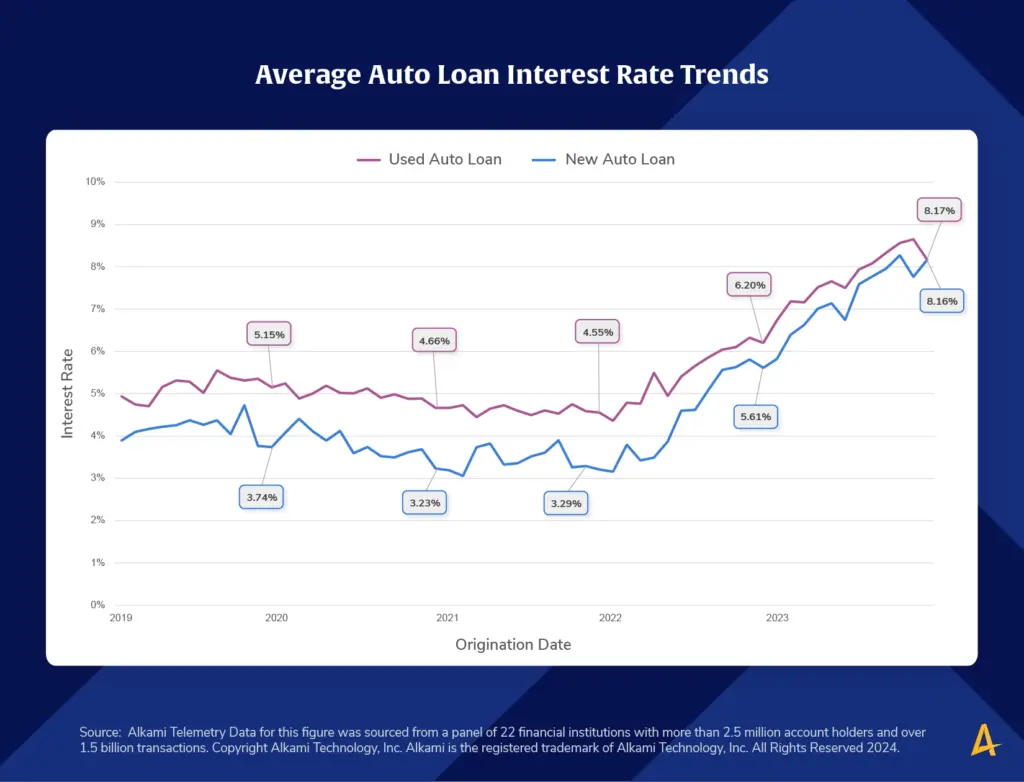

New Auto Loan Tax Break May Save Buyers Thousands: The road to buying a new car has been full of potholes lately. Between sky-high sticker prices, interest rates pushing 9%, and supply chain delays, many Americans are tapping the brakes on their dream of owning a new ride. But there’s a new policy headed to the tax code that might just shift things into drive — a proposed auto loan tax break that could save buyers up to $10,000 per year in interest deductions. This new deduction is aimed at easing the financial burden for car buyers financing new, U.S.-assembled vehicles. It’s part of a broader tax bill intended to stimulate domestic manufacturing and revive auto sales. But will it really make a difference? Let’s break it down so it’s crystal clear — whether you’re buying your first car, helping a family member make a decision, or advising clients on tax strategy.

New Auto Loan Tax Break May Save Buyers Thousands

The auto loan interest deduction coming in 2025 is a powerful incentive — but only for those who meet its specific criteria. If you’re in the market for a new, U.S.-assembled car and fall within the right income range, this tax break could save you hundreds — or even thousands — of dollars. But the policy won’t dramatically change the landscape. It’s a targeted benefit that helps some, not all. With tariffs pushing prices higher and existing EV credits ending, buyers should still do the math — and time their purchases wisely.

| Feature | Details |

|---|---|

| Tax Break Name | Auto Loan Interest Deduction |

| Maximum Deduction | $10,000 per year on interest |

| Eligible Vehicles | New cars assembled in the U.S. |

| Income Phase-Out | Begins at $100K (single) / $200K (married) |

| Timeframe | 2025 to 2028 |

| Applies To | Auto loans only (no leases or used vehicles) |

| Tax Form Needed | IRS Form 1040, Schedule 1 |

| Government Source | IRS.gov – Credits & Deductions |

What Is the New Auto Loan Tax Break?

This proposed deduction allows taxpayers to write off the interest paid on an auto loan, up to a maximum of $10,000 per year, as long as the car purchased is new and built in the United States. The deduction is above-the-line, meaning it’s available even to those who don’t itemize their taxes — which is most Americans.

Unlike a tax credit, which reduces the amount of taxes you owe dollar for dollar, a deduction reduces your taxable income, which then lowers your tax bill based on your tax bracket. So, if you’re in the 22% tax bracket and you deduct $4,000 in interest, you’ll save roughly $880 on your tax return. This deduction is scheduled to go into effect starting January 1, 2025, and will be available through December 31, 2028.

Why Was It Introduced?

The auto industry has faced several setbacks in recent years: supply chain disruptions, rising inflation, and a shift in consumer demand. As a result, car prices have soared, and high interest rates have made financing increasingly difficult.

The new auto loan deduction is designed to:

- Make vehicle ownership more affordable for middle-income Americans

- Stimulate sales of U.S.-assembled cars and trucks

- Offset some of the financial strain caused by recent tariffs on imported auto parts

- Encourage a shift back to purchasing over leasing, especially for EVs and hybrids

It’s also seen as a political maneuver to replace some of the soon-to-expire EV tax credits, which are being phased out in the same timeframe.

Who Qualifies for the Tax Break?

To benefit from the deduction, you must meet the following criteria:

- Purchase a new vehicle that is assembled in the United States

- Finance the vehicle with an auto loan (leasing does not qualify)

- Loan interest must be reported on IRS Form 1098 by your lender

- Income must fall within or under the phase-out limits:

- $100,000 for individual filers

- $200,000 for married couples filing jointly

If your income is above these limits, your deduction is reduced by $200 for every $1,000 over the cap. At $150,000 (individual) or $250,000 (married), the deduction phases out entirely.

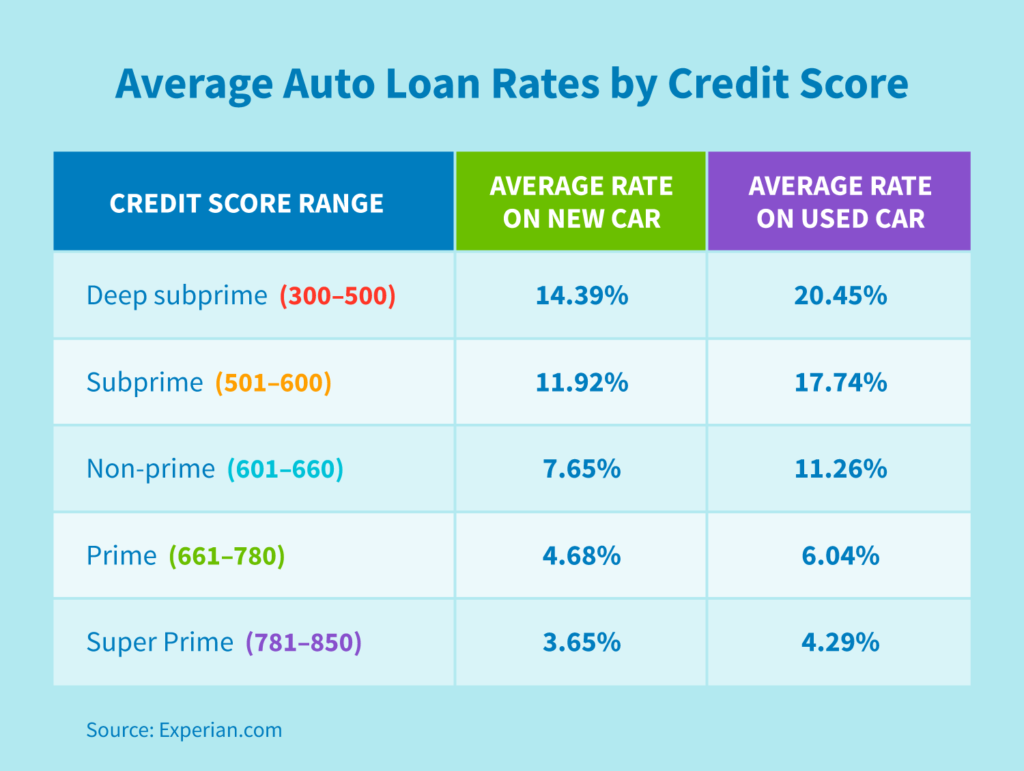

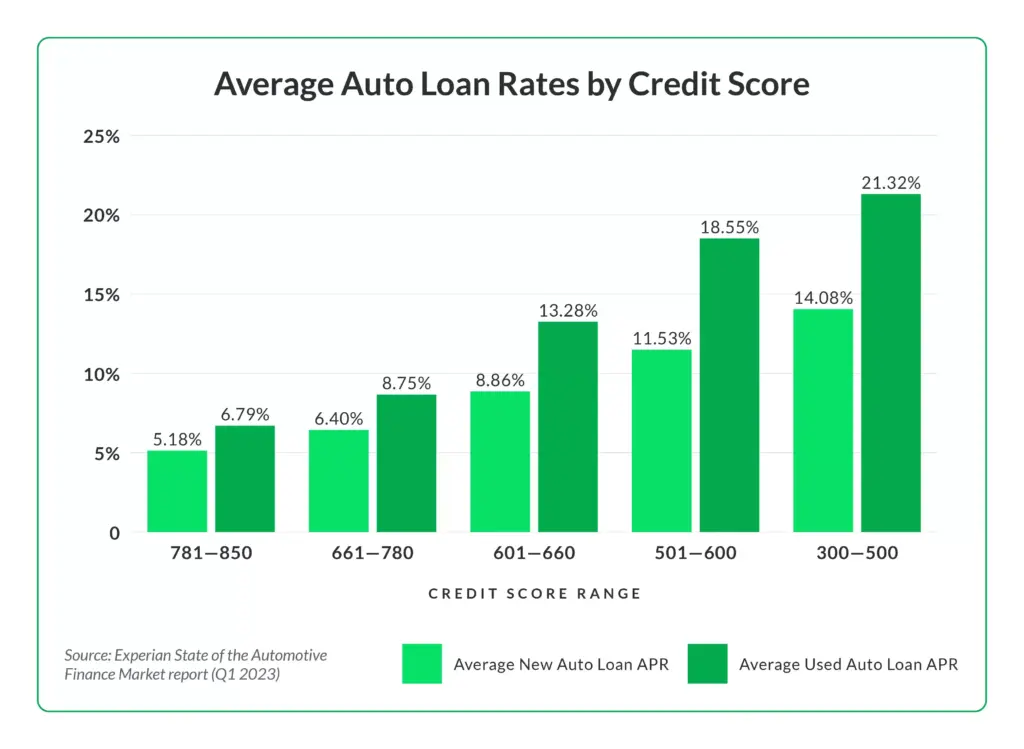

How Much Could You Actually Save?

Let’s walk through a practical example:

Example:

- Vehicle Price: $44,000

- Loan Term: 60 months

- Interest Rate: 9%

- Total Interest Paid Over 5 Years: $10,750

- Average Annual Interest Paid: ~$2,150

If you qualify to deduct the full amount, you could reduce your taxable income by $2,150 per year. If you’re in the 24% tax bracket, that equals $516 in annual tax savings — or over $2,000 saved over four years.

That’s a meaningful chunk of change, especially for families on tight budgets.

Step-by-Step: How to Claim New Auto Loan Tax Break May Save Buyers Thousands

- Check Your Vehicle’s Eligibility

- It must be new and built in the U.S.

- Check VIN and assembly location at NHTSA’s VIN Decoder

- Finance Your Vehicle

- The deduction only applies to interest on auto loans — not leases, cash purchases, or personal loans.

- Stay Within Income Limits

- Avoid phasing out by keeping your AGI below $100,000/$200,000.

- Track Loan Interest

- Your lender will issue Form 1098, which lists the annual interest paid.

- File With IRS Form 1040 + Schedule 1

- Report interest under “Adjustments to Income.”

Real-Life Buyer Scenarios

Case 1: First-Time Buyer (Dylan, 24)

- Income: $48,000/year

- Vehicle: New Toyota Corolla (assembled in Mississippi)

- Loan Interest Paid: $2,400

- Estimated Savings: ~$500/year

- Verdict: Qualifies for full deduction and uses tax refund to cover insurance.

Case 2: Family of Five (The Martinez Family)

- Joint Income: $112,000

- Vehicle: New Chrysler Pacifica

- Loan Interest: $3,600/year

- Estimated Tax Savings: ~$720/year

- Verdict: Savings offset monthly grocery inflation and childcare costs.

Case 3: High-Earner (Ava, 38, Consultant)

- Income: $220,000

- Vehicle: New Ford Mustang

- Verdict: Phased out of deduction — no benefit received.

How Does It Compare to EV Credits and Other Deductions?

Previously, buyers of new electric vehicles could qualify for a $7,500 federal tax credit, and used EVs were eligible for a $4,000 credit. However, these incentives are being phased out by September 2025.

| Deduction/Credit | Amount | Qualifying Vehicle | Timeframe |

|---|---|---|---|

| Auto Loan Interest Deduction | Up to $10,000/year | New, U.S.-assembled | 2025–2028 |

| New EV Tax Credit | Up to $7,500 | Select new EVs | Ends Sept 2025 |

| Used EV Tax Credit | Up to $4,000 | Select used EVs | Ends Sept 2025 |

| Section 179 (Business Vehicles) | Up to $80,000 | Heavy-duty trucks, vans | Ongoing |

Expert Opinions

Michael Kelley, a senior tax analyst with the Tax Foundation, shared:

“While the deduction may look generous on paper, it’s only beneficial for a very specific group of buyers. And with new tariffs driving prices up, the net benefit may be marginal.”

Jennifer Harmon, finance director at a Midwest auto group, adds:

“We’re already seeing interest from buyers asking about 2025 models. If this tax break becomes law, it’ll help sell inventory faster — but won’t completely solve affordability issues.”

Industry Impact: Will It Really Spark Sales?

Most experts agree that this tax break won’t create a buying frenzy, but it could:

- Encourage more financing over leasing

- Provide a tax advantage to U.S. automakers like Ford, GM, and Chrysler

- Drive domestic car production and supply chain growth

- Provide moderate relief for middle-class families

However, it’s unlikely to offset the impact of tariffs, price increases, or the end of EV credits, which are major market factors.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Millennial Who Achieved Early Retirement Reveals Harsh Truth About FIRE Lifestyle