Just Withdrew From Your IRA: So, you just withdrew from your IRA (Individual Retirement Account)—maybe for an emergency, a new home, helping out family, or you just hit that 59½ milestone and said, “I earned this.” Now the big question is: Where should that money go next? Don’t worry. Whether you pulled out a little or a lot, this guide breaks it down in plain English. We’ll walk through smart, safe, and growth-friendly options for your money—no confusing Wall Street talk, just real-life advice.

Just Withdrew From Your IRA

Pulling money from your IRA isn’t the end of your retirement plan—it’s just another step. Whether you need the money now or later, what you do with it next determines how long it lasts and how much it helps. Use the bucket system to organize your strategy. Keep what you need liquid. Grow what you won’t need for a while. And protect yourself from taxes, inflation, and risky moves. This is your retirement. Make every dollar count—and make your next move your smartest yet.

| Insight | Details |

|---|---|

| Top Priority | Preserve value, avoid unnecessary taxes |

| Short-Term Options | High-yield savings, CDs, and T-bills |

| Long-Term Growth | ETFs, mutual funds, dividend-paying stocks |

| Taxable or Not? | Roth IRA = tax-free (if qualified); Traditional IRA = taxed |

| Risk to Avoid | Letting money sit idle or investing recklessly |

| Withdrawal Strategy | Bucket approach: short, medium, long-term |

| Real-World Data | 20% of retirees withdraw early without reinvestment plans (Fidelity) |

| Official Reference | IRS IRA Rules |

Understanding Why People Withdraw IRA Funds

People tap into their IRA accounts for all sorts of reasons. You might be retired, switching careers, facing health issues, helping a child or grandchild with college, or buying property. Maybe inflation is just hitting too hard, and your Social Security check doesn’t stretch like it used to.

Whatever your reason, you’re not alone. According to a Fidelity report, about 20% of retirees begin withdrawing from their IRAs sooner than expected, often without a clear plan for what comes next. The risk? That money sits idle, gets taxed too heavily, or loses value to inflation.

Step-by-Step Guide: Where to Put That IRA Money If You’ve Just Withdrew From Your IRA

Step 1: Use the 3-Bucket System

Financial planners often recommend breaking down retirement cash into three simple “buckets”:

Bucket 1: Immediate Use (0–3 Years)

This bucket covers what you need now: rent, food, bills, or maybe a one-time purchase like a used truck or a trip to see the grandkids.

Best options:

- High-Yield Savings Account: Many offer 4%+ APY, fully FDIC-insured. Try Ally, Marcus, or your local credit union.

- Short-Term CDs: Certificates of Deposit give you locked-in interest (4–5% for 6-12 months).

- Money Market Accounts: Earn more than regular checking, with check-writing access.

Example: You withdraw $15,000 and put $10,000 in a high-yield savings at 4.5% APY. That earns you $450 a year—better than letting it sit in a no-interest account.

Bucket 2: Short- to Mid-Term Growth (3–7 Years)

You may not need this money right away, but you’ll probably want it soon—for home repairs, healthcare costs, or helping with a grandchild’s tuition.

Best options:

- Treasury Bonds or I-Bonds: Safe, U.S. government-backed. I-Bonds adjust for inflation. Buy directly at TreasuryDirect.gov.

- Laddered CDs: Buy CDs with staggered maturity dates (1-year, 2-year, etc.), so you always have one maturing.

- Bond Funds or ETFs: Consider a low-cost bond index fund like BND or AGG for stability with some returns.

Bucket 3: Long-Term Growth (8+ Years)

This is where your money can grow and build over time—especially if you’re healthy, active, and might live 20-30 more years in retirement.

Best options:

- S&P 500 ETFs: Like SPY or VOO—broad-market exposure, low fees, reliable performance over time.

- Dividend Growth Stocks: Invest in companies with a solid history of paying and increasing dividends (e.g., Johnson & Johnson, Procter & Gamble).

- Target-Date Retirement Funds: These automatically rebalance toward safety as you age (e.g., Vanguard Target Retirement 2035 Fund).

Example: Investing $25,000 in an S&P 500 ETF growing at 8% annually becomes $54,000 in 10 years—without adding anything extra.

Understanding the Tax Rules

Withdrawals can impact your tax bill big time. Here’s the breakdown:

- Traditional IRA: Withdrawals are taxed as ordinary income. If you’re under 59½, add a 10% penalty unless you qualify for an exception.

- Roth IRA: Qualified withdrawals are tax-free. You must be 59½ and have had the account for at least 5 years.

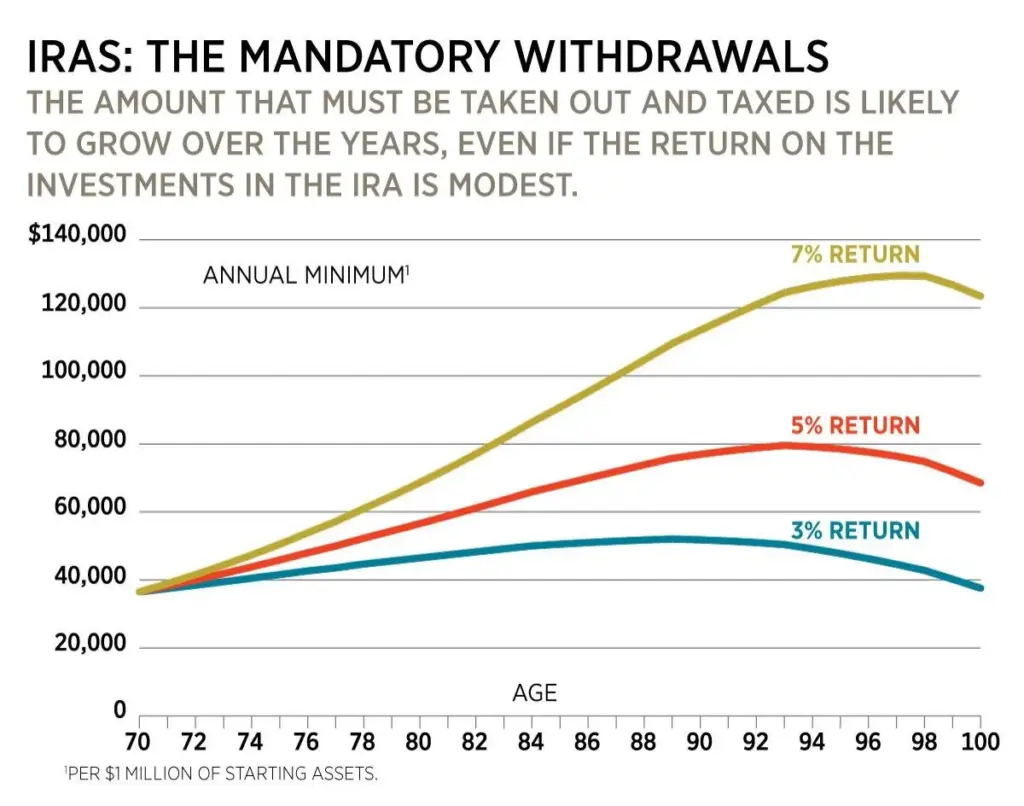

- Inherited IRA: Requires minimum annual withdrawals (based on your life expectancy or 10-year rules).

Pro Tip: Don’t Let It Sit Idle

Many retirees withdraw IRA funds and let them sit in a checking account or spend them too quickly. This is one of the top regrets retirees share, according to a recent Vanguard survey.

Cash sitting in your checking account loses value every year due to inflation. Even just a 3% inflation rate means your money loses $300 in value per $10,000 over 12 months.

Instead, put those dollars to work. Even low-risk options like Treasury bonds or CDs can outpace inflation safely.

What to Avoid?

- Idle Cash: Checking and low-interest savings earn less than inflation.

- High Fees: Don’t fall for high-commission financial advisors or complicated products with surrender charges.

- Unregulated Investments: Crypto, exotic real estate, private equity—these may sound exciting, but they’re not meant for retirement funds unless you really know what you’re doing.

- Emotional Investing: Avoid decisions based on fear (like selling everything during a downturn) or greed (like chasing hot stocks).

Real-Life Example: Native American Retiree Case Study

Name: David, Age 63

Tribe: Navajo Nation

Location: New Mexico

David withdrew $40,000 from his Traditional IRA to help remodel his home and support his daughter’s new business. He divided the funds like this:

- $10,000 → High-yield savings (for emergencies)

- $10,000 → 12-month CD ladder

- $15,000 → Target-date retirement fund (2035)

- $5,000 → Roth IRA contribution (from his regular income)

He worked with a local tribal credit union and a fee-only fiduciary advisor. After taxes and smart planning, he was able to reduce penalties and let his unused funds grow.

Tools and Resources to Help You Plan

| Resource | Purpose |

|---|---|

| IRS IRA Info | Rules and tax details |

| Treasury Bonds | Buy government bonds online |

| RMD Calculator | Know your required withdrawals |

| Tax Estimator | Estimate your income tax |

| Find a Fiduciary | Trusted financial advisor search |

IRS Reveals the Truth: Does Requesting a Tax Extension Delay Your Payment?

Social Security Slashing Benefits by Up to 50% — Here’s Who’s Getting Hit First

Expert Offers Guidance for Couples Planning Retirement With Limited Savings