Lack of Succession Planning Among Financial Advisers: In the world of personal finance, trust is key. When clients entrust their financial advisers with their retirement savings, investment strategies, and long-term financial goals, they rely on consistent, expert guidance. But what happens when that adviser suddenly leaves the firm, retires, or is unavailable due to health reasons? The lack of proper succession planning in the financial advisory field can create significant risks that affect both advisers and clients. In this article, we will dive into why succession planning matters, the risks it mitigates, and how both clients and advisers can ensure a smooth transition that protects clients’ financial futures.

Lack of Succession Planning Among Financial Advisers

Lack of succession planning among financial advisers can create risks that go beyond just business continuity; it can jeopardize the long-term financial security of clients. With the industry’s aging population of advisers, the need for clear and actionable succession plans is more urgent than ever. By taking proactive steps, advisers and clients can ensure that financial relationships continue seamlessly, even in the event of retirement or unforeseen circumstances. For advisers, planning ahead ensures that their clients are always taken care of and that their legacy of trust remains intact. For clients, knowing that there is a clear succession plan in place helps build confidence in the adviser and the firm. In the end, succession planning is not just about planning for the end, it’s about ensuring the continuity of expert financial guidance for years to come.

| Key Topic | Details |

|---|---|

| Why Succession Planning Matters | Succession planning ensures that clients continue to receive consistent, reliable financial guidance. |

| Risks of Not Having a Plan | Disruption in client relationships, loss of knowledge, and increased vulnerability during transitions. |

| Statistics | 69% of first-generation financial advisers (G1s) lack crucial elements in their succession plans. |

| What Clients Can Do | Engage in conversations with advisers about succession plans, seek transparency, and consider alternatives. |

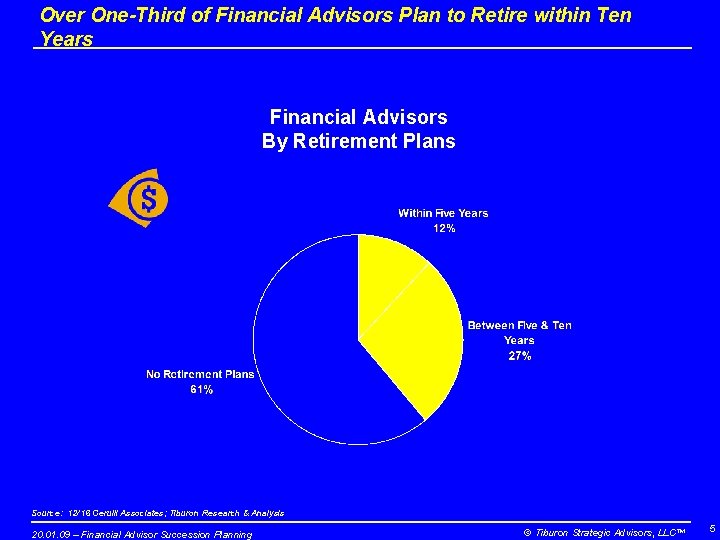

| Adviser Insights | 44% of younger advisers (G2s) feel older advisers are unprepared for retirement. |

Why is Succession Planning Important for Financial Advisers?

The Silent Risk

Succession planning might not be the most exciting topic for financial advisers, but it is essential. Without it, clients can face unexpected disruptions when their trusted adviser steps away or is no longer available to manage their finances. It’s like relying on a coach who unexpectedly leaves mid-season with no one to take their place. For clients who depend on this relationship, the consequences can be dire.

Succession planning isn’t just about replacing an adviser; it’s about preserving the continuity of financial advice and maintaining a relationship that spans generations. If an adviser retires without a plan, clients could be left with gaps in service that affect their financial well-being.

The Aging Adviser Population

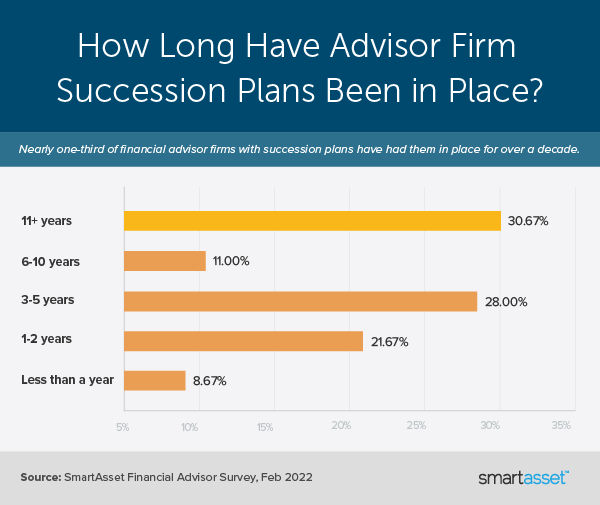

The financial advisory industry is facing a major demographic shift. According to a study by the Financial Planning Association, more than 40% of financial advisers in the U.S. are over the age of 55, with many planning to retire within the next 5 to 10 years. However, very few have formal succession plans in place. This trend places an even greater burden on clients to ensure that their adviser has made adequate arrangements to hand over the reins.

Risks of Lack of Succession Planning Among Financial Advisers

1. Disrupted Client Relationships

When an adviser doesn’t have a clear plan for retirement or transition, clients may feel left out in the cold. If the succession plan is unclear, clients can experience disruptions in service, and in some cases, it can even lead to the loss of clients. Trust is the bedrock of any financial advisory relationship, and without proper planning, that trust can quickly erode.

2. Loss of Institutional Knowledge

A financial adviser’s expertise often comes from years of working with their clients. They know the ins and outs of their clients’ goals, fears, and financial history. Without a succession plan, that knowledge could be lost, which means that new advisers might have to start from scratch. Clients may find themselves having to re-explain their entire financial situation, which can lead to frustration and a delay in making decisions.

3. Increased Vulnerability During Transitions

In the absence of a plan, there may be a significant gap between the departure of the old adviser and the introduction of a new one. This could leave clients exposed to market changes or, worse, to missed opportunities. Without proper documentation, the new adviser might not be able to act quickly enough, potentially affecting portfolio performance and client goals.

4. Client Attrition

A lack of succession planning can drive clients to seek alternative advisers or firms. Clients may be uncomfortable with the uncertainty or the lack of transparency and may look for a firm with a more comprehensive plan in place. This can lead to the loss of assets under management (AUM) and, ultimately, a reduction in revenue for the firm.

How Financial Advisers Can Prepare for the Future?

1. Start Early with a Formal Plan

Succession planning should not be left to the last minute. The earlier an adviser starts, the better. A succession plan should include key elements such as:

- Timeline for retirement: When does the adviser plan to step down, and what is the transition schedule?

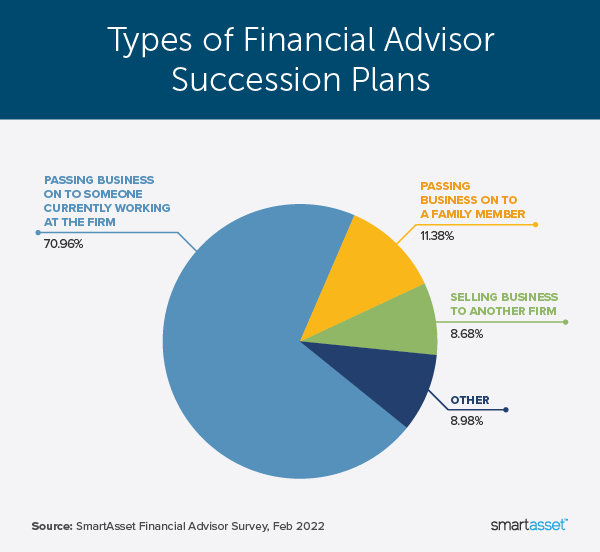

- Identification of successors: Who will take over the client accounts and the business?

- Knowledge transfer: How will the successor learn the intricacies of existing client relationships?

- Legal and financial considerations: How will the business’s assets and the adviser’s equity be transferred?

By addressing these elements early, advisers can ensure a smooth transition and avoid the disruptions that come with uncertainty.

2. Involve the Team

For firms with multiple advisers, the succession plan should be a team effort. It’s essential to get buy-in from junior advisers (Generation 2, or G2s) who may one day take over the practice. If they aren’t involved, it’s more likely that the transition will be rocky. A clear, shared vision will ensure the firm continues its operations smoothly even after the senior advisers retire.

3. Communicate with Clients

Open, honest, and proactive communication with clients about succession planning is crucial. Advisers should not wait until retirement is imminent to have these conversations. Clients should be informed of the plan early on so they don’t feel blindsided or neglected. Advisers should also reassure clients that their best interests will always come first, no matter who is handling their accounts.

What Clients Can Do to Protect Their Financial Future?

1. Ask the Right Questions

If you’re working with a financial adviser, it’s essential to have a candid conversation about the succession plan. Here are a few key questions to ask:

- What is your plan for transitioning client relationships if you retire or are unavailable?

- Who will take over the management of my accounts, and what qualifications do they have?

- How will you ensure that my financial goals and needs are met during the transition?

- Do you have a formal, documented succession plan that you can share with me?

These questions will help you understand whether your adviser is prepared for the future and whether their firm has the resources to ensure continuity.

2. Seek Transparency

Transparency is key in any financial relationship. If your adviser is hesitant to discuss their succession plan or does not have one in place, it may be time to reconsider your options. Having a formal succession plan ensures that the adviser’s clients are treated with respect and that their financial futures are not left to chance.

3. Explore Alternative Firms

If your current adviser doesn’t have a plan in place, it may be wise to consider looking for an alternative firm with a more structured approach to succession. Firms with clear plans for transition are more likely to provide consistent service and protect your financial interests in the long run.

Legal Aspects of Succession Planning

It’s also crucial to recognize the legal implications of succession planning. Proper legal documentation ensures that there are no disputes about the transfer of ownership or the management of client portfolios. Legal considerations might include:

- Business valuation: How is the value of the business determined, and how will it be transferred?

- Buy-sell agreements: These agreements outline how the business will be bought out when the adviser retires or leaves.

- Client contracts: Advisers need to ensure that their clients’ agreements allow for a smooth transition of services to a successor.

A well-drafted legal framework for succession planning not only secures the adviser’s business but also ensures that the client relationship remains uninterrupted.

Example of a Successful Succession Plan

Consider the example of Jane Smith, a financial adviser who has been in business for 30 years. Jane recognized the importance of succession planning early in her career. She chose her successor, Emily, a talented adviser she mentored for years. Together, they developed a transition plan that included detailed client notes, strategies for portfolio management, and a timeline for Emily to gradually take on more responsibility. As a result, Jane’s clients felt confident in the transition, and many of them continued their relationships with Emily without missing a beat.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Gen X Could See a Big Payday Soon With Upcoming Financial Changes- Check Detail!

CNBC Uncovers the Devastating Financial Impact of Supporting Adult Children on U.S. Families