July 17 Could Bring Full Social Security Payments: If you were born between the 11th and 20th of the month, get ready for a key date—July 17, 2025. This is the day that the Social Security Administration (SSA) is set to issue your regular payment. Whether you’re eagerly awaiting your check or just keeping track of when your benefits will arrive, it’s important to know exactly how the process works and what to expect. In this guide, we’ll break down everything you need to know about Social Security payments, including the exact dates for your payment, how the SSA determines these dates, and some helpful tips for making sure you get your money on time. We’ll also dive into some key questions surrounding Social Security, so whether you’re a retiree, a professional working with Social Security clients, or simply someone looking for clarity, you’ll find valuable insights here.

July 17 Could Bring Full Social Security Payments v

Understanding when and how you’ll receive your Social Security payments is crucial for managing your finances effectively. Whether you’re a retiree, someone receiving disability benefits, or a professional managing Social Security for clients, knowing your payment schedule can save you time, stress, and confusion. For those born between the 11th and 20th of the month, keep an eye on July 17, 2025, as your official Social Security payment date. Stay on top of your schedule, update your contact information when necessary, and remember to plan ahead. By doing so, you can ensure that you’re always prepared when your payment arrives.

| Key Information | Details |

|---|---|

| Payment Date for Those Born 11th-20th | July 17, 2025 |

| SSA Payment Schedule Overview | Benefits are issued on Wednesdays based on your birth date range |

| Benefits of Timely Payments | Avoid delays by knowing your payment date |

| SSA Official Website | Visit SSA’s official website |

| Payment Delay Tips | Wait 3 business days before contacting SSA in case of a delay |

| Social Security and Inflation | Social Security payments often adjust based on the cost of living |

| Social Security for Disabled Individuals | Disability benefits follow the same schedule as retirement benefits |

Understanding Social Security Payment Dates

Social Security benefits are a lifeline for millions of Americans, providing essential income for retirees, the disabled, and families of workers who have passed away. But if you’re like many people, understanding exactly when you’ll get your benefits can sometimes be confusing. So let’s clear that up.

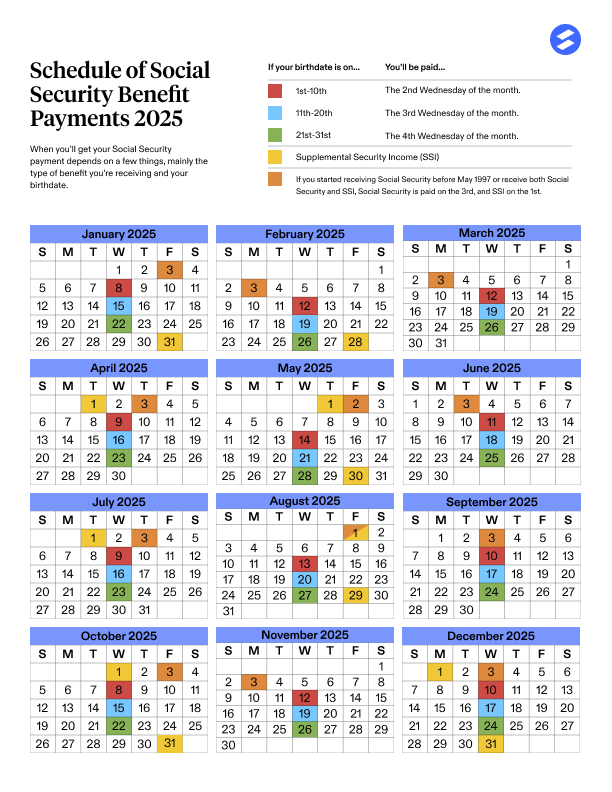

Social Security Payment Schedule

The SSA issues payments according to a strict schedule based on your birthdate. If you were born between the 11th and 20th of the month, your payment will be issued on the third Wednesday of each month. This means, for July 2025, you can expect your payment to land on July 17.

Payment Ranges

Here’s a quick breakdown of the SSA’s monthly payment schedule for 2025, based on birthdates:

- Born 1st-10th: Payments are made on the second Wednesday of the month.

- Born 11th-20th: Payments are made on the third Wednesday.

- Born 21st-31st: Payments are made on the fourth Wednesday.

If your payment falls on a holiday or weekend, you’ll usually receive it on the preceding business day. For example, if a holiday like Labor Day falls on the second Monday of the month, you may see your payment arrive earlier, on the preceding Friday.

Why is Social Security Payment Scheduling Important?

Social Security payments are essential for millions of American families. In fact, about 65 million Americans receive monthly Social Security benefits. These include not only retirees, but also individuals receiving disability benefits, survivor benefits, and more. The money from Social Security can mean the difference between a comfortable living and financial hardship, especially for retirees or those who are disabled.

By sticking to a consistent schedule, the SSA ensures that benefits are distributed fairly and predictably, making it easier for recipients to plan their finances. Knowing when your payment is coming helps you budget for your expenses, avoid surprises, and plan your spending wisely.

Common Myths About Social Security Payments

Despite the SSA’s clear scheduling system, there are still a few misconceptions about when Social Security payments arrive. Let’s address some of these myths:

- Myth: Social Security payments are always made at the beginning of the month.

Fact: Payments are made on specific Wednesdays based on your birthdate. For those born between the 11th and 20th, the third Wednesday is your payment date. - Myth: You will always get your check on the exact date.

Fact: If your payment day falls on a weekend or holiday, expect the payment to arrive the previous business day. - Myth: I can’t change my payment schedule.

Fact: You may be able to change how and when you receive your payment, including opting for direct deposit or setting up a specific payment schedule through your my Social Security account.

Social Security and Inflation Adjustments

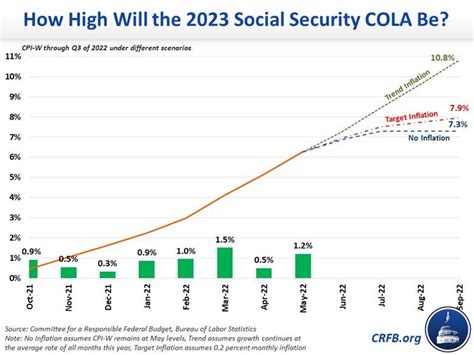

Cost-of-Living Adjustments (COLA) are another important aspect of Social Security. Each year, the SSA may make changes to the amount of your Social Security payment to account for inflation. These adjustments are designed to ensure that the purchasing power of your benefits doesn’t decrease due to rising prices.

In 2025, Social Security recipients will see a COLA increase of 3.2%, which means that most beneficiaries will receive a higher payment than the previous year. While the COLA increase helps offset inflation, it’s still important for beneficiaries to plan their spending carefully, especially when the economy experiences higher inflation rates.

Social Security for Disabled Individuals

If you’re receiving Social Security Disability Insurance (SSDI), your payment schedule is the same as for retirees. If you were born between the 11th and 20th, your payment will come on the third Wednesday of the month, just like other Social Security beneficiaries.

However, there are some important distinctions between SSDI and retirement benefits. For example, SSDI recipients are typically younger, and many may also have additional health concerns or caregiving needs. For these individuals, timely payments are essential, and they can benefit from understanding the special rules that apply to their payments.

How to Maximize Your July 17 Could Bring Full Social Security Payments?

Here are some strategies for maximizing your Social Security benefits:

- Delay Benefits Until Full Retirement Age (FRA)

Your FRA is between ages 66 and 67, depending on the year you were born. Waiting to claim your benefits until you reach this age can increase your monthly payment. If you can delay your benefits even further, up to age 70, your payment amount will increase even more. - Work Longer for Higher Benefits

Your Social Security benefits are based on your highest-earning 35 years. If you have fewer than 35 years of work history, the SSA will factor in zero earnings for those years. Working longer or increasing your earnings can help boost your Social Security payout. - Consider Spousal Benefits

If you are married, you may be eligible for spousal benefits, which can be up to 50% of your spouse’s benefit. This can be especially helpful if one spouse has a lower lifetime earning history. - Claim Benefits Strategically

If you’re married or divorced, you may have options to claim survivor benefits or ex-spouse benefits, depending on your situation. Consulting with a financial advisor who specializes in Social Security can help you navigate these options.

Other Resources for Social Security Recipients

If you receive Social Security benefits, it’s important to know what additional resources are available to you:

- Medicare: Most Social Security recipients are eligible for Medicare, the federal health insurance program. Check the SSA’s website for enrollment information.

- Supplemental Nutrition Assistance Program (SNAP): If you are struggling with food costs, you may qualify for food assistance programs.

- Low-Income Energy Assistance: Some recipients may be eligible for assistance with energy bills.

Why Some Social Security Recipients Might See Their Payments Slashed by 50%

Senior Couples Set to Get $3,089 Social Security Payment in July- Check Eligibility Criteria!