Here’s the Average Social Security Payment: When you think about Social Security, it’s easy to picture those monthly checks that support so many Americans in their retirement years. But how much is the average payment for July 2025, and what can we expect in 2026? Let’s break it all down in a way that’s easy to understand, but also full of helpful insights for those who need the details.

Social Security benefits are crucial for millions of retirees, disabled individuals, and survivors across the United States. These payments are meant to provide a steady income after someone has worked for decades and paid into the system. However, the amount each person receives is based on various factors, like their work history and the amount they paid in taxes during their working years. In this article, we’ll take a close look at the average Social Security payment for July 2025, what could change for 2026, and how you can plan ahead. Whether you’re already receiving benefits or are preparing for the future, this guide will provide the information you need to navigate the world of Social Security.

Here’s the Average Social Security Payment

Understanding your Social Security benefits and how they might change in the future is essential for long-term financial planning. With COLA increases, Medicare premium hikes, and new legislation that benefits seniors, it’s important to stay informed and adjust your plans accordingly. Whether you’re a retiree or planning for the future, knowing how Social Security works and the potential changes on the horizon will help you make the best decisions for your financial health.

| Key Topic | Details |

|---|---|

| Average Social Security Benefit (July 2025) | $1,952.23 per month ($23,400 annually) |

| Cost-of-Living Adjustment (COLA) 2025 | 2.5% increase based on CPI-W |

| Projected COLA for 2026 | 2.6%–2.7%, based on inflation projections |

| Medicare Part B Premium (2026) | Estimated $206.20/month, a $21.50 increase |

| Tax Relief for Seniors (One Big Beautiful Bill Act) | 88% of Social Security beneficiaries exempt from federal income taxes |

| Changes to WEP and GPO | Repeal of Windfall Elimination Provision and Government Pension Offset |

Average Social Security Payment for July 2025

So, what’s the typical Social Security payment for July 2025? As of this year, the average Social Security benefit is approximately $1,952.23 per month. This number reflects the 2.5% Cost-of-Living Adjustment (COLA) that was applied at the start of 2025. This increase was implemented to help retirees keep up with inflation and rising costs. For those receiving Social Security benefits, this increase means an extra $1,800 per year, which, while not a huge amount, can still make a significant difference in monthly expenses.

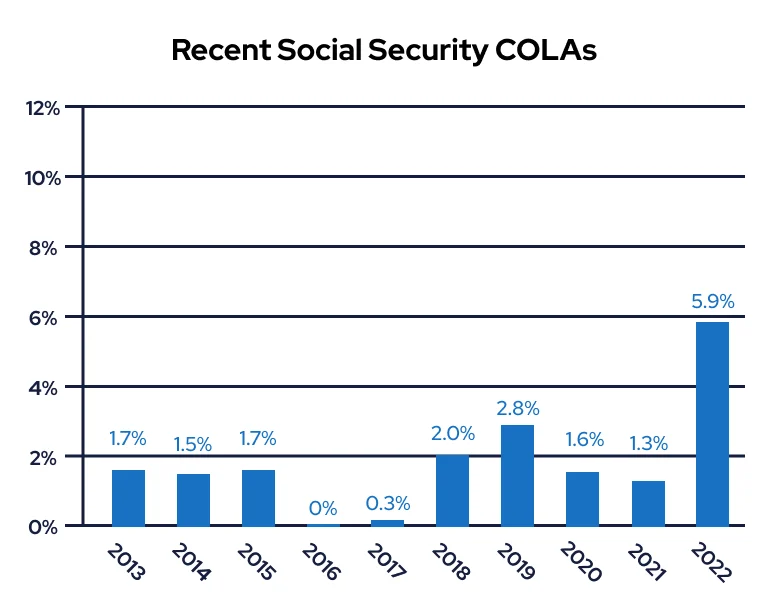

Why the increase in COLA? Each year, the government looks at the inflation rate using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to decide if a COLA is needed. The 2.5% increase for 2025 was lower than the 3.2% boost in 2024, but it’s still a positive adjustment to help seniors, who are often more affected by inflation, especially when it comes to costs like food and healthcare.

What’s Changing in 2026?

You may be wondering what to expect for Social Security benefits in 2026. While it’s always hard to predict exactly how much benefits will change in the future, we can look at trends and projections to get a sense of what’s ahead.

Projected COLA for 2026

For 2026, experts are predicting a COLA increase of 2.6% to 2.7%. This is based on the most recent inflation data and how the economy is shaping up. While these increases aren’t huge, they’re still helpful for retirees. For example, someone receiving the average benefit of $1,952 could see an increase of $51.23 to $52.74 per month. While this won’t completely offset rising costs, it will still provide some relief.

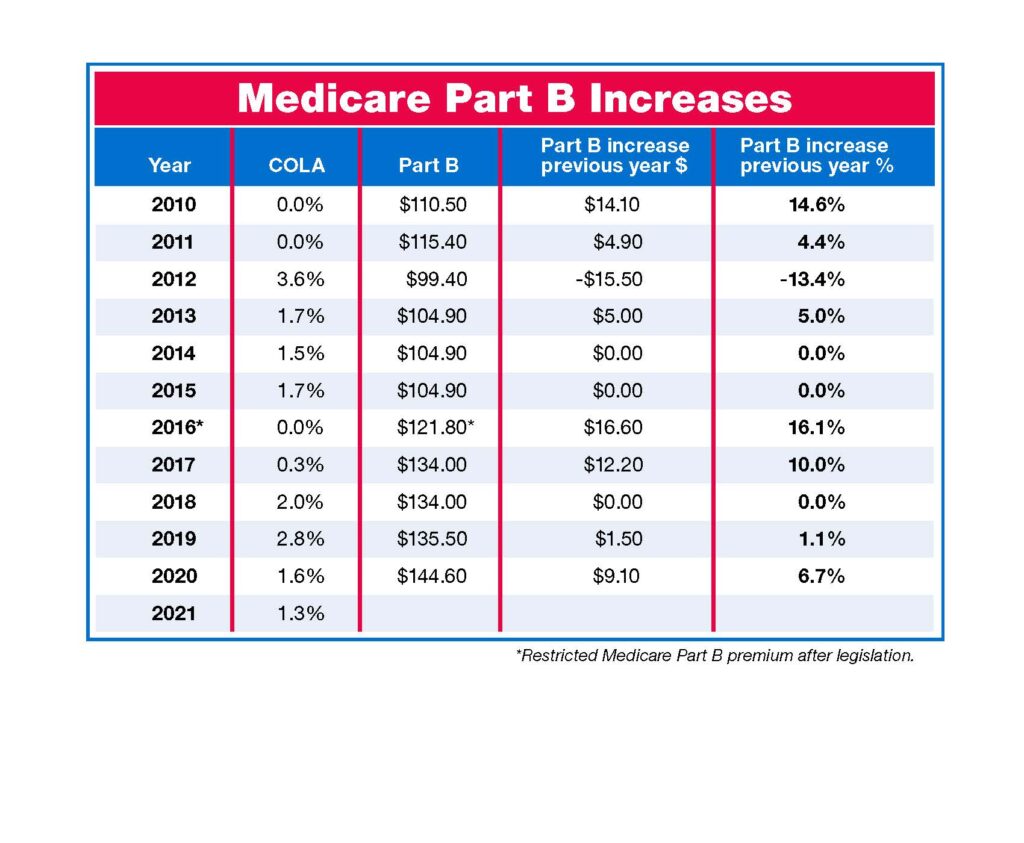

Medicare Part B Premiums

Medicare Part B premiums are another important factor in determining how much retirees will take home each month. The Medicare Part B premium covers outpatient services, and for 2026, Medicare premiums are expected to rise by $21.50, bringing the monthly premium to $206.20.

If you’ve ever looked at your monthly Social Security check and wondered why it seems smaller than expected, it’s often because of these premiums. Medicare premium hikes, especially significant ones like this, can quickly eat into the benefits you receive. For some retirees, these hikes can mean that their COLA increases are nearly offset, which is a critical factor to consider when planning for the future.

Understanding the Impact of the “One Big Beautiful Bill Act”

In July 2025, a major piece of legislation, the One Big Beautiful Bill Act, was signed into law. This law brought several changes that could benefit Social Security recipients in the coming years. Let’s break down the key points of this bill:

1. Tax Relief for Seniors

One of the most exciting provisions of the bill is that 88% of Social Security beneficiaries will no longer have to pay federal income taxes on their benefits. This is a huge win for retirees, as it will mean more take-home pay each month. The bill increases the “Senior Deduction”, which is a tax break specifically for older adults, allowing individuals to deduct up to $6,000 and couples to deduct up to $12,000 from their taxable income. This could help reduce the tax burden for many seniors.

2. Repeal of WEP and GPO

Another significant change is the repeal of the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO). These provisions affected workers who had pensions from jobs where they didn’t pay into Social Security, like many public sector employees. If you’re someone who worked in a non-Social Security-covered job and are now collecting Social Security, this repeal could potentially increase your monthly benefits.

3. Medicare and Healthcare

While the bill brought some exciting changes, it also introduced some complications. Medicare funding was impacted by the bill, and this could mean higher out-of-pocket costs for retirees. For example, some cost-saving programs were eliminated, leaving those with lower incomes struggling to pay for necessary healthcare services. It’s something to keep in mind, especially if you’re planning for retirement.

What Does This Mean for You?

The changes in Social Security, especially the COLA increases and Medicare premium hikes, have a real impact on retirees. Here’s how you can make sense of it all and plan for your future:

- Understand the COLA Process: Every year, the government adjusts Social Security benefits based on inflation. While these increases are helpful, they may not always keep pace with the rising costs of living. Stay informed about inflation trends to understand what you might expect in future years.

- Account for Rising Medicare Costs: Medicare premiums continue to rise, so it’s essential to budget for these increases. Keep in mind that even if your Social Security benefits go up, rising healthcare costs could eat into those gains.

- Consider Your Tax Situation: With new tax relief measures in place, many retirees will see a reduction in taxes owed on their Social Security benefits. This could significantly improve your financial situation, but make sure to consult with a tax professional to understand how these changes impact you.

- Revisit Your Retirement Savings Strategy: With healthcare and other expenses rising, it might be time to look at your retirement savings strategy again. Consider diversifying your retirement income, whether through other savings, investments, or part-time work, to supplement your Social Security.

Practical Tips for Maximizing the Average Social Security Payment

- Work Longer If Possible: The longer you work and contribute to Social Security, the higher your benefits will be. Delaying your retirement by even a few years can increase your monthly benefits significantly.

- Consider Spousal Benefits: If you’re married, you may be eligible for spousal Social Security benefits. This allows one spouse to receive a portion of the other’s Social Security benefit, often the higher one.

- Be Smart About When You Claim Benefits: You can begin claiming Social Security at age 62, but your monthly payments will be lower. Waiting until your full retirement age (between 66 and 67 for most people) or even 70 will result in higher payments.

- Use the SSA’s Online Tools: The Social Security Administration offers several online tools to help you plan your benefits, such as the Retirement Estimator and the Benefit Calculator. These can help you get a better understanding of how much you’re entitled to receive.

Social Security Projected to Cut Benefits by 2033, Affecting Retired Workers

Trump’s ‘Big Beautiful Bill’ Sparks Debate Over Social Security and Benefits

Recent Adjustment to Social Security Benefits Raises Questions- Check Details!