managing your retirement savings.

More Retirees Are Relying Solely on Social Security — Survey Reveals Growing Dependence

Social Security Is Running Out of Cash — Here’s the Shocking Timeline

Social Security Confidence Hits 15-Year Low Among Young Adults — Here’s Why