July 2025 SSI Payments: If you rely on your July 2025 SSI or Social Security check, brace yourself—there may be less money in your account than you expected. A major policy shift by the Social Security Administration (SSA) now allows the agency to withhold up to 50% of your benefit if you’ve received an overpayment notice after April 25, 2025. That’s a big change from the 10% cap most people are used to.

Overpayments happen when SSA sends more money than they should—often due to clerical errors, income misreporting, or changes in eligibility. This new rule increases the default recovery rate to 50%, and for millions of Americans on fixed incomes, this change could be financially devastating. Understanding why this is happening, who’s affected, and how to respond is critical. This article breaks it down in plain English—so you can take control, avoid surprises, and protect your hard-earned benefits.

July 2025 SSI Payments

July 2025 may bring a sudden drop in Social Security or SSI payments for thousands of Americans. But you’re not powerless. Understand the rules, read your SSA mail carefully, and take swift action with waivers, appeals, or payment plans. If you’re struggling, reach out—legal aid groups, community nonprofits, and financial counselors can help you defend your benefits and secure your future.

| Topic | Fast Fact | Why It Matters |

|---|---|---|

| New 50% Withholding Rule | Effective April 25, 2025 | Could cut July checks in half for millions |

| Who Is Affected? | SSI, SSDI, Social Security recipients with overpayments | 1 in 8 of 67 million beneficiaries could be impacted |

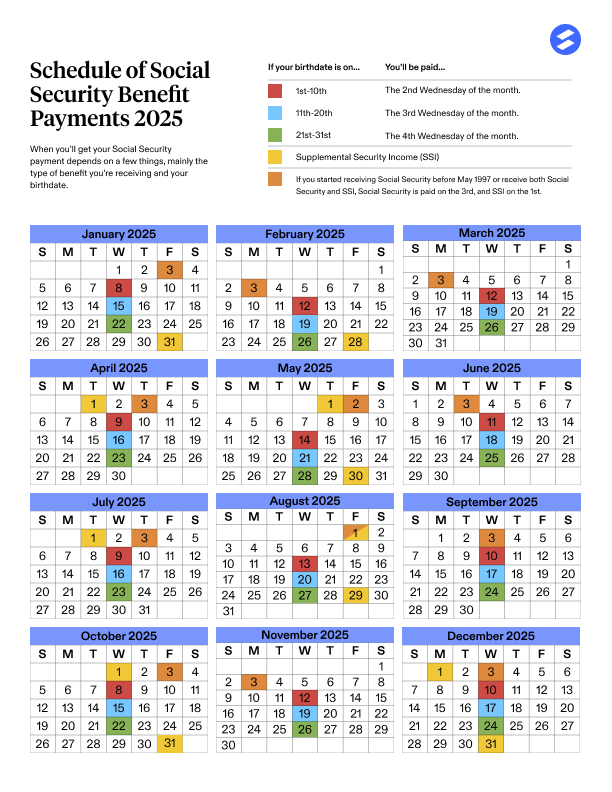

| July 2025 Payment Dates | SSI: July 1; SS: July 3, 9, 16, 23 | Know when your money hits |

| SSA Overpayment Total | $23 billion (FY 2023) | Driving the push to recover funds faster |

| Relief Options | Waiver, appeal, lower rate, payment plan | You don’t have to accept the full 50% cut |

| Official Resource | SSA Payment Calendar | Verify your specific deposit date |

Why July 2025 SSI Payment and Social Security Payments May Shrink

Understanding Overpayments

An overpayment happens when SSA pays you more than you were eligible to receive. Common causes include:

- Failing to report income changes or working while on SSDI/SSI

- Living arrangement changes

- Receiving workers’ compensation or VA benefits

- Clerical or systems errors within SSA

Even if it’s SSA’s mistake, they’re still legally obligated to recover the funds.

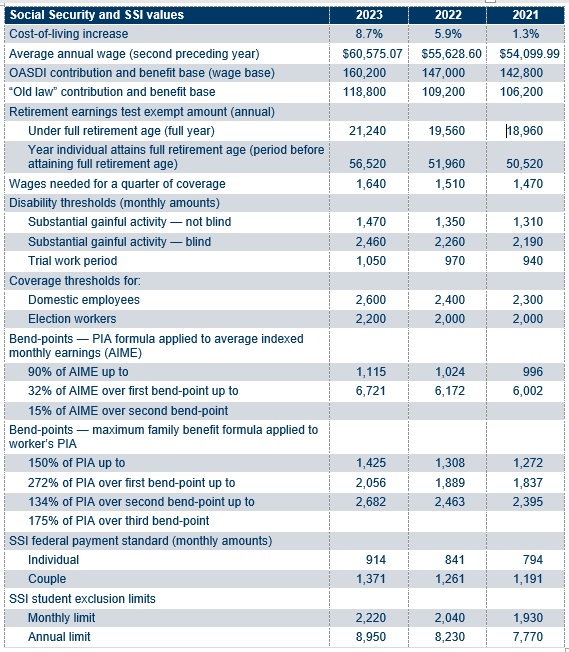

Why Is SSA Enforcing the 50% Rule Now?

In recent years, the SSA has come under scrutiny for failing to adequately manage overpayments. In FY 2023, the agency reported over $23 billion in outstanding overpayment debt. In response to pressure from Congress and federal auditors, SSA increased the recovery rate to show fiscal responsibility.

In April 2024, the agency temporarily lowered the standard recovery rate to 10% following public backlash. But by April 25, 2025, the SSA reversed course. Anyone receiving an overpayment notice dated on or after that date is now subject to a default 50% withholding—unless they appeal or request a reduction.

July 2025 Payment Schedule

Here’s when you can expect your money to arrive:

| Benefit Type | Payment Date | Who Receives It |

|---|---|---|

| SSI | Tuesday, July 1, 2025 | All SSI recipients |

| Social Security (Before May 1997) | Thursday, July 3, 2025 | Long-term beneficiaries |

| Birthdays 1–10 | Wednesday, July 9, 2025 | Recent claimants born early in the month |

| Birthdays 11–20 | Wednesday, July 16, 2025 | Mid-month birthdays |

| Birthdays 21–31 | Wednesday, July 23, 2025 | Late-month birthdays |

If your payment isn’t in your account by the fourth business day after your scheduled date, you should contact SSA at 1-800-772-1213 or visit your local office.

How to Know If You’re Affected by the Withholding?

You might be affected if:

- You received a Notice of Overpayment dated April 25, 2025, or later

- You are receiving benefits under Title II (Social Security/SSDI) or SSI

- The notice includes a section outlining “Monthly Recovery” or “New Withholding Rate”

- You haven’t taken any action to appeal or request a lower rate

Dual beneficiaries (receiving both SSI and Social Security) will only have the Social Security portion reduced. SSI withholdings are still capped at 10%.

Real-World Impact: How 50% Withholding Looks in Action

Let’s say Linda, 72, receives $1,400/month in Social Security retirement benefits. Due to a miscalculation of her pension offset, SSA says she owes $4,200.

Under the old 10% recovery rule:

- SSA would withhold $140 per month

- She’d repay the debt in 30 months

Under the new 50% rule:

- SSA withholds $700 per month

- She repays in just 6 months

- But now Linda has to survive on $700 per month—which won’t cover rent, medication, and utilities

Many low-income recipients simply can’t afford that kind of hit to their income. That’s why relief options are so important.

What You Can Do to Avoid or Reduce the July 2025 SSI Payments Withholding

1. Request a Waiver

If the overpayment wasn’t your fault and you can’t afford repayment, you can apply for a waiver using Form SSA-632-BK.

There is no deadline to request a waiver—but SSA must stop collections while your request is under review.

2. Appeal the Overpayment

If you believe SSA is wrong about the overpayment, file an appeal within 60 days of receiving the notice using Form SSA-561-U2. SSA cannot enforce recovery while the appeal is pending.

3. Request a Lower Withholding Rate

If 50% is too much, request a reduction in monthly withholding. Be prepared to show:

- Rent or mortgage bills

- Utility bills

- Medical or prescription costs

- Food and transportation expenses

SSA may lower the rate to as little as 5%, depending on your situation.

4. Offer a Repayment Plan

Instead of automatic withholdings, you can propose to pay back the debt in installments. SSA often agrees to 12-, 24-, or 36-month plans based on your income.

Support Resources and Legal Help

Navigating SSA’s paperwork and rules can be overwhelming. Thankfully, help is available.

- Legal Aid: Use LSC.gov’s legal aid directory to find a free or low-cost legal expert near you.

- National Council on Aging (NCOA): Offers personalized assistance and benefit checkups for older adults.

- Center for Medicare Advocacy: Helps those whose SSI/SSDI benefits impact their healthcare eligibility.

If English is not your first language or you have a disability, ask SSA for an interpreter or accommodation during appeals or field office visits.

What If You’re a Caregiver or Adult Child?

If you’re managing a loved one’s finances, be proactive:

- Help them sign up for a My Social Security account

- Review their payment notices monthly

- Assist with waiver or appeal forms if needed

- Contact the SSA Representative Payee Program if your role is official

Unpaid caregivers should also explore if the individual qualifies for state supplemental payments or SNAP benefits due to reduced income.

How This Affects Other Federal Benefits?

A sudden drop in Social Security income may increase eligibility for other programs like:

- Supplemental Nutrition Assistance Program (SNAP)

- Medicaid

- Low-Income Home Energy Assistance Program (LIHEAP)

- Section 8 or HUD housing subsidies

You should report your reduced income to your state or county caseworker to recalculate your eligibility.

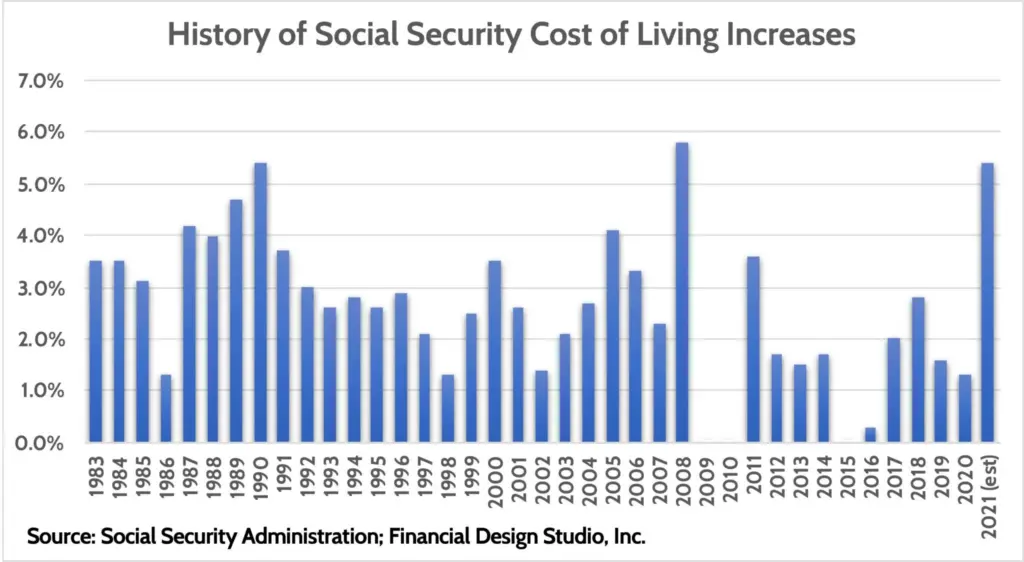

Policy Perspective and Long-Term Implications

SSA is under pressure to recover overpayments efficiently, especially with insolvency concerns looming over the Social Security Trust Fund. While the 50% withholding helps SSA meet federal budget expectations, it also raises ethical concerns—particularly when vulnerable Americans bear the brunt.

Advocacy groups are urging Congress to pass legislation that:

- Caps recoveries at 10% for low-income households

- Allows retroactive waivers for people unaware of past errors

- Enhances staffing and training to prevent future overpayments

Until that happens, individuals must rely on existing tools like waivers, appeals, and legal aid.