Next $2,002 Social Security Payment Date: The next $2,002 Social Security payment date confirmed is here, and it’s essential news for retirees and disability beneficiaries alike. If you’re one of the eligible recipients, your Social Security check—averaging $2,002—is coming Wednesday, July 9, 2025, depending on your birthday and benefit type. With recent updates in Social Security law, including the repeal of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), understanding your eligibility and maximizing your payout is more important than ever.

Millions of Americans rely on Social Security as their primary source of income in retirement. It’s more than just a number—it’s a lifeline. Whether you’re newly retired, working part-time, or receiving disability benefits, knowing your exact payment date, understanding what affects your monthly benefit, and staying updated on policy changes can help you plan better and avoid surprises.

Next $2,002 Social Security Payment Date

The $2,002 Social Security payment arriving on July 9, 2025, is part of a larger system that affects nearly 74 million Americans. With recent policy changes like the WEP/GPO repeal, retirees—especially those from the public sector or living abroad—are seeing major financial improvements. Whether you’re approaching retirement, already receiving benefits, or helping a loved one navigate the system, knowing when and how much you’re getting—and how to protect or increase it—is essential.

| Topic | Details |

|---|---|

| Payment Date & Amount | $2,002 deposited Wednesday, July 9, 2025 for birthdays 1–10. Next: July 16 (11–20), July 23 (21–31). |

| Average Benefit (2025) | $1,976/month post-COLA; about $23,712/year. |

| 2025 COLA | 2.5% cost-of-living adjustment effective January 2025. |

| SSI 2025 Max | $967 individual, $1,450 couple monthly. |

| Payment Schedule | July 1 (SSI only), July 3 (pre-May 1997 or SSI + SSDI), July 9, 16, and 23 (retirement or SSDI). |

| WEP/GPO Repeal | Repealed January 5, 2025. Retroactive payments from January 2024. |

| Repeal Impact | Increases of $360–$1,190+ per month for affected public-sector and overseas retirees. |

| Trust Fund Status | Expenditures now exceed income; long-term solvency concerns remain. |

| Earnings Limits 2025 | Under FRA: $23,400. FRA year: $62,160. No limit after full retirement age (FRA). |

| Max Benefit at Age 70 | $5,108/month if you delayed claiming to age 70. |

| Expat Eligibility | Foreign pension recipients now receive full benefits with back pay after WEP repeal. |

Understanding Social Security’s Payment Schedule

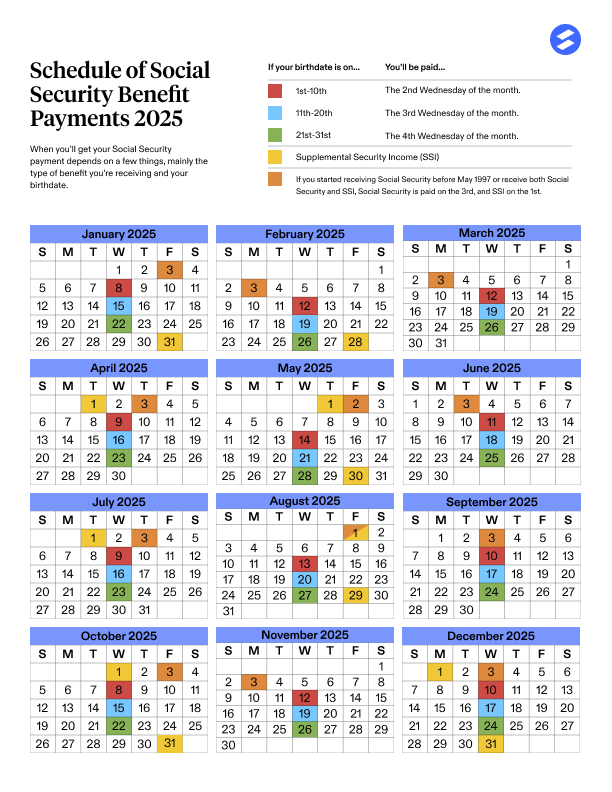

Social Security payments don’t hit everyone’s account on the same day. The payment schedule depends on your birth date and benefit type. For retirees who started receiving benefits after May 1997 and aren’t receiving Supplemental Security Income (SSI), the monthly benefit arrives based on the following breakdown:

- 1st–10th of the month: Paid on the 2nd Wednesday – this July, that’s July 9, 2025.

- 11th–20th: Paid on the 3rd Wednesday – July 16, 2025.

- 21st–31st: Paid on the 4th Wednesday – July 23, 2025.

If you started receiving benefits before May 1997 or receive both SSI and Social Security, your benefit is usually paid on the 3rd of the month, which this year is July 3, 2025. SSI-only recipients already received their check on July 1, 2025.

Knowing your payment date helps you better manage bills, automatic withdrawals, and financial planning.

Why $2,002? The Truth About “Average” Social Security Payments

The $2,002 figure is the national average benefit for retired workers in mid-2025. This figure increased slightly from $1,976 due to the 2.5% Cost-of-Living Adjustment (COLA) announced in January. But here’s the deal: that number is just an average. Your benefit might be significantly more—or less—depending on a few key things:

Key Factors That Determine Your Benefit:

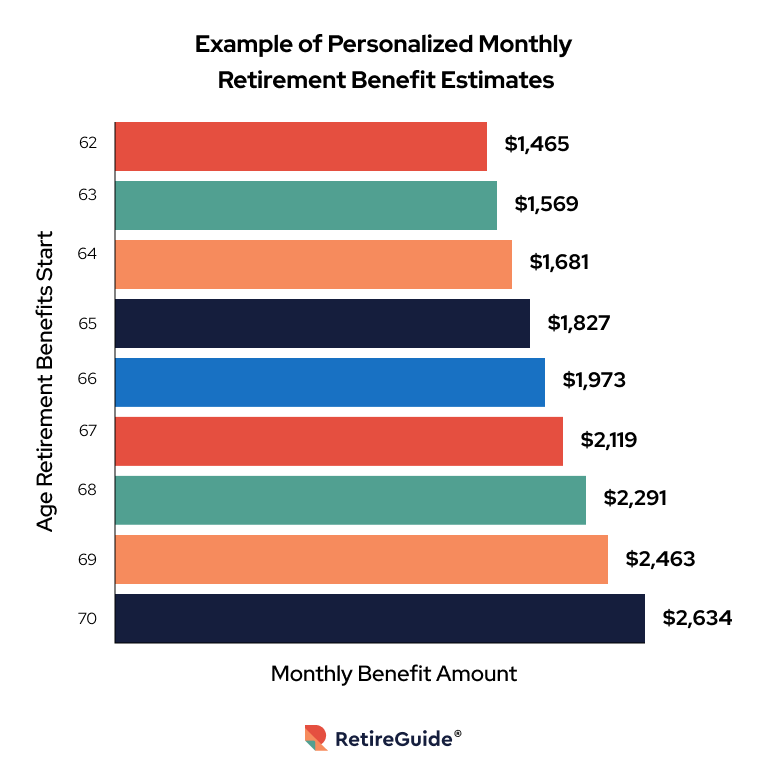

- Lifetime Earnings: Your 35 highest-earning years form the base for your benefit.

- Age You Start Claiming: Claiming before Full Retirement Age (FRA) reduces your monthly amount. Delaying past FRA increases it.

- Taxable Earnings Limit: If you paid Social Security tax on income up to the annual taxable maximum, your benefit will be higher.

- Years Worked: If you worked fewer than 35 years, zeros are factored in for missing years, lowering your benefit.

Real-Life Example:

Let’s say Joe retires at age 66 with 35 years of solid earnings, averaging $60,000/year. His estimated benefit? Around $2,050/month.

Now contrast that with Linda, who worked part-time for 25 years and started benefits at age 62. Her monthly payment might be around $1,200/month.

So yes, $2,002 is the average, but it’s not a one-size-fits-all.

Major Policy Change: WEP and GPO Repeal

The Social Security Fairness Act, passed in January 2025, repealed the WEP and GPO. This is HUGE.

These two rules had long penalized retirees who earned a pension from non-covered government jobs (like teaching or working overseas) by reducing their Social Security benefits—often drastically.

Now repealed, millions of public-sector and expat retirees are seeing:

- Retroactive payments from January 2024.

- Monthly increases between $360 to $1,190, depending on income history and pension size.

- Restoration of survivor benefits previously offset by GPO rules.

Many retirees who were previously discouraged from applying due to these rules are now being advised to file or reapply.

Still Working? Know the Earnings Limits

If you’re under your Full Retirement Age (FRA) and still working, you may see a temporary reduction in benefits if your earnings exceed the limit.

For 2025, the rules are:

- Under FRA: You can earn up to $23,400/year without penalty. Over that, $1 is withheld for every $2 you earn.

- Year of FRA: The limit increases to $62,160. Over that, $1 is withheld for every $3 earned.

- After FRA: No limits apply—you can work and earn as much as you want, and no reductions occur.

It’s important to understand that withheld benefits aren’t lost forever—they’re used to increase your future benefit.

Smart Tips to Maximize Your Next $2,002 Social Security Payment

- Delay Claiming (If You Can)

Every year you delay after FRA increases your benefit by about 8%—up to age 70. That can mean a $1,500 check becomes a $2,000+ one. - Check Your Earnings Record

Log in to your My Social Security account and verify that all your wages have been reported correctly. Errors can reduce your benefit. - Coordinate With a Spouse

Married? Consider strategies like filing for spousal benefits or delaying the higher earner’s benefit for max household payout. - Understand Tax Implications

Up to 85% of your benefit can be taxed based on your combined income. Knowing your tax bracket helps you plan better. - Plan for Medicare Enrollment

Medicare enrollment at age 65 is critical. Delaying can cause permanent penalties unless you’re still covered by employer insurance. - Avoid Overpayment Clawbacks

If you’re notified of a Social Security overpayment, you have 90 days to file an appeal or request a waiver. Respond quickly to avoid losing up to 50% of future checks.

What If You’re Living Abroad?

Retirees who live outside the U.S.—especially those receiving foreign pensions—used to face reduced or eliminated benefits due to WEP/GPO. Now, thanks to the repeal:

- They receive full benefits without offsets.

- They’re eligible for retroactive pay from as far back as January 2024.

- Over 300,000 American expats could benefit, many of whom were previously unaware they were even eligible.

If you’re living abroad, check the U.S. Embassy or Social Security’s international operations site to file or adjust your claim.

What About Social Security’s Future?

Here’s the truth: Social Security is not bankrupt, but it is under financial pressure. The most recent report from the Social Security Trustees projects the trust fund could be depleted by 2034–2035 unless Congress acts.

After that, incoming taxes would only cover about 77% of scheduled benefits.

While reforms like raising the retirement age, increasing payroll taxes, or adjusting COLAs are on the table, current retirees are unlikely to see drastic benefit cuts. But future beneficiaries should stay informed.

Some Social Security Recipients Could See Payments Slashed in Half— Check Why!

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!