Do you really need $1 million to feel financially comfortable? It’s one of those classic money questions that gets tossed around at family gatherings, retirement planning seminars, and all over the internet. For years, the $1 million mark has been treated like some magical number that guarantees peace of mind and freedom. But here’s the truth: You don’t need $1 million to feel financially secure—not in 2025, not ever. What you need is a lifestyle that’s in sync with your income, a good grasp of your financial goals, and a solid plan to get there. In this comprehensive guide, we’ll unpack what “financially comfortable” actually means, how much money you might really need, and what steps you can take today—regardless of how much you’ve got in the bank.

Need $1 Million to Feel Financially Comfortable

So, do you really need $1 million to feel financially comfortable? The answer is: not really. Most people can achieve that sense of security with far less, especially if they manage their expenses, reduce debt, invest smartly, and make intentional lifestyle choices. Rather than focusing on one big number, think about what matters most to you—and build a financial life that supports it. Comfort isn’t just in your wallet. It’s in your habits, values, and mindset.

| Topic | Details |

|---|---|

| Keyword Focus | Do you need $1 million to feel financially comfortable? |

| Average Net Worth for Comfort | $839,000 (Charles Schwab 2025 Modern Wealth Survey) |

| Wealth Threshold (Perceived) | $2.3 million |

| By Generation | Gen Z: $329K, Millennials: $847K, Gen X: $783K, Boomers: $943K |

| Popular Rule of Thumb | 25x your annual expenses or 10–12x your income for retirement |

| Top Comfort Factors | Cash flow, debt freedom, emergency savings, cost of living |

| Reliable Resource | Charles Schwab Wealth Survey 2025 |

What Does It Mean to Be Financially Comfortable?

Being financially comfortable means something different to everyone. But in general, it’s about feeling secure in your ability to handle life’s expenses—today and in the future.

You don’t need to drive a luxury car or live in a mansion. For most people, being financially comfortable means:

- Paying bills on time without stress

- Having savings to fall back on

- Not worrying about unexpected medical or home expenses

- Being on track for retirement

- Living without paycheck-to-paycheck anxiety

In other words, it’s not about being “rich.” It’s about having financial stability and options.

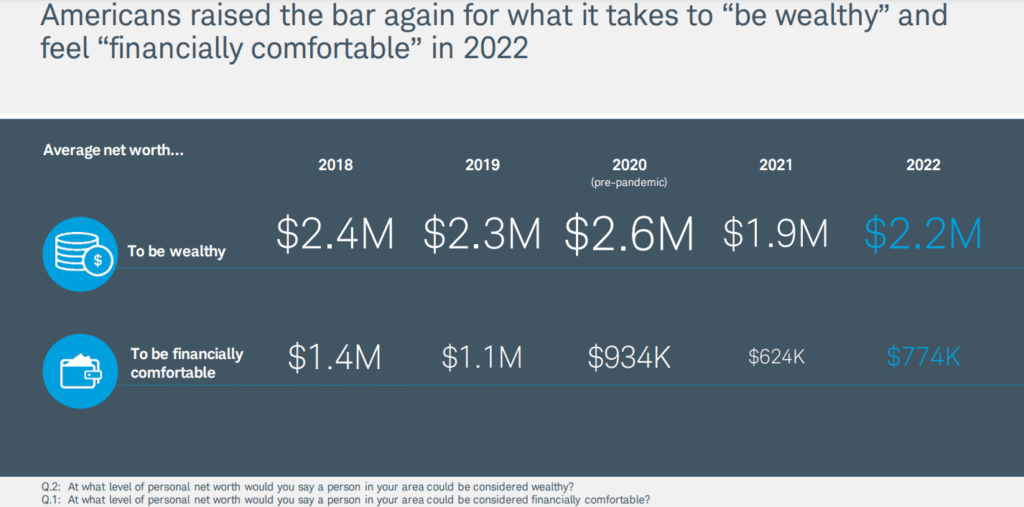

What the Data Says About Financial Comfort?

Let’s take a look at real data from the 2025 Charles Schwab Modern Wealth Survey:

- Americans say they need about $839,000 in net worth to feel financially comfortable.

- To feel wealthy, that number jumps to $2.3 million.

- These figures change significantly by generation:

- Gen Z: $329,000

- Millennials: $847,000

- Gen X: $783,000

- Baby Boomers: $943,000

Clearly, “comfort” doesn’t require seven figures—unless you live in a high-cost city or have very expensive lifestyle needs.

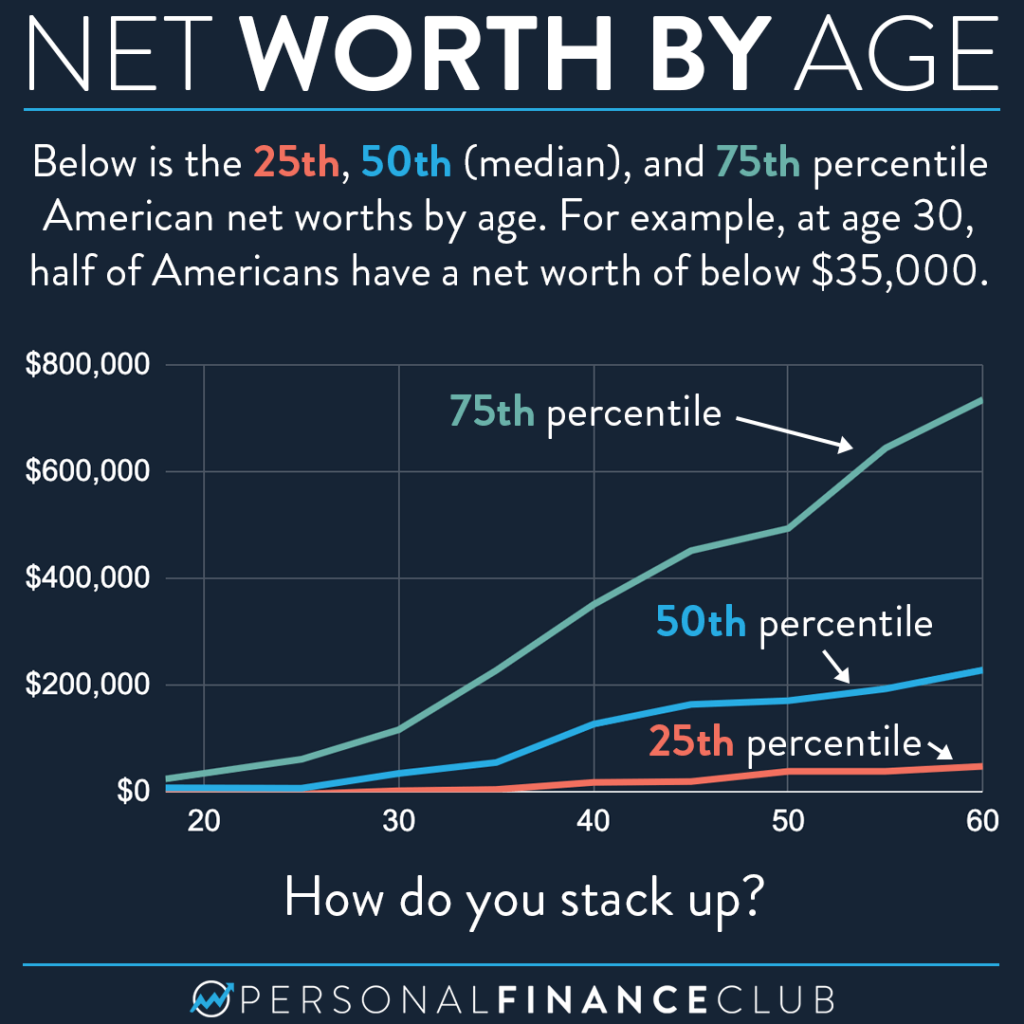

Also worth noting: most Americans aren’t even close to these numbers. According to Federal Reserve data, the median net worth of U.S. households is about $192,900. So if you’re not sitting on $800K+, you’re not alone.

Why Do You Think You Need $1 Million to Feel Financially Comfortable?

So why do so many people keep clinging to that million-dollar figure?

Here are a few reasons:

- Media and pop culture: TV shows, movies, and ads often paint $1 million as the “golden ticket” to freedom.

- Inflation over time: In the 1980s, $1 million felt like endless money. Today, it’s still a lot—but not what it once was.

- Retirement calculators: Many online tools throw out the $1M benchmark without considering personal context.

The result? Many people feel like they’re failing financially—even when they’re doing just fine by more realistic standards.

A Practical Guide to Reaching Financial Comfort

You don’t need to win the lottery or build a tech startup to feel good about your finances. Here are six steps that can help you feel more secure—no matter your income level.

1. Know Your Personal Number

Everyone’s “comfortable” number is different. Instead of chasing someone else’s benchmark, figure out what your life costs.

Start with:

- Monthly housing, food, transportation, and healthcare

- Annual recurring costs like insurance, property taxes, and holidays

- Future goals like education or retirement

Use the Rule of 25: Multiply your yearly expenses by 25 to get an idea of what you’d need to retire. So if you spend $50,000 a year, your comfort number might be $1.25 million—but it could be lower if you have other income sources.

2. Build and Maintain a Budget

A good budget isn’t about restriction—it’s about knowing where your money’s going.

Recommended tools:

- You Need a Budget (YNAB)

- Mint

- Empower

Aim for a 50/30/20 rule:

- 50% needs

- 30% wants

- 20% savings/debt payoff

Tracking every dollar builds awareness and leads to smarter spending habits.

3. Eliminate High-Interest Debt

Credit card debt is one of the biggest barriers to financial comfort. The average APR is over 20%—making it almost impossible to get ahead if you’re carrying a balance.

Strategies to pay it down:

- Snowball method: Pay off smallest balances first for momentum

- Avalanche method: Pay off highest-interest debt first for max savings

- Consider debt consolidation if you’re overwhelmed

4. Create an Emergency Fund

Experts recommend keeping 3 to 6 months of living expenses in a savings account you can access easily.

Why it matters:

- Covers unexpected costs like car repairs or medical bills

- Reduces anxiety around job loss or reduced income

- Keeps you from relying on credit cards or loans

5. Invest Regularly

You don’t have to be wealthy to invest. In fact, starting small and early gives your money the most time to grow.

Steps to take:

- Contribute to a 401(k), especially if your employer offers a match

- Open a Roth IRA or Traditional IRA

- Consider low-cost index funds or ETFs

According to Vanguard, even $100/month invested at 7% annual return grows to nearly $122,000 in 30 years.

6. Think Beyond the Numbers

Comfort is about more than dollars. It’s also about:

- Job satisfaction and work-life balance

- Health and insurance coverage

- A supportive community or family network

Financial well-being includes emotional well-being. Don’t ignore that part of the equation.

The Role of Location and Lifestyle

Where you live has a massive impact on how far your money goes.

Example:

- $60K/year in Tulsa, Oklahoma = comfortable middle class

- $60K/year in San Francisco = struggling to afford rent

Also, lifestyle creep—increasing your expenses as your income grows—can erode progress. Avoid it by being intentional about spending and investing any raises or windfalls.

Real Stories from Real People

“We have around $500,000 in savings and no debt. I’m not a millionaire, but I feel more secure than ever.” – Marissa, 44, Tennessee

“Living in a smaller town and working remotely has changed everything. I don’t need a million bucks—I just need control over my time and finances.” – Kevin, 39, Colorado

“I used to chase numbers. Now I chase peace. Financial comfort came when I stopped comparing myself to everyone else.” – Tara, 57, New York

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

CNBC Uncovers the Devastating Financial Impact of Supporting Adult Children on U.S. Families

Gen X Could See a Big Payday Soon With Upcoming Financial Changes- Check Detail!