In These Areas, Life Expectancy Barely Beats the State Pension Age: Let’s get real for a second: If you’re living in certain parts of the U.S. or U.K., you might not live much longer than it takes to collect your first pension check. Sounds harsh, right? But it’s true—and it’s happening right now. The topic of “life expectancy barely beating the state pension age” isn’t just for policy nerds or academics. It affects millions of everyday working folks—especially in poorer neighborhoods where access to healthcare, nutritious food, and safe housing is limited. Whether you’re hustling in rural Alabama or clocking long hours in East Glasgow, your zip code might just decide how long you live—and whether you’ll enjoy any of your retirement years.

In These Areas, Life Expectancy Barely Beats the State Pension Age

In many communities across the U.K. and U.S., life expectancy barely exceeds the age when you’re eligible to retire. That’s not just a statistical quirk—it’s a crisis. People are working their whole lives, only to die before they can enjoy the fruits of their labor. We need to stop treating retirement like a one-size-fits-all number. Whether through flexible retirement ages, better healthcare access, or proactive lifestyle changes, there are ways forward. But it starts with awareness—and action. Don’t wait for a policy change. Start planning. Take care of your health. And raise your voice for those whose time is running out too soon.

| Topic | Details |

|---|---|

| State Pension Age (U.K.) | 66 (rising to 67 by 2028, 68 by 2046) |

| Average Life Expectancy (UK) | 79.3 for men, 83.1 for women |

| Life Expectancy (USA) | 76.4 years |

| Worst-hit Regions (UK) | Glasgow, Blackpool, Liverpool, parts of Wales, Birmingham |

| Healthy Life Expectancy Range | As low as 52 in some UK areas |

| Social Security Full Retirement Age (U.S.) | 66–67 depending on birth year |

| Official Website | UK State Pension |

The Reality Check: Life Expectancy vs. Pension Age

Let’s break it down. The state pension age in the U.K. is currently 66, with plans to raise it to 67 by 2028 and 68 by 2046. That’s all good—if you live long enough to enjoy it.

But here’s the thing: In places like Glasgow’s East End, Blackpool, or some boroughs in Liverpool, the average male life expectancy is just 65. That means some people won’t even live to collect a single pension check.

In the U.S., the situation isn’t much different. The national average life expectancy is 76.4 years, but in some southern states like Mississippi, West Virginia, and Louisiana, it dips as low as 71 years. For Black and Native American men, the numbers can fall even lower.

All of this raises a simple but chilling question: What’s the point of a pension if people don’t live long enough to use it?

What’s Behind the Numbers?

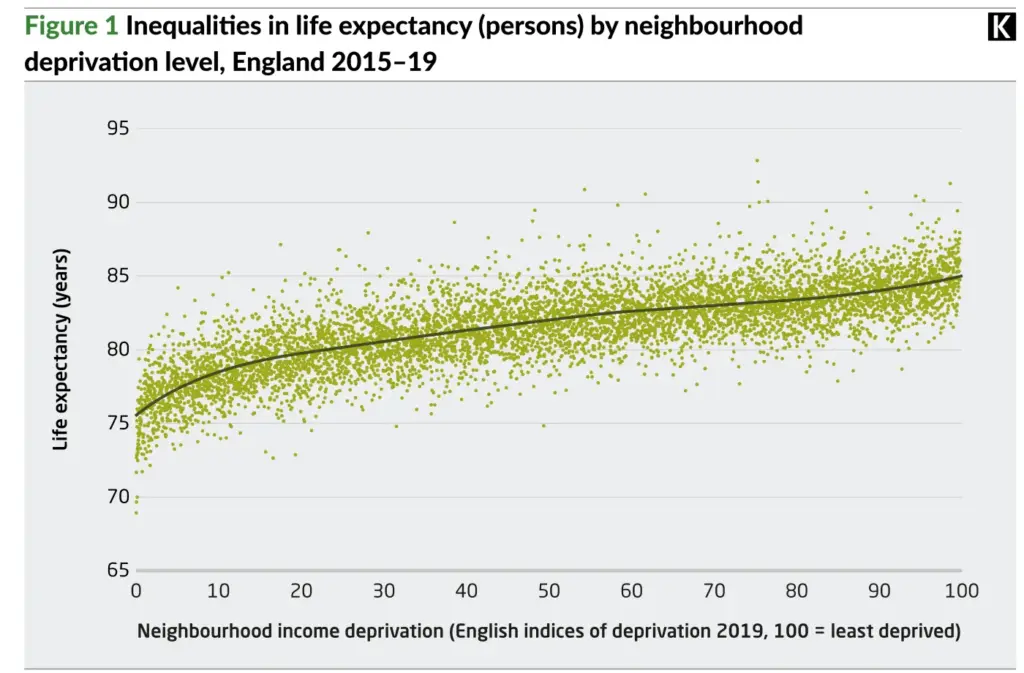

1. Deprivation and Inequality

The number one factor? Poverty. There’s a well-documented correlation between socioeconomic status and lifespan. Poorer communities are more likely to experience:

- Substandard housing

- Lower educational attainment

- Poor access to healthcare

- Dangerous or physically demanding jobs

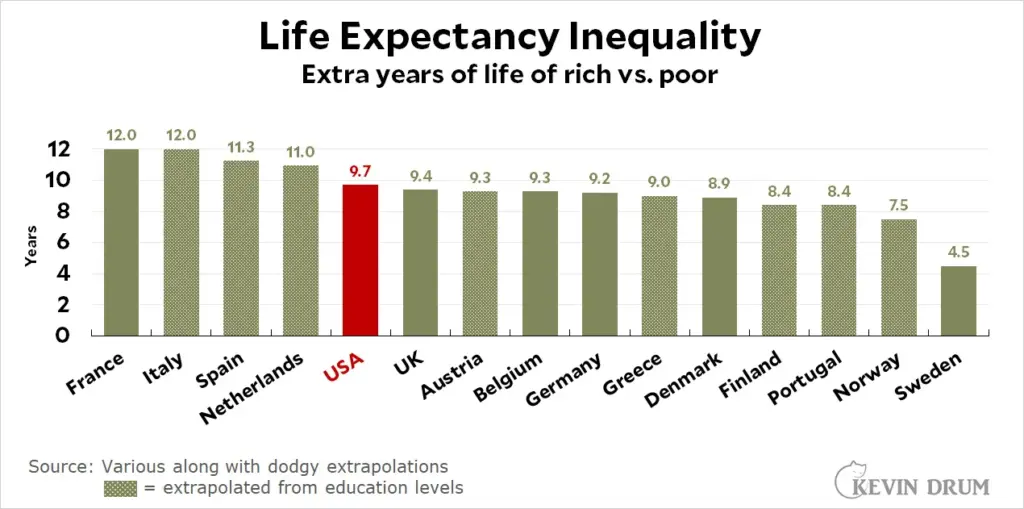

In the U.K., the Health Foundation reports a 10-year life expectancy gap between the most and least deprived regions. Similar gaps exist in the U.S., often along racial and regional lines.

2. Chronic Illnesses

People in these regions often suffer from multiple long-term health conditions, including diabetes, high blood pressure, obesity, and respiratory disease. A report from Public Health England found that people in deprived areas are more likely to have 3 or more chronic conditions by the age of 50, effectively making retirement age a medical finish line rather than a new beginning.

3. Healthcare Access

In both countries, poorer communities often lack access to primary care physicians and preventive services. In the U.S., lack of insurance plays a major role. In the U.K., where the NHS provides universal care, waiting times, clinic closures, and overstretched services still hit poorer communities the hardest.

4. Dangerous Occupations

Working-class folks are more likely to take physically demanding jobs—construction, manufacturing, delivery, and service industry roles. These jobs don’t just take a physical toll; they also come with increased injury risk and long-term wear on the body. By the time they reach retirement age, many of these workers are already dealing with disabilities.

5. Racism and Structural Barriers

In the U.S., racial inequality deeply impacts life expectancy. A CDC study found that Black Americans live four years less on average than white Americans, and Native Americans face even more dramatic gaps. These are not genetic differences—they’re the result of systemic inequities in housing, education, healthcare, and employment.

Healthy Life Expectancy: A Critical Metric

It’s not just about living longer—it’s about living well.

In many disadvantaged regions, the average healthy life expectancy—the years someone can expect to live without a disabling health condition—is as low as 52. So even if you live to 76 or 80, chances are you’ll spend your last couple decades battling illness, disability, or financial hardship.

This means people aren’t just dying young—they’re getting sick younger too. That’s the real tragedy.

What Can You Do About Life Expectancy Barely Beats the State Pension Age?

Let’s move from doom and gloom to action. Whether you’re 25 or 55, you can take steps to protect yourself—and advocate for change.

1. Know Your Stats

Use official tools to calculate your estimated life expectancy:

- U.S. Social Security Life Expectancy Calculator

- UK ONS Life Expectancy Data

These tools provide a starting point for understanding your long-term financial and health planning needs.

2. Start Retirement Planning Early

Open a Roth IRA, 401(k), or workplace pension and start contributing as soon as possible—even if it’s just a little each month. The earlier you start, the more you’ll benefit from compound interest.

Many people in low-income communities avoid pensions because they “don’t expect to live that long.” But early investment can be the game-changer that makes retirement possible—even if it’s short.

3. Prioritize Preventive Healthcare

If you can, schedule annual physicals, blood tests, and screenings. Many chronic illnesses are preventable—or manageable—if caught early.

Even simple habits like:

- Walking 30 minutes a day

- Reducing sugar and processed foods

- Getting 7+ hours of sleep

- Limiting alcohol and tobacco

…can significantly increase both life expectancy and quality of life.

4. Advocate for Policy Change

Support policies that:

- Fund local healthcare clinics

- Address food deserts

- Improve housing conditions

- Allow flexible pension ages based on occupation and health

Germany and Norway offer early retirement options for people in physically demanding jobs or with poor health. There’s no reason the U.S. and U.K. can’t adopt similar policies.

5. Use Technology to Stay on Track

Mobile apps like MyFitnessPal, Apple Health, Fitbit, or the NHS app can help you monitor your health. You can track calories, step count, sleep patterns, and even manage prescriptions or appointments.

Real-Life Example: Glasgow vs. Surrey

Let’s compare two real areas in the U.K.

- Glasgow (East End): Male life expectancy is around 65 years, with healthy life expectancy at 54. Many never reach state pension age or enjoy it for long.

- Surrey (Affluent area): Life expectancy is 85, with healthy years lasting well into the mid-70s.

Same country, wildly different outcomes. One gets 20 years of retirement. The other gets a few—if any.

The Professional Angle: Why This Matters at Work

If you work in healthcare, policy, or finance, this isn’t just a social issue—it’s a professional one.

For employers:

- Offer wellness programs

- Create flexible retirement options

- Support mental health access

For advisors:

- Educate clients early

- Include healthcare planning in retirement strategies

- Factor regional risks into planning tools

For policymakers:

- Push for region-specific pension adjustments

- Expand early retirement pathways

- Address healthcare and housing inequity

Integrated Pension Rules May Reduce State Pension for Some, Confirms DWP

State Pension Payment Increase for Those Receiving Disability Benefits- Check Details!

UK Set to Raise State Pension Age Beyond 67 as Life Expectancy Grows