Ontario Residents Set to Receive Tax-Free Government Payment: Ontario residents have some great news on the horizon! The provincial government is distributing tax-free payments to eligible residents. These payments are designed to help with the increasing costs of living, including energy bills, property taxes, and other necessary expenses. For many Ontarians, this can be a financial lifeline. But what exactly is this payment? How do you qualify, and how do you apply? Let’s dive into everything you need to know.

Ontario Residents Set to Receive Tax-Free Government Payment

The Ontario Trillium Benefit provides much-needed financial support for residents facing high living and energy costs. By filing your taxes on time and keeping your personal information up-to-date with the Canada Revenue Agency (CRA), you can ensure that you receive your payments without any hassle. Whether you are an individual, married, or a single parent, this program is designed to provide assistance across Ontario.

| Key Info | Details | Reference |

|---|---|---|

| Who is Eligible? | Residents of Ontario who file their taxes, rent, or pay property tax. | Canada.ca |

| Payment Amount | Up to $360 annually, depending on your eligibility. | Canada.ca |

| Eligibility Criteria | Must be 18+ years old, live in Ontario, and file taxes. | Canada.ca |

| How to Apply | Automatically assessed when you file your taxes. | Ontario.ca |

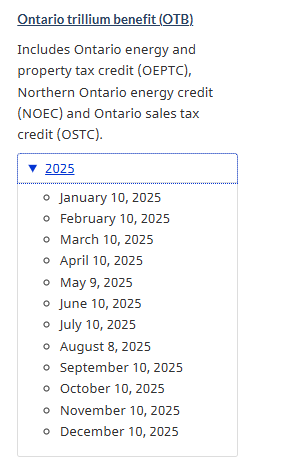

| Payment Dates | Paid monthly, starting on the 10th, with lump sums for smaller amounts. | Canada.ca |

| Deadline for Filing | Tax returns must be filed by April 30, 2025. | Canada.ca |

Understanding the Ontario Trillium Benefit (OTB)

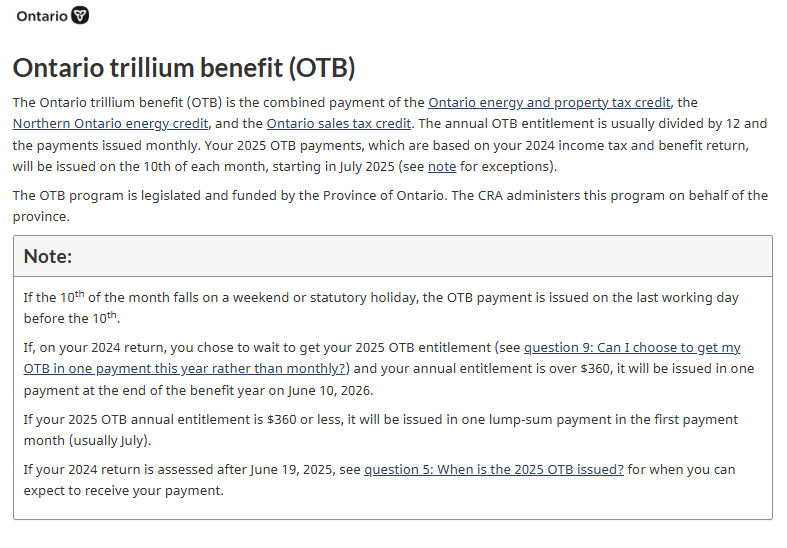

The Ontario Trillium Benefit (OTB) is a provincial government program designed to ease the financial burden of Ontario residents. The benefit helps cover a range of essential expenses including energy costs, property taxes, and sales tax. This program is made up of three different credits:

- Ontario Energy and Property Tax Credit (OEPTC): Provides relief to Ontarians by covering part of their energy and property tax costs.

- Northern Ontario Energy Credit (NOEC): Aimed at reducing energy costs for people living in the colder climates of Northern Ontario.

- Ontario Sales Tax Credit (OSTC): Reduces the burden of the provincial sales tax for low- to moderate-income individuals and families.

Each of these credits helps address specific financial challenges faced by Ontarians, and together they form the Ontario Trillium Benefit, a crucial tool for residents looking to make ends meet.

Eligibility for the Ontario Trillium Benefit

To qualify for the OTB, several conditions must be met. Here’s a breakdown of what you need to be eligible:

1. Residency

- You must be a resident of Ontario by December 31 of the year prior to the payment year. If you plan to receive benefits for the year 2025, you must live in Ontario by December 31, 2024.

2. Age Requirement

- You must be 18 years old or older by the end of the year you are applying for the benefit.

3. Tax Filing

- Filing your taxes is crucial! You must file your 2024 income tax return by April 30, 2025. The Ontario Trillium Benefit is automatically assessed based on the information provided in your tax return, so filing is a must.

4. Property Tax or Rent

- If you’re claiming the Ontario Energy and Property Tax Credit (OEPTC), you need to pay rent or property tax for your main residence. If you live in a long-term care facility or student housing, you may still qualify for the benefit.

5. Northern Ontario Residents

- If you live in Northern Ontario, you may qualify for an additional credit to help offset the high energy costs associated with the region’s colder climate. This is the Northern Ontario Energy Credit (NOEC).

6. Other Eligibility Factors

- If you are responsible for home energy costs while living on a reserve, you may be eligible for the NOEC as well. In addition, eligibility is not restricted by whether you live alone or with others, so married, separated, and single parents can all qualify.

How Much Will You Receive?

The payment amount varies based on a number of factors including your income, age, and where you live. However, here’s a general overview:

- If your annual entitlement is $360 or less, you will receive a lump sum payment, usually in July.

- If your entitlement is greater than $360, you will receive your payment in monthly installments, typically starting on the 10th of each month.

The amount you receive depends on your income, family size, and whether you live in Northern Ontario.

Maximizing Your Benefit

While the Ontario Trillium Benefit can be a helpful financial cushion, it’s important to take steps to ensure you receive the maximum benefit available. Here are a few tips:

- File Your Taxes on Time: Make sure your 2024 tax return is filed by April 30, 2025, to avoid missing out on payments.

- Update Your Personal Information: Ensure that your CRA My Account is up-to-date with the latest personal information like address, marital status, and number of dependents.

- Keep Track of Your Payments: Once your OTB payments are processed, monitor your CRA account to check the status of your payments and confirm the amount received.

- Check for Additional Benefits: In addition to the OTB, you may be eligible for other government benefits such as GST/HST credit, Canada Child Benefit (CCB), and Ontario Child Benefit (OCB). These benefits can be combined to provide significant financial relief.

Ontario Residents Set to Receive Tax-Free Government Payment Application Process

There’s no need for a separate application for the Ontario Trillium Benefit. The benefit is automatically assessed based on your income tax return. Here’s how it works:

- File Your Taxes: File your 2024 income tax return by April 30, 2025.

- Automatic Assessment: Once your return is filed, the Canada Revenue Agency (CRA) will automatically assess your eligibility for the benefit.

- Payment Issuance: If eligible, payments will be issued monthly, starting on the 10th of each month. Smaller amounts are paid in a lump sum during the year (usually July).

- Update Your Information: Make sure your personal details are updated in your CRA My Account or My Service Canada Account. This will ensure there are no delays in processing.

Important Dates to Remember

- April 30, 2025: Deadline to file your 2024 tax return.

- July 10, 2025: First round of payments for those who qualify for a lump sum.

- June 10, 2026: Final payment for those who have a higher annual entitlement.

Be sure to keep track of these dates to avoid missing out!

Ontario Trillium Benefit Arrives This Week—Here’s What Canadian Residents Should Know

Trump’s Tariffs on Canadian Goods May Catch Markets Off Guard, Warns CIBC

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout