TSP Withdrawals and Social Security’s Future for Federal Retirees: Retirement is something we all look forward to, especially after years of hard work and service. But when you’re a federal employee, navigating the complex world of retirement benefits can feel like a maze. With recent changes to the Thrift Savings Plan (TSP) and Social Security, it’s more important than ever to understand how these shifts could impact your financial future. This article provides a comprehensive guide to the latest developments and offers practical advice on how to secure your retirement.

TSP Withdrawals and Social Security’s Future for Federal Retirees

Retirement may seem far off, but the decisions you make today can have a significant impact on your financial future. With changes to TSP withdrawals and Social Security benefits, it’s important to stay informed and adjust your retirement strategy accordingly. Whether you’re a federal employee or someone planning for retirement in the near future, understanding the new rules and seeking expert advice can help you secure a comfortable and worry-free retirement.

| Key Topic | Details |

|---|---|

| TSP Withdrawal Changes | – RMD Age: Now 73 for those born between 1951 and 1959 and 75 for those born in 1960 or later. – Roth TSP Exemption: No RMDs for Roth TSP accounts. – New Early Withdrawal Exceptions: Public safety workers are exempt from the early withdrawal penalty. |

| Social Security Updates | – WEP Repeal: Full benefits for retirees with public pensions and Social Security credits. – Tax Relief: Senior Deduction helps eliminate federal taxes on Social Security for most retirees. – COLA Adjustment: 2.5% increase in 2025 to help keep up with inflation. |

| Projections for Social Security | – Trust funds may run out by 2033, which could lead to a 23% reduction in benefits unless Congress acts. |

| Retirement Strategy Advice | – Review TSP withdrawal options (lump-sum, installment payments, annuities). – Plan for increased RMDs. – Stay updated on Social Security benefit changes. |

TSP Withdrawals: Key Updates in 2025

The Thrift Savings Plan (TSP) is one of the most important retirement benefits for federal employees. As the landscape of retirement planning evolves, it’s vital to understand these changes and make strategic decisions. Let’s dive into the significant updates to TSP withdrawals and how they can impact your retirement.

Required Minimum Distributions (RMDs)

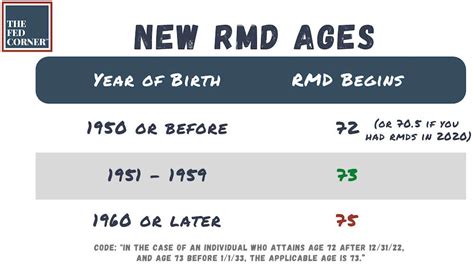

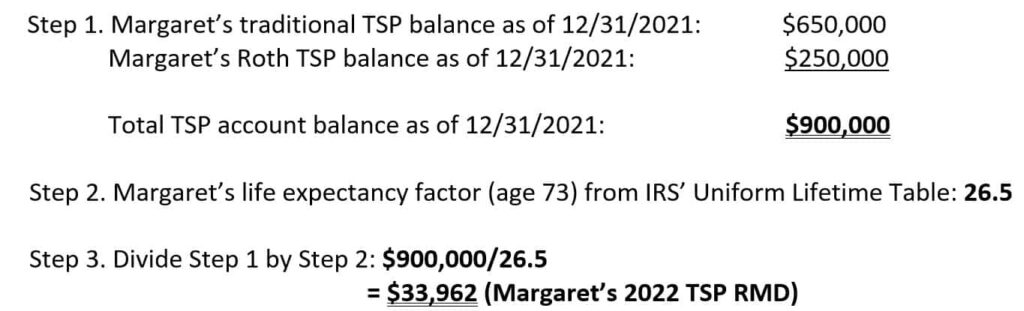

The SECURE Act 2.0 has raised the age for Required Minimum Distributions (RMDs). Previously, retirees had to begin withdrawing from their TSP accounts at age 72. Now, the RMD age has increased:

- Age 73: For those born between 1951 and 1959.

- Age 75: For those born in 1960 or later.

This gives you more flexibility in managing your TSP funds, allowing you to delay withdrawals and let your retirement savings grow longer.

Why It Matters:

If you’re still working or have other sources of income in retirement, delaying your RMDs can reduce your taxable income and allow your savings to continue compounding. By pushing off withdrawals, you can lower your tax burden and maintain a higher standard of living in your later retirement years.

Roth TSP Exemption from RMDs

A major change in 2025 is that Roth TSP accounts are now exempt from RMDs. Previously, even though Roth TSPs were funded with after-tax dollars, they still required you to take withdrawals starting at a certain age. Now, this restriction has been removed, making Roth TSPs even more appealing for long-term savings.

Why It Matters:

If you want your retirement savings to grow without forced withdrawals, the Roth TSP is a great option. You won’t have to worry about mandatory distributions eating into your savings, which can help ensure your funds last throughout your retirement.

Early Withdrawal Penalty Exceptions

Under the SECURE Act 2.0, early withdrawal penalties can be avoided for certain federal employees. Specifically, public safety workers who have at least 25 years of service can now access their TSP funds early without facing the usual 10% penalty.

Why It Matters:

This is a significant update for first responders and law enforcement officers who may need to access their retirement savings earlier than planned. It provides more financial flexibility, especially in the case of an emergency or unexpected financial burden.

In-Plan Roth Conversions

In 2026, federal employees will gain the ability to convert their traditional TSP balances into Roth TSP accounts within the plan itself. This offers more flexibility in your tax planning and retirement strategy.

Why It Matters:

Converting a traditional TSP balance to a Roth TSP allows you to pay taxes now and withdraw funds tax-free later. If you anticipate being in a higher tax bracket in retirement, this could be a smart move. The ability to convert within the plan simplifies the process and avoids additional fees or complications.

Social Security: What’s Changing and What It Means for You

Social Security is a crucial component of retirement for many federal employees. However, recent changes to the program could affect how much you receive in retirement, and understanding these updates is essential for planning.

Windfall Elimination Provision (WEP) Repeal

In January 2025, President Biden signed the Social Security Fairness Act into law, which repeals the Windfall Elimination Provision (WEP). The WEP had previously reduced Social Security benefits for workers who earned pensions from jobs not covered by Social Security, such as federal employees. Now, retirees who receive both a public pension and Social Security will be entitled to their full Social Security benefits.

Why It Matters:

If you were impacted by the WEP in the past, this repeal is a game-changer. It means you will now receive the full amount of Social Security benefits that you’ve earned, rather than having them reduced.

Senior Tax Relief: The “One Big Beautiful Bill”

The “One Big Beautiful Bill” was signed into law in July 2025 and includes a Senior Deduction. This new provision allows retirees to deduct up to $6,000 for individuals and $12,000 for couples from their taxable income. This measure effectively eliminates federal taxes on Social Security benefits for the majority of retirees.

Why It Matters:

This tax relief can significantly reduce your tax burden in retirement, especially if you rely heavily on Social Security as a source of income. By eliminating taxes on Social Security, more of your income stays in your pocket, allowing you to stretch your retirement savings further.

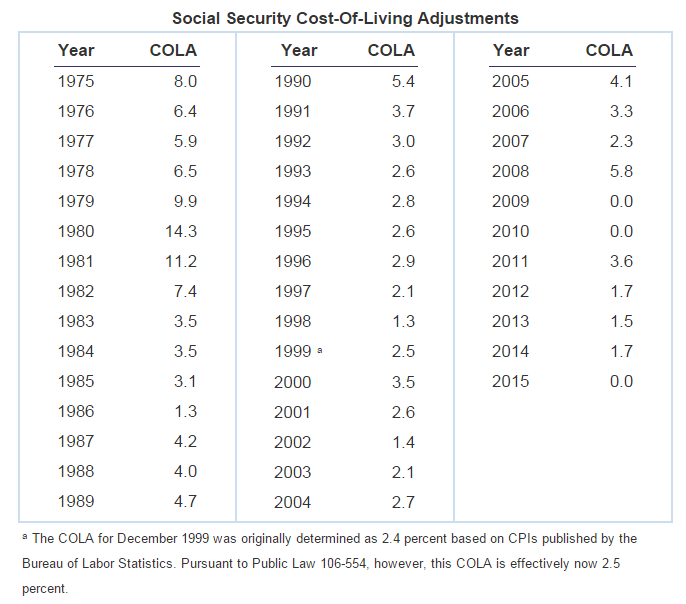

Social Security Cost-of-Living Adjustment (COLA)

Each year, Social Security benefits are adjusted to keep pace with inflation. In 2025, recipients will see a 2.5% increase in their monthly benefits. This adjustment helps protect the purchasing power of Social Security benefits, especially as inflation continues to rise.

Why It Matters:

While a 2.5% increase may not fully offset the effects of inflation, it does provide some relief for beneficiaries. Keeping track of COLA increases will help you understand how your retirement income will be affected by rising costs.

Social Security Trust Fund Projections

The Social Security Trust Fund is projected to be depleted by 2033, according to recent government reports. If this happens and no action is taken, Social Security benefits could be reduced by 23% across the board.

Why It Matters:

This projection is a wake-up call for future retirees. While Congress is likely to act before the fund is depleted, it’s crucial to stay informed and understand the potential risks to your Social Security benefits.

Retirement Strategy: TSP Withdrawals and Social Security’s Future for Federal Retirees

Now that you understand the changes to TSP and Social Security, it’s time to focus on the most important question: How can you secure your retirement? Here are some actionable steps to help you make the most of these updates.

1. Review Your TSP Withdrawal Options

Start by reviewing your options for withdrawing money from your TSP account. You can choose from lump-sum distributions, installment payments, or annuities. Each option has its pros and cons, so it’s essential to consider your unique financial situation and retirement goals.

2. Take Advantage of Roth TSP

Consider converting part or all of your TSP balance into a Roth TSP. The ability to avoid RMDs in Roth TSP accounts offers long-term growth potential. With the added flexibility of in-plan Roth conversions coming in 2026, now is a good time to reevaluate your strategy.

3. Stay Informed on Social Security Changes

Keep track of important changes like the WEP repeal, Senior Deduction, and COLA adjustments. These updates can directly impact your retirement income. By staying informed, you can adjust your financial strategy to maximize your Social Security benefits.

4. Plan for Future RMDs

With RMD ages now increasing, it’s crucial to plan ahead for when you’ll need to start withdrawing funds. The later RMD age means that you have more time to grow your TSP funds, but it also means you’ll have to prepare for potentially larger withdrawals later in retirement.

5. Consult a Financial Advisor

Given the complexity of the changes to TSP and Social Security, consulting with a financial advisor is a wise move. An advisor can help you tailor a retirement strategy that accounts for the new rules and ensures your financial security.

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Senior Couples Set to Get $3,089 Social Security Payment in July- Check Eligibility Criteria!

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits