Millennials Say They Need $847,000 to Feel Financially Secure: When it comes to financial security, every generation has its own take on how much money they need to feel comfortable. Recent data has sparked some interesting conversations, especially around the expectations millennials have compared to other generations. According to a recent survey, millennials believe they need a whopping $847,000 in net worth to feel financially secure. But is this realistic? How do other generations, like Gen Z, Gen X, and Baby Boomers, feel about their financial needs? Let’s dive in and break it down, step by step.

Millennials Say They Need $847,000 to Feel Financially Secure

In the end, the amount of money people believe they need for financial security varies greatly by generation. While millennials may feel that $847,000 is necessary to feel comfortable, other generations, like Gen Z and Gen X, have their own unique expectations. The important thing to remember is that financial security isn’t just about having a specific amount of money—it’s about smart planning, early savings, and the right investment strategies. By understanding your financial needs, setting goals, and taking proactive steps to secure your future, you can start building the financial foundation you need, no matter what generation you belong to.

| Key Insight | Data & Stats | Source |

|---|---|---|

| Millennials’ Financial Needs | $847,000 to feel financially secure | MarketWatch |

| Gen Z’s Financial Needs | $329,000 to feel financially secure | MarketWatch |

| Gen X’s Financial Needs | $783,000 to feel financially secure | MarketWatch |

| Baby Boomers’ Financial Needs | $943,000 to feel financially secure | MarketWatch |

| Perceived vs. Actual Net Worth | Median net worth for retirees is $409,900 | MarketWatch |

| Generational Insecurity | 84% of Gen X feels financially insecure | Bankrate |

As the economy continues to shift, people’s financial goals and needs evolve. What felt like enough just a decade ago might no longer seem sufficient, especially with rising costs of living, inflation, and economic uncertainty. So, what exactly do these numbers mean, and why do millennials think they need almost $850,000 to feel financially secure?

Let’s break it down.

Why Do Millennials Think $847,000 is Enough?

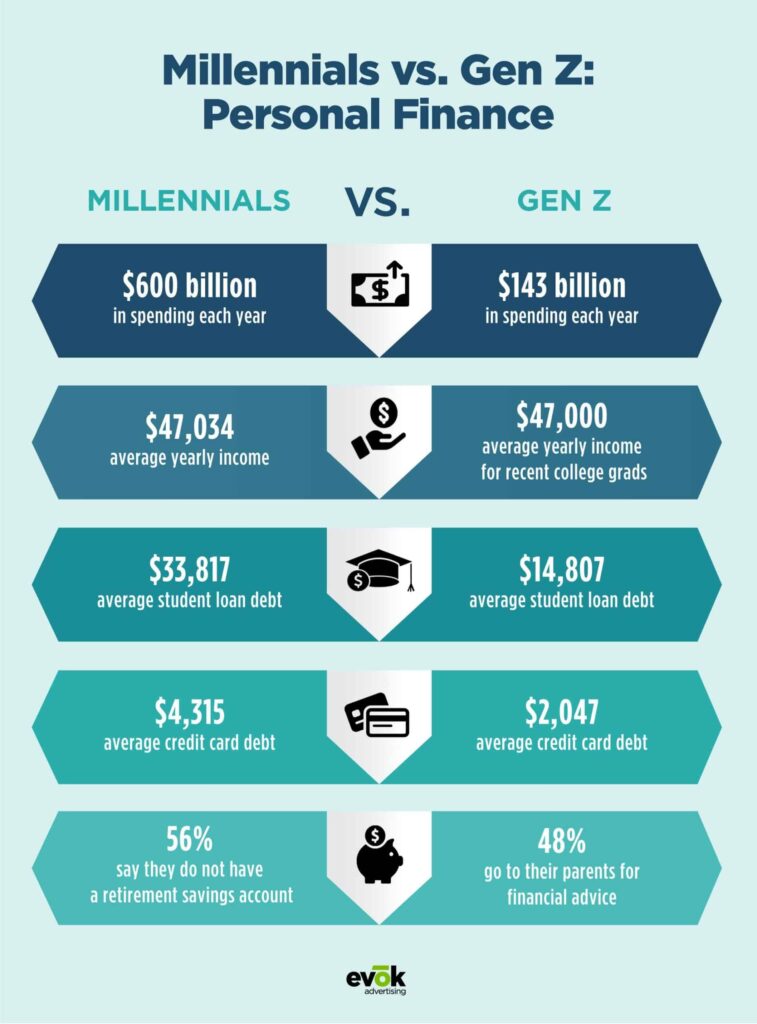

Millennials, the generation born between 1981 and 1996, are often painted as the ones struggling the most when it comes to financial stability. Between the student loan crisis, rising housing costs, and the high cost of healthcare, it’s no surprise that millennials have a higher perception of how much they need to feel financially secure.

According to recent studies, millennials need approximately $847,000 to feel comfortable with their financial standing. This number is a bit shocking, but when you look at the challenges millennials face, it starts to make sense.

The Challenges Millennials Face

- Student Loan Debt: As of 2023, the total student loan debt in the U.S. has surpassed $1.7 trillion. Millennials, in particular, are burdened with this debt, and it weighs heavily on their ability to save or invest in the future. Many millennials graduated with student loan debt of more than $30,000—a significant amount considering the median household income in the U.S. is around $70,000.

- Rising Housing Costs: The cost of buying a home has increased dramatically over the past decade. According to the National Association of Realtors, the median price of a home in the U.S. in 2023 is about $420,000. Millennials, many of whom are entering the housing market for the first time, are finding it difficult to get a foot in the door.

- Healthcare and Insurance: Healthcare costs have skyrocketed over the years, and many millennials are still navigating the balance between decent insurance and affordable premiums. Out-of-pocket medical expenses can drain savings, making financial security seem like a distant dream.

- The Gig Economy: Many millennials work in the gig economy, taking on freelance jobs or side hustles. While this offers flexibility, it doesn’t come with benefits like health insurance, retirement plans, or paid time off. This lack of benefits means millennials need to save more to prepare for the future.

These challenges mean that millennials need more money to feel secure. They can’t rely on traditional financial security models and must plan to have a larger cushion.

How Other Generations Compare to Millennials Say They Need $847,000 to Feel Financially Secure?

Now, let’s look at the financial needs of Gen Z, Gen X, and Baby Boomers.

Gen Z – $329,000

The youngest generation, Gen Z, born between 1997 and 2012, feels that $329,000 is enough to feel financially secure. While this number is much lower than millennials’ expectations, it’s still quite high compared to older generations. Gen Z has grown up in a world where financial literacy is much more emphasized, and many young people are starting to save early—whether through retirement accounts or investment opportunities.

Moreover, many Gen Zers are entering a rapidly changing job market, with more opportunities to work remotely and diversify their income. Despite these advantages, Gen Z is still dealing with student loans, though their expectations of financial security might be influenced by a more cautious approach to spending.

Gen X – $783,000

Gen Xers, born between 1965 and 1980, require about $783,000 to feel financially secure. This generation is in the midst of their peak earning years, with many balancing mortgage payments, kids’ education, and preparing for retirement. Their financial needs fall between millennials and baby boomers, reflecting the pressures of raising families while preparing for an uncertain financial future.

Gen Xers are also feeling financial strain, with 84% of them saying they feel financially insecure, according to a Bankrate survey. As a result, many Gen Xers are looking for ways to save aggressively and invest wisely for retirement.

Baby Boomers – $943,000

Baby boomers, born between 1946 and 1964, have the highest perceived financial need. They believe $943,000 is necessary for financial security. Baby boomers are nearing or already in retirement, and many are focused on ensuring their savings last throughout their retirement years.

At this stage in life, they have likely accumulated significant wealth, but healthcare costs and the unpredictability of Social Security benefits have raised concerns. Many are adjusting their expectations based on the realities of living longer and the rising cost of healthcare.

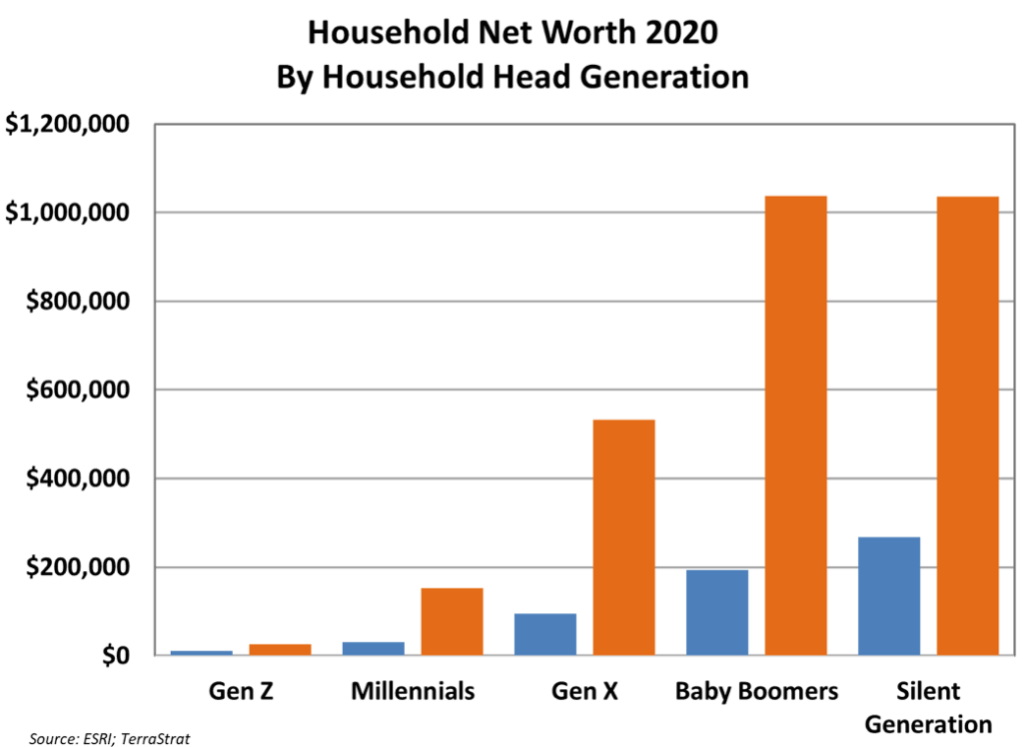

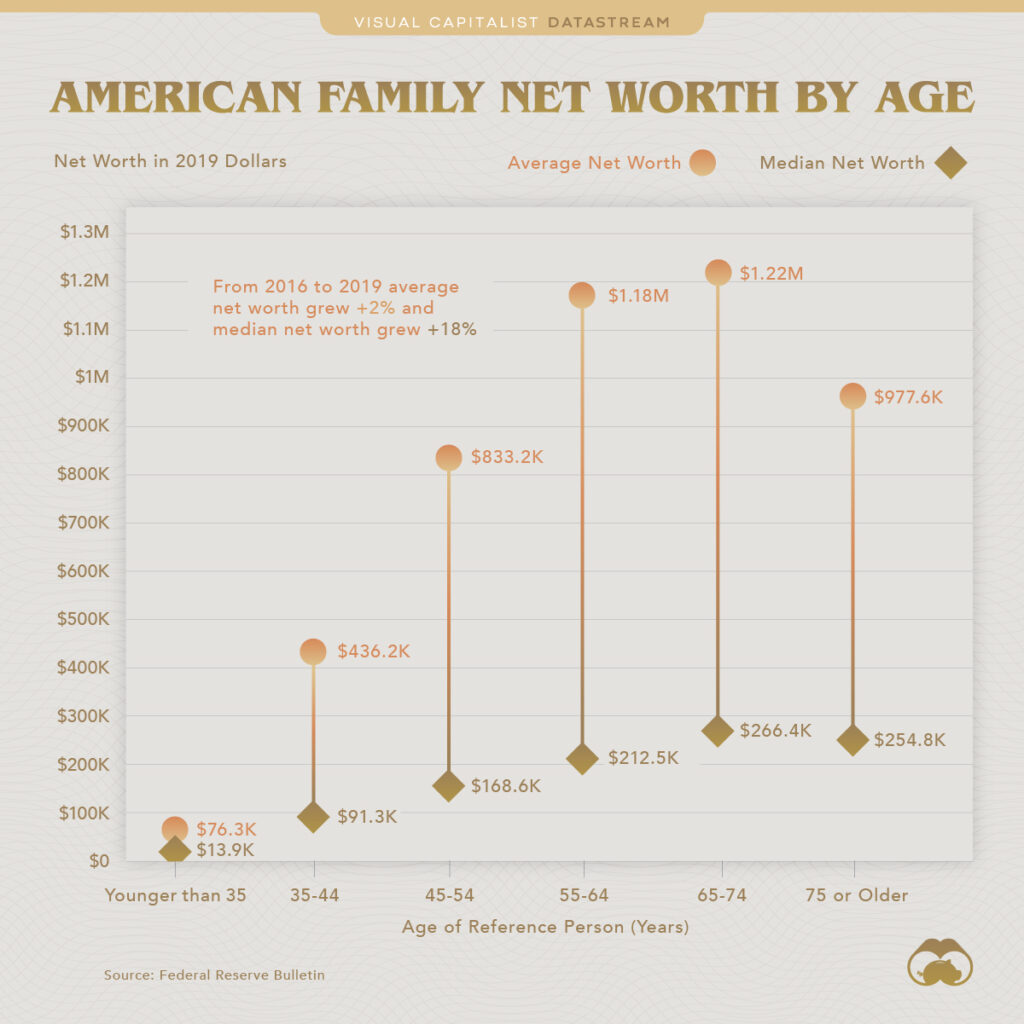

Understanding the Gaps: Perceived vs. Actual Net Worth

While these numbers may seem high, the reality is that many Americans, regardless of their generation, are far from reaching these figures. For example, the median net worth for retirees is around $409,900, according to recent MarketWatch data. This shows a significant gap between what people think they need to feel financially secure and the actual savings many have.

This gap is a stark reminder that financial security is more about mindset and planning than a specific dollar amount. Building a comfortable retirement or savings plan isn’t just about accumulating a large sum but about making the right decisions early on, like investing, saving consistently, and planning for the unexpected.

How to Bridge the Gap: Practical Financial Tips

- Start Saving Early: The earlier you start, the more your money can grow. Even small amounts can add up over time, thanks to the power of compound interest. Setting up an automatic savings plan can help.

- Pay Off Debt: High-interest debt, like credit card balances, can drain your financial resources. Focus on paying off debt before aggressively saving or investing.

- Invest in Your Future: Contribute to retirement accounts like a 401(k) or IRA. If you can, invest in stocks, bonds, or real estate. Over the long term, investing has a higher chance of growing your wealth compared to just saving in a savings account.

- Create a Budget: Track your spending and identify areas where you can cut back. This will allow you to save more and avoid unnecessary debt.

- Emergency Fund: Having an emergency fund of 3-6 months’ worth of living expenses can provide peace of mind and prevent financial stress in case of unexpected events.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

CNBC Uncovers the Devastating Financial Impact of Supporting Adult Children on U.S. Families

What Financial Independence Really Means in 2025—and Why FIRE Isn’t Just a Trend