Ontario Trillium Benefit Arrives: If you’re a resident of Ontario, Canada, and you’re feeling the pinch of rising energy and property costs, the Ontario Trillium Benefit (OTB) is here to lend a helping hand. As one of the province’s major financial assistance programs, the OTB aims to ease the cost burden on low- to moderate-income families and individuals by providing direct payments to eligible residents. But what exactly is the OTB, who qualifies, and how much can you expect to receive? This article will break down everything you need to know about the 2025 Ontario Trillium Benefit, including key highlights, how to apply, payment schedules, and answers to frequently asked questions.

Ontario Trillium Benefit Arrives

The Ontario Trillium Benefit is a valuable financial tool for those in need, offering significant relief to help with everyday costs like energy and property taxes. If you’re eligible, the benefit can provide much-needed support, especially in the face of rising living costs. By filing your 2024 tax return, completing the necessary forms, and ensuring your CRA account is up-to-date, you can access these payments. Remember to mark your calendar for the payment dates and watch for your monthly deposit.

| Key Details | 2025 Ontario Trillium Benefit |

|---|---|

| First Payment Date | July 10, 2025 |

| Maximum Payment | $1,461 (for eligible seniors aged 65+) |

| Eligibility | Ontario residents who filed their 2024 tax returns |

| Credits Included | Ontario Sales Tax Credit (OSTC), Ontario Energy and Property Tax Credit (OEPTC), Northern Ontario Energy Credit (NOEC) |

| Application Process | Automatic through tax returns (no separate application) |

| Official Website | Ontario Trillium Benefit |

The Ontario Trillium Benefit combines three credits that aim to help residents cover everyday costs. These credits are the Ontario Sales Tax Credit (OSTC), Ontario Energy and Property Tax Credit (OEPTC), and Northern Ontario Energy Credit (NOEC). While these may sound like a bunch of bureaucratic jargon, they’re really just ways the Ontario government offers direct cash payments to help ease the financial strain on its citizens. If you’re eligible, you can get a significant boost to your finances, particularly when it comes to energy bills and property taxes.

Understanding the Three Main Credits

Let’s break down the three credits that make up the Ontario Trillium Benefit:

- Ontario Sales Tax Credit (OSTC): This credit helps lower-income Ontarians cope with the provincial sales tax. It’s available to individuals 19 years or older and can be up to $371 per year for eligible individuals.

- Ontario Energy and Property Tax Credit (OEPTC): Aimed at individuals who pay property taxes or high energy costs, this credit can be as high as $1,283 for adults aged 18-64, and $1,461 for seniors aged 65 and over.

- Northern Ontario Energy Credit (NOEC): This credit helps residents of Northern Ontario who face high energy and property taxes. Single individuals can get up to $185, while families can claim up to $285.

Together, these credits provide a much-needed financial cushion, especially for individuals or families facing high living costs in Ontario.

Eligibility: Are You Eligible for the Ontario Trillium Benefit?

So, how do you know if you’re eligible for the Ontario Trillium Benefit? Well, there are a few conditions you must meet. The general eligibility requirements are as follows:

Basic Eligibility

To qualify for the OTB, you must:

- Be a resident of Ontario as of December 31, 2024.

- Have filed your 2024 income tax return. This is critical. Even if you don’t owe any taxes, filing your return is necessary to determine your eligibility.

- Meet the eligibility criteria for one or more of the credits. The credits are based on things like your income level, whether you pay rent, property taxes, or energy bills, and your age.

Specific Credit Eligibility

- OSTC: Available to individuals aged 19 or older or to parents/spouses/common-law partners.

- OEPTC: Available to individuals who paid rent, property taxes, or energy bills in 2024.

- NOEC: Available to residents of designated Northern Ontario regions who paid for energy or property taxes in 2024.

If you meet these basic and credit-specific requirements, you’re in the running to receive the OTB!

How Much Can You Expect to Receive?

The Ontario Trillium Benefit is designed to offer relief, but how much you’ll actually receive depends on a few factors. Here’s a rundown of the maximum annual amounts:

| Credit Type | Eligibility Group | Maximum Annual Amount |

|---|---|---|

| OSTC | Individual | Up to $371 |

| OEPTC | Age 18-64 | Up to $1,283 |

| OEPTC | Age 65+ | Up to $1,461 |

| NOEC | Single | Up to $185 |

| NOEC | Families | Up to $285 |

If your total entitlement is $360 or less, you’ll receive the amount as a lump sum in July 2025. But if you qualify for more than $360, you can opt for monthly payments starting from July 2025 or a lump sum payment at the end of the benefit year (June 2026).

Examples of How Payments Work

Let’s break it down further with an example.

- Example 1: You’re a single individual, aged 65, living in Southern Ontario. You qualify for the maximum $371 for the OSTC, the $1,461 for the OEPTC, and no entitlement to the NOEC (since you’re not in Northern Ontario). Your total entitlement would be $1,832. In this case, you can choose to receive monthly payments or a lump sum at the end of the benefit year.

- Example 2: You live in Northern Ontario, pay property taxes, and earn enough to qualify for the full $371 under OSTC and $285 under NOEC. If your total entitlement doesn’t exceed $360, you’d get a lump sum payment in July 2025.

These examples show how the benefit works, with payments tailored to your specific situation.

Payment Schedule: When Can You Expect Your Payment?

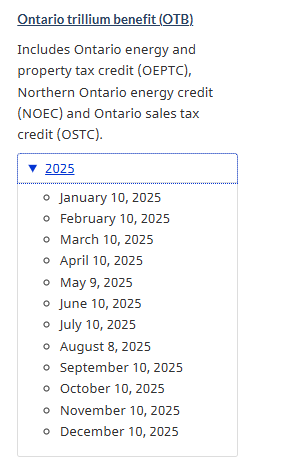

The OTB payment schedule is set annually, and payments are issued on specific dates. For the 2025–2026 benefit year, payments are scheduled as follows:

- First Payment: July 10, 2025

- Subsequent Payments: Every 10th of each month (with adjustments if the 10th falls on a weekend or holiday).

So, mark your calendar for the payment dates, and ensure you check your account on the specified days. Payments will be sent directly to your bank account if your CRA (Canada Revenue Agency) information is up to date.

In case you miss the July payment for any reason, don’t worry—the program is designed to help, so you can still receive future payments. Just ensure you’re up-to-date with your filings and CRA information.

How to Apply for the Ontario Trillium Benefit Arrives?

You don’t need a separate application to receive the OTB. Here’s how to get started:

- File Your 2024 Income Tax Return: Whether you owe taxes or not, this is the first step to ensure your eligibility.

- Complete Form ON-BEN: This is the Application for the Ontario Trillium Benefit and Ontario Senior Homeowners’ Property Tax Grant. Be sure to fill it out when filing your taxes.

- Update Your CRA Account: Make sure your CRA account has your current address and banking information to ensure you get your payment without delays.

Once you’ve completed these steps, you’re good to go! You’ll automatically be considered for the benefit, and payments will begin if you qualify.

Understanding Your CRA Account and Banking Details

To ensure your payment goes smoothly, it’s essential to keep your Canada Revenue Agency (CRA) account updated. Here’s what you need to do:

- Update Your Address: If you’ve moved recently, update your address with the CRA. This will ensure that any correspondence or adjustments related to the OTB are sent to the right place.

- Banking Information: For direct deposit, update your banking details. Payments for the Ontario Trillium Benefit are sent directly to your bank account, which means there’s no waiting around for checks to arrive in the mail.

You can manage all of this through your CRA “My Account” online portal. It’s crucial to do this before the payment dates, especially if you’ve recently changed banks or addresses.

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout

GST/HST Payments in Canada Start This Week—Check If You Qualify for the July 2025 Deposit

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way