GST/HST Payments in Canada Start This Week: July 2025 Guide starts here with context, clarity, and confidence. This guide is great for a reader of any age—easy enough for a 10‑year‑old to follow, but detailed enough for a seasoned professional. We’ll unpack what the credit is, who gets it, how much it is, when it comes, how to qualify, practical examples, FAQs, and pro tips—plus sources from official sites to support every claim.

GST/HST Payments in Canada Start This Week

This enhanced guide explains everything about the July 2025 GST/HST credit—what it is, who qualifies, how much it is, when it’s paid, and how to make sure you get yours. It’s clear enough for a 10‑year‑old to grasp, while packing professional‑grade insights and trusted sources. Update your CRA profile, mark your calendars, estimate your amount, and be ready to welcome that boost. You’ve got this—steady, straightforward, and supported.

| Item | Detail |

|---|---|

| Payment Date | July 4, 2025 (direct deposit), mailed cheque shortly after |

| Maximum Federal Credit | $533 (single), $698 (couple), +$184 per child under 19 |

| Quarterly vs. Lump Sum | Quarterly if ≥$50 per quarter; lump sum if quarterly < $50 |

| Provinces with Top‑Ups | NB, NL, NS, PEI, SK—ranging $27.50 to $575 per quarter |

| Eligibility Basis | 2024 tax return filing, Canadian residency, age/family status |

| Phase‑out Threshold | Starts reducing at AFNI $45,521, fully phased out at higher income levels |

What Is the GST/HST Credit?

The Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit is a tax‑free quarterly payment issued by the Canada Revenue Agency (CRA). The goal is to provide partial relief to lower‑ and modest‑income Canadians for the GST or HST they pay on everyday goods and services. Instead of waiting for a tax refund, this credit delivers money throughout the year—ideally when people need it most.

Introduced in July 2009, this credit replaced two older benefit programs and has since helped millions manage household costs. It’s timed to land every three months, though sometimes CRA bundles payments into a lump sum if the quarterly amount is very small.

Why July 2025 Payment Matters?

Starting July 2025, the credit for the year July 2025 to June 2026 will be delivered. The payment scheduled for July 4, 2025, is particularly important because of two key factors:

- Lump‑Sum Option: If your quarterly share is under $50, CRA will send the full annual amount rather than four smaller cheques.

- Updated Rates: This payment reflects the new rates for 2025–2026, including federal amounts, per‑child top‑ups, and provincial additions in places such as New Brunswick, Newfoundland & Labrador, Nova Scotia, Prince Edward Island, and Saskatchewan.

Who Qualifies?

To be eligible for the July 2025 GST/HST credit, you must meet these conditions:

- Filed your 2024 tax return: CRA uses this for income assessment.

- Canadian resident in June–July 2025: Residency qualifies you for the upcoming payment period.

- Meet age/family criteria:

- 19 years or older, or

- Have a spouse or common‑law partner, or

- Are a parent living with a child under 19.

- Adjusted Family Net Income (AFNI) must be below certain thresholds. Credit amounts start phasing out at about $45,521 and gradually decrease.

The credit is calculated based on family structure and income. That means each spouse in a couple file jointly, and children under 19 at the beginning of the payment period count for top‑ups.

How Much Can You Receive?

Federal Credit

For the July 2025 to June 2026 period:

- Single Adults: Up to $533 per year ($133.25 per quarter)

- Couples/Common‑Law: Up to $698 per year ($174.50 per quarter)

- Per Child Under 19: Additional $184 per year per child ($46 per quarter)

Provincial Top‑Ups

Certain provinces add extra funds:

- New Brunswick: Up to $75 per quarter

- Newfoundland & Labrador: Around $575.50 per quarter through multiple supplements

- Nova Scotia: Approximately $63.75 per quarter

- Prince Edward Island: Around $27.50 per quarter

- Saskatchewan: Up to $299 per quarter

These amounts are combined with the federal credit to determine the final payment.

Lump Sum vs. Quarterly

- Quarterly Credit: If the federal + provincial credit is $50 or more per quarter, payments are made four times a year.

- Lump Sum: If the total per quarter falls below $50, CRA issues one full annual payment in July instead.

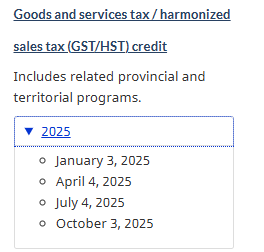

When Are Payments Issued?

- Direct Deposit: July 4, 2025—assuming CRA has your banking information.

- Cheques: Usually arrive within 7 to 10 business days—carry the official CRA mailing schedule.

- No Deposit by July 15? Best to contact CRA to investigate.

Missing a payment doesn’t mean you’re ineligible—it could be a processing delay or information error.

Step‑by‑Step to Ensure You Get GST/HST Payments in Canada Start This Week

1. File Your 2024 Tax Return

Use certified software or paper filing. The more accurate your filing—especially around dependent and marital status—the more precise your credit calculation.

2. Update “My Account”

Log into CRA’s My Account portal to:

- Confirm or update banking details for direct deposit.

- Make sure your mailing address is current.

- Update marital status and dependent information if changed.

3. Estimate Your Payment

CRA offers online calculators that estimate payment once tax is processed. Use the Child and Family Benefits Calculator after your return is assessed.

4. Plan for Payment Day

- July 4: Anticipate direct deposit.

- Monitor your CRA profile for confirmation or deposit status.

- Cheque deliveries may follow by July 15. If not, contact CRA or check your statement online.

5. Troubleshoot Missing Payments

If funds don’t arrive on time:

- Check for errors in bank or mailing info.

- Look for CRA notices in “My Account.”

- Contact CRA to resolve missing funds—even after July, CRA can issue retroactive payments.

Real‑World Scenarios

Single Parent (Marlon): AFNI $40,000, one child.

- Federal credit: $717/year → $179.25/quarter

- Provincial top‑up (NB): $75/quarter

- Total = $254.25 each payment

Couple in Nova Scotia (Emily & Jordan): Two kids under 19, combined AFNI $60,000

- Federal + children = $1,066/year → $266.50/quarter

- Nova Scotia top‑up: $63.75/quarter

- Total = $330.25 per quarter

Solo Adult (Emma), no kids:

- Federal: $533/year → $133.25/quarter

If Emma lived in Saskatchewan with a $45,000 AFNI, she could see an additional provincial top‑up, pushing her total higher.

Canada Updates CRA Benefit Schedules for July 2025—Here’s What’s Coming Your Way

Pro Tips and Extra Info

- Wildfire or Postal Delays may slow cheque delivery—check recent CRA notices if you’re in affected regions.

- CRA’s “My Account Mail” service lets you get digital notices instead of waiting for paper.

- A one-time grocery rebate of up to $978 may be available summer 2025. It’s separate from GST/HST credit but could arrive alongside it.

- Don’t confuse this credit with provincial or child benefits. They each have their own eligibility and application processes.

Why This Games Changer?

- Financial stability: Combined government support—GST/HST, Canada Child Benefit, provincial supplements—can help households manage costs more effectively.

- Budget predictability: Knowing your quarterly or lump‑sum payments makes planning bills easier.

- Increased amounts: The 2025–2026 year sees raises in federal credit and some provincial budgets—more money for those who need it.

Final Summary and Action Plan

Here’s what you should do:

- Confirm your 2024 tax return is filed and assessed.

- Log into CRA My Account before July 1—update banking, address, family status.

- Use CRA’s online calculators to estimate credit.

- Expect your July 4 direct deposit—or a cheque by July 15.

- Update CRA if you moved provinces or had family changes.

- Keep your eyes peeled for a separate summer grocery rebate.

With these steps, you’ll ensure you don’t miss out on your GST/HST credit—and maybe even some extras from provincial programs.