House Passes Explosive Crypto Bill After Right-Wing Rebellion: The GENIUS Act, short for Guiding and Establishing National Innovation for U.S. Stablecoins Act, is a groundbreaking piece of legislation that is set to redefine the regulation of stablecoins in the United States. Passed by the U.S. House of Representatives in July 2025, the bill aims to create a cohesive framework for stablecoins, which are a specific type of cryptocurrency designed to hold a stable value, often pegged to the U.S. dollar. This historic bill is considered a turning point in crypto regulation, ensuring that cryptocurrencies have a secure, transparent, and trustworthy foundation in the U.S. financial system.

The GENIUS Act has already caused significant ripples across the cryptocurrency industry, with investors, financial professionals, and everyday users all wondering how this new legislation will impact them. In this article, we’ll break down the GENIUS Act step by step, using clear language, real-life examples, and practical advice to help you understand its implications. Whether you’re just getting started with cryptocurrencies or you’re an experienced professional looking for a deep dive into the bill’s provisions, we’ve got you covered!

House Passes Explosive Crypto Bill After Right-Wing Rebellion

The GENIUS Act is a landmark piece of legislation that aims to regulate the growing stablecoin market in the U.S. By establishing clear rules for issuance, reserves, and consumer protections, the bill ensures that the crypto market can grow safely and transparently. As more financial institutions and businesses look to explore digital currencies, the GENIUS Act lays a strong foundation for the future of stablecoins and the broader crypto market. Whether you’re an investor or just curious about how crypto works, understanding the GENIUS Act is essential for navigating the future of digital finance.

| Key Feature | Details |

|---|---|

| What is the GENIUS Act? | A comprehensive bill designed to regulate stablecoins in the U.S. by creating clear rules around issuance, reserves, and consumer protection. |

| Main Purpose | To establish a secure, transparent system for the use and regulation of stablecoins, boosting trust in the crypto market. |

| Regulation Bodies | Federal agencies like the OCC (Office of the Comptroller of the Currency) and state regulators will oversee stablecoin issuers. |

| Consumer Protections | In cases of issuer insolvency, stablecoin holders will have priority claims on reserves. Members of Congress cannot profit from stablecoins. |

| Impact on Stablecoin Market | The bill could make the stablecoin market worth up to $2 trillion. Financial institutions like JPMorgan and companies like Meta and Amazon may launch their own. |

| Timeline for Implementation | The provisions of the GENIUS Act will take effect 18 months after its enactment or 120 days after the final regulations are issued. |

What Exactly Is the GENIUS Act?

The GENIUS Act is a major step in establishing stablecoins as a stable and secure method of exchange in the U.S. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which can be highly volatile, stablecoins are pegged to a real-world asset, like the U.S. dollar, and are designed to maintain a steady value. The primary goal of this legislation is to create clear rules for how these coins are issued, who can issue them, and how they should be regulated.

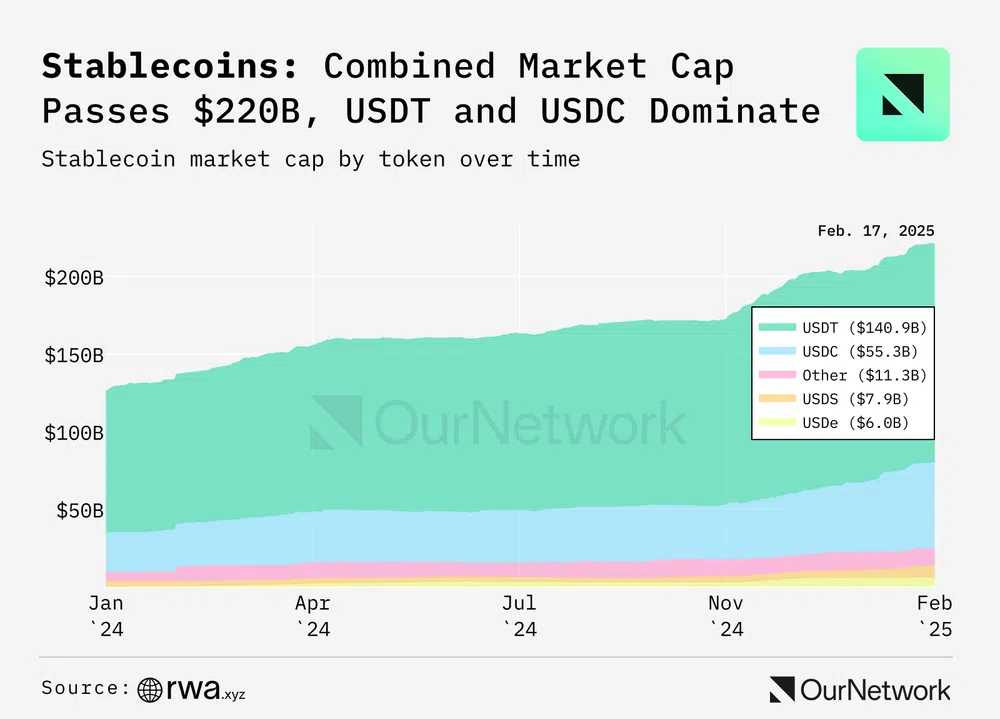

For example, stablecoins like Tether (USDT) and USD Coin (USDC) are already used by millions for transactions, investments, and even as a store of value. However, as with all cryptocurrencies, the lack of regulation can sometimes lead to issues related to fraud, security breaches, and consumer trust. The GENIUS Act is designed to address these issues head-on, bringing much-needed structure to the market.

Breaking Down the House Passes Explosive Crypto Bill After Right-Wing Rebellion

1. Who Can Issue Stablecoins?

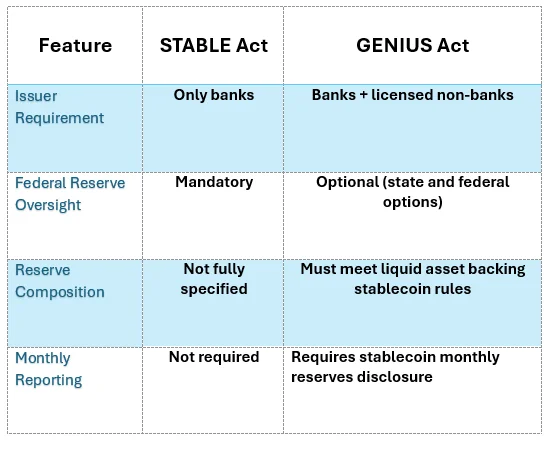

A critical feature of the GENIUS Act is the establishment of strict rules for who can issue stablecoins. The bill ensures that only well-regulated entities like banks, credit unions, and approved FinTech firms can issue stablecoins.

These entities must meet certain criteria to prove they have the financial stability and legal compliance to issue digital currencies. For example, issuers must prove they have enough reserve assets to back every stablecoin issued. In essence, it ensures that you, the consumer, can trust that when you trade in or redeem your stablecoins, they are backed by real, tangible assets.

2. What Are the Reserve Requirements?

A hallmark of the GENIUS Act is its requirement that stablecoins must be fully backed by reserves. This means that for every stablecoin issued, the issuer must hold an equivalent amount of U.S. dollars or other low-risk liquid assets in reserve.

This provision is critical because it prevents instability in the market and makes sure that stablecoins do not become the next big financial bubble. If you’re ever worried about the stability of your digital dollar, rest assured knowing it’s backed by a reserve.

For example, if a financial institution issues 1 million stablecoins, it must have 1 million U.S. dollars or other highly liquid assets in reserve to ensure the stability of the coin’s value.

3. Regulatory Oversight and Roles

The GENIUS Act designates several key U.S. regulatory agencies as responsible for overseeing stablecoin issuers.

Federal agencies like the Office of the Comptroller of the Currency (OCC) and the National Credit Union Administration (NCUA) will be at the forefront of this oversight. These agencies are tasked with making sure that the rules are followed and that the market remains transparent and trustworthy.

But that’s not all. The GENIUS Act also empowers state regulators to play a role in enforcing these new rules. This dual-layer approach ensures that there is both federal and state oversight, which is vital for the smooth functioning of the market.

4. Consumer Protections: What Happens if an Issuer Fails?

Another important provision of the GENIUS Act is its focus on consumer protection. Stablecoins are designed to be stable, but what happens if the company behind them goes bankrupt? The GENIUS Act ensures that stablecoin holders are prioritized in any bankruptcy proceedings.

This means if an issuer becomes insolvent, people who hold the issuer’s stablecoins will have priority claims to the reserves backing those coins. This safeguard helps to protect consumers, ensuring they don’t lose their investment if something goes wrong.

Additionally, the bill prevents members of Congress from profiting off stablecoins. This provision was included to prevent any potential conflicts of interest from lawmakers who might otherwise benefit from the crypto industry.

5. When Will the GENIUS Act Be Implemented?

Once signed into law, the GENIUS Act will be implemented within 18 months, or sooner if the final regulations are issued earlier. This gives regulators ample time to set up the necessary infrastructure and ensure that the market will operate smoothly under the new rules.

The Bigger Picture: Why Does This Matter?

1. The Expansion of Stablecoins

The passing of the GENIUS Act is expected to lead to the explosive growth of the stablecoin market. Experts predict that stablecoins could become a $2 trillion industry within the next few years. Financial giants like JPMorgan, Bank of America, and even Meta (formerly Facebook) are eyeing the creation of their own stablecoins as a way to reduce transaction costs and streamline business operations.

For instance, Meta has already made moves to launch its own stablecoin, which would allow for faster, cheaper transactions on its platforms like Facebook and WhatsApp.

2. Boost to U.S. Financial Technology

By creating a clearer framework for stablecoins, the GENIUS Act also helps U.S. financial institutions embrace blockchain technology and digital currencies. As more traditional companies consider entering the crypto space, they can now do so with confidence, knowing that the rules are clear, and that their investments are safe.

The bill also encourages more innovation in the FinTech space, making the U.S. a leader in the global digital finance ecosystem.

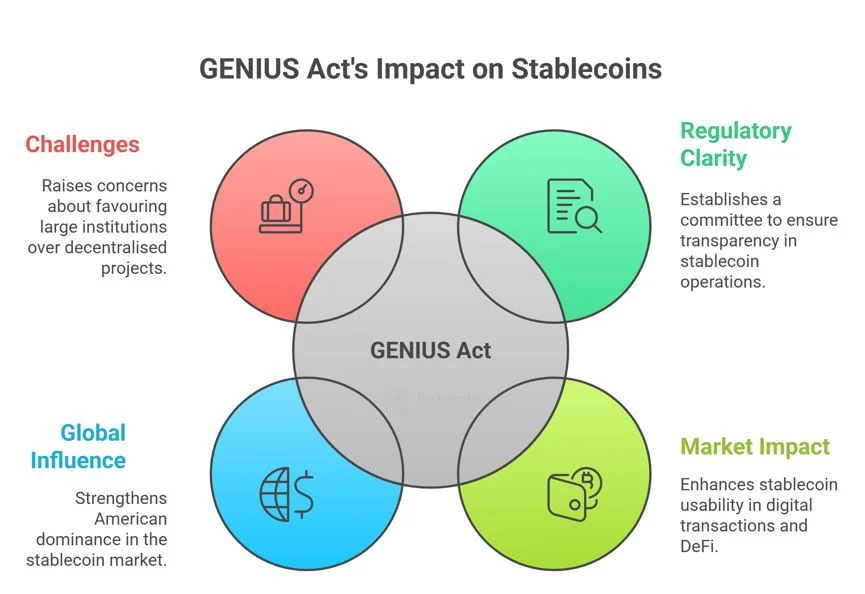

3. Global Implications

The GENIUS Act isn’t just about U.S. financial markets. It’s part of a broader global shift towards regulatory clarity for digital currencies. The U.S. is positioning itself to lead the world in cryptocurrency and blockchain innovation. With other countries looking to regulate digital assets, the GENIUS Act sets a precedent for international regulation, potentially influencing how other governments approach crypto regulation in the coming years.

4 Financial Mistakes Americans Keep Making That Wreck Their Budgets

Upcoming Social Security Changes Require Immediate Action — Missing Deadline Could Delay Your Money

Social Security to Undergo Major Change This Fall — Here’s What Recipients Should Know