How a Marriage Rule Is Denying Americans Survivor Benefits: When it comes to Social Security survivor benefits, timing really is everything. And we’re not just talking years—we’re talking days. If you were divorced from your spouse and your marriage lasted even seven days less than 10 years, you might be shocked to find out you don’t qualify for survivor benefits. That’s right—even 9 years, 11 months, and 3 weeks won’t cut it. So what gives? This article breaks down the strict 10-year marriage rule, why it exists, how it affects people, what exceptions exist, and what you can do about it. We’ll also explore calls for reform and how to protect yourself through smart planning.

How a Marriage Rule Is Denying Americans Survivor Benefits

Being married for 9 years and 11 months shouldn’t leave someone with zero support after a former spouse dies—especially if they spent that time sharing a life, raising kids, or depending financially on each other. Yet the current system offers no leniency. Whether you’re just shy of the mark or preparing for the future, awareness is everything. The more you understand your rights and timing, the better your chances of securing the benefits you’ve earned. If you’re in this boat, don’t panic—but do act. Talk to an advisor. Review your timeline. And plan now to avoid being denied later.

| Topic | Details |

|---|---|

| Rule Name | 10-Year Marriage Rule |

| Applies To | Divorced spouses seeking Social Security survivor benefits |

| Minimum Requirement | Must be married 10 full years |

| No Grace Period | Even 7 days short = disqualification |

| Exceptions | If caring for minor or disabled child of the deceased |

| Official Source | SSA Survivor Benefits |

| Estimated Impact | Thousands of Americans denied annually |

| Advice | Track dates, plan ahead, seek legal or Social Security advice early |

What Is the 10-Year Marriage Rule?

The 10-year marriage rule is a provision by the Social Security Administration (SSA) that requires you to have been married to your former spouse for at least 10 years in order to collect divorced spouse survivor benefits after they die.

This rule applies only if you’re divorced. Widows and widowers who were still married at the time of death only need to meet a 9-month marriage rule.

The logic behind the 10-year rule was originally to ensure only spouses with significant financial interdependence would be eligible for benefits. But the rule has not changed in decades—even as marriage patterns and retirement needs have evolved.

How a Marriage Rule Is Denying Americans Survivor Benefits: The Real-World Impact

Let’s consider a few real-life scenarios.

Case 1: Just 6 Days Short

Martha, age 67, was married for 9 years and 359 days. When her ex-husband passed away, she assumed she’d qualify for benefits. But when she applied, the SSA denied her claim—because she was six days short of the requirement.

Case 2: Just Barely Eligible

Joe and his ex-wife divorced just after their 10-year anniversary. Although their relationship had ended years earlier, the final divorce decree was signed just in time. Joe was later able to claim full survivor benefits after his ex passed.

Case 3: Special Exception for Children

Linda, 62, was married only 8 years but had custody of her deceased ex-husband’s disabled child. Thanks to a child-in-care exception, Linda was still eligible for survivor benefits.

These stories reveal how a few days on paper can translate into thousands of dollars in income—or none at all.

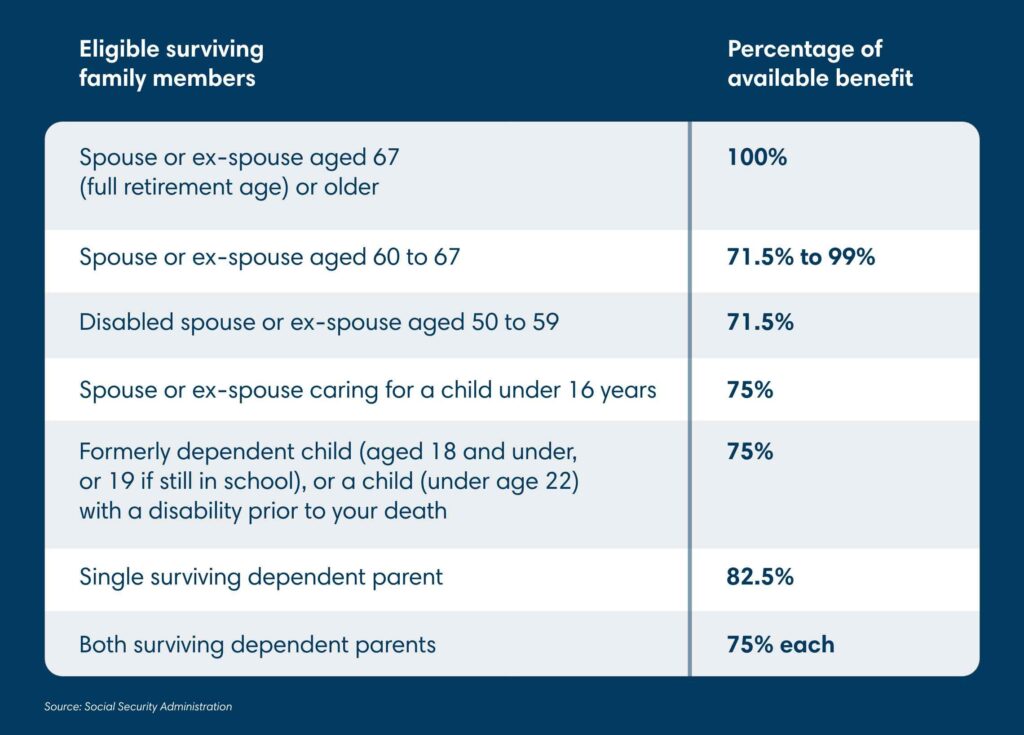

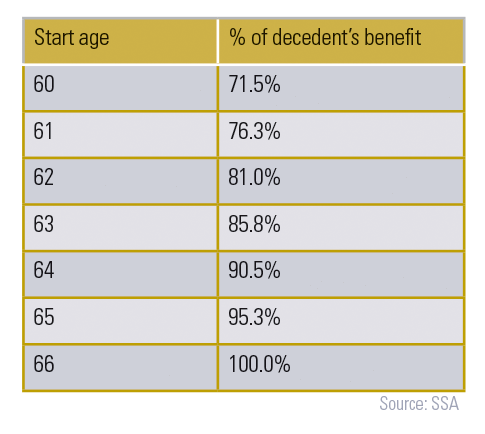

Survivor Benefits: A Financial Lifeline

As of 2025, the average monthly Social Security survivor benefit is about $1,505. Over 10 years, that’s more than $180,000 in potential income. If you’re entitled to 100% of a deceased spouse’s benefit, the stakes are even higher.

These benefits are especially critical for:

- Low-income retirees

- Women, who make up the majority of divorced beneficiaries

- Those without strong personal work histories

- Individuals supporting dependent or disabled children

Exceptions to the Rule

There are only a few narrowly defined exceptions to the 10-year rule. Here are the main ones:

1. Child-in-Care Provision

You may qualify for survivor benefits regardless of marriage length if you are caring for the deceased ex-spouse’s child, who is under 16 or disabled, and receiving Social Security benefits.

2. Multiple Marriages to the Same Person

If you divorce, remarry the same person, and the combined time married equals 10 years, you might qualify—as long as the remarriage occurred shortly after the initial divorce.

3. Disability of the Surviving Spouse

You may apply for reduced survivor benefits starting at age 50 if you’re disabled. However, this doesn’t override the 10-year rule—it just changes the age requirement.

How to Avoid Losing Survivor Benefits?

If you’re nearing the 10-year mark, and divorce is being considered, pause and think about these steps:

1. Check Your Dates Carefully

Get your marriage certificate and divorce decree. Ensure the legal marriage lasted at least 10 full years to the day.

2. Talk to a Social Security Attorney

A professional can help you explore exceptions, appeal denials, and strategize.

3. Consider Postponing Divorce

If you’re close to the 10-year mark, wait until the anniversary passes. That delay could secure lifetime benefits.

4. Use the SSA Estimator

Use the SSA Benefits Estimator to calculate potential survivor benefits based on your or your ex-spouse’s earnings record.

5. Appeal (with Realistic Expectations)

You can always appeal a denied claim, but survivor benefits tied to the 10-year rule are rarely overturned. The SSA is very strict.

Why the Rule Needs Reform?

Critics argue the rule is outdated and arbitrary. It penalizes individuals for circumstances beyond their control:

- Shorter marriages can still involve shared finances, caregiving, and support.

- Modern marriages are diverse; many Americans don’t follow traditional timelines.

- Cohabitation and common-law relationships often go unrecognized.

Several advocacy groups—including the National Committee to Preserve Social Security and Medicare—are pushing for:

- Lowering the requirement to 7 or 8 years

- Offering partial benefits for marriages over 5 years

- Recognizing financial interdependence beyond legal marriage

To date, no federal reform has passed, but with growing awareness and public outcry, pressure continues to build.

What If You Don’t Qualify?

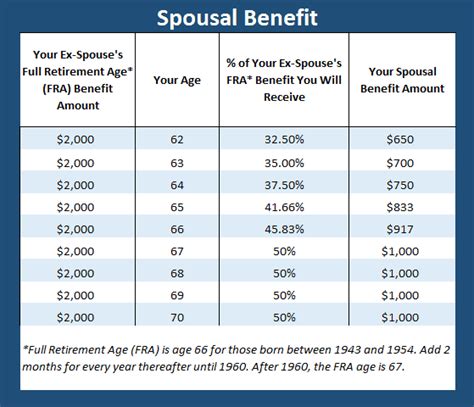

Not qualifying for survivor benefits doesn’t mean you’re out of options. Consider the following:

- Your own Social Security retirement benefits

- Spousal benefits from your current spouse, if remarried

- Supplemental Security Income (SSI) if you’re low-income

- Private retirement savings or annuities

- State-level support programs

You should also request a benefits review with SSA to explore all options.

Common Myths About Survivor Benefits

Let’s bust a few misconceptions:

Myth 1: You get survivor benefits automatically.

False. You must apply and provide documentation.

Myth 2: Living together for 10 years counts.

False—unless your state recognizes common-law marriage and you can prove it.

Myth 3: You can’t collect survivor benefits if you remarry.

It depends. If you remarry before age 60, generally no. If you remarry after 60, you still can.

Myth 4: The rule doesn’t apply if you were the breadwinner.

Also false. The rule applies based solely on the marriage duration and eligibility, not earnings.

Why SSA Beneficiaries May See Delays or Changes in Their Upcoming Payments- Check Details

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!