Mothers at Risk of Missing Out on Full DWP State Pension: In recent years, a significant issue has emerged for thousands of mothers in the UK who may be missing out on their full State Pension due to historical mistakes in the National Insurance (NI) system. These errors, primarily related to the Home Responsibilities Protection (HRP) system, have left many parents, especially stay-at-home mothers, at risk of not receiving the pension they deserve. If you’re a mother who took time off work to care for children or other dependents, you might be entitled to certain credits that should have been added to your National Insurance record. Unfortunately, due to administrative oversights and outdated systems, many women—often unaware—could be missing out on valuable years of state pension benefits. In this article, we’ll dive deep into the issue, the steps you can take to secure your entitlements, and what the government is doing (or failing to do) to correct the situation.

Mothers at Risk of Missing Out on Full DWP State Pension

The issue of missing Home Responsibilities Protection credits for mothers in the UK is a significant concern, and it’s clear that many women are at risk of receiving less than the full State Pension they’re entitled to. While the government has started the process of fixing the errors, the slow pace and bureaucratic challenges leave many women in the dark. If you think you might be affected, don’t wait for someone to tell you—take charge of your pension future. Check your National Insurance record, contact HMRC if needed, and ensure that your entitlements are properly accounted for. This is your future, and you deserve every penny you’re owed.

| Key Point | Details |

|---|---|

| Issue at Hand | Thousands of mothers may miss out on full state pension due to NI errors. |

| Cause | Errors in the Home Responsibilities Protection (HRP) system. |

| Impact | Over 100,000 individuals could be affected, mostly stay-at-home mothers. |

| Correction Progress | Only 12,379 cases rectified; £104 million paid out so far. |

| Government’s Plan | DWP expects to correct only 8% of cases, a significant shortfall. |

| Next Steps for Affected Individuals | Check your National Insurance records and claim any missing HRP credits. |

| Official Resources | Gov.uk, HMRC |

What Is the State Pension and How Does It Work?

Before we get into the specifics of the problem, let’s break down what the State Pension is and why it’s so important. The UK State Pension is a government payment that you receive once you reach the official retirement age. It’s designed to provide financial support to people who have contributed to the National Insurance (NI) system throughout their working life.

The amount you receive depends on how many qualifying years you have in your NI record. For instance, if you’ve worked and paid NI contributions for most of your life, you’ll be entitled to the full State Pension. On the other hand, if you’ve been out of the workforce (to care for children, for example), it can hurt your pension entitlement unless those years are accounted for.

What Went Wrong? The HRP System and Administrative Failures

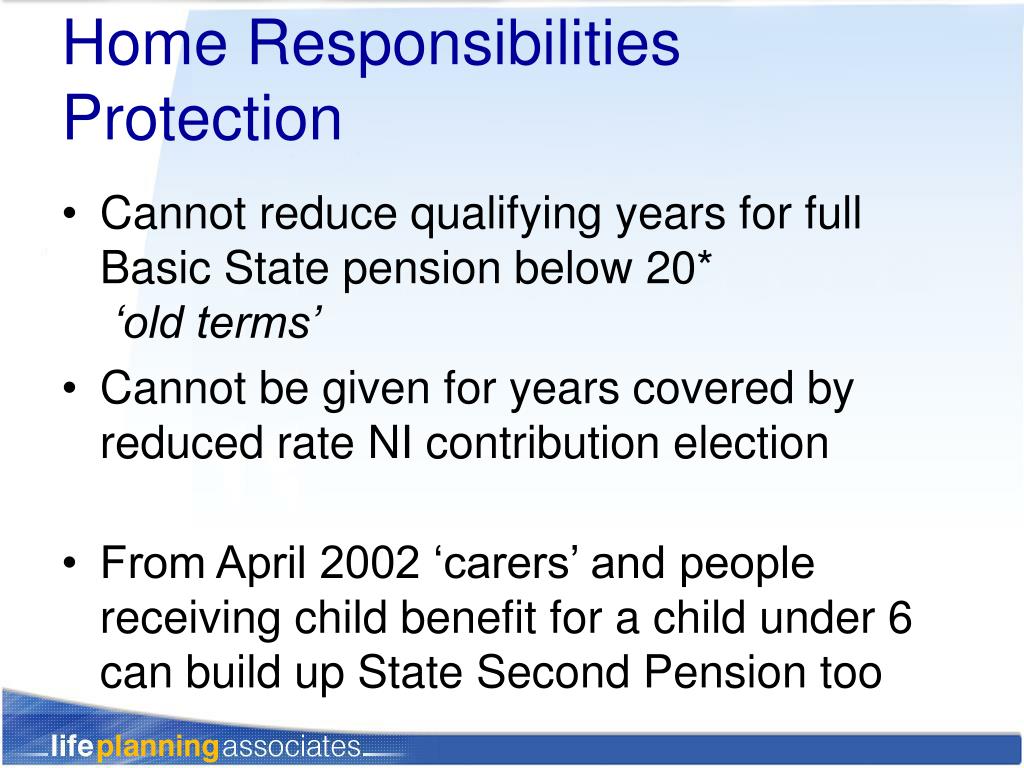

The Home Responsibilities Protection (HRP) system was introduced to help protect people who couldn’t work because they were caring for young children, elderly family members, or disabled relatives. HRP allowed them to continue building their National Insurance record, even though they weren’t earning a regular wage.

However, over the years, a significant number of women—mostly mothers—who took time out of work to care for their children before 2000, didn’t receive the HRP credits they were entitled to. This means that their National Insurance records are incomplete, and they may not have the full entitlement to their State Pension.

This issue is particularly prevalent for those who claimed child benefit before 2000. These individuals were automatically supposed to receive HRP credits. Yet, due to administrative oversights, they did not.

How Big Is the Problem?

According to estimates, as many as 370,000 people might be affected by this error. However, only around 12,379 cases have been rectified so far, and £104 million has been paid out in compensation. But these numbers represent a tiny fraction of the individuals who should have been corrected, as the Department for Work and Pensions (DWP) initially expected to fix about 90% of the cases, totaling roughly £1 billion in corrections. Now, they’re on track to address just 8% of these cases, which is a huge shortfall.

What Should You Do If You’re One of the Mothers at Risk of Missing Out on Full DWP State Pension?

If you believe you might be affected by this issue, it’s crucial to take action. Here’s what you need to do:

- Check Your National Insurance Record: The first step is to check your NI record to see if you’re missing any HRP credits. You can do this online through the government’s official website, Gov.uk. If you spot any gaps, especially for years when you were at home caring for children, that’s a red flag.

- Verify Your Child Benefit Claims: If you claimed child benefit before 2000, you should have been granted HRP credits automatically. Check whether those credits were added to your record. If not, you’ll need to take action.

- Contact HMRC: If you find discrepancies in your record, get in touch with HMRC (Her Majesty’s Revenue and Customs). They can help you understand the situation and guide you through the process of rectifying the errors.

- Review Communications from the DWP: The Department for Work and Pensions (DWP) has sent out some information regarding this correction program. However, many people mistook these communications for scams. If you received an official letter from the DWP, read it carefully and don’t ignore it.

What’s the Government’s Response?

The government has acknowledged the issue and launched a correction process. However, the process has been criticized for being too slow and bureaucratic. Former pensions minister Steve Webb has openly criticized the government’s response, calling it insufficient. According to Webb, the system for addressing these claims is overly complicated, and many women find it difficult to navigate.

The fact that only 8% of the cases are expected to be corrected by the DWP has raised concerns about the fairness of the process. Many individuals are being left in the dark, unsure about whether or not they are receiving their rightful pension contributions.

Can You Claim Back Missing Pension Contributions?

Yes, you can. If you discover that you’re missing HRP credits, you have the right to claim them. But be prepared for a lengthy process. The DWP and HMRC both have official guidelines to help you through this, but the road to securing your rightful pension entitlement can be confusing and time-consuming.

Additional Considerations

- Understanding the Complexity of Pension Systems: The UK state pension system is complex, and many people don’t realize they may have missing credits until much later in life. While it’s frustrating that administrative errors are affecting thousands, it’s important to take a proactive approach to ensure your pension is correct. Having a clear understanding of how the system works and how contributions are calculated can give you a better idea of what to look for in your own records.

- Timing Matters: It’s essential to act sooner rather than later. The longer you wait, the more difficult it may become to prove your case or rectify any errors. Furthermore, pension claims can be more difficult to address the closer you are to retirement age, so don’t delay checking your record.

- What About Women Who Are Currently Caregivers?: For mothers or caregivers who are currently at home taking care of children or relatives, the situation is even more pressing. Many of these women may not realize that their future pension is at risk due to incomplete National Insurance records. Proactively managing your contributions can help secure a comfortable retirement later in life.

Integrated Pension Rules May Reduce State Pension for Some, Confirms DWP

State Pension Payment Increase for Those Receiving Disability Benefits- Check Details!

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows