Millions of Americans Just Got a Retirement Warning: Retirement might seem far away for many, but for millions of Americans, the clock is ticking. A recent warning from financial experts has raised alarms about the future of retirement in the U.S. The situation is increasingly challenging, as more and more people are finding themselves unprepared for the financial demands of retirement. Whether you’re just starting your career, in the middle of your working life, or nearing retirement age, understanding the state of American retirement planning is essential to securing your financial future. In this article, we’ll explore the key factors contributing to this retirement crisis, practical advice on how to prepare, and some insights into how Americans can still get back on track, even with the challenges ahead.

Millions of Americans Just Got a Retirement Warning

The future of retirement in the U.S. is undeniably challenging. With millions of workers lacking access to retirement plans, low savings rates, and uncertainty surrounding Social Security, many Americans face a tough road ahead. However, with the right planning, early action, and smart investing, you can still secure a comfortable retirement. Start saving today, diversify your investments, and plan for a long and healthy retirement. It’s never too early to take charge of your financial future.

| Topic | Key Data | Source |

|---|---|---|

| Retirement Savings | Nearly 56 million private-sector workers lack access to employer-sponsored retirement plans. | CBS News |

| Savings Shortfall | Many Americans, especially those 55+, have less than $50,000 saved for retirement—far below recommended levels. | Prudential |

| Social Security | Projections suggest Social Security’s trust funds may run out by 2034, potentially cutting benefits. | CBS News |

| Retirement Planning Tips | Start saving early, diversify investments, and plan for longevity to secure a financially stable retirement. | Investopedia |

| Retirement Age | As life expectancy increases, planning for a retirement lasting 30 years or more is becoming more critical. | Hawthorn School |

The State of Retirement in the U.S.: Why Experts Are Worried

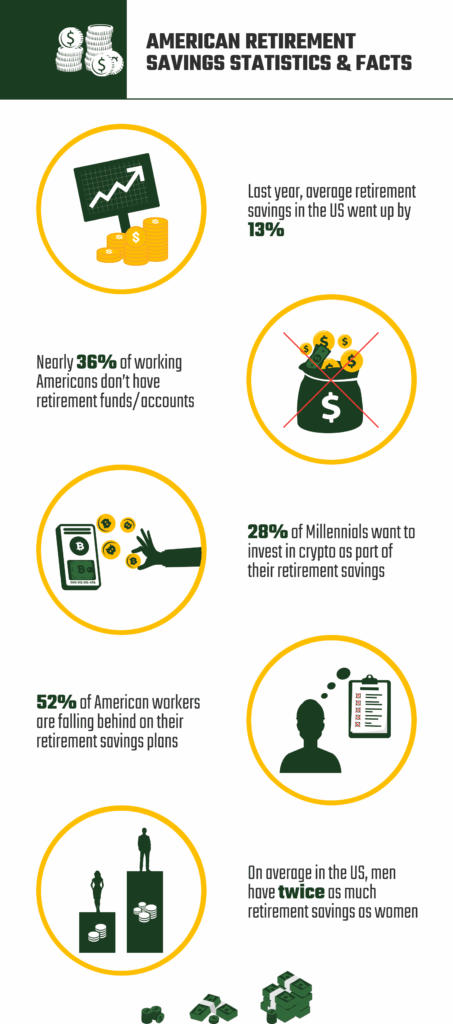

Retirement is supposed to be a time to kick back and relax after decades of hard work. But for millions of Americans, it’s looking more like a financial cliff rather than a peaceful retreat. According to experts, many people aren’t saving enough, and the systems in place—like Social Security—are facing growing uncertainty.

A major issue is that many workers simply don’t have access to retirement plans, especially in the private sector. About 56 million American workers don’t have access to employer-sponsored retirement accounts like 401(k)s . This makes it hard for many to save consistently for retirement, setting them up for a potential disaster down the road.

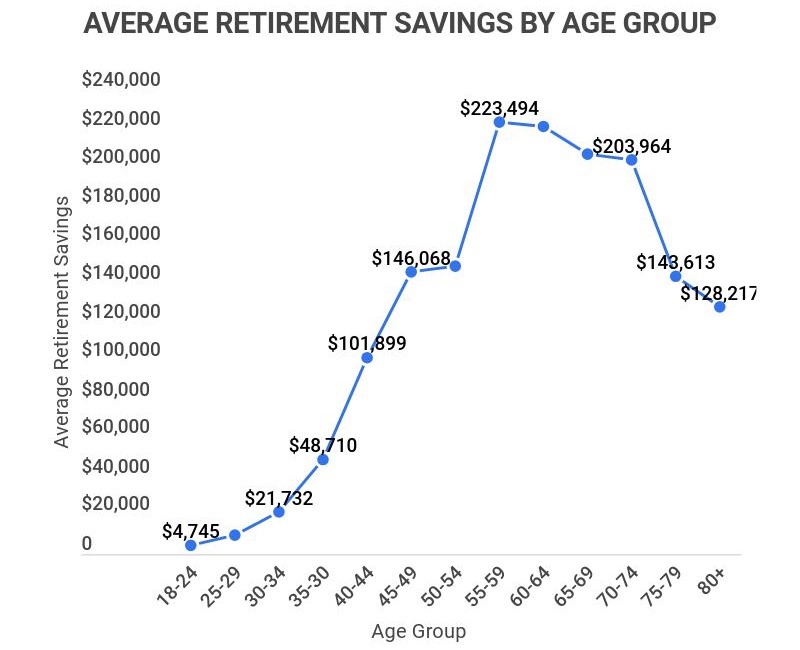

Even those who do have retirement accounts are often falling short. A recent survey showed that many people over 55 have less than $50,000 saved for retirement—far below the recommended amount of eight times their annual salary.

Social Security is another source of concern. Many Americans rely heavily on Social Security for their retirement income. However, projections show that Social Security’s trust fund may run out by 2034, which could lead to reduced benefits for retirees. This adds more pressure to people who are already struggling to save enough.

Key Issues Contributing to the Crisis

- Limited Access to Retirement Plans: Many workers in the private sector lack access to employer-sponsored retirement accounts. Without these, saving for retirement becomes much more difficult.

- Inadequate Savings: Even those with retirement accounts often find themselves far behind on saving enough. The general rule of thumb is that by age 55, you should have saved at least eight times your annual salary. However, many are falling short.

- Uncertainty Around Social Security: Social Security is designed to provide a safety net for retirees, but with the trust fund running low, future retirees may see benefits reduced unless changes are made.

Millions of Americans Just Got a Retirement Warning: Practical Advice for Planning Your Retirement

While the retirement situation in the U.S. is challenging, it’s not all doom and gloom. There are still steps you can take to improve your chances of retiring comfortably. Here’s a detailed guide on how to prepare:

1. Start Saving Early

The earlier you start saving for retirement, the better. Time is your best friend when it comes to growing your savings. Compound interest allows your money to grow exponentially over time, so the earlier you begin contributing, the more you’ll have when you retire.

Even if you can only contribute a small amount at first, it’s better than nothing. Automate your savings so that a portion of your paycheck goes straight into a retirement account like a 401(k) or an IRA. This way, you won’t be tempted to spend it.

2. Take Advantage of Employer-Sponsored Plans

If your employer offers a 401(k) or other retirement plan, take full advantage of it. Many employers will match your contributions up to a certain amount, essentially giving you free money for your retirement. If your employer offers a matching program, try to contribute at least enough to get the full match.

If you don’t have access to an employer-sponsored plan, consider opening an individual retirement account (IRA) on your own. IRAs offer tax advantages that can help you save more over the long term.

3. Diversify Your Investments

Relying solely on Social Security is risky. To truly secure your future, you should diversify your investments. That means having a mix of stocks, bonds, real estate, and other assets to protect your money against inflation and market volatility.

Consider a combination of index funds and target-date funds, which are designed to adjust their risk level based on your age and how far you are from retirement.

4. Be Realistic About Your Retirement Needs

Retirement may last 30 years or longer, so you need to be realistic about how much money you’ll need. Create a budget for your retirement years and think about what your expenses will look like.

Do you plan to travel a lot? Will you have medical expenses? It’s important to estimate your future needs accurately and adjust your savings goals accordingly.

5. Plan for Longevity

Life expectancy is rising, which means you could live much longer than previous generations. According to the Centers for Disease Control and Prevention (CDC), the average life expectancy for Americans is 79 years, but many people live well into their 80s or even 90s.

This means that your retirement savings will need to last longer than ever before. Start planning with longevity in mind, and ensure your portfolio can weather longer periods of withdrawal.

6. Don’t Forget About Healthcare Costs

Healthcare costs are often overlooked in retirement planning but can be one of the biggest expenses you face. According to a report by Fidelity, a 65-year-old couple retiring in 2024 may need approximately $315,000 to cover healthcare costs throughout retirement. It’s crucial to factor these costs into your retirement plans.

Look into Medicare and other health insurance options to understand what’s covered and what you might need to pay out-of-pocket. Some people opt for Health Savings Accounts (HSAs), which allow you to save money tax-free for medical expenses.

7. Work with a Financial Advisor

If you’re not confident in your ability to manage your retirement planning, working with a financial advisor can help you make smart decisions. They can guide you on investments, saving strategies, and tax-efficient ways to prepare for retirement. A professional can help you create a personalized plan that takes into account your unique financial situation and goals.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

Goodbye to 65: How the Changing U.S. Retirement Age Will Impact Millions of Americans