One Simple Rule Could Transform How You Spend: Let’s be real—money management in America today isn’t easy. Between rising rent, inflation on groceries, and online shopping being just one click away, spending less and saving more feels harder than ever. Most folks try budgeting apps or spreadsheets, but let’s face it—those don’t always stick. That’s where one simple spending rule comes in. It’s not complicated. It doesn’t require math. And best of all? It works whether you’re making $30,000 or $300,000 a year. This one simple rule could truly transform how you spend money—and help you build serious savings over time.

One Simple Rule Could Transform How You Spend

The 1% Rule may sound simple, but it’s powerful. It’s like a speed bump for your wallet—just enough to slow you down and think clearly. In a world of Buy Now, Pay Later, this rule brings old-school patience back into your financial life. You’ll not only save more, but you’ll also spend with intention. It’s a small habit that can make a big difference over months—and a life-changing impact over years. Whether you’re just getting started with money management or trying to level up your finances, this one simple rule can truly transform how you spend—and help you build lasting wealth.

| Key Detail | Explanation |

|---|---|

| Main Rule | Wait 24 hours before buying anything that costs more than 1% of your annual income. |

| Income Example | $60,000 income = $600 spending threshold |

| Source | NY Post |

| Average Monthly Impulse Spend | $314/month, per CNBC |

| Average Annual Savings | $2,000–$5,000 when applied consistently |

| Who It Helps Most | Impulse shoppers, young adults, families, freelancers, and professionals |

| Suggested Pairing | Combine with 50/30/20 rule or zero-based budgeting for full control |

What Is the 1% Rule for Spending?

The “1% Rule” is a straightforward method to curb impulse spending and build a habit of thoughtful financial decisions.

Here’s how it works:

If something costs more than 1% of your annual income, wait 24 hours before buying it.

That’s it. Nothing fancy, no software needed. Just a pause between the urge and the purchase. For example:

- If you make $50,000 a year, your threshold is $500.

- Thinking about buying a $550 iPhone or a new treadmill? Wait 24 hours.

- After that, decide if it’s still worth it.

This cooling-off period gives your brain time to think logically, not emotionally.

Why the 1% Rule Works (Psychology Behind the Pause)

When we buy something on impulse, it’s often driven by emotional thinking, not logic. Behavioral economists like Daniel Kahneman say we have two systems of thinking:

- System 1: Fast, emotional, reactive

- System 2: Slow, rational, and thoughtful

The 1% Rule activates System 2—forcing you to think before swiping your card. That 24-hour delay is a chance to cool down and reevaluate the real value of the item.

This rule also helps avoid what’s called “post-purchase dissonance,” aka buyer’s remorse. Giving yourself time lets you ask:

- Do I really need this?

- Is this the best time to spend this amount?

- Can I get a better deal elsewhere?

- What happens if I wait 30 days instead of just one?

Often, you’ll realize the answer is “I don’t need it,” and that’s money saved.

Examples: The 1% Rule by Income Bracket

| Annual Income | 1% Threshold | Example Items to Pause Before Buying |

|---|---|---|

| $30,000 | $300 | Fancy sneakers, weekend Airbnb, espresso machine |

| $50,000 | $500 | Smartwatch, tech gadgets, high-end gym equipment |

| $75,000 | $750 | Gaming console bundle, airline tickets, sofa |

| $100,000 | $1,000 | iPhone, flat-screen TV, luxury mattress |

Remember: This rule works no matter your income level, because it scales with your lifestyle and your budget.

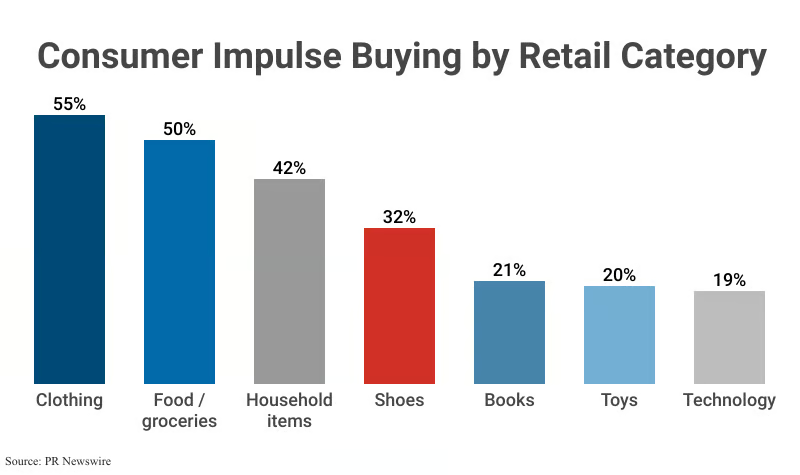

The Real Cost of Impulse Spending

According to a recent CNBC report, the average American spends $314/month on impulse purchases. That’s nearly $3,800 a year—enough for:

- A vacation

- A new emergency fund

- Retirement contributions

- Down payment for a car

Even cutting those impulse buys in half could help you save $1,500–$2,000 a year.

Now imagine compounding that over 5 years with interest. The long-term impact is massive.

How to Use One Simple Rule Could Transform How You Spend: A Step-by-Step Guide

Step 1: Determine Your After-Tax Annual Income

Use your pay stubs, tax return, or bank deposits to estimate your real, take-home income for the year.

Example: $4,000/month take-home pay = $48,000/year.

Step 2: Calculate 1%

Move the decimal two places to the left.

$48,000 x 1% = $480

That’s your pause threshold.

Step 3: Tag Large Purchases

Mentally tag any item that crosses that threshold. If you’re shopping online, you can bookmark the product. If you’re in-store, take a photo or make a note.

Step 4: Wait 24 Hours

Walk away. Don’t put it in the cart, even virtually. Set a 24-hour reminder on your phone or calendar.

Step 5: Reflect

Ask yourself:

- Is this a smart use of my money?

- Can I wait a week and still feel the same?

- Do I have enough saved for it?

- Will I regret not buying it—or buying it?

Step 6: Act Accordingly

- If it’s still worth it and in budget—go for it.

- If not—redirect that money into savings or an emergency fund.

What Makes This Rule So Effective?

- It builds willpower: Like exercising a muscle, the more you practice pausing, the easier it becomes.

- It simplifies decision-making: No need to debate every little expense—just follow the 1% rule.

- It trains you to prioritize: Big purchases become thoughtful investments, not split-second decisions.

Success Stories from Real People

“I used to order gadgets online every weekend. Since applying the 1% Rule, I’ve saved over $2,000 in just four months and realized I don’t miss those things at all.” — Jared W., San Diego

“My partner and I added this rule to our joint finances. Anything over 1% of our combined income goes into a 24-hour hold. Our fights about money? Basically disappeared.” — Nicole A., Austin

Even kids can get it. A mom on Reddit shared how her 12-year-old started using the rule with birthday money and decided to save up for a bike instead of buying a hoverboard on a whim.

How the 1% Rule Compares to Other Budgeting Systems?

| Budgeting Method | What It Focuses On | Difficulty | Who It’s Best For |

|---|---|---|---|

| 1% Rule | Emotional spending control | Easy | Everyone — especially impulsive spenders |

| 50/30/20 Rule | Budgeting by categories | Medium | Beginners, households |

| Zero-Based Budgeting | Every dollar is assigned | Advanced | Finance-savvy professionals |

| Envelope Method | Cash-only budgeting | Medium | People who overspend digitally |

While the 1% Rule doesn’t replace a full budget, it’s the perfect first step for those who find other methods overwhelming.

How to Maximize the 1% Rule with Other Tools

Pairing the 1% Rule with these tools supercharges your savings:

- High-yield savings accounts

- Budget apps: YNAB, Mint, or PocketGuard

- Cashback plug-ins: Rakuten, Honey

- Goal tracking: Set mini-goals like “Every 1% I don’t spend = $10 to vacation fund”

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Lack of Succession Planning Among Financial Advisers May Pose Unexpected Risks to Clients

Most Americans Feel Financial Stress, and Higher Income Isn’t Always the Solution, Says Expert