8-Year Rule Can Boost Your Benefits by $250,000: When it comes to planning for retirement, few decisions are as critical as when to start collecting Social Security benefits. Many people don’t realize that by waiting to claim, you can actually increase your monthly payout by a significant amount. The so-called “8-Year Rule” can potentially add up to $250,000 more in benefits over your lifetime. Sounds intriguing, right? But how does it work? In this article, we’ll break down exactly how the 8-Year Rule works, why waiting until you turn 70 can give you a huge advantage, and the factors you need to consider before making this important decision. Whether you’re just starting to think about retirement or already have a plan in place, this guide will give you the insights and facts you need to make the right choice for your future.

8-Year Rule Can Boost Your Benefits by $250,000

Choosing the right age to claim Social Security benefits is one of the most important decisions you’ll make for your retirement. The 8-Year Rule offers a powerful strategy to increase your lifetime benefits by delaying claims until age 70. By carefully considering your health, financial needs, and the impact on your spouse, you can make the best decision for your unique situation. Remember, your Social Security benefits are a key part of your retirement strategy. By understanding the long-term impact of when you start claiming, you can significantly boost your financial security for the future.

| Topic | Details |

|---|---|

| Age to Claim Social Security | You can claim Social Security benefits starting at age 62. |

| Full Retirement Age (FRA) | FRA varies by birth year (typically 66 or 67). |

| 8-Year Rule | Delaying benefits from 62 to 70 increases your monthly benefits by 8% per year. |

| Potential Lifetime Benefit Increase | Waiting until 70 can add $250,000+ to your Social Security benefits over a lifetime. |

| Source for Official Information | Social Security Administration |

The 8-Year Rule: What It Is and How It Works

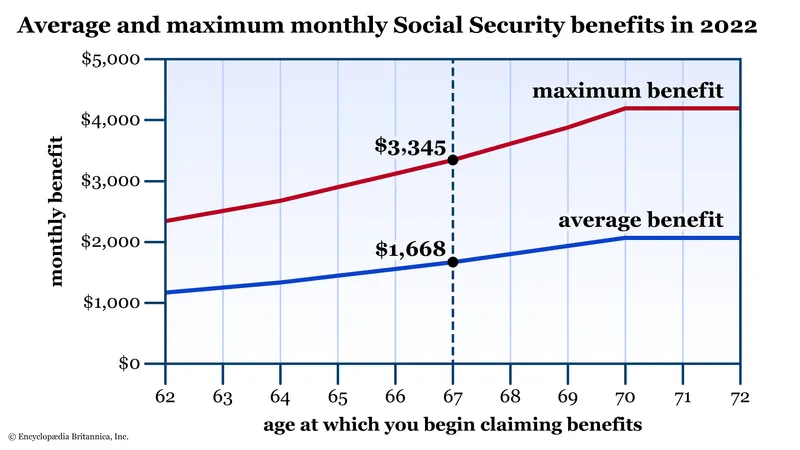

The 8-Year Rule is a strategy that revolves around the optimal timing of when to start collecting Social Security benefits. It emphasizes the importance of delaying benefits until age 70, which can increase your monthly payout by as much as 32%. Let’s break this down:

Claiming Social Security at Age 62

The earliest you can begin collecting Social Security benefits is at age 62. While it may seem tempting to start as soon as you can, there’s a catch. If you start collecting at 62, your benefits are permanently reduced. On average, you’ll get about 25-30% less than you would if you waited until your Full Retirement Age (FRA).

For example, if your FRA benefit is projected to be $2,000 per month, claiming at 62 could reduce that amount to $1,400 or so. That’s a significant cut, and it could impact your financial security in the long run.

The Full Retirement Age (FRA) – A Sweet Spot?

Your FRA is the age at which you can claim your full, unreduced Social Security benefits. For people born between 1943 and 1954, your FRA is 66. For those born in 1960 or later, your FRA is 67. If you claim benefits at your FRA, you get the full benefit based on your work history, which may seem like the best option.

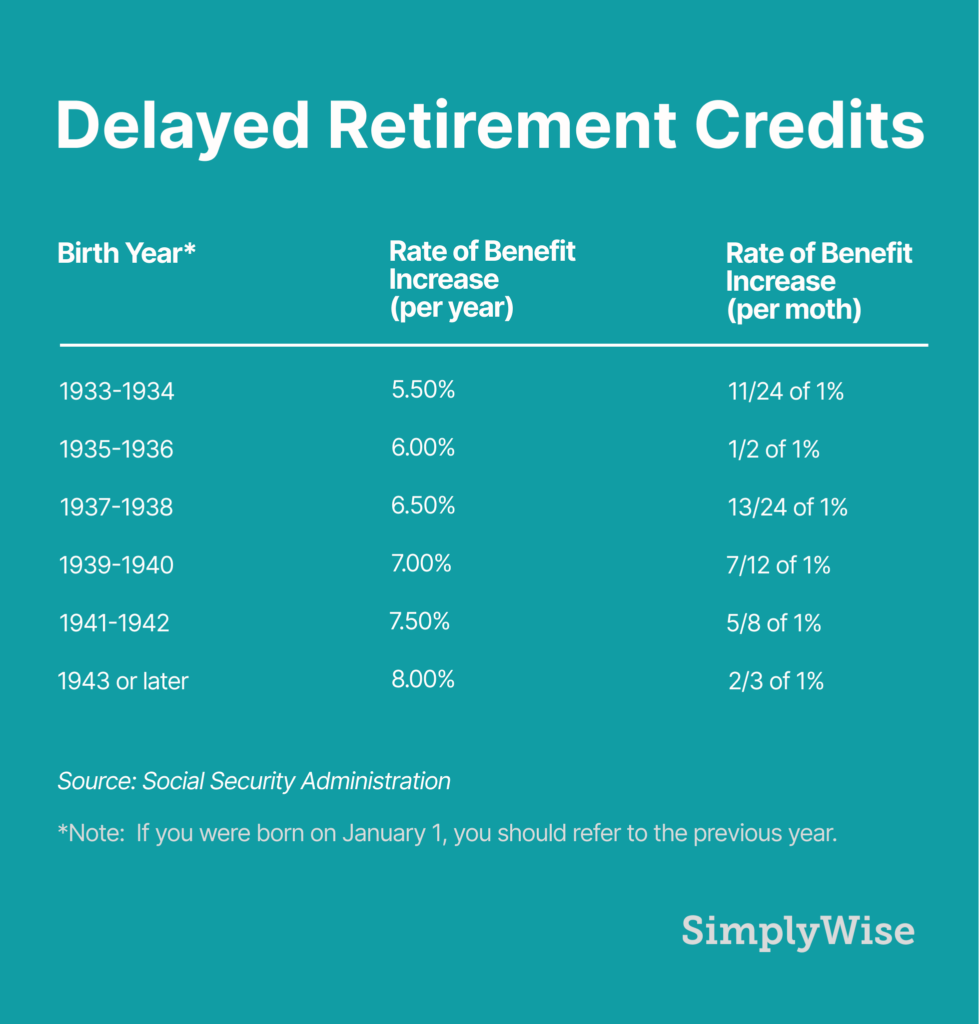

Waiting Until Age 70

Here’s where the 8-Year Rule really starts to shine. If you delay your benefits beyond your FRA, Social Security offers a delayed retirement credit. This means your monthly benefits will increase by 8% per year for each year you wait, up to age 70. This is a guaranteed increase that isn’t based on the stock market or any external factors. It’s a safe and reliable way to boost your monthly payout.

So, let’s go back to that example where your FRA benefit is $2,000 per month. If you wait until age 70, your monthly benefit could increase by up to 32%, bringing it to about $2,640. That’s an extra $640 per month. Over the course of a year, that’s nearly $8,000 more, and over a decade, that’s more than $80,000 extra.

How the 8-Year Rule Can Boost Your Benefits by $250,000?

While the immediate increase in your monthly benefits is impressive, the real power of the 8-Year Rule lies in the long-term effect. By waiting until 70, you can boost your lifetime benefits by hundreds of thousands of dollars.

Consider the following example:

- Age 62 Claim: If you start collecting at 62, you receive a smaller benefit but for a longer period of time.

- Age 70 Claim: If you wait until 70, you receive a larger monthly benefit, but you forgo those earlier years of benefits. However, in the long run, your larger monthly payments can more than make up for the months you didn’t collect.

According to data from the Social Security Administration (SSA), someone who starts collecting at age 70 could receive $250,000 or more over their lifetime compared to someone who started at 62, depending on their life expectancy.

The Financial Impact

If you claim Social Security early, you might end up collecting a smaller amount over the course of your retirement, depending on how long you live. For example, someone who claims at 62 and lives to 80 might collect $500,000. However, someone who waits until 70 and lives to 80 might collect $750,000 or more. That’s a $250,000 difference, which can be a game-changer for your retirement finances.

Factors to Consider Before Waiting Until Age 70

As appealing as the idea of waiting until age 70 is, it’s not a one-size-fits-all solution. There are a number of personal factors you should consider when making this decision.

1. Health and Life Expectancy

Your health plays a major role in deciding whether to delay Social Security. If you’re in poor health or have a family history of shorter life spans, it may make more sense to claim earlier. On the flip side, if you’re healthy and expect to live a long life, delaying benefits could provide substantial long-term financial rewards.

2. Financial Need

Not everyone has the luxury of waiting until 70. If you need the income to cover your expenses, claiming early might be the better option. However, if you have other retirement income sources, delaying benefits could allow your Social Security to grow and ensure you have a bigger financial cushion later on.

3. Spousal Benefits

If you’re married, your decision can impact your spouse’s benefits as well. If you delay your benefits, it can increase the amount your spouse receives as a survivor benefit after you pass away. This could provide significant financial security for your partner in their later years.

4. Tax Implications

Delaying your benefits could have tax consequences, especially if you’re still working. In general, the more money you receive from Social Security, the more likely it is that some of it will be taxed. The Social Security Administration provides useful tools for understanding how taxes might impact your benefits based on your income levels.

5. Inflation and Cost of Living Adjustments (COLA)

Social Security benefits are adjusted for inflation through the Cost of Living Adjustment (COLA), which helps keep your benefits in line with rising prices. Delaying your benefits can be a great way to combat inflation, especially if you have a significant amount of time before you start claiming.

How to Calculate Your Social Security Benefits?

To better understand how waiting affects your benefits, you can use several online calculators provided by the Social Security Administration. These tools allow you to input your specific work history and personal details to estimate your monthly benefits at different claiming ages.

For more precise calculations, it’s always a good idea to speak to a financial advisor who specializes in Social Security planning. They can help you assess your full retirement needs and tailor a strategy that makes the most sense for your specific situation.

Social Security Claims Are Surging — 5 Alarming Reasons You Should Act Fast

Upcoming Social Security Changes Require Immediate Action — Missing Deadline Could Delay Your Money

Social Security Shake-Up Incoming — What Every Recipient Needs to Know Now