Pensioners Born Before This Date Could Be Owed Extra Monthly Payments: If you’re a pensioner born before September 23, 1958, and receiving a UK state pension, you may be owed extra monthly payments as part of the government’s Winter Fuel Payment program. These payments aim to provide financial relief for older adults who face high heating bills during colder months. With inflation still pinching pockets and energy prices rising year after year, this annual support scheme is more important than ever. In this comprehensive guide, we’ll cover who qualifies, how much you could get, and what steps you should take to ensure you don’t miss out.

Pensioners Born Before This Date Could Be Owed Extra Monthly Payments

If you’re born before 23 September 1958, receiving a state pension, and earning less than £35,000 a year, then the UK Government may owe you £200 to £300 in extra winter support. With no application needed, this automatic benefit makes a real difference for millions of older adults. Staying informed ensures you don’t miss out. Whether you’re a retiree, caregiver, or financial advisor, knowing the right dates, thresholds, and contacts could mean more comfort and less stress this winter.

| Category | Details & Insights |

|---|---|

| Eligibility Date | Born before September 23, 1958 |

| Income Cap | Income ≤ £35,000 per year (approximate, not strictly means-tested) |

| Payment Amount | Between £200 and £300, depending on age |

| Payment Method | Automatic bank deposit by November 2025 |

| Other Support | Cold Weather Payments, Warm Home Discount, Pension Credit |

| Exceptions | Care home residents, those in hospital for 12+ weeks may be excluded |

| Official Source | gov.uk/winter-fuel-payment |

What Is the Winter Fuel Payment?

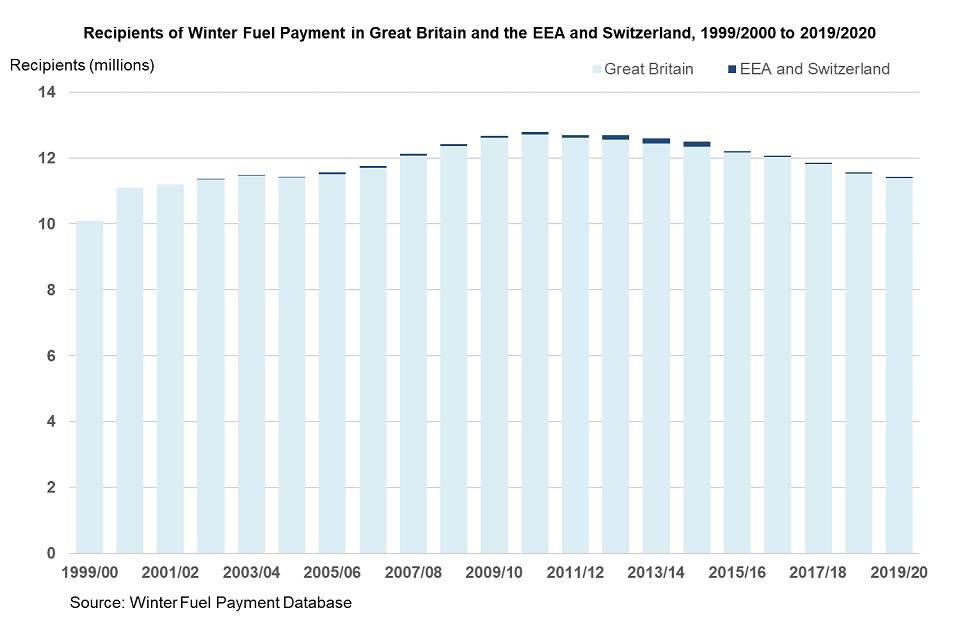

The Winter Fuel Payment is a yearly tax-free benefit provided by the UK Government to help older people pay their heating bills during the winter months. Originally launched in 1997, the scheme has evolved into a critical support mechanism, particularly for those on fixed incomes.

Every winter, millions of pensioners receive this payment, helping them avoid fuel poverty, stay healthy, and manage unexpected spikes in their heating costs.

Who Qualifies for the Extra Payments?

To receive the Winter Fuel Payment, you must meet several eligibility criteria. Let’s break it down:

Basic Eligibility

- You were born on or before 23 September 1958

- You live in the UK during the qualifying week (usually the third week of September)

- You receive State Pension or certain other Social Security benefits

This birthdate aligns with the age at which individuals reach the State Pension Age for the relevant year.

Residency Requirements

- You must be ordinarily resident in the UK

- Expats in the European Economic Area (EEA) or Switzerland may be eligible, depending on circumstances

Exceptions and Disqualifications

You may not be eligible if:

- You lived in a care home and received Pension Credit during the qualifying week

- You were in hospital for over 12 weeks receiving free treatment

- You were in prison during the qualifying week

- You are not claiming a qualifying benefit

Payment Amounts: What Will You Receive?

The amount you receive depends primarily on your age and living situation. The standard rates for Winter 2025/2026 are:

| Age Group | Living Alone | Living with another qualifying person | Living in Care Home |

|---|---|---|---|

| Under 80 | £200 | £100 each | £100 |

| 80 or over | £300 | £150 each | £150 |

Payments are made per person, not per household, but the structure changes slightly if you’re living with another qualifying pensioner.

Example:

If you’re 81 and live alone, you’ll receive the full £300. If you’re 75 and live with another eligible pensioner, you’ll receive £100 and so will your partner.

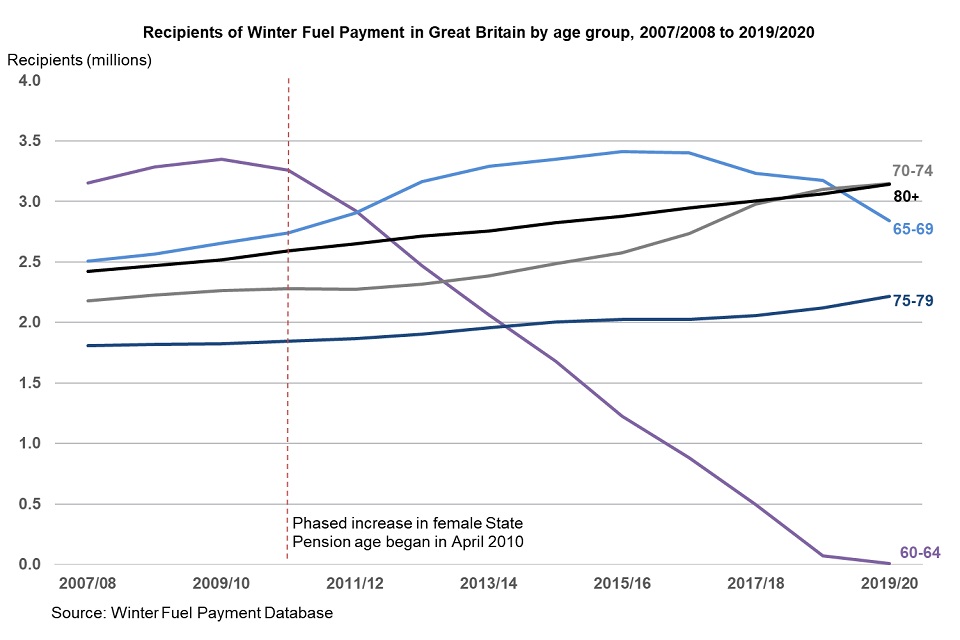

Why the September 23, 1958 Cut-Off?

The cut-off date corresponds to the State Pension Age (SPA), which has gradually increased due to life expectancy and economic sustainability concerns. As of recent years, men and women both reach SPA at 66, but the cut-off date for eligibility aligns with individuals who were state pension age during the qualifying week in 2025.

How and When You’ll Be Paid?

The good news? If you’re eligible, you don’t have to apply. Most payments are made automatically in November 2025. Here’s what you can expect:

- Payment will be sent to the same bank account where your pension or benefits are deposited

- You should receive a letter in October confirming the amount and expected date

- If you’re eligible but don’t receive your payment by December 31, 2025, you should contact the Winter Fuel Payment Centre

Real-Life Scenarios

Let’s look at how this plays out for different people:

Case 1: Peter, 79

Peter lives alone, receives a basic state pension, and has an annual income of £28,000. He qualifies for £200 in November, which will be deposited automatically.

Case 2: Elaine, 84

Elaine lives with her daughter, is over 80, and receives only her pension. She’ll receive £300, helping her offset heating expenses over the winter.

Case 3: John & Mary, both 77

John and Mary live together and both receive state pensions. Each will receive £100, totaling £200 for the household.

What If Pensioners Born Before This Date Could Be Owed Extra Monthly Payments Did Not Get It?

By the end of December, if no funds have appeared, it’s time to follow up:

- Call the Winter Fuel Payment Centre: 0800 731 0160

- Provide your National Insurance number, bank details, and pension information

- Visit gov.uk/winter-fuel-payment for the latest updates

Additional Winter Support Schemes

You might also qualify for these:

Cold Weather Payment

You’ll get £25 for each 7-day period of cold weather (0°C or below) between November and March. Eligibility usually requires Pension Credit or income-based ESA.

Warm Home Discount

A £150 one-off discount on your electricity bill, available to those on Guarantee Credit or low incomes.

Pension Credit

A top-up for low-income pensioners that may unlock additional benefits, including Cold Weather Payments and Housing Benefit.

Will It Affect Other Benefits or Taxes?

No. The Winter Fuel Payment is:

- Non-taxable

- Does not count as income

- Does not reduce Housing Benefit, Pension Credit, or Council Tax Support

This makes it one of the most efficient and risk-free winter supports for seniors.

The Bigger Picture: Correcting Underpayments

In recent years, the Department for Work and Pensions (DWP) discovered that over 100,000 pensioners were underpaid due to administrative errors. More than £570 million has been repaid so far, and the audits continue.

If you think you’ve been underpaid your pension or missed past Winter Fuel Payments, you can:

- Call the Pension Service

- Request a payment history audit

- Consult a financial advisor for follow-up

Advice for Financial Professionals and Carers

- Conduct annual benefit reviews with clients before September

- Create checklists for older adults to monitor their incoming benefits

- Encourage Pension Credit applications, as many eligible pensioners miss out

- Use local authority referral schemes for emergency fuel grants or heating upgrades

Supporting older adults with financial literacy and proactive planning can significantly impact their well-being and trust in your services.

Exact Dates for DWP Winter Fuel Payments in 2025 Revealed—Check If You’re Eligible

Winter Fuel Payment 2025 Confirmed – How Much You’ll Get and When It’s Coming

New DWP £200 Cost of Living Boost Announced—Here’s Who Qualifies