Inside Trump’s ‘Big Beautiful Bill’: In the summer of 2025, former President Donald Trump signed into law a massive tax and budget reform package known as the One Big Beautiful Bill (OBBBA). Nicknamed for its lofty goals and campaign-era flair, the bill touched nearly every corner of the U.S. tax code, from corporate tax structures to social welfare budgets. But the piece that hit home for millions of older Americans? Changes to how Social Security benefits are taxed.

Although Trump publicly claimed this bill would “eliminate taxes on Social Security,” that’s not entirely accurate. Instead, the law introduces a new senior tax deduction aimed at reducing—or even eliminating—federal income tax on Social Security benefits for many retirees. So, what does this mean for you, your family, or the future of the Social Security system? Let’s unpack it, step-by-step.

Inside Trump’s ‘Big Beautiful Bill’

The One Big Beautiful Bill offers meaningful, but limited, tax relief to seniors. It may save hundreds—sometimes thousands—of dollars for qualifying retirees, especially those with modest retirement incomes. But it is not a full repeal of Social Security taxes, and it leaves out both the poorest and the wealthiest retirees. Whether it remains after 2028 depends on politics and public pressure. For now, take advantage of it if you qualify, and keep your eye on how future reforms may reshape retirement taxes even further.

| Feature | Details |

|---|---|

| Bill Name | One Big Beautiful Bill Act (OBBBA), signed July 4, 2025 |

| Primary Change | $6,000 deduction for individuals age 65+, $12,000 for married couples |

| Social Security Tax Repeal? | No full repeal—relief is through deductions only |

| Who Benefits Most? | Individuals earning under $75,000 or couples earning under $150,000 |

| Expiration | Temporary: covers tax years 2025 through 2028 |

| Est. Impact | 88% of retirees will pay no federal income tax on SS benefits |

| Cost to Federal Deficit | Estimated $2.8–3.4 trillion over 10 years |

| Official Source | Social Security Administration |

A Quick Recap: Why Are Social Security Benefits Taxed at All?

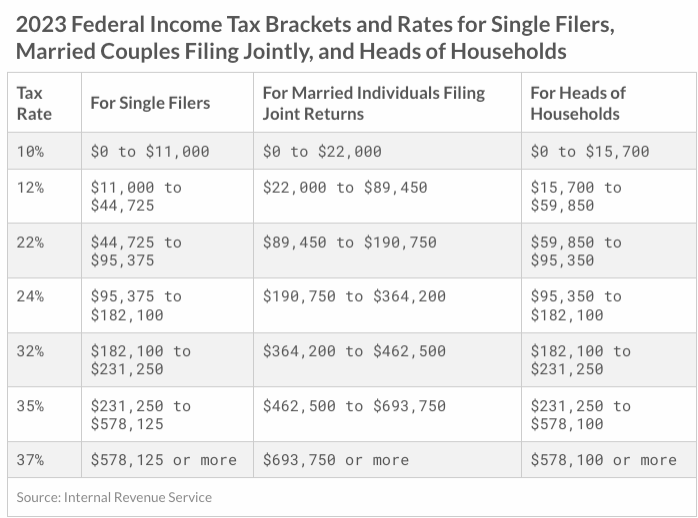

Let’s back up a bit. Social Security benefits became taxable in the 1980s under a bipartisan reform effort to stabilize the trust fund. Before that, they were entirely tax-free. Under existing law, beneficiaries could be taxed on up to 85% of their benefits, depending on their combined income and filing status.

Here’s how it worked before OBBBA:

- Individuals earning over $25,000 (or couples over $32,000) began paying tax on a portion of their Social Security.

- Up to 85% of those benefits could be included in your taxable income.

Fast forward to 2025, and that system had never been inflation-adjusted, meaning more and more seniors ended up taxed over time—an effect critics called a “stealth tax hike.”

The One Big Beautiful Bill attempts to roll back that effect—but only partially.

Breaking Down the Senior Deduction

Trump’s bill doesn’t actually change how Social Security itself is taxed. Instead, it gives qualifying seniors a standard deduction boost:

- $6,000 per person aged 65 or older

- $12,000 for married couples where both spouses are 65+

This deduction is added to the standard deduction that all filers receive, meaning seniors can shield more of their income from taxation—ultimately reducing or eliminating tax liability on Social Security benefits.

Who’s Eligible?

- Must be 65 or older by the end of the tax year

- Must have an Adjusted Gross Income (AGI) under:

- $75,000 for individuals

- $150,000 for married couples filing jointly

- The deduction phases out gradually for those with incomes above those levels, and is eliminated entirely beyond:

- $175,000 for individuals

- $250,000 for couples

Real-World Example: How Much Can You Save?

Let’s say Joe, age 70, receives $20,000 a year in Social Security and has a $30,000 pension.

- Total income: $50,000

- Standard deduction for a senior in 2025: $15,700

- New senior deduction: $6,000

- Total deductions: $21,700

- Taxable income: $28,300

In this scenario, none of Joe’s Social Security income would be taxed, and he’d see a tax savings of several hundred dollars compared to 2024.

Now consider Margaret and Frank, a married couple aged 68 and 69. Their combined income is $120,000 from a mix of retirement accounts and Social Security.

- They qualify for the $12,000 senior deduction

- Their Social Security benefits are only partially taxed due to their higher income

- They save roughly $800–$1,200 per year compared to previous law

What’s the Catch?

This sounds like a win for seniors—and in many cases, it is. But here are some important caveats:

It’s Temporary

The deduction applies only from 2025 through 2028. Unless extended, it disappears in 2029.

It Doesn’t Help Everyone

- Low-income seniors who already paid no tax on Social Security won’t see any benefit.

- High-income seniors don’t qualify due to income phase-outs.

- It doesn’t affect state taxes in most states—though some, like Colorado and Nebraska, follow federal rules closely.

It May Hurt the Social Security Trust Fund

Taxation of benefits brings in roughly $50 billion annually. Reducing that revenue, even indirectly, may accelerate the depletion of the trust fund, now projected to run dry in 2032 (one year earlier than prior estimates).

Why Inside Trump’s ‘Big Beautiful Bill’ Matters to Native and Rural Elders?

In rural communities and tribal lands, where incomes are often lower and cost of living is higher, even modest tax savings matter.

Take Darlene Two Elk, a 72-year-old Lakota elder living on a fixed income in South Dakota. “We don’t have luxury pensions,” she says. “So even if I only save $300 a year in taxes, that’s two months’ worth of groceries.”

Yet, many Native American elders already receive such low Social Security benefits that they’re not taxed anyway. For them, this deduction is symbolic more than practical.

How It Compares to Previous Tax Laws?

| Law | Key Social Security Impact |

|---|---|

| 1983 Reform (Reagan era) | Introduced taxes on benefits for high earners |

| 1993 Budget Act (Clinton era) | Increased taxable portion from 50% to 85% |

| 2017 Tax Cuts and Jobs Act | No change to SS taxes, but lowered overall tax brackets |

| 2025 One Big Beautiful Bill | Introduces new senior deduction, indirectly reducing SS taxation |

The OBBBA is the first major change in Social Security tax treatment in over 30 years—even though it doesn’t directly reform how the benefits themselves are calculated.

What Policy Experts Say

While the White House touts the law as a “historic win for America’s seniors,” many fiscal experts are cautious.

According to the Tax Policy Center, “The senior deduction is generous, but targeted primarily at middle-income seniors. It is not a structural fix.”

The Committee for a Responsible Federal Budget states:

“Tax relief must be paired with a sustainable funding plan for Social Security. Otherwise, this is just kicking the can down the road.”

What You Should Do Now?

- Verify Your Income

- Check your AGI on last year’s tax return.

- Remember: AGI includes retirement account withdrawals, investment income, and part-time work.

- Update Withholding or Estimated Payments

- If you’re no longer taxable, you might be overpaying.

- Submit a new W-4P or adjust quarterly payments.

- Use Tax Software

- Most modern tax programs will auto-calculate eligibility for the senior deduction.

- Make sure your software is up-to-date for 2025.

- Consult a Professional

- Especially if you’re near the income limit.

- A CPA can advise on ways to stay under the cutoff by managing withdrawals or using Roth IRAs.

Millions of Americans Could See Their Social Security Checks Cut by 50 Percent

$2,000 Social Security Payments Arriving in 4 Days—Check If You Qualify Now

Trump’s New Tax Bill Could Reshape How Social Security Benefits Are Taxed