How Much a Middle-Class Retiree Spends at 75: If you’ve ever asked yourself, “How much does a middle-class retiree spend at 75?”, you’re not alone—and you’re smart to ask. Many people spend their entire careers saving for retirement, but very few stop to consider how much they’ll actually need to spend after they retire, especially once they hit their mid-70s.

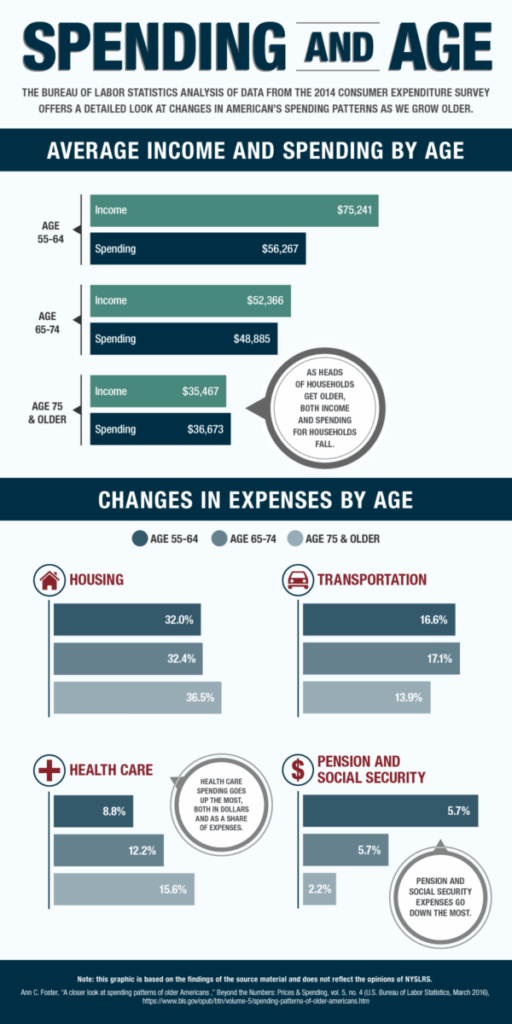

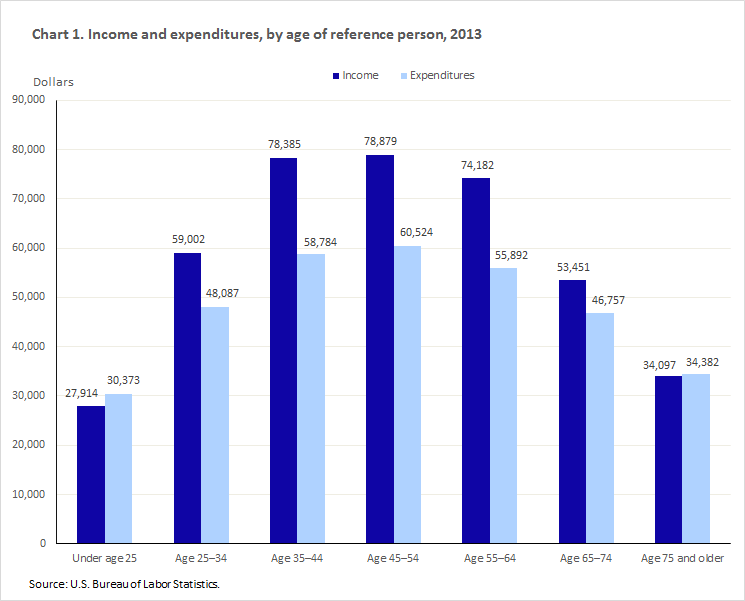

According to the U.S. Bureau of Labor Statistics (BLS), retirees aged 75 and older spend approximately $4,457 per month, or $53,481 annually. That number is lower than what retirees aged 65–74 typically spend, but it’s still significant—and it comes with its own set of challenges and considerations. Whether you’re planning your own retirement, helping a family member, or just trying to get ahead, this article walks you through the real costs, smart strategies, and common surprises that come with retirement spending at 75 and beyond.

How Much a Middle-Class Retiree Spends at 75

So, how much does a middle-class retiree spend at 75? On average, around $4,457 per month, or $53,481 annually, according to official government data. While this may sound manageable, the rising cost of healthcare, longer lifespans, and regional cost variations mean you must plan carefully and review your financial picture regularly.Your retirement years can be the most rewarding of your life—if your money is aligned with your values. Whether you’re in the slow-go or no-go years, a clear, realistic spending plan ensures you stay in control of your finances.

| Topic | Details |

|---|---|

| Monthly Spending at Age 75+ | $4,457 per month (BLS Consumer Expenditure Survey) |

| Annual Spending | Approx. $53,481/year |

| Spending vs. Ages 65–74 | Down from $5,066/month (approx. $60,800/year) |

| Biggest Expenses | Housing (36%), Healthcare (14.4%), Transportation (11.6%), Food (11.3%) |

| Safe Withdrawal Rate | 3.7% of retirement savings per year (Morningstar) |

| Income Sources | Social Security, pensions, 401(k)/IRA withdrawals, annuities |

| Regional Differences | High cost in CA/NY; lower in Midwest/South |

| Planning Tools | Fidelity Retirement Planner, AARP Calculator, BLS CES |

Why Retirement Spending at 75 Matters More Than You Think?

Let’s face it: Most people plan for retirement like it’s one big block of time. But retirement happens in stages. What you need at 65 is not the same as what you’ll need at 75. Your lifestyle changes, your priorities shift, and—perhaps most critically—your spending patterns evolve.

At 75, you’re no longer in the “go-go” years of early retirement. You’re entering what financial planners call the “slow-go” phase. This is when discretionary spending drops, but core expenses like healthcare and housing persist. For some, spending even increases due to rising medical needs or the cost of long-term care.

So, understanding the real-world numbers helps ensure your nest egg doesn’t crack under pressure.

Case Study: Meet the Johnsons

To make this more real, meet Tom and Linda Johnson, both 75, living in Omaha, Nebraska. They’ve owned their home for 30 years, live modestly, and draw from Social Security and a small IRA.

Here’s how their monthly budget breaks down:

| Category | Monthly Cost |

|---|---|

| Housing (property tax, insurance, upkeep) | $1,400 |

| Food & groceries | $500 |

| Healthcare (Medicare, supplements, prescriptions) | $850 |

| Utilities & Internet | $250 |

| Transportation (gas, insurance, maintenance) | $300 |

| Leisure & subscriptions | $200 |

| Miscellaneous (gifts, church, pet care) | $250 |

| Total | $3,750 – $4,500 |

Their expenses are lower than the national average, but they’re typical of many middle-class households, especially in affordable regions.

How Much a Middle-Class Retiree Spends at 75?

Let’s break down the top categories.

Housing – 36% of Total Spending

You might think once the mortgage is paid off, housing costs disappear. Not quite. Older adults still pay property taxes, home insurance, maintenance, and sometimes HOA fees or assisted living rent.

- Average housing costs: $1,610/month

- Seniors renting or living in senior communities can see higher costs

- Assisted living ranges from $3,500–$7,000/month depending on the state

Even aging in place brings expenses—leaky roofs, updated bathrooms, and heating bills all add up.

Healthcare – 14.4% of Total Spending

According to Fidelity Investments, a retired couple aged 65 may need more than $315,000 to cover healthcare expenses during retirement.

At 75, medical needs increase:

- Medicare Part B and D premiums

- Medigap or Advantage Plan premiums

- Co-pays and deductibles

- Vision, hearing, and dental (often not covered by Medicare)

- Prescription costs

On average, seniors 75+ spend $7,690 per year on healthcare—more than any other demographic.

Food – 11.3%

Even if you’re eating out less, food still accounts for a notable chunk of monthly expenses—especially with rising grocery prices.

- National average: $500/month

- Specialty diets, meal delivery services, or help with cooking can increase this

Transportation – 11.6%

Even without commuting, car expenses don’t vanish. Insurance, repairs, and gas still matter—plus rideshare or paratransit options for non-drivers.

- Annual average: $6,200

- Consider trading in vehicles for Uber/Lyft credits or senior transportation programs

Regional Variations: Where You Live Matters

Spending at 75 doesn’t look the same in every state.

| State | Est. Annual Retirement Cost |

|---|---|

| California | $65,000+ |

| Florida | $50,000 |

| New York | $60,000+ |

| Texas | $52,000 |

| Mississippi | $44,000 |

| Nebraska | $48,500 |

Housing and healthcare costs can drastically shift based on your ZIP code. If you’re flexible, moving to a low-cost-of-living state can stretch your savings significantly.

Retirement Income: How Middle-Class Retirees Fund These Expenses

Most retirees at 75 rely on a mix of:

- Social Security: The average monthly benefit is around $1,900 in 2024

- Pensions: Fewer people have them today, but some still receive fixed payments

- IRA/401(k) withdrawals: Many retirees follow the 3.7% rule

- Annuities or passive income

If your income doesn’t cover your expenses, you may need to tap into principal or consider downsizing.

The 3.7% Rule: Safe Withdrawal Strategy

Many financial planners now recommend withdrawing 3.7% of your retirement savings annually, rather than the traditional 4%, due to increased longevity and market volatility.

- $1 million portfolio = $37,000/year or $3,083/month

- Combine that with Social Security, and you may reach $5,000+/month in income

Keep in mind: Safe withdrawal rates are not guaranteed, especially during inflationary periods or market downturns.

Strategies to Cut Costs at 75

- Consider relocating to a state with no income tax or lower property taxes

- Review your Medicare plan annually during open enrollment to avoid unnecessary premiums

- Downsize your home or take in a tenant if you have extra space

- Apply for senior discounts: from groceries to public transit

- Avoid elder financial scams by limiting who has access to accounts and using monitoring tools like AARP Fraud Watch

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

Waze Co-Founder Shares Candid Retirement Advice After Years of Entrepreneurship

New Report Reveals Britons May Need £300k in Retirement Savings to Match State Pension