Millions of Americans Set to Receive $1,000 Direct Deposits: In 2025, millions of Americans will receive $1,000 direct deposits as part of a federal program designed to help ease financial strain for individuals and families across the United States. The move comes as part of the government’s efforts to combat inflation and provide relief to those feeling the financial pressure. If you haven’t heard about it yet, don’t worry—we’ve got all the details you need to know about the $1,000 direct deposits and how to find out if you qualify. This article dives into everything you need to understand, from eligibility requirements to how to check if you’re on the list for the payout. We’re breaking it down into easy-to-understand sections that anyone, regardless of age or experience with financial matters, can follow. Plus, we’ll share some practical advice on how you can make sure you’re ready when the funds hit your account.

Millions of Americans Set to Receive $1,000 Direct Deposits

| Topic | Details |

|---|---|

| Direct Deposit Amount | $1,000 per eligible individual or family |

| Eligibility | Single filers earning up to $75,000, Married couples up to $150,000 |

| Payment Methods | Direct deposit, paper checks, or prepaid debit cards |

| Payment Dates | Payments started mid-July 2025, with staggered checks |

| Social Security Recipients | Automatically included (SSDI, SSI, VA Benefits) |

| IRS Non-Filer Tool | Used for those who haven’t filed taxes |

| More Information | IRS Website |

What Are the $1,000 Direct Deposits?

In simple terms, the $1,000 direct deposit is a one-time payment that is being distributed to help Americans cope with the rising cost of living and to ensure families have some financial support. These payments are part of a larger initiative called “stimulus checks“ that have been rolled out in different phases by the U.S. government.

While stimulus payments are nothing new (we’ve seen several rounds of direct payments over the past few years), this $1,000 payment is aimed at a more specific group of people in 2025. Whether you’re an individual or part of a family, this stimulus payment can help ease the burden caused by inflation, rising costs, and economic instability.

Why Are These Payments Being Distributed?

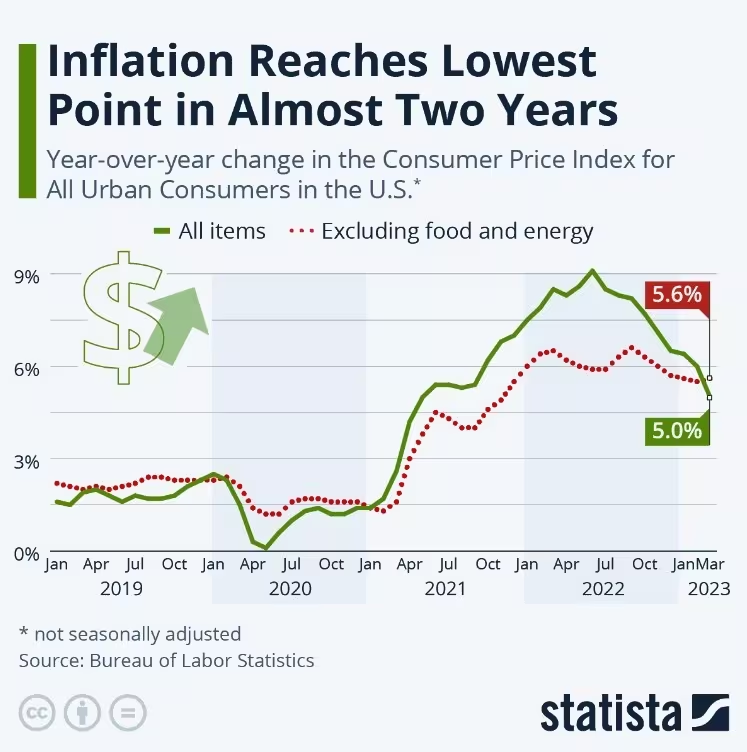

The main goal of these payments is economic relief. With inflation on the rise and everyday costs increasing, many Americans are finding it more challenging to make ends meet. These stimulus payments are a way for the government to provide a bit of breathing room for people struggling financially.

The pandemic’s long-term economic effects are still being felt across the nation, even as we move forward. Many individuals, particularly those in lower income brackets, are still recovering from financial hardships. The $1,000 stimulus aims to provide targeted relief during this period of inflation, offering much-needed financial support to eligible individuals and families.

Eligibility: Are You On the List?

Before you start looking for that $1,000 payment in your bank account, it’s important to understand who qualifies for the direct deposit.

Income Limits for 2025 Stimulus Payment

For the $1,000 stimulus to hit your account, your income must fall within specific limits. These thresholds are set based on your filing status (single, married, or head of household).

- Single filers: Up to $75,000 in adjusted gross income (AGI)

- Married couples filing jointly: Up to $150,000 in AGI

- Head of household: Up to $112,500 in AGI

The income limits are designed to make sure that the payment goes to those who need it the most. If you earn more than the threshold for your filing status, you may not qualify for the $1,000 deposit.

Special Cases: Social Security and Non-Filers

If you’re one of the millions of Americans who receive Social Security benefits (like SSDI, SSI, or VA benefits), you will likely receive this payment automatically. The U.S. government will ensure these payments are sent out to eligible recipients without the need for extra paperwork. If you haven’t filed taxes in recent years but think you should still qualify for the payment, don’t worry. The IRS Non-Filer tool can help you get in the system.

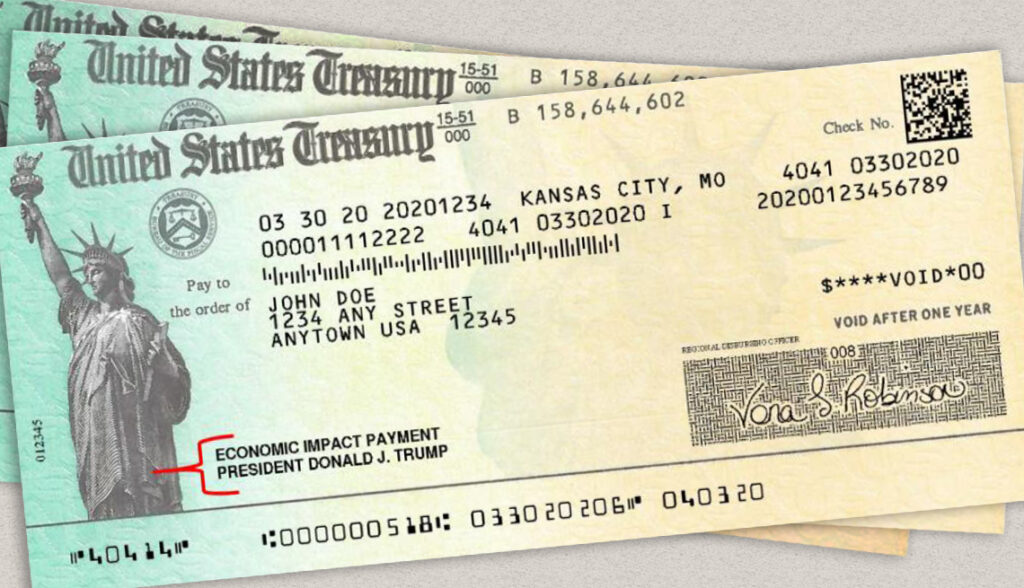

How Will the Payments Be Sent?

The $1,000 payment can be delivered in one of three ways, depending on what information the IRS has on file for you.

- Direct deposit: This is the fastest and most secure method. If you’ve filed taxes recently and provided your bank account information, your payment should be directly deposited into your account.

- Paper checks: If the IRS doesn’t have your bank information, you’ll likely receive your payment via paper check.

- Prepaid debit cards: Some recipients may receive a prepaid debit card with the stimulus funds loaded onto it.

Important Dates: When Will You Get Your Money?

The first wave of direct deposits began in mid-July 2025. If you’re receiving a paper check or prepaid card, you may experience a slightly longer wait, as those are being sent out in waves. It’s a good idea to monitor your mailbox or bank account regularly to see if the payment has been issued.

Step-by-Step Guide to Ensure You Get What Millions of Americans Set to Receive $1,000 Direct Deposits

If you’re wondering how to ensure you receive your payment, here’s a quick breakdown:

- Check Your Eligibility:

- Confirm you meet the income limits for your filing status.

- If you receive Social Security benefits, you’re automatically included.

- If you haven’t filed taxes recently, use the IRS Non-Filer Tool.

- Update Your Information:

- If you’ve moved recently or changed bank accounts, make sure your IRS records are up to date. You can do this through the IRS website or by calling them.

- Monitor Your Bank Account:

- If you’ve opted for direct deposit, check your account frequently to see if the funds have arrived.

- Watch Your Mailbox:

- If you’re receiving a paper check or prepaid debit card, be sure to keep an eye out for it in the coming weeks.

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Your Fall Benefits May Arrive Differently — Major Social Security, VA Payout Change Ahead

Social Security Shake-Up Incoming — What Every Recipient Needs to Know Now