Harsh Truth About FIRE Lifestyle: The FIRE movement—short for Financial Independence, Retire Early—has gained huge momentum over the past decade, especially among millennials tired of the daily grind. For many, it promises escape from the rat race, control over your time, and the dream of financial freedom. But what happens after you actually achieve it?

Enter Rose Han, a millennial who reached early retirement at just 32 years old. After paying off over $100,000 in student loans and building a net worth well over $1 million, she walked away from a high-powered finance career. But what came next wasn’t the never-ending vacation many imagine. Within just six months, Rose faced an uncomfortable truth—freedom without purpose can feel empty. This article breaks down the lessons from Rose’s journey and provides a complete guide to FIRE—explained in plain language, backed by data, and filled with practical steps for anyone interested in retiring early with purpose.

Harsh Truth About FIRE Lifestyle

FIRE offers freedom, but freedom without purpose can quickly lose its sparkle. Rose Han’s story is a reminder that financial independence is a means to an end, not the end itself. Whether you’re dreaming of van life, international travel, or starting your own business, FIRE gives you the tools to make it happen. But always ask yourself: What kind of life do I want to live—and how will I fill my days once I’m free to choose? With the right mix of planning, purpose, and passion, you can not only retire early—you can retire fulfilled.

| Feature | Details |

|---|---|

| Name | Rose Han |

| FIRE Age | 32 |

| Debt Paid Off | $100,000+ student loans |

| Net Worth at Retirement | Over $1 million |

| Experience After FIRE | Felt unfulfilled and bored within 6 months |

| Main Takeaway | Financial freedom does not guarantee long-term happiness |

| Current Focus | Financial education via Investing with Rose |

| Official FIRE Resources | ChooseFI, Mr. Money Mustache |

What Is the FIRE Movement?

FIRE stands for Financial Independence, Retire Early. The basic idea is simple: save and invest enough money so you no longer need to work for a paycheck. Most FIRE followers save 50% to 70% of their income and invest in low-cost index funds. Once their investments can support their yearly expenses—using a rule called the 4% Rule—they consider themselves financially independent.

For example, if you want to live on $40,000 a year, you’ll need about $1 million saved up. Why? Because 4% of $1 million is $40,000. That’s the core of the FIRE philosophy.

But FIRE isn’t just about money. For many, it’s about freedom: the ability to travel, spend more time with family, or pursue creative passions. Still, that freedom can feel overwhelming if you’re not prepared for what comes after.

Who Is Rose Han?

Rose Han began her career on Wall Street, making a six-figure income. But she quickly realized the corporate lifestyle wasn’t for her. By living below her means, investing wisely, and avoiding lifestyle inflation, she became financially independent in her early 30s.

She quit her job and hit the road in a van, living the dream—or so she thought. Within a few months, she found herself feeling disconnected, lacking structure, and searching for meaning. The excitement faded. She missed having goals, teammates, and challenges.

Instead of coasting through early retirement, Rose launched “Investing with Rose,” a financial education business that helps others reach financial independence—with a focus on building meaningful lives, not just big bank accounts.

What Rose Han Learned After Retiring Early

- Freedom without purpose isn’t satisfying.

- Work can be meaningful when it aligns with your values.

- Retiring early isn’t about escaping your job—it’s about creating a life you love.

Rose now encourages others to think differently about FIRE. Rather than simply retiring early, she advises people to build a life you don’t want to retire from.

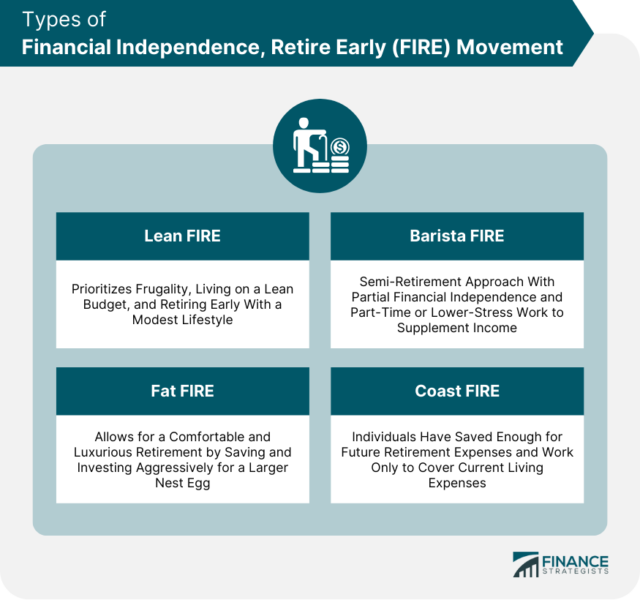

Variations of FIRE

Not all FIRE followers take the same path. Here are the major styles:

- Lean FIRE: Retire on a very low annual budget, usually $25k–$40k. Requires extreme frugality.

- Fat FIRE: Allows for a more luxurious retirement lifestyle with higher annual expenses.

- Barista FIRE: Quit your high-stress job, but still work part-time to cover daily expenses while investments grow.

- Coast FIRE: Save enough early that your investments grow without new contributions. You only need to cover your current expenses.

Rose initially aimed for Fat FIRE but ultimately adopted a hybrid approach—working on something she loves without financial pressure.

The Psychological Side of Early Retirement

Financial freedom is powerful—but it doesn’t automatically create happiness.

According to the American Psychological Association (APA), many early retirees experience:

- Loss of identity: We tie self-worth to careers.

- Lack of routine: Without a schedule, days can blur together.

- Social isolation: Coworkers are a big part of most people’s daily lives.

- Restlessness: Too much free time can lead to boredom or anxiety.

A 2020 study published by the Journal of Economic Behavior & Organization found that early retirees without hobbies or meaningful activities reported lower life satisfaction than those who continued working part-time or volunteering.

That’s why purposeful planning is just as important as financial planning.

Why Millennials and Gen Z Are Embracing FIRE

Younger generations are leading the charge toward FIRE. Here’s why:

- Job dissatisfaction: Many workers feel disengaged and unfulfilled.

- Burnout: Especially post-pandemic, people want more work-life balance.

- High housing and education costs: Traditional retirement paths feel out of reach.

- Technological freedom: You can make money from anywhere—remote work, side hustles, or digital businesses.

According to a 2023 MagnifyMoney survey, nearly 43% of millennials are actively pursuing financial independence or early retirement.

Step-by-Step FIRE Plan: Harsh Truth About FIRE Lifestyle

Step 1: Define Your “Why”

Start by asking: Why do I want to retire early? What will I do with my time? Write this down. It’s your guiding light.

Step 2: Calculate Your FIRE Number

Use the 4% Rule:

- Multiply your desired annual spending by 25.

- Example: $60,000/year x 25 = $1.5 million

That’s how much you need in investments to be financially independent.

Step 3: Save Aggressively

Aim to save 50–70% of your income. Use tax-advantaged accounts like:

- Roth IRA

- 401(k)

- HSA (Health Savings Account)

- Brokerage accounts for flexibility

Step 4: Invest in Low-Fee Index Funds

The FIRE community favors simple, diversified options like:

- VTSAX: Vanguard Total Stock Market Index Fund

- VTI: Vanguard Total Market ETF

- FZROX: Fidelity ZERO Total Market Index Fund

These have low fees and consistent long-term returns.

Step 5: Cut Expenses Where It Counts

- Live below your means: Rent a smaller home, drive a used car.

- Meal plan: Eating out adds up fast.

- Avoid lifestyle creep: Don’t increase spending just because you earn more.

Step 6: Practice Mini-Retirements

Before going all-in, try taking a 3-month sabbatical or gap year. It helps you preview FIRE life and avoid surprises.

Step 7: Build a Post-FIRE Plan

- Will you travel?

- Start a business?

- Volunteer or mentor?

Plan your post-retirement routine now—not after you leave your job.

More Real FIRE Stories

- Mr. Money Mustache: Retired at 30, now teaches millions how to live simply and invest wisely.

- Kristy Shen and Bryce Leung: Authors of Quit Like a Millionaire, retired in their 30s and now travel the world.

- Corey Forsythe: Reached Coast FIRE at 35 with $1.1 million invested, but still chooses to work part-time for fulfillment.

These stories prove that FIRE is more flexible than you might think.

Common FIRE Myths Debunked

Myth 1: You have to make six figures to achieve FIRE.

Truth: Many FIRE followers make less than $80,000. It’s about how much you save, not how much you make.

Myth 2: FIRE is about never working again.

Truth: Many FIRE achievers keep working—but on their own terms.

Myth 3: You have to give up all fun.

Truth: FIRE is about intentional spending, not deprivation.

FIRE Checklist: Are You Ready?

- Do you know your monthly and yearly expenses?

- Are you saving at least 40% of your income?

- Do you invest regularly in index funds?

- Do you have a plan for what to do post-retirement?

- Have you tested your lifestyle through mini-retirements?

- Are you mentally prepared for less structure and fewer work relationships?

If you checked 4 or more, you’re on the right track.

Gen Z Is Saving for Retirement Early, But Employers May Be Falling Behind

What Financial Independence Really Means in 2025—and Why FIRE Isn’t Just a Trend

Inside Trump’s ‘Big Beautiful Bill’ and Its Impact on Your Social Security