When CRA Starts Scrutinizing Your CPP Payments: Navigating Canada’s tax system can feel a bit like walking through a maze, especially when it comes to your Canada Pension Plan (CPP) and Old Age Security (OAS) payments. You’ve worked hard for those benefits, so you may be wondering, “When does the CRA start taking a closer look at my CPP payments?” Well, the answer lies in the amount of money you’re making, how you report that income, and whether you’re crossing certain thresholds. If you’re earning more than the average Canadian, the CRA might pay you a visit, so to speak. Don’t worry, though! This article will explain exactly when the Canada Revenue Agency (CRA) gets involved with your CPP payments, why they might scrutinize you, and most importantly, how to avoid any issues. By the end, you’ll be fully equipped to handle your finances like a pro and keep the CRA off your back. So, let’s dive in!

When CRA Starts Scrutinizing Your CPP Payments

Dealing with the CRA can feel like navigating a maze, but with a little knowledge and preparation, you can avoid most of the common pitfalls. Always report your income, double-check your tax returns, and keep an eye on your OAS thresholds. If you’re ever unsure about your financial situation, don’t hesitate to consult with a tax professional. Keeping the CRA off your back doesn’t have to be stressful – just stay organized, stay compliant, and you’ll be able to enjoy your CPP and OAS benefits without worrying about an audit.

| Key Points | Details |

|---|---|

| What is the CRA Scrutiny? | The CRA may start reviewing your CPP payments when you have high income or discrepancies in reporting. |

| OAS Clawback Threshold | Income above $151,668 (for seniors aged 65-74) triggers a potential clawback of Old Age Security (OAS). |

| Tax Red Flags | Unreported income, errors in pension splitting, and high marginal tax rates can attract CRA’s attention. |

| Practical Advice | Always report your income, double-check your tax returns, and consult a tax professional when in doubt. |

| Official Resources | Learn more on the CRA’s official website: CRA – Canada Revenue Agency |

Understanding CRA Scrutiny of Your CPP Payments

Before we dive into how the CRA scrutinizes CPP, let’s take a step back and make sure we understand what CPP is. The Canada Pension Plan (CPP) is one of the most crucial parts of Canada’s social security system. It provides a source of income for Canadians who are retired, disabled, or have lost a spouse.

The CRA’s role is to ensure that everyone is paying the appropriate amount of tax based on their income – and that includes payments related to the CPP.

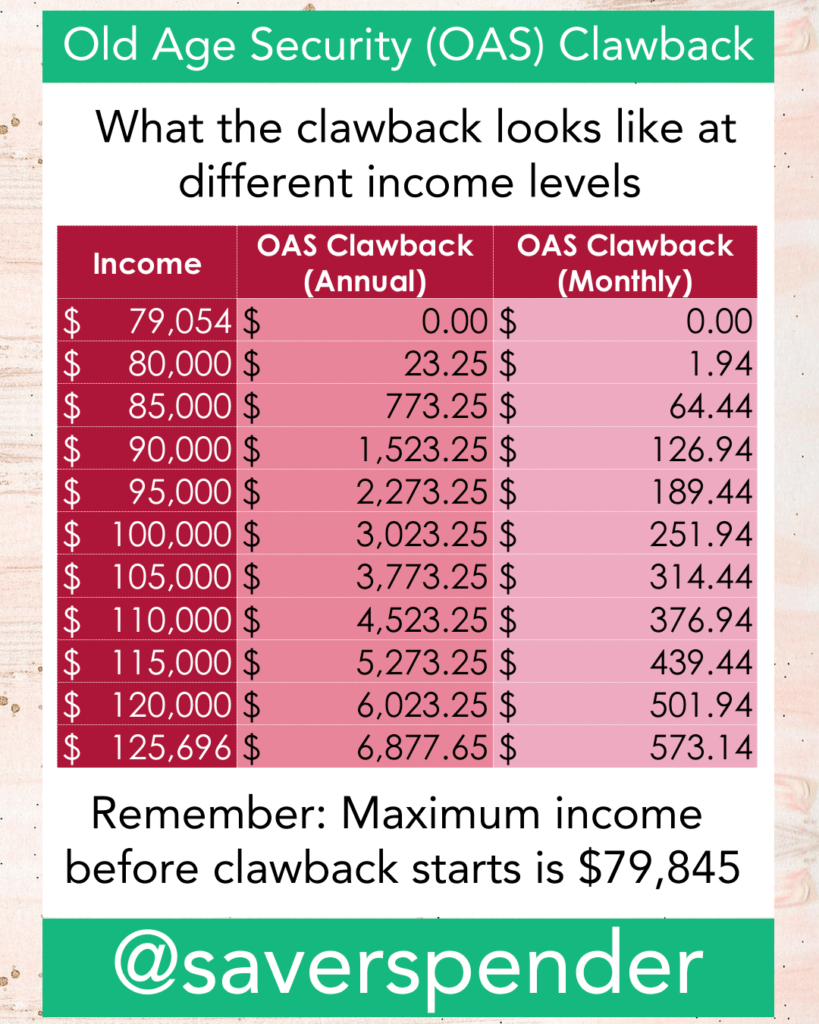

However, once your income rises above certain levels, your Old Age Security (OAS) payments, which are also administered by the CRA, come into play. That’s when things can get complicated, as your OAS payments might start to get clawed back if your income is deemed too high. If you’re receiving both OAS and CPP, and your income is higher than the CRA’s thresholds, the agency might take a closer look at your situation.

When Does the CRA Starts Scrutinizing Your CPP Payments?

The OAS Clawback Threshold

Here’s the crux of the issue: when your income surpasses a certain level, the CRA can begin reducing your OAS benefits. This is known as the OAS clawback or OAS recovery.

Here’s a breakdown of the current OAS clawback thresholds for 2026:

- For seniors aged 65 to 74: Your net world income must be under $151,668 to receive the full OAS. If you go over, your OAS payments will be reduced, and if you earn a lot more, you could lose all of your OAS benefits.

- For seniors aged 75 and older: The threshold increases slightly to $157,490.

Your net world income includes all sources of income such as salaries, pensions, investments, and even rental income.

Example:

If you’re 68 years old and earning $170,000, you will start seeing a reduction in your OAS benefits, and if your income keeps rising, you could lose it entirely.

The key here is knowing how your income is structured. Even if your CPP payments don’t get clawed back, if your income goes above the thresholds, the CRA may begin investigating your OAS benefits and tax filings.

How the CRA Tracks High-Income Seniors?

The CRA doesn’t just sit and wait for you to report your income. They have sophisticated methods to detect discrepancies, which could lead them to start scrutinizing your CPP and OAS payments. The CRA uses several methods to identify people who might be trying to game the system, intentionally or unintentionally.

1. Unreported Income

If you don’t report all your sources of income – say, rental income, freelance earnings, or capital gains from selling investments – the CRA will spot the discrepancy through their cross-referencing methods. Their job is to ensure that all income is reported and taxed properly, and unreported income is one of the biggest red flags.

2. Mistakes in Pension Splitting

Many seniors try to split their pension income with their spouse to reduce their tax liability. While this is a legal strategy, doing it incorrectly could raise the CRA’s eyebrows. If you misreport pension splitting or make an error in your calculations, the CRA might flag your return.

3. Mistakes with Tax-Free Savings Accounts (TFSA) or Registered Retirement Income Funds (RRIF)

Errors like over-contributing to a TFSA or withdrawing more than allowed from an RRIF can also attract scrutiny. If you make a mistake, penalties can be hefty, and the CRA may choose to dig deeper into your financial history.

4. High Marginal Tax Rates

As you get older, you might choose to start receiving your CPP early, or you could have a side business or additional investment income. These can create high marginal tax rates, especially if your income exceeds the OAS threshold. If this happens, the CRA may check to ensure that all of your income is being reported correctly.

5. Discrepancies in Your Tax Returns

Mismatched information, either between your tax return and CRA’s records or between different forms of income you report, will almost certainly raise a red flag. The CRA may want to verify the accuracy of your return if things don’t add up.

How to Avoid CRA Scrutiny?

The good news is that with the right strategies in place, you can avoid the CRA’s scrutiny altogether. Here are a few practical tips:

1. Report All Income

It sounds simple, but it’s crucial. Whether it’s a part-time job, investments, or freelance work, report all sources of income. If you have rental properties or sell assets, make sure to report any capital gains or rental income. The CRA is very good at cross-checking information, and unreported income is one of the most common causes of audits.

2. Double-Check Your Tax Returns

Tax mistakes are common and easy to make. Double-check everything, from your T4 slips (employment income) to your RRSP contributions. Even small discrepancies can set off alarms at the CRA. Using tax software that automatically checks for errors can help, but it’s always a good idea to get a professional to take a look if you’re not sure.

3. Consult a Tax Professional

If your finances are complicated or you’re unsure about how to handle income splitting, CPP, OAS, or investment earnings, it’s worth consulting a tax professional. A professional can help you optimize your taxes, avoid errors, and stay on top of any potential issues that might trigger the CRA’s interest.

4. Track Your Investments and Contributions

Keep a detailed record of all your investments and contributions to your RRSP, TFSA, and other accounts. The CRA may ask for documentation if they decide to look into your financial situation. A well-organized set of records will make any future reviews much easier to handle.

Earning This Much Could Trigger CRA Scrutiny of Your CPP Payments — Are You at Risk?

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way

Canada Is Sending Out Larger GST Cheques—Here’s Who Gets the Bigger Payout