Major Benefits Update for Public Sector Retirees: If you’re a public sector retiree, the news you’ve been waiting for has finally arrived. Major changes to two provisions that previously reduced or eliminated Social Security benefits for public workers have now been repealed. We’re talking about the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). If you were affected by these provisions, you’ll want to read on to understand how these changes will affect your retirement. Whether you work for the government, local schools, or any other public sector job, understanding how these new regulations impact your retirement planning is crucial. This article will break down the changes, explain what you need to do, and help you make the most of the opportunities ahead.

Major Benefits Update for Public Sector Retirees

The repeal of WEP and GPO provisions through the Social Security Fairness Act marks a major shift in how public sector retirees will receive their Social Security benefits. These changes not only bring a significant boost to monthly payments but also ensure that retirees no longer face unfair reductions in their benefits due to their government pensions. With retroactive payments, new eligibility for benefits, and the possibility of reevaluating your retirement plans, there’s never been a better time for public sector retirees to take charge of their financial futures.

| Key Detail | Important Numbers/Stats | Sources |

|---|---|---|

| Repeal of WEP and GPO | $360-$460 per month increase for affected retirees | SSA.gov, Investopedia |

| Retroactive Payments for Affected Retirees | Retroactive payments from January 2024 | |

| Changes Started in 2025 | Most retirees began receiving increased benefits by April 2025 | |

| Social Security Fairness Act Signed into Law in 2025 | Affects retirees in non-Social Security covered jobs | |

| Average Benefit Increase for Affected Individuals | $460 per month expected by 2033 |

For retirees in the public sector, the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO) have been two major hurdles when it came to collecting full Social Security benefits. These provisions had long caused confusion, frustration, and, in many cases, financial hardship. But, thanks to the passage of the Social Security Fairness Act in January 2025, both of these provisions have been repealed, making way for a much-needed boost in monthly benefits for public sector retirees.

This update is massive, and the repeal of WEP and GPO will likely result in a substantial increase in Social Security payments for individuals who previously had their benefits reduced. It’s time to dive deeper into what these changes mean for you and your retirement plans.

Understanding WEP and GPO

Before we get into the juicy details of the changes, let’s review what WEP and GPO were all about and why they caused so much concern among public sector retirees.

Windfall Elimination Provision (WEP)

The Windfall Elimination Provision was a rule that reduced the Social Security benefits of people who had earned a pension from a job where they didn’t pay into Social Security. For example, if you worked for the government, a local school district, or any other non-Social Security-covered job, your Social Security benefits were often reduced when you retired.

How did it work? If you worked a government job or another public sector role where you didn’t pay into Social Security, the WEP reduced your benefits based on the number of years you worked in Social Security-covered employment. The longer you worked a non-Social Security job, the more your benefits were reduced.

Government Pension Offset (GPO)

The Government Pension Offset applied to spouses and survivors of people who worked in non-Social Security-covered jobs. If you had a spouse who worked for the government and earned a pension but didn’t pay into Social Security, the GPO could reduce or even eliminate your spousal or survivor benefits. The offset was equal to two-thirds of the government pension your spouse received.

Both WEP and GPO made it incredibly difficult for public sector workers and their families to benefit fully from Social Security, even after contributing to their retirement through pensions and other plans.

Major Benefits Update for Public Sector Retirees: How the Repeal of WEP and GPO Impacts Your Retirement

With the Social Security Fairness Act signed into law in 2025, retirees who were previously affected by WEP and GPO are in for a much-needed change. Here’s how these updates impact you:

1. Increased Monthly Benefits

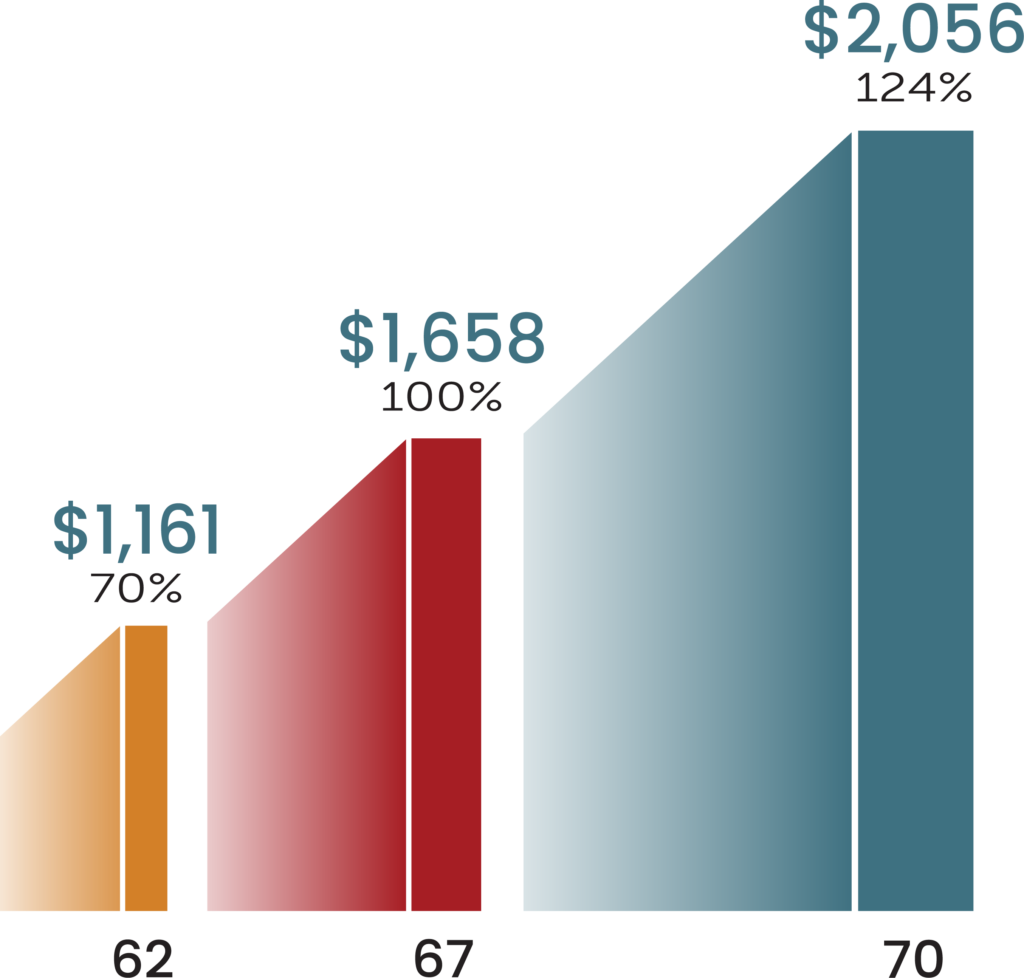

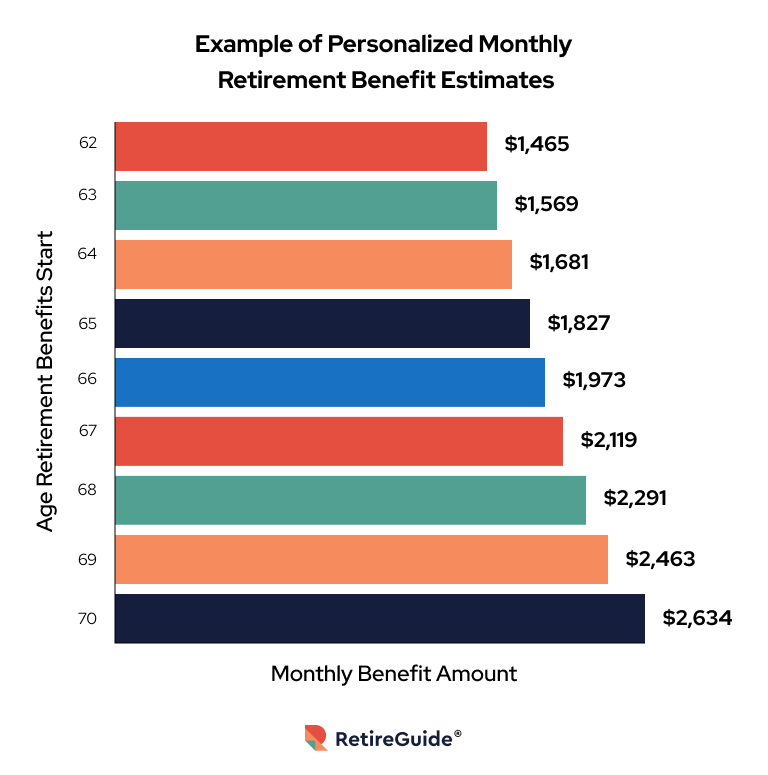

One of the most exciting aspects of this change is that affected retirees will now receive their full Social Security benefits. According to estimates from the Social Security Administration and other government sources, retirees can expect an average monthly increase of $360, rising to $460 per month by 2033.

This increase is particularly important for retirees who depend on their Social Security benefits to make ends meet. It will provide greater financial security for public sector retirees who previously saw their Social Security checks reduced due to WEP and GPO.

2. Retroactive Payments

Another huge advantage of the repeal is that retroactive payments will be issued for the benefits that were reduced under WEP and GPO, dating back to January 2024. If you were impacted by WEP or GPO, you’ll receive payments for any amount you would have been entitled to since that time.

These retroactive payments began to be processed in February 2025, and many retirees saw their adjusted benefits start arriving in April 2025.

3. Eligibility for New Beneficiaries

Previously, if you were working in a public sector job and were ineligible to receive Social Security benefits due to WEP or GPO, you may now be eligible to apply for them. The repeal of these provisions means that even if you didn’t qualify before, you can now apply for Social Security benefits if you meet other eligibility criteria.

What You Need to Do Now: Steps to Take

The good news is that the changes are in place, but there are still some actions that you, as a retiree or soon-to-be retiree, should take to ensure you maximize your benefits. Here’s a breakdown of what you need to do:

1. Verify Your Information with the Social Security Administration (SSA)

Make sure that the Social Security Administration (SSA) has your correct mailing address, direct deposit details, and other contact information. This is essential for ensuring that you receive your retroactive payments and the increased monthly benefits.

2. Check Your Social Security Statement

Visit the official Social Security website and log into your account. There, you can review your earnings history and check if your future benefits have been adjusted to reflect the repeal of WEP and GPO. If you find any discrepancies, contact the SSA to get it sorted.

3. Reevaluate Your Retirement Plans

If you’ve been relying on your pension alone or other forms of income, the increased Social Security benefits may mean you can rethink your retirement strategy. Consider consulting with a financial advisor to review your retirement savings and adjust your plans accordingly.

4. Apply for Benefits if You Were Previously Ineligible

If you weren’t eligible for Social Security benefits because of WEP or GPO, now is the time to apply. The repeal may allow you to access Social Security benefits for the first time.

5. Stay Informed About Future Legislation

Although the Social Security Fairness Act is a huge win for retirees, it’s always a good idea to stay updated on any future changes to Social Security laws. Subscribe to news outlets and the SSA website for updates that may affect your benefits down the road.

Additional Insights and Considerations

While the Social Security Fairness Act is a significant victory, there are other elements of retirement planning that public sector retirees should consider.

Diversify Your Retirement Income

Even with the boost in Social Security benefits, relying solely on Social Security or your pension may not be enough to maintain your desired lifestyle in retirement. It’s a good idea to diversify your retirement savings with other vehicles like IRAs, 401(k)s, or Roth IRAs to help you save more efficiently.

Healthcare in Retirement

As a public sector retiree, you may be eligible for certain healthcare benefits. Make sure you fully understand your healthcare coverage options, including eligibility for Medicare or any health insurance offered by your former employer. Understanding how these programs work together can help prevent gaps in coverage during your retirement years.

Tax Implications

In some cases, increases in Social Security benefits may have tax implications, especially if your overall retirement income reaches certain thresholds. Consult with a tax professional to determine if any changes in your Social Security payments will affect your tax liability.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

$5,108 Social Security Checks Arrive in July—Here’s Who Qualifies