How the Changing U.S. Retirement Age Will Impact Millions of Americans: Retirement has long been a dream for many, with the age of 65 seen as the magic number for when you can finally hang up your work shoes, relax, and enjoy the fruits of your labor. However, changes to the retirement age are shaking up the world of Social Security, and millions of Americans are left wondering how it will affect their future plans. The full retirement age (FRA), which determines when Americans can start receiving full Social Security benefits, is rising, leaving many questioning how they’ll navigate these changes. In this article, we’ll break down the upcoming changes to the U.S. retirement age, what it means for you, and how to plan accordingly. Whether you’re getting ready for retirement or just starting to think about it, understanding the impact of these changes can help you make smarter decisions for your financial future.

How the Changing U.S. Retirement Age Will Impact Millions of Americans

The increasing retirement age is a significant change that will impact millions of Americans, both young and old. While it may help secure the financial stability of the Social Security system, it also poses challenges, especially for low-income individuals, those with physically demanding jobs, and certain demographic groups.

Key Takeaways:

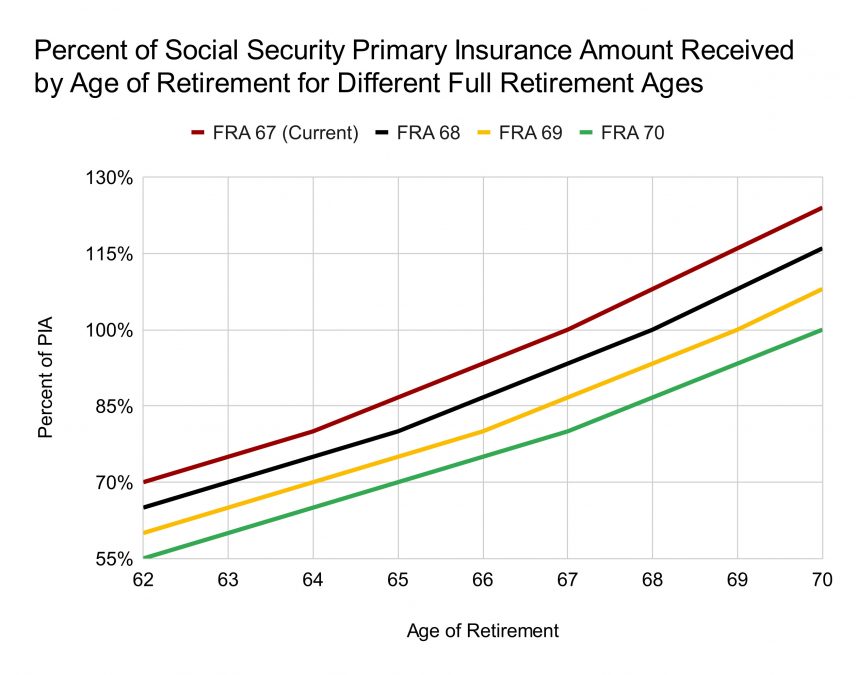

- The full retirement age is rising to 67 for those born in 1960 or later, and could reach 69 by 2033.

- Claiming Social Security before FRA means permanent reductions in benefits, while delaying until 70 offers an 8% increase each year.

- Planning for retirement is more important than ever. Start saving early, consider all your options, and speak with a financial planner to ensure you make the best choices for your situation.

By understanding the changes and planning ahead, you can still make the most of your retirement years. Don’t wait until it’s too late to prepare – start today!

| Topic | Key Insight | Statistics & Data |

|---|---|---|

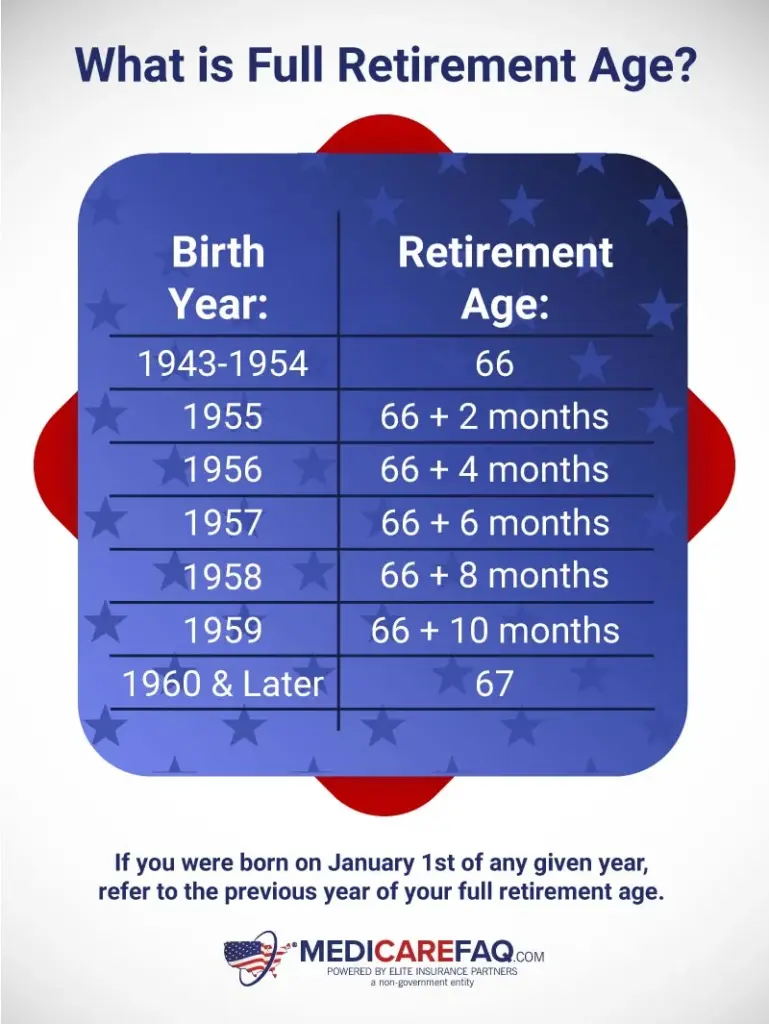

| Retirement Age Changes | The FRA is increasing, with full benefits now being available at 67 for people born in 1960 or later. | FRA increases gradually, with 69 under consideration by 2033. |

| Early Retirement Penalties | Claiming benefits before FRA leads to permanent reductions of up to 30% of monthly Social Security payments. | Early claims reduce benefits by 30%. |

| Delayed Retirement Credits | Delaying retirement until age 70 results in an 8% increase in monthly payments each year. | Benefits increase 8% per year for delaying until age 70. |

| Impact on Low-Income Workers | Lower-income individuals may face significant hardship as they rely heavily on Social Security for their retirement. | Impact is greater for those relying on Social Security. |

| Health & Employment Factors | Health issues or physically demanding jobs can make working past 65 challenging, especially for those in blue-collar jobs. | High-impact on workers in physically demanding roles. |

The Rise of the Retirement Age: A New Era

Social Security, the safety net that supports millions of retirees, is undergoing some major changes. Back in the 1980s, Congress raised the full retirement age from 65 to 66. Now, with life expectancy increasing and Social Security facing financial pressures, lawmakers are considering further increases. For those born in 1960 or later, the full retirement age has already risen to 67, and it could keep climbing. By 2033, the full retirement age could even be raised to 69.

Why is this happening?

The government’s decision to raise the FRA is partly due to the increasing life expectancy. The idea is that since people are living longer, they should work longer to fund their retirement benefits. This change also aims to ensure the long-term financial stability of the Social Security program. However, while it may make financial sense for the system, it poses significant challenges for workers, especially those in physically demanding jobs or those with limited financial resources.

What Does Changing U.S. Retirement Age Will Impact Millions of Americans Mean for You?

If you’re planning for retirement, this change can be a big deal. The decision to claim Social Security benefits at your FRA is critical because it affects how much you’ll receive each month. Let’s break down how this change will impact different groups of people:

1. Early Retirement: The Downsides

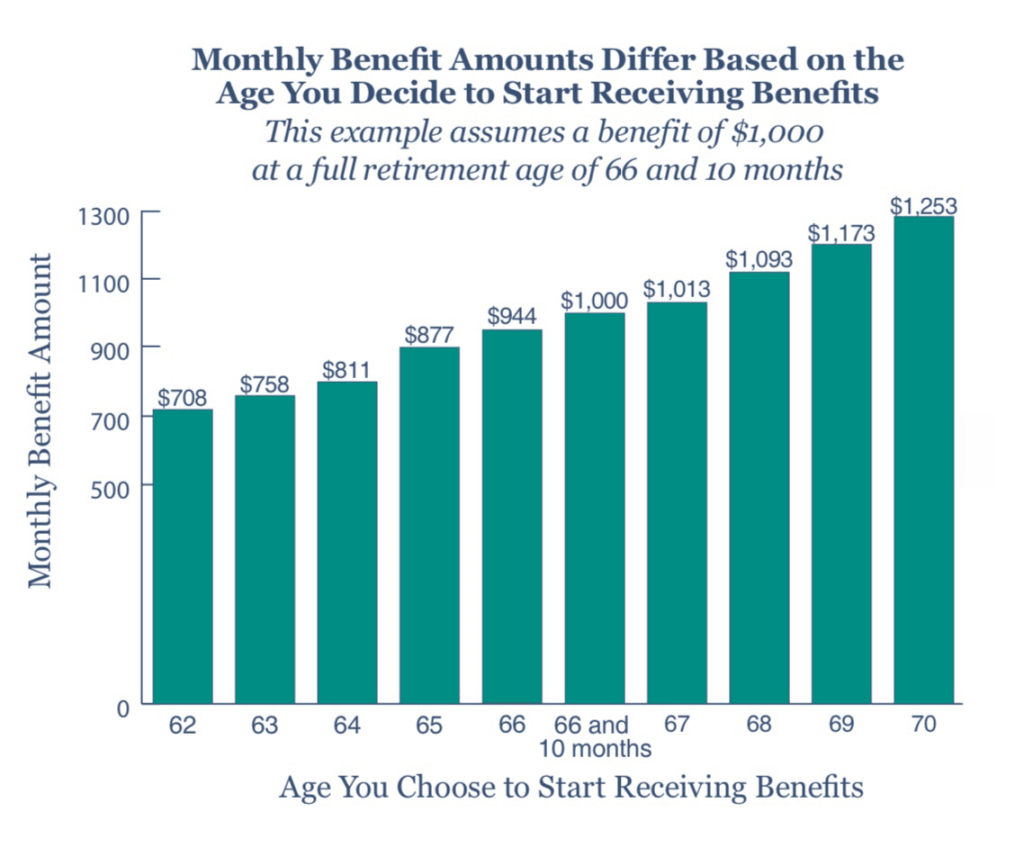

In the U.S., you can start claiming Social Security at age 62, but there’s a catch: claiming benefits early results in a permanent reduction. You can expect a reduction of up to 30% in your monthly payments. For example, if you’re eligible for $1,500 per month at your full retirement age, claiming at 62 might drop that amount to $1,050.

Practical Example:

Let’s say you claim benefits at 62, but your FRA is 67. That means you lose 30% of your monthly benefits. Over 20 years, that can add up to a significant amount of money that you’re missing out on.

The downside of early retirement isn’t just about lower monthly benefits – it could also impact your long-term financial stability. If you rely on Social Security as a major source of retirement income, the earlier you claim, the less you will have each month to live on.

2. Delayed Retirement: The Upsides

On the other hand, if you delay claiming your Social Security benefits past your FRA, you can receive delayed retirement credits. This means you get an 8% increase in benefits for each year you delay claiming beyond your FRA, up to age 70. That’s a sweet deal for anyone who can afford to keep working and put off claiming their Social Security.

Practical Example:

If you wait until 70 to claim Social Security instead of 67, you could increase your monthly benefit by 24% (8% per year for three years). This can make a significant difference in the amount of money you’ll have in retirement.

However, waiting until 70 might not be possible for everyone. For people in physically demanding jobs or those who aren’t in good health, it might not make sense to delay benefits for such a long period.

3. Impact on People with Health Issues

For individuals with significant health concerns or a family history of early death, delaying Social Security until age 70 may not provide a good return on investment. You may not live long enough to fully benefit from waiting, making it a financial gamble. For these individuals, claiming earlier may be the better option despite the reduction in benefits.

How to Adapt:

If you have health concerns, it’s crucial to consider your life expectancy and how long you may rely on Social Security benefits. Talk to your doctor about your health and consider financial planning strategies to ensure you have enough money for retirement.

Who Will Be Most Affected?

1. Low-Income Workers

For many workers, especially those in lower-income brackets, Social Security is a lifeline. They often don’t have the savings or pensions to rely on in retirement, making Social Security their primary source of income. For these individuals, the higher retirement age can be particularly damaging, as they may not be able to work longer due to health issues or job scarcity.

How to Adapt:

If you’re in this situation, it’s essential to start planning early. Consider saving more aggressively during your working years, if possible, or exploring other retirement income options, like employer-sponsored retirement plans or individual retirement accounts (IRAs). It’s also worth speaking with a financial planner to get personalized advice on how to optimize your Social Security benefits.

2. People in Physically Demanding Jobs

If you work in a physically demanding job, such as construction or healthcare, delaying retirement can be difficult. These jobs can take a toll on your body, and working past your 60s might not be feasible. In such cases, early retirement might be the only option – even if it means accepting a permanent reduction in your Social Security benefits.

How to Adapt:

For people in physically demanding jobs, it’s important to plan for early retirement and factor in the reduced benefits. Finding ways to supplement your Social Security income, like through part-time work or investments, could help mitigate the impact of reduced benefits.

3. Minorities & Those with Shorter Life Expectancies

For certain demographic groups, such as African Americans, who tend to have shorter life expectancies, the rising retirement age can seem particularly unfair. If you live a shorter life, delaying Social Security until 69 might not provide you with enough years to make up for the reduced benefits from waiting.

How to Adapt:

In these situations, it might be better to claim benefits earlier rather than later. Each individual’s situation is unique, so it’s critical to weigh the pros and cons based on personal health, family history, and finances.

Practical Tips for Navigating Retirement Age Changes

1. Start Early with Retirement Planning

Planning for retirement is a marathon, not a sprint. Start early by setting aside savings through employer retirement plans like a 401(k), or open an IRA to supplement your Social Security benefits. The earlier you start, the more you’ll have when you finally retire.

2. Factor in Health and Work Factors

Your health and job type play a significant role in determining when to retire. If you’re in a physically demanding job or have health problems, consider retiring earlier to avoid burnout. On the other hand, if you’re healthy and can continue working, delaying retirement could increase your monthly benefits in the long run.

3. Monitor Policy Changes

Changes in Social Security policies, including retirement age adjustments, can have long-term effects.

4. Work with a Financial Planner

Given the complexity of retirement planning, especially with increasing retirement ages, working with a financial planner is a smart move. A professional can help you navigate your options, optimize Social Security benefits, and create a personalized strategy for your retirement.

Expert Offers Guidance for Couples Planning Retirement With Limited Savings

U.S. Retirement Age Set to Rise Again as Social Security Faces Major Funding Crisis

Social Security Retirement Age Adjusted to 67 Under New Guidelines- Check Official Details!