How to Stop Overspending: Overspending can sneak up on anyone — whether you’re a fresh college grad, a stay-at-home parent, or the CFO of a growing startup. The good news? You don’t need to be a finance whiz to get back on track. How to stop overspending is one of the most common financial questions Americans ask today, and the answer starts with a smart, doable strategy.

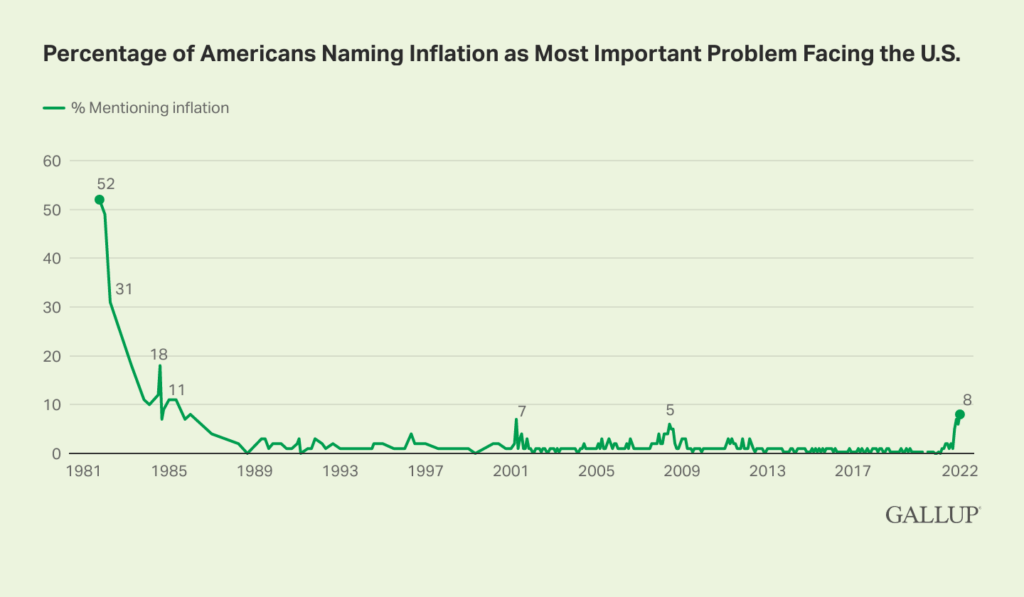

In today’s high-cost environment, managing money has never been more important. According to a 2024 Gallup poll, 61% of U.S. adults say that inflation is causing them significant financial stress. Combine that with the rise of digital wallets, one-click buying, and social media pressure, and it’s no surprise that overspending has become a national habit. But don’t sweat it — we’ve got you covered. This guide, built with input from ChatGPT and backed by reliable data and expert strategies, will walk you through seven practical, effective tips to stop overspending and take control of your money — for good.

How to Stop Overspending?

Overspending doesn’t mean you’re bad with money — it just means you’re human. But with the right tools, a few smart systems, and a bit of awareness, you can stop overspending and build a better financial future. Start small. Track your expenses. Cut one spending trigger this week. Create a goal that excites you. These changes will compound into real, lasting results. Remember, budgeting isn’t about saying “no” — it’s about saying “yes” to what truly matters.

| Key Insight | Description |

|---|---|

| Main Issue | Emotional and impulsive spending, poor budgeting, and easy online shopping platforms |

| Solution | Budgeting, automation, setting financial goals, and removing shopping triggers |

| Top Tip | Use cash for problem categories and apply a 24-hour rule before buying |

| Stat | 61% of Americans feel financial hardship from rising prices |

| Who It’s For | Families, students, young professionals, and anyone wanting to manage money better |

| Official Help | Visit consumer.gov for budgeting resources and tips |

Why Do We Overspend in the First Place?

Let’s be real: most of us don’t set out to blow our budgets. Overspending often happens because of our environment, habits, and emotions. According to a study from the American Psychological Association, money is the number one source of stress for Americans. And when we’re stressed, we often self-soothe by spending.

Retailers know this. That’s why they use psychological triggers — like flash sales, urgency tactics, and free shipping thresholds — to push us into buying more. Add in easy mobile payments, saved card info, and Buy Now, Pay Later options, and you’ve got the perfect storm for overspending.

We also live in a “compare and spend” culture. Social media glamorizes a lifestyle that most people can’t afford. And let’s not forget the good ol’ “I work hard, I deserve this” mindset — which, while emotionally valid, can wreck your financial goals.

The Hidden Costs of Overspending

Overspending isn’t just about a few extra bucks here and there. It can have long-term consequences that can hurt your finances and quality of life. Here’s what overspending can cost you:

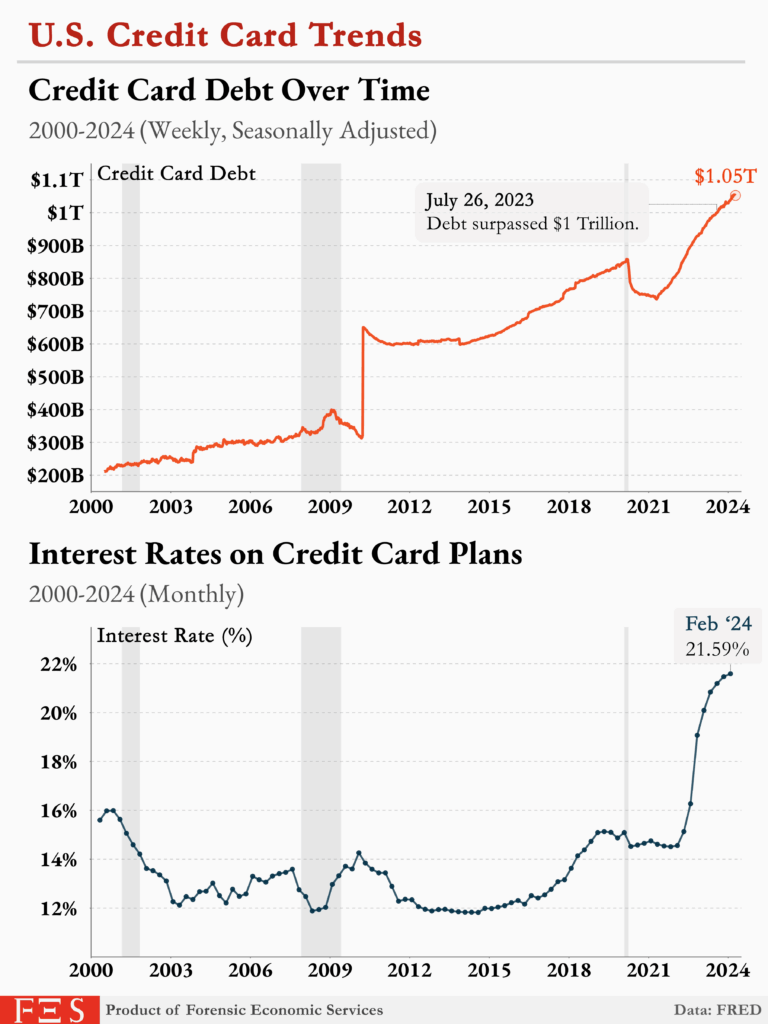

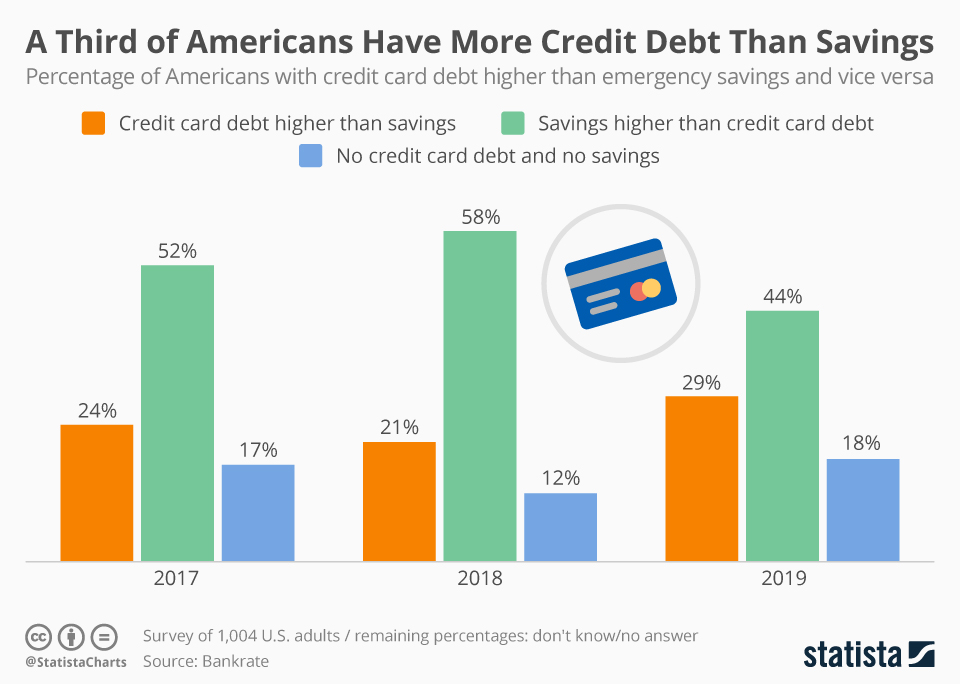

- High-interest debt: The average credit card APR in 2024 is over 20.6%. That means a $1,000 balance could cost you hundreds in interest annually.

- Lower credit score: Maxing out credit cards can drive down your score, making loans and mortgages more expensive or even inaccessible.

- Mental and emotional strain: Constant money anxiety leads to tension, poor sleep, and stress-related health issues.

- Relationship problems: According to CNBC, financial stress is one of the top causes of divorce in the U.S.

- Missed goals: Whether it’s buying a home, starting a business, or retiring early — overspending eats into your dreams.

7 ChatGPT-Approved Tips On How to Stop Overspending

1. Track Every Dollar

The first step to controlling your spending is knowing exactly where your money goes. Use an app like Mint, YNAB, or a good ol’ spreadsheet. Start by tracking for 30 days. Write down every expense — even that $3 coffee or $2 app purchase.

Break down your spending into categories:

- Needs (rent, bills, groceries)

- Wants (entertainment, dining out, clothes)

- Impulse (unplanned purchases)

Once you see where your money is leaking, you can plug the holes.

2. Set Limits for “Fun” Spending

Let’s be clear — budgeting doesn’t mean you can’t enjoy life. It just means you’re being intentional. Set a “fun budget” that allows you to spend without guilt — but within limits.

Use the 50/30/20 rule:

- 50% of income goes to essentials

- 30% to lifestyle

- 20% to savings or debt payoff

If you bring home $3,500 a month, your “fun” budget is around $1,050. That’s still plenty for hobbies, food, and the occasional splurge — without breaking the bank.

3. Apply the 24-Hour Rule

Impulse purchases are your budget’s worst enemy. Here’s a fix: if it’s not something you planned, wait 24 hours before buying. Chances are, you won’t even want it the next day.

This simple rule works for everything — online orders, tech gadgets, clothes, and random kitchen tools you saw on TikTok.

4. Automate Savings and Bills

Set it and forget it. One of the smartest moves you can make is to automate transfers to your savings and bill payments right after payday.

Example: If you get paid on the 1st and 15th, schedule $200 to go to savings, $100 to a debt account, and your bills on autopay. This way, you’re not tempted to spend what should be saved.

Banks like Chime, Ally, and Capital One 360 make automation easy.

5. Remove Digital Spending Triggers

Online shopping is dangerously easy. Take back control by reducing the temptations.

- Unsubscribe from promo emails using tools like Unroll.me

- Delete saved card info from shopping websites

- Remove shopping apps from your phone

- Unfollow influencers who promote excessive consumerism

Even small changes like using incognito mode while browsing can reduce your chances of impulse buying.

6. Use Cash for Problem Categories

Using physical cash creates a “pain of paying” that digital payments don’t. For high-risk categories like food, coffee, or clothes, withdraw a fixed amount at the beginning of the week.

When the cash is gone, that’s it. No more spending until next week. It’s old-school — and it works.

Tip: Use envelopes labeled by category to stay organized.

7. Set a Clear Financial Goal

You’re more likely to stick to your budget when you know what you’re working toward. Make your goal specific, measurable, and time-bound.

Instead of “I want to save money,” try:

- “I want to save $3,000 in the next 6 months for an emergency fund.”

- “I want to pay off $5,000 of credit card debt by the end of this year.”

Create visual reminders — like a progress bar or a savings tracker on your fridge — to keep you motivated.

Bonus Tips That Go the Extra Mile

Review Your Bank Statements Weekly

Set aside 15 minutes each week to go over your account activity. Spotting subscriptions, hidden fees, or fraudulent charges early can save you money and headaches.

Try a No-Spend Challenge

Commit to spending zero on non-essentials for a set period — a weekend, a week, or even a month. It’s like a financial cleanse that resets your habits.

Use the “Treat Yourself Tax”

Every time you make a discretionary purchase, match it with a small deposit into savings. Buy a $40 hoodie? Put $5 into your rainy-day fund. It builds discipline fast.

Tools That Help You Stop Overspending

| Tool | What It Does |

|---|---|

| Rocket Money | Cancels unused subscriptions and tracks bills |

| YNAB | Zero-based budgeting tool that assigns every dollar a job |

| PocketGuard | Shows how much is safe to spend after bills and savings |

| Honey/Capital One Shopping | Finds coupons and lower prices automatically |

| Qube Money | Digital cash envelope system with real-time controls |

US Online Spending Jumps by $24.1 Billion as Deep Discounts Drive Summer Sales

Revealed: The Top 20 U.S. Companies You’ll Want to Work for in 2025—Are You On the List?

Good News for Parents: Walmart’s Back-to-School Deals Start at Just $0.25—Full Backpacks Under $5!