No Taxes on Social Security: “No taxes on Social Security” is no longer just a catchy political slogan—it’s now official federal policy for most retirees. On July 1, 2025, the White House confirmed that the One Big Beautiful Bill has changed the game. According to government estimates, 88% of seniors will pay zero federal income tax on their Social Security benefits starting this year.

But what does that really mean? Who qualifies? Is it permanent? And how can you make sure you don’t owe Uncle Sam a dime? In this detailed guide, we’ll break it all down. Whether you’re retired, planning your exit from the workforce, or advising clients as a tax or financial pro—this is must-know info.

No Taxes on Social Security?

This is a game-changer for millions of seniors. Thanks to the One Big Beautiful Bill, most Americans aged 65+ will finally get what they’ve long demanded—no federal tax on their Social Security benefits. But remember: this isn’t a forever deal. The benefit lasts through 2028, and planning ahead will be key to getting the most from it. If you’re approaching retirement or advising someone who is, now’s the time to act. Use this window of tax relief to reevaluate IRA strategies, income timing, and withdrawal plans.

| Topic | Details |

|---|---|

| Policy Name | One Big Beautiful Bill |

| Effective Date | July 1, 2025 |

| Main Benefit | 88% of seniors will owe zero federal tax on Social Security |

| Who Benefits | Individuals aged 65+ with income ≤ $75,000 (single) or ≤ $150,000 (married) |

| New Senior Deduction | $6,000 for individuals / $12,000 for married couples |

| Duration | Temporary (2025–2028) |

| Official Source | WhiteHouse.gov |

Understanding the Context: Why This Change Matters

Before this new legislation, the IRS could tax up to 85% of your Social Security benefits, depending on your income. For retirees living on fixed incomes, that meant every extra dollar from a pension or part-time job could push their tax burden up fast.

For decades, older Americans have argued that taxing Social Security is essentially double taxation—they already paid into the system through payroll taxes. The new law aims to ease that burden by introducing a “senior bonus deduction” that offsets any taxes owed on benefits for most seniors.

This is the first time in over 40 years that any serious reform has been passed around Social Security taxation. And while the relief is temporary for now (set to expire in 2028), it provides significant breathing room for millions.

What the White House Confirmed (And What It Doesn’t Mean)

Here’s exactly what the federal government announced:

- Starting in 2025, seniors aged 65 and older can claim an additional $6,000 deduction (individual) or $12,000 (married couples) on top of their standard deduction.

- The standard deduction for 2025 is $15,700 for individuals and $31,400 for married couples filing jointly.

- When combined, these deductions will wipe out the taxable portion of Social Security benefits for about 88% of beneficiaries, according to the IRS and SSA.

But here’s the important part: this isn’t a complete repeal of Social Security taxation. It’s an income-based relief.

If your adjusted gross income (AGI) is above $75,000 (individual) or $150,000 (married), you may still owe taxes. And if you’re under 65, you don’t qualify for the new deduction—at least not yet.

No Taxes on Social Security Rules: What Changed, What Stayed

What’s the Same:

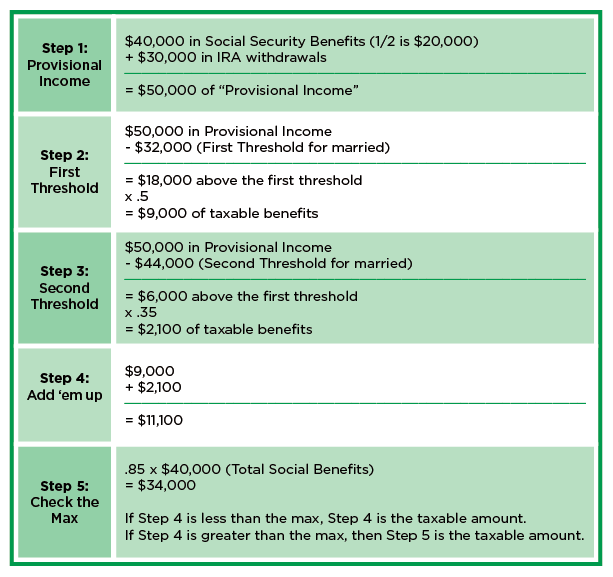

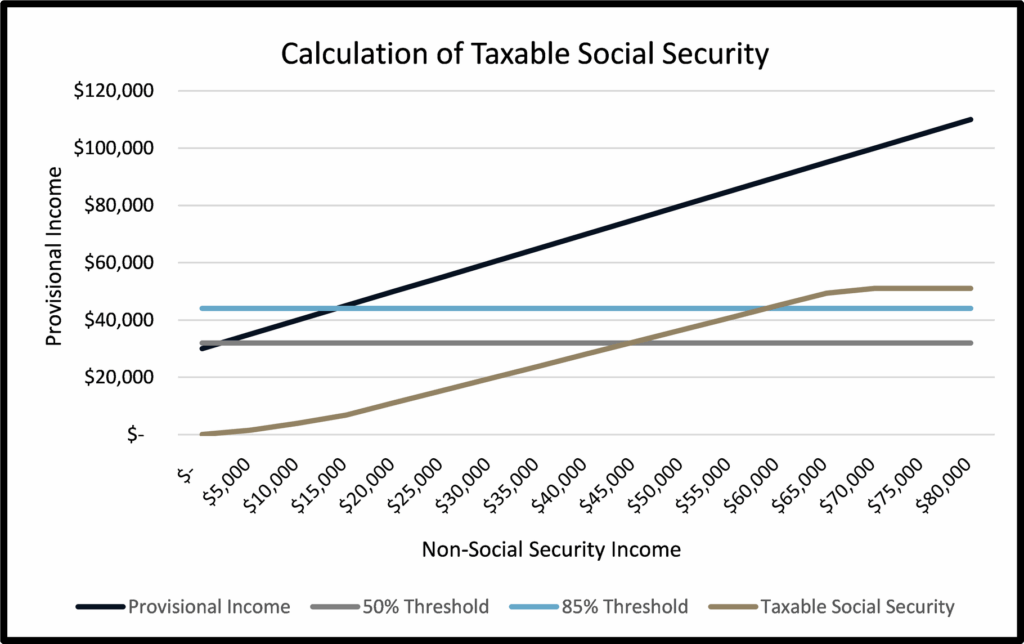

- The formula for calculating taxable Social Security hasn’t changed.

- Your combined income still includes:

- Half of your Social Security benefits

- Plus all other taxable income (wages, IRA withdrawals, pensions, capital gains, etc.)

What’s New:

- The new senior deduction is applied after the standard deduction, dramatically reducing taxable income.

- This means many people’s AGI falls below the threshold, triggering zero taxes on Social Security.

Who Still Pays Taxes on Social Security?

While this law helps most retirees, some people will still pay taxes. You may still owe if:

- You are under age 65

- You file as single and earn more than $75,000

- You file jointly and your household income is more than $150,000

- You have large capital gains, rental income, or non-tax-sheltered IRA withdrawals

- You live in one of the 13 states that still tax Social Security benefits at the state level

Even then, the portion of your benefits taxed could be lower than before, depending on how the deduction affects your bottom line.

Step-by-Step Guide: How to See If You Qualify for No Taxes on Social Security?

Want to know if you’ll owe tax? Here’s how to check:

- Add up your total income:

- Include all income from pensions, investments, savings, and part-time work.

- Add 50% of your Social Security benefits.

- Subtract the standard deduction:

- $15,700 (single), $31,400 (married)

- Subtract the senior deduction:

- $6,000 (single), $12,000 (married)

- If your taxable income is below the IRS thresholds:

- $25,000 for single filers

- $32,000 for married couples

- Your benefits will not be taxed

Real-Life Example: How the Numbers Work

Mary, a 68-year-old widow living in Arkansas, receives:

- $22,000 in Social Security

- $14,000 in pension income

- $3,000 in savings interest

Total Combined Income:

- 50% of Social Security = $11,000

- $14,000 + $3,000 = $28,000

Deductions:

- Standard: $15,700

- Senior: $6,000

- Total deductions = $21,700

Taxable Income: $28,000 – $21,700 = $6,300

Since this is below the taxable Social Security income threshold, Mary owes nothing on her benefits.

Long-Term Planning Tips for Professionals and Retirees

Tax professionals and advisors should take note: this new deduction opens doors to strategic retirement planning. Here’s how:

Optimize Roth Conversions

- Converting traditional IRAs to Roth accounts before turning 65 can reduce future taxable income

- Use the tax-free window created by this deduction to manage required minimum distributions (RMDs)

Delay Taking Social Security

- For those nearing retirement, delaying benefits until age 70 can increase the size of your monthly checks—potentially doubling them

- With new deductions, delaying also positions you to receive larger checks tax-free

Maximize Deductions Over Time

- Bunch medical expenses or charitable contributions into certain years

- Use standard deduction + senior bonus to structure income year by year

- Monitor for tax law changes between now and 2028

What Experts Are Saying

- According to the Tax Policy Center, the senior deduction reduces taxable benefits for roughly 47 million people, the largest middle-class tax cut since the Bush-era reforms.

- The American Association of Retired Persons (AARP) applauded the bill, calling it a “powerful step toward restoring fairness in retirement taxation.”

- Some economists, however, caution that sunsetting the deduction in 2028 could create tax “whiplash” for future retirees.

Legislative and Policy Notes

- This new deduction passed with bipartisan support, though its future depends on Congressional leadership post-2028.

- The IRS will issue updated Schedule R worksheets for calculating Social Security tax eligibility.

- Taxpayers should also watch for adjustments to income limits based on inflation.