M&S Takes a Stand for Farmers in Inheritance Tax Battle: Marks & Spencer (M&S), a well-known British retailer, has recently waded into a heated debate regarding proposed changes to the UK’s inheritance tax laws. The changes, which threaten to increase the inheritance tax burden on agricultural land, have raised alarm bells in the farming community. As one of the largest food retailers in the UK, M&S has voiced concerns that these proposed changes could make it harder for younger generations to enter the farming industry. In this article, we will break down what’s at stake, how the changes may affect farmers, and why M&S has become a key player in this ongoing debate.

M&S Takes a Stand for Farmers in Inheritance Tax Battle

The inheritance tax debate is more than just a matter of policy—it’s about the future of farming, rural communities, and food security in the UK. While the UK government defends its proposed changes, organizations like M&S and the farming community are raising valid concerns about the impact on family-owned farms. As the clock ticks down to 2026, policymakers and stakeholders must work together to find a balanced solution that supports the next generation of farmers while ensuring the sustainability of the agricultural sector.

| Topic | Details |

|---|---|

| Inheritance Tax Changes | The government plans to introduce a 20% inheritance tax on agricultural assets over £1 million. |

| M&S’s Concern | M&S warns that these changes will discourage young people from entering the farming industry. |

| Current Tax Relief | The existing Agricultural Property Relief (APR) offers tax exemptions for family farms. |

| Government’s Response | The government defends the policy, saying three-quarters of estates will remain unaffected. |

| Farmer Protests | Farmers are protesting against these changes, fearing the impact on family-owned farms. |

| Important Dates | These changes are set to come into effect in April 2026. |

| M&S’s Role in the Debate | M&S calls on the government to rethink its tax policy, emphasizing the long-term effects on agriculture. |

| Industry Impact | This policy could impact 200,000 jobs within the agricultural sector. |

Introduction: The Battle Over Inheritance Tax and the Future of UK Farming

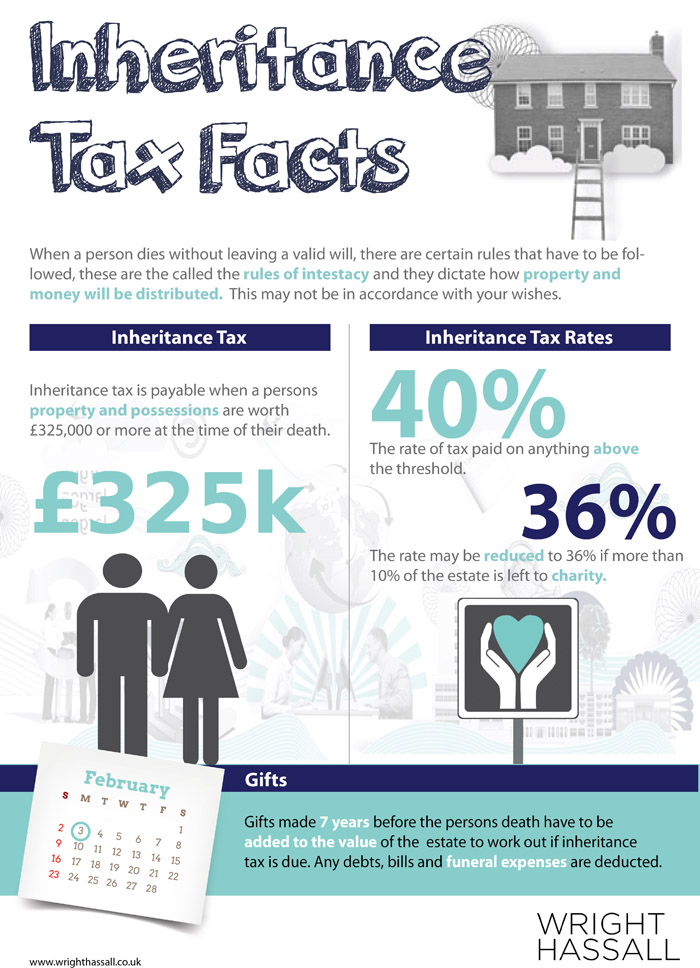

Inheritance tax (IHT) is a complex issue for many families, especially those who own valuable assets, such as farmland. The UK government’s proposed changes to inheritance tax laws have created a storm of controversy, particularly in the farming community.

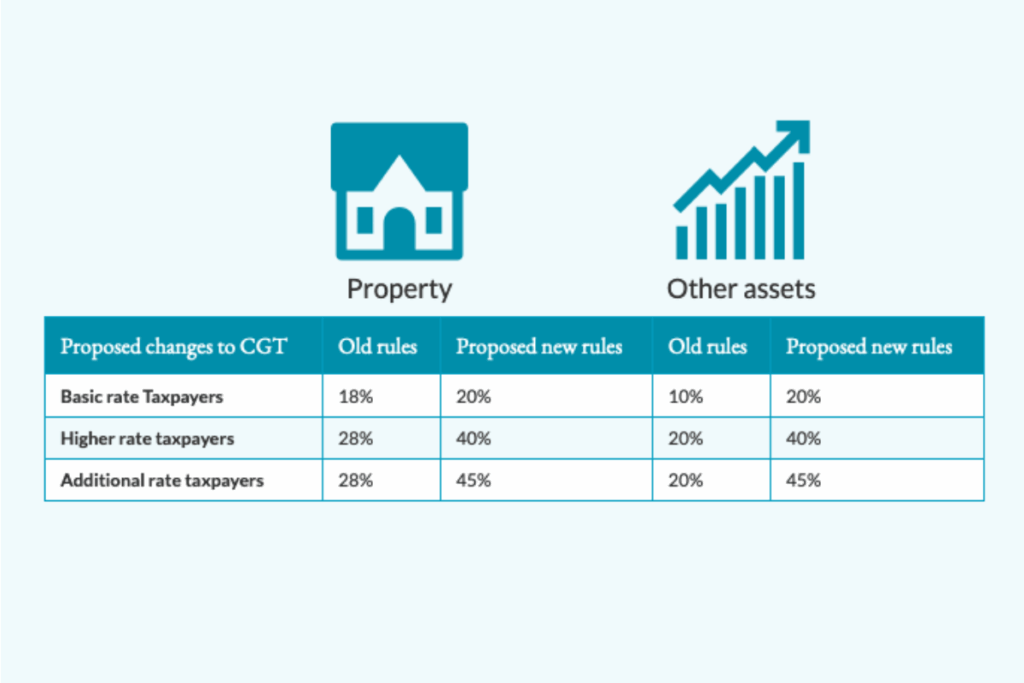

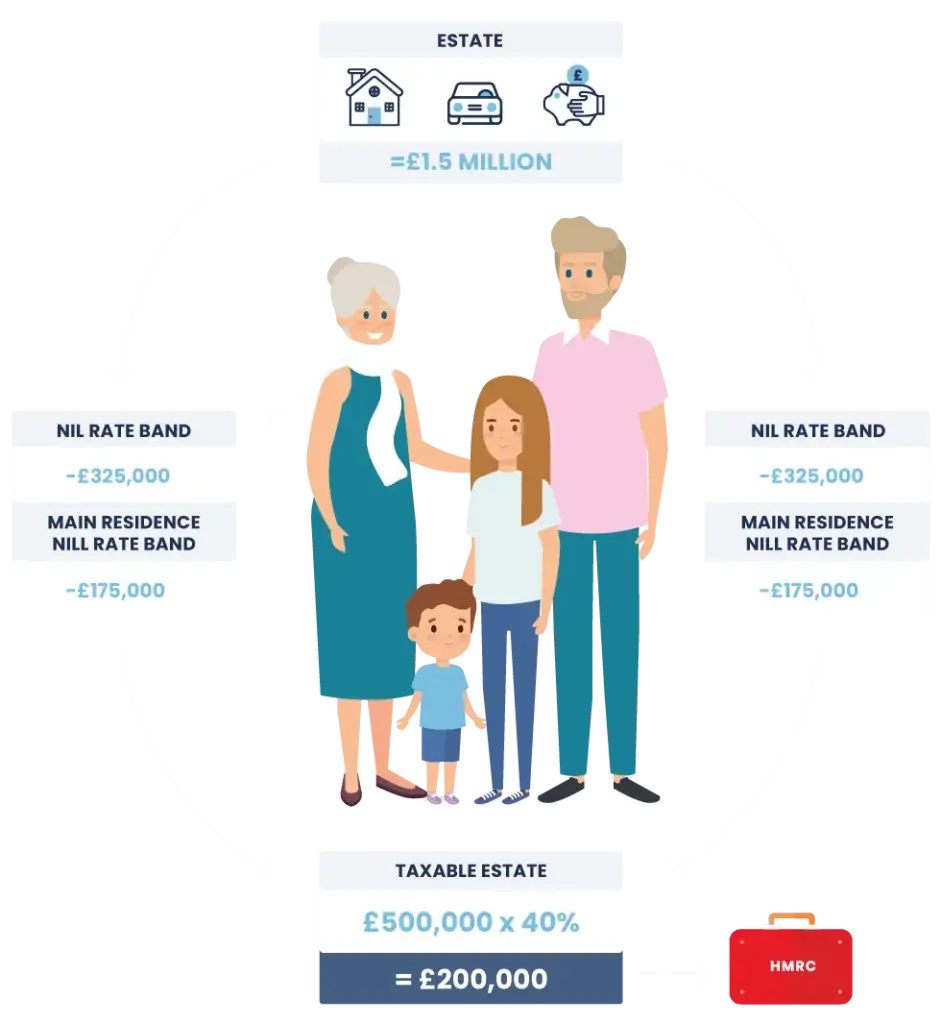

Marks & Spencer (M&S) has taken a strong stance against these changes, warning that they could severely impact the future of agriculture in the UK. The proposal, which includes a 20% inheritance tax on agricultural estates valued above £1 million, is expected to be implemented by 2026. Under the current system, family-owned farms are largely exempt from inheritance tax, thanks to Agricultural Property Relief (APR). However, the new tax reforms would reduce this exemption, potentially forcing farming families to sell off land or assets just to cover the tax bill.

M&S’s concerns are simple: these changes could prevent young people from inheriting and maintaining family farms, pushing them out of the industry and into more lucrative—but less rewarding—fields.

Understanding Agricultural Property Relief (APR)

Agricultural Property Relief (APR) has been a cornerstone of UK tax policy for decades. Introduced in the 1970s, APR allows agricultural property to pass between generations without being subject to inheritance tax, provided the land is used for farming. This relief has enabled family farms to remain intact, passed down through the generations, without the pressure to sell or divide their land to pay inheritance taxes.

APR has been particularly important in the agricultural sector, where profit margins are often tight and land is the primary asset. Without APR, many family farms would struggle to survive, as the inheritance tax could take a significant chunk of the estate’s value, forcing families to make hard decisions about whether to sell land or equipment to cover the tax.

The proposed tax changes, which would impose a 20% inheritance tax on agricultural estates valued over £1 million, are viewed by many in the farming community as a serious threat. Critics argue that these changes could push many smaller, family-owned farms to the brink of collapse.

The Impact of M&S Takes a Stand for Farmers in Inheritance Tax Battle: What’s at Stake?

Young Farmers Could Be Hit Hard

One of the main concerns raised by M&S and farming organizations is the potential for the proposed changes to discourage young people from entering the industry. Farming, already a tough profession, requires a significant initial investment. With land prices rising and profit margins staying slim, it’s already difficult for young farmers to get started. The new inheritance tax could make it even harder for the next generation to take over family farms, as they may be unable to afford the tax bill when inheriting the property.

Case Study: The Hill Family Farm

Take, for example, the Hill family farm in Gloucestershire, which has been passed down through generations. The Hill family relies on APR to ensure that their land remains intact. Under the proposed tax changes, the Hill family would face a 20% tax bill on any portion of their farm valued over £1 million. With the land’s value increasing, the family may be forced to sell parts of their farm to cover the tax. This scenario highlights the very real fears of farmers across the UK.

Economic Impact: 200,000 Jobs at Risk

The agricultural industry employs roughly 1.5 million people across the UK, with 200,000 of those working on family-run farms. If family-owned farms are sold off due to inheritance tax pressures, it could lead to widespread job losses in rural communities. Small farms often serve as the backbone of local economies, and their closure would have a ripple effect on other industries, including local shops, schools, and services.

M&S’s Role and Public Response

Marks & Spencer, with its deep ties to the UK food industry, is not the only company voicing concern about the proposed changes. Other major agricultural stakeholders, including the National Farmers’ Union (NFU), have also spoken out. However, M&S’s public stance has brought significant attention to the issue.

Steve McLean, M&S’s head of agriculture and fisheries, has been vocal about the potential consequences of the tax changes. He’s expressed concerns that the new policy would create a situation where “only the wealthiest, corporate farming operations would survive,” leaving family farms to struggle or disappear.

In response, the UK government has defended the proposal, stating that three-quarters of estates will continue to pay no inheritance tax at all, and the remaining estates will pay half the usual rate, spread over 10 years, interest-free. However, critics, including M&S, argue that this won’t be enough to prevent the collapse of family-run farms.

Exploring Alternatives: Can We Protect Family Farms?

While the inheritance tax changes are set in motion, there’s still time for a potential compromise. Some experts have suggested a sliding scale for tax exemptions, based on the size and economic viability of the farm. Others have called for greater incentives for young people entering agriculture, such as tax breaks for first-time farmers or subsidies for the transfer of land to the next generation.

Additionally, technology could play a role in reducing the burden of inheritance tax on young farmers. By investing in new farming techniques and technologies, younger farmers could increase efficiency and profitability, making it easier to absorb the costs of inheritance tax.

Long-Term Implications: The Future of Food Security

The long-term impact of these changes could go beyond just the financial strain on farmers. Family farms are an essential part of the UK’s food security strategy. If family-run farms decline and are replaced by large corporate farms, it could lead to less sustainable farming practices, fewer local food sources, and a more centralized food supply chain. This could make the UK more vulnerable to global supply chain disruptions, such as those caused by climate change or geopolitical instability.

UK Revives Pensions Commission Amid Savings Crisis — What It Means for Your Retirement

UK Households Can Get £333 a Week — But Only If They Follow This 35-Hour Rule

Nurse Busted in £21,000 DWP Fraud — You Won’t Believe What She Claimed