More Retirees Are Relying Solely on Social Security: More retirees are relying solely on Social Security in 2025 than ever before, according to several new surveys that paint a stark picture of the nation’s retirement landscape. With savings falling short, pensions drying up, and inflation eating away at fixed incomes, America’s older generation is leaning hard on a system that was never meant to be their only financial lifeline. If you’re wondering whether Social Security alone is enough to retire on — the short answer is: probably not. But if you’re like nearly 22 million seniors today, you may not have much of a choice. Let’s break it all down and talk about what this trend means for your retirement, your parents, or even your future self.

More Retirees Are Relying Solely on Social Security

The days of retiring with a fat pension and a gold watch are mostly behind us. Today, more retirees than ever depend solely on Social Security, despite its limitations and uncertain future. Whether you’re decades away from retirement or just a few years out, the writing’s on the wall: you can’t afford to wing it. Get informed, get a plan, and start preparing now — because Social Security was meant to be a safety net, not your whole financial foundation.

| Key Point | Details |

|---|---|

| Main Topic | More Retirees Are Relying Solely on Social Security in 2025 |

| % Relying Substantially | 65% of retirees depend heavily on Social Security |

| % Relying 100% | 39% of retirees depend on it entirely, up from 25% in past decades |

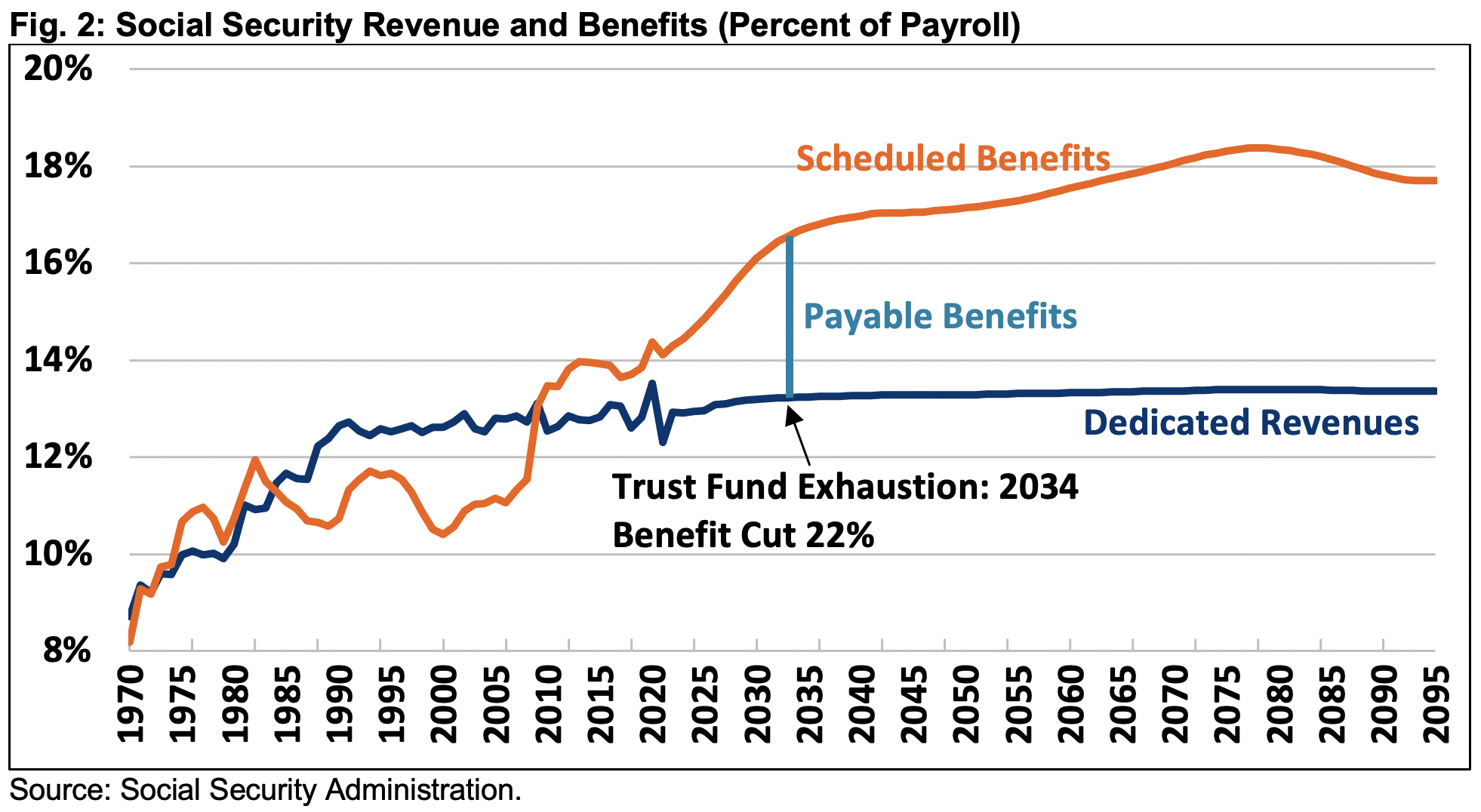

| Trust Fund Depletion Date | Expected by 2034, benefits may drop to 81% unless fixed |

| Rising Concern | Only 36% of Americans have confidence in the system’s long-term health |

| Official Source | Social Security Administration – SSA.gov |

What’s Going On with Social Security?

Back in the day, Social Security was designed to be a supplement, not the whole enchilada. Think of it like the side of mashed potatoes, not the main steak on your retirement plate.

But these days? For millions of older Americans, it’s the whole meal.

A recent survey by The Senior Citizens League (TSCL) shows that 39% of seniors now live on Social Security alone. That’s about 21.8 million Americans. Add in those who rely on it for more than half of their income, and you’re looking at a whopping 73% of retirees using Social Security as their primary money source.

Meanwhile, AARP’s 2025 survey found that 65% of retirees say they “rely substantially” on Social Security to get by. Yet only 36% of Americans feel confident the program will be there when they need it. That’s the lowest trust level since 2010.

Why More Retirees Are Relying Solely on Social Security?

Let’s face it — retirement planning has changed, and not always for the better.

1. Pensions Are Almost Extinct

Remember pensions? Those reliable monthly paychecks you got just for retiring after decades of work? They’ve mostly gone the way of the flip phone. Fewer companies offer pensions today, shifting the responsibility to workers through 401(k)s and IRAs. Only 14% of private-sector workers have defined benefit pensions today — down from 60% in 1980.

2. Wages and Savings Are Lagging

According to the Federal Reserve, nearly 40% of Americans can’t cover a $400 emergency expense without going into debt. So it’s no surprise that saving for retirement gets delayed. The National Institute on Retirement Security reports that the average retirement account balance for Americans ages 55–64 is only $104,000 — barely enough to last a few years.

3. The Cost of Living Keeps Rising

Even with annual COLAs (Cost-of-Living Adjustments), many retirees say Social Security benefits don’t keep up with actual inflation. In 2025, the COLA is 2.5%, but prices for rent, healthcare, food, and utilities have risen much faster — making it hard for retirees to stay afloat.

4. Financial Literacy Gaps

Many people don’t fully understand how Social Security works, when to claim benefits, or how Medicare and taxes impact payments. In fact, a Nationwide Retirement Institute study found that only 6% of Americans could correctly answer basic questions about how their benefits are calculated.

5. Disparities Across Demographics

Women, minorities, and low-wage workers are more likely to rely heavily on Social Security. Women live longer, take more time off for caregiving, and often earn less — leading to lower lifetime contributions and benefits.

How Much Does Social Security Actually Pay?

Not as much as you’d think — especially if you’re used to a middle-class lifestyle.

According to SSA.gov, the average monthly benefit in 2025 is about $1,907. That’s $22,884 per year — not enough to cover rent in many parts of the U.S.

Here’s how it compares:

| Living Costs vs. Social Security (2025) | |

|---|---|

| Average Monthly SS Benefit | $1,907 |

| Average Rent (1BR apt, U.S.) | $1,450–$2,100 |

| Medicare Premium (Part B) | $174.70/month |

| Groceries & Utilities | $600–$900/month |

| Transportation & Other Needs | $300–$500/month |

| Disposable Income Left | Often $0 or negative |

Unless you’re living rent-free or in a low-cost rural area, relying solely on Social Security can feel like walking a financial tightrope.

Regional Realities: Where You Live Matters

In some parts of the country, you might be able to stretch your Social Security check. In others, it barely covers the basics.

According to Kiplinger’s 2025 data:

- Best States for Social Security Income: Mississippi, Arkansas, West Virginia, and Oklahoma, where costs are lower.

- Worst States for Social Security Income: California, New York, Massachusetts, and Hawaii, due to high rents and taxes.

Understanding regional cost differences can be key when planning retirement. Moving to a lower-cost state — or even downsizing your home — might make all the difference.

What You Can Do About It

Don’t panic — but do plan. Whether you’re close to retirement or still have decades to go, here’s what you can do:

1. Delay Claiming Benefits

If you can afford to wait, claiming Social Security at age 70 (instead of 62 or 67) could increase your benefit by 25%–30%.

Example: If your monthly benefit at 67 is $1,800, waiting until 70 could boost it to over $2,200.

2. Build Supplemental Income Streams

Don’t count on Social Security alone. Use other tools like:

- Employer-sponsored 401(k) plans (especially with matching)

- Traditional or Roth IRAs

- Health Savings Accounts (HSAs)

- Real estate, dividend stocks, or annuities for passive income

3. Pay Off Debt

Start working now to eliminate credit card debt, car payments, and even your mortgage if possible. The less you owe, the more freedom you’ll have on a fixed income.

4. Learn How Social Security Works

Visit SSA.gov and create a “My Social Security” account to estimate your benefits and see how different claiming ages affect your payouts.

5. Consult a Certified Financial Planner

Planning early — even in your 40s or 50s — with expert help can create a customized retirement strategy that blends Social Security with other savings and income.

Generational Differences: Boomers vs. Millennials

While today’s retirees (mostly Boomers) rely heavily on Social Security, younger generations are less confident they’ll see full benefits.

According to a recent Bankrate survey:

- 73% of workers under 45 fear Social Security won’t be there for them at all.

- Only 36% believe it will remain a major source of income.

This lack of trust is pushing younger people toward side hustles, real estate, and crypto investments — sometimes without fully understanding the risks.

Proposed Reforms: Can the System Be Saved?

Several ideas have been floated in Washington to fix Social Security’s funding issues before the 2034 trust fund deadline:

- Raise the payroll tax cap: Currently, only income up to $168,600 is taxed. Raising or eliminating the cap would bring in more revenue.

- Increase the retirement age: Some lawmakers suggest pushing full retirement age to 69.

- Means testing: Wealthier retirees might receive smaller checks, allowing more funding for lower-income seniors.

- Adjust COLA formulas: Using a more senior-specific inflation index could provide more accurate annual raises.

None of these options are painless, and they will likely require bipartisan cooperation — something in short supply lately.

The Social Security Bridge Strategy That May Help You Delay Retirement Withdrawals

Think Social Security Cuts Are Bad? The Fix Might Be Even Worse

Why Your Social Security Retirement Checks Might Shrink Sooner Than Expected- Check Details